|

April 12, 2013

Highlights of this Issue:

Status of FASB Investment Companies Project

On December 12, 2012, the Financial Accounting Standards Board (FASB or the Board) agreed that the accounting for real estate investments should be considered in a separate phase of the Investment Companies project and that all REITs should be exempted from conclusions reached in phase I of the project. This reverses the Board’s previous decision on the applicability of Investment Companies guidance to mortgage real estate investment trusts. NAREIT has consistently advocated the exclusion of both equity and mortgage REITs from the Investment Companies standard.

Subsequently, the Board has added a phase II to the project dedicated to disclosure requirements for companies meeting the scope of Investment Companies guidance. After the Board completes this phase of the project, it will then move to phase III, which is dedicated to the accounting for investments in real estate. The Board has not defined the scope of phase III of the project. The overarching issue identified is whether the scope will be limited to accounting for real estate investments only in the context of the Investment Companies standard or whether the scope would include accounting and reporting for investments in real estate more broadly. There was significant discussion as to whether phase III, if it considers investments in real estate more broadly, should consider accounting and reporting for real estate investments/investment property based on the definition/characteristics of the asset (i.e., an asset-based approach) or be based on the characteristics of the entity holding the property (i.e., an entity-based approach). Previously, the Board pursued an entity-based approach in its Investment Property Entities proposed standard. That project was subsequently eliminated from the Board's active agenda due to the difficulty the Board encountered in developing the definition of an "investment property entity."

Outlook

The Board plans to issue a final standard on Investment Companies in the first half of 2013 with an effective date for periods beginning after December 15, 2013. The Board will address the disclosure requirements afterwards, and the accounting for real estate property investments thereafter. The Board will revisit the accounting for REITs (both mortgage and equity REITs) when it discusses real estate specific issues at a later date.

Status of FASB/IASB Joint Leases Project

Since completing the majority of its re-deliberations in September 2012, the FASB and the International Accounting Standards Board (IASB) (collectively, the Boards) and its respective staff have been drafting the revised exposure draft of the Leases proposal. At a meeting on April 10, the FASB voted to move forward with the issuance of the revised exposure draft by a narrow margin. Three board members indicated that they would dissent from issuing the exposure draft due to a preference for a single lease model and concerns over whether the costs of implementing the revised exposure draft would outweigh the benefits. NAREIT understands that the revised exposure draft should be published in May 2013, with a 120 day comment period.

Lessee Accounting

The Boards have agreed to a dual approach for lessee accounting, allowing straight-line expense recognition for some leases and an interest and amortization approach with a front-loaded expense recognition pattern for other leases. Under either model, all leases would be recognized on the balance sheet unless the maximum lease term is 12 months or less.

The dividing line for lease classification would be based on a principle of consumption of the underlying asset. Generally, lessees would recognize expense on a straight-line basis for leases of property (i.e., land, a building or part of a building, or both). The accounting for other types of leases (e.g., equipment) would generally follow the interest and amortization approach, resulting in front-loaded interest expense.

Lessor Accounting

Lessor accounting would incorporate a consumption model that is symmetrical to lessee accounting. NAREIT believes that most lessors of investment property would continue to qualify for an approach similar to today’s operating lease accounting, recognizing income on a straight-line basis over the lease term.

For leases of assets other than property (e.g., equipment), lessors would generally apply the receivable and residual approach. Under this approach, a lessor would account for the lease as if the right to use the underlying asset were sold. Therefore, the lessor would recognize an upfront profit, a receivable for a portion of the asset, and a residual asset.

NAREIT Reviewed Draft of Re-Exposure Document for Fatal Flaws

In December 2012, the FASB asked selected constituents for comments on the draft of the revised proposed standard. NAREIT provided a number of recommendations to the FASB.

NAREIT’s Ongoing Areas of Concern

NAREIT’s most significant concern is that the Boards may conclude that the proposed accounting model is too complex and respond by eliminating the dual approach. If this decision is reached, the Boards may resort to the original single approach that could require front-ending charges to a lessee’s earnings and the application of the receivable and residual approach by all lessors.

Based on the tentative decisions, property is defined as land, buildings, or portion thereof. NAREIT believes that the definition of property should be expanded to include structural components that are similar to buildings (e.g., cellular towers).

The Boards continue to require that non-lease elements be separated from the lease. As NAREIT highlighted in its March 13, 2012 comment letter, a lease containing embedded services should be accounted for as a single lease contract pursuant to the Leases standard. Over time, lease agreements have evolved from strictly payment for the rental of space (i.e., a net lease) with separate charges for items like common area maintenance (CAM) to leases where the rent payment includes the reimbursement for embedded services (i.e., a gross lease). Examples of embedded services in lease agreements include:

-

CAM;

-

Security;

-

Taxes and Insurance; and,

-

Landscaping.

NAREIT observed that these services are performed by the lessor to protect its own interests, rather than for the benefit of the lessee. The lessor performs these services in large part to maintain the quality, ongoing appeal, and value of the lessor’s underlying asset. Therefore, NAREIT does not believe that these services should be separated from the rental revenue stream.

As a result, these items should be subject to the Leases exposure draft, and be outside the scope of the Revenue Recognition Proposal. Outlook

The Boards expect to re-expose the Proposal for comment in May 2013, with a 120 day comment period. While the Boards have not finalized an effective date for the proposed lease accounting standard, NAREIT does not expect the standard to be effective prior to 2017. Once the Boards re-expose the proposed Leases standard, NAREIT will re-engage with its member task force to establish consensus views and issue a comment letter to the Boards. NAREIT will also continue to coordinate its advocacy efforts with members of the Real Estate Equities Securitization Alliance (REESA).

FASB and IASB move toward finalizing their Joint Revenue from Contracts with Customers standard

The Boards have continued to work together toward finalizing their re-deliberations of the proposed Revenue from Contracts with Customers Proposal (the Proposal or the Revenue Recognition Proposal). While NAREIT continues to monitor the Boards’ joint meetings on the Proposal, there have not been any major changes to the exposure draft that would have a major impact on NAREIT’s members. NAREIT and its REESA counterparts continue to be concerned about the following issues that were raised in our March 13, 2012 comment letter that could have a negative impact to the real estate industry:

-

The Proposal should apply to all sales of real estate, including equity interests in entities that represent “in substance” real estate

-

The interaction between the Leases Proposal and the Revenue Recognition Proposal appears to significantly change the unit of account for the same lease agreement – while leases are outside the scope of the Revenue Recognition Proposal, embedded services would be separated from the lease agreement and be accounted for under the Revenue Recognition Proposal

-

The Proposal should provide further clarification to guidance on sales of real estate that include put and call options

Outlook

The Boards expect to finalize re-deliberations in the near term and issue a final standard in the second quarter of 2013 with an effective date of January 1, 2017.

FASB issues long awaited Reporting Discontinued Operations proposal

On April 2, the FASB issued Proposed Accounting Standards Update, Reporting Discontinued Operations (the Proposal). The Proposal would eliminate the great majority of discontinued operations reported by NAREIT member companies. Under current U.S. GAAP, companies that sell even a single investment property are generally required to report the sale as a discontinued operation. Comments on the Proposal are due no later than August 30. One comment that NAREIT intends to make is that the Update should allow early adoption. If you would like to participate in the evaluation of this proposed update and developing NAREIT's comment letter, please contact George Yungmann at at gyungmann@nareit.com by April 30.

The proposed update would redefine a discontinued operation for purposes of U.S. GAAP. At a recent FASB meeting, the Board discussed an issue raised during the external review of the exposure draft and decided to replace the cash-generating unit concept in the proposed definition of discontinued operation from IFRS with the current definition of component of an entity in U.S. GAAP. Therefore, a component of an entity or a group of components of an entity that represent a separate major line of business or major geographic area of operations would be eligible for discontinued operations reporting. The proposed update would require certain disclosures with respect to discontinued operation, as well as meaningful disclosures with respect to a dispositions of components of an entity that do not rise to the level of discontinued operations.

NAREIT has advocated this specific modification to the definition of a discontinued operation since it met with FASB representatives in 2006. The Board was sympathetic to NAREIT’s request at that time and decided to work with the IASB to converge this particular accounting standard. After the Boards agreed to the converged definition, this project was delayed because of the priority assigned to the major convergence projects (e.g., Leases, Revenue Recognition, Financial Instruments, and Insurance).

Outlook

NAREIT has formed a task force that is evaluating the Proposal. Comments are due to the Board by August 30. The Board has not established an effective date at this time.

FASB issues exposure draft on Financial Instruments - Credit Impairment

On December 20, 2012, the FASB issued a proposal (the Proposal) that would change the accounting treatment for credit losses on financial assets. All NAREIT member companies would be impacted by the Proposal, as the model would apply to all financial assets, including debt instruments, loans and loan commitments, lease receivables, and trade receivables. Under the Proposal, companies would be required to recognize an allowance for credit losses based on the companies' current estimate of contractual cash flows not expected to be collected at each reporting period. Currently, companies are required to recognize an allowance for credit losses based on whether it is probable that a loss event has occurred. The current model has been highly criticized since the financial crisis for allowing companies to record an insufficient allowance for probable credit losses.

Previously, the FASB had been working with the IASB to develop a converged model for accounting for credit losses on financial assets. That model would require companies to establish an allowance for credit losses based on credit deterioration. The FASB received feedback about this model's complexity and questioned how it could be consistently implemented in practice. Therefore, the FASB decided to develop a new model, while the IASB proceeded with its model, which was issued for public comment in March 2013.

Outlook

NAREIT has formed a task force that is evaluating the Proposal. Comments are due to the Board by May 30. The Board has not established an effective date for the Proposal.

FASB seeks comments on Financial Instruments - Classification and Measurement exposure draft

On February 14, the FASB issued a proposal (the Proposal) for the classification and measurement of financial instruments. Both equity and mortgage REITs that report financial assets and/or financial liabilities would be impacted by the Proposal, as the proposed model would apply to entities across industries with few exceptions.

Debt Investments

Under the Proposal, classification and measurement of a financial asset would be based on the asset's cash flow characteristics and the entity's business model for managing the financial asset. This would represent a fundamental change from the current model, which is based on the legal form of the financial asset (i.e., a loan versus a security). Based on the cash flow characteristics and business model assessments, financial assets would be classified into one of three categories:

-

Amortized cost – financial assets with solely payments of principal and interest that are held for the collection of contractual cash flows

-

Fair value through other comprehensive income (OCI) – financial assets with solely payments of principal and interest that are both held for the collection of contractual cash flows and for sale

-

Fair value through net income – financial assets that do not qualify for measurement at either amortized cost or fair value through other comprehensive income

Equity Investments

Under the Proposal, all equity investments ( e.g., investments in common or preferred stock), with the exception of investments accounted for under the equity method, would be measured at fair value with changes in fair value recognized in net income. This classification conclusion would be based on the fact that equity investments do not have payments of principal and interest. Financial Liabilities

Under the Proposal, financial liabilities ( e.g., non-recourse debt) would generally be measured at amortized cost unless the entity's business model is to subsequently execute transactions based on the financial liabilities' fair value ( e.g., short sales). Replacement of the Unconditional Fair Value Option with Limited Conditional Fair Value Options

The Proposal would replace the unconditional fair value option under current U.S. GAAP with limited fair value options. The fair value option under the Proposal would be limited to: -

A group of financial assets and financial liabilities if the entity both:

-

Manages the net exposure relating to those financial assets and financial liabilities (which may be derivative instruments) on a fair value basis and

-

Provides information on that basis to the reporting entity's management.

-

Hybrid financial liabilities that meet certain prescribed criteria.

-

Financial assets that meet the proposed contractual cash flow characteristics criterion and are managed within a business model that has the objective of both holding financial assets to collect contractual cash flows and selling financial assets.

Presentation and Disclosure

For financial instruments measured at amortized cost by public companies, the Proposal would require parenthetical disclosure of fair value on the face of the balance sheet. The only financial instruments excluded from this requirement would be financial instruments with terms one year or less. Private companies would be excluded from these presentation and disclosure requirements. Outlook

NAREIT has formed a task force that is evaluating the Proposal. Comments are due to the Board by May 15. The Board has not established an effective date for the Proposal.

NAREIT comments on FASB Transfers and Servicing - Repurchase Agreements and Similar Transactions proposal

On March 29, 2013, NAREIT submitted a comment letter to the FASB on its proposal that would impact the accounting for repurchase agreements and similar transactions. NAREIT member companies generally welcomed the proposal, given that most that use repurchase agreements as a source of financing already account for the instruments in a manner consistent with the proposal (i.e., secured borrowings). Further, NAREIT believes that the essence of the proposal that would require transactions meeting these characteristics to be accounted for as secured borrowings provides a more transparent depiction of a company’s leverage. NAREIT requested that the FASB permit early adoption of the Proposal and provide preparers with the ability to retroactively restate prior periods that are presented in the financial statements. While NAREIT recognizes that providing companies with optional transition methods and effective dates may reduce the comparability of application of the Proposal across companies, NAREIT believes that the ability to early adopt and restate prior periods would result in consistent application of the Proposal within a company’s financial reporting at the earliest possible date. This would enhance comparability among accounting periods within the comparative financial statements and, therefore, make operating trends of individual companies much easier to understand.

Outlook

The Board has not established an effective date for the Proposal.

NAREIT comments on FASB Disclosure Framework discussion paper

On November 30, 2012, NAREIT submitted a letter to the FASB in response to the Board's invitation to comment on the Disclosure Framework.

NAREIT supported the Board's objective to improve the effectiveness of disclosures in the notes to the financial statements by clearly and concisely communicating the information that is most important to users of financial statements. NAREIT offered the following recommendations that should assist the board in developing an effective framework that would promote consistent decisions and the proper use of discretion by the Board, financial statement users, preparers, auditors and regulators alike:

-

Engage all interested constituents, including regulators (i.e., the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB)), preparers, analysts, and auditors, in field testing of the Disclosure Framework

-

Utilize the Disclosure Framework to determine minimum disclosure requirements for each accounting standard that would be included in all financial statements, regardless of industry

-

Collaborate with the SEC to eliminate existing redundancies between the notes to financial statements and disclosure requirements contained in MD&A

-

Develop a financial reporting model that delineates which disclosures belong in the notes to the financial statements as opposed to MD&A

-

Ensure that interim disclosures are not a mere repeat of the annual disclosures unless there is a material change

-

Maintain a summary of critical accounting policies in annual financial statements in order to preserve financial statements as a self-contained document

Outlook

The FASB plans to continue its evaluation of stakeholder input through its re-deliberations in 2013. Additionally, the SEC has announced its plan to host a roundtable to discuss whether information should be presented in the financial statement footnotes or in MD&A. The topic of “Disclosure Overload” is also being evaluated in Europe. Recently, NAREIT and some of its member companies participated in an IASB Questionnaire on the topic, which sought possible solutions to the perceived problem. Further, the IASB held a forum on disclosure overload on January 28, 2013.

NAREIT collaborates with First Call on Reporting NAREIT FFO

As previously reported, NAREIT has been working with representatives from First Call to add Funds From Operations (FFO) as defined by NAREIT as a standard measure included in First Call reporting. Prior to this NAREIT initiative, First Call provided consensus earnings estimates based on a “majority rules” policy. That is, analyst estimates included in the consensus estimate of Funds From Operation and Adjusted Funds From Operation (AFFO) included only those analyst estimates meeting the definition applied by the majority of reporting analysts without regard to the NAREIT definition. For example, if the majority of reporting analysts based their estimates on any given definition, e.g., “recurring FFO,” analyst estimates based on any other definition, including NAREIT’s FFO definition, would not be included in the consensus. Further, it was unclear whether the consensus FFO estimate reported by First Call was reported in accordance with NAREIT’s definition or any other definition.

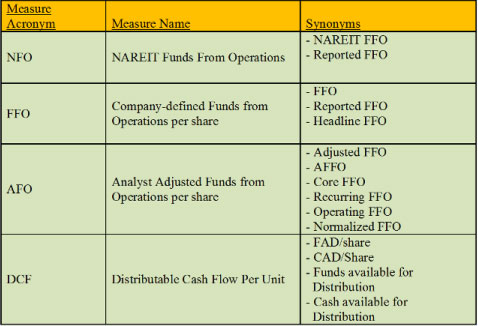

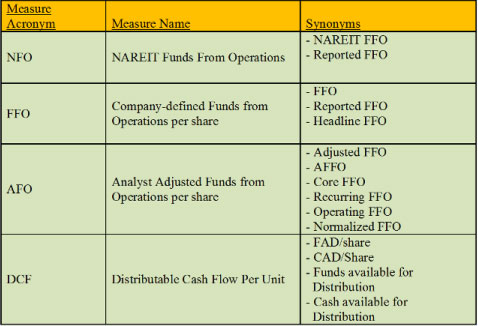

In order to ensure consistency in reporting FFO and that First Call reports a consensus estimate based on the NAREIT definition of FFO, NAREIT initiated a dialogue with First Call and recommended that the following measures be included in the First Call data:

-

NAREIT-defined FFO

-

Company-modified FFO

-

Analyst-adjusted FFO (i.e., a cash flow metric)

Recently, NAREIT learned that First Call is preparing to amend the naming conventions for FFO measures as follows:  Outlook Outlook

First Call is in the process of researching how many analysts currently provide their FFO earnings estimates based on NAREIT’s definition. Additionally, First Call plans to “go live” with the new categories of FFO in the May/June timeframe. First Call will take a multi-faceted approach to marketing the new measures. First, users of First Call will be able to see the measure upon submitting their earnings estimates. Additionally, First Call’s sales and account teams will be performing outreach to brokerage firms. Thirdly, First Call will ask for the NAREIT FFO measure from the analyst firm’s director of research. NAREIT has offered to assist in marketing/educating analysts with those that we currently have a relationship. NAREIT will consider how it might further promote this new First Call reporting model.

NAREIT comments on IVSC Investment Property discussion paper

NAREIT continues to participate on a working group of the International Valuation Standards Council (IVSC or the Council) that is developing a global standard for valuing investment property. The Council issued a discussion paper (the Paper) that surveyed constituents with respect to the form and content of a standard. On March 5, NAREIT submitted a comment letter to the Council that highlighted the following items:

-

NAREIT believes that the definition of Investment Property contained in International Valuation Standard No. 233 Investment Property under Construction (IVS 233) and International Accounting Standard 40 Investment Property (IAS 40) should be amended. This is consistent with our view that the IVSC guidance should not be restricted to supporting accounting requirements. We recommend that the wording should encompass any income-producing real estate asset that is capable of reliable fair value measurement.

-

NAREIT believes that the Council should provide guidance on which assets should be included in the valuation of investment property. In our view, assets to be included in the valuation should be dictated by the real estate market and the characteristics of the related intangible. For example, the value of a hotel should generally include the inherent value of the brand – but only if the brand is transferable by the owner of the hotel. We note that it would be difficult to separate the value of the brand from the value of the real estate. Other examples of intangible assets that should be factored into the valuation of investment property include:

-

Existing air rights

-

Energy credits

-

Real estate tax credits

-

Rights under long-term leaseholds

-

NAREIT urged the IVSC to discuss in the guidance the range of valuation support for companies that measure and report investment property at fair value in financial statements, as well as valuations for other purposes. Valuation support ranges from full independent appraisals to valuation advisory or consulting support. Our experience indicates that the purpose of the valuation and subsequent uses would influence the form and extent of valuation support, including the format of the valuation reports provided by valuers. NAREIT has discussed this matter with representatives of the Appraisal Institute in the U.S. as well as representatives of a number of the major public accounting firms. The consensus of these discussions was that the valuation profession should recognize this range of valuation support. Based on this consensus, NAREIT does not believe the standard should require full independent appraisals exclusively.

-

NAREIT agrees that the valuation report should contain sufficient information on the inputs used to enable the reporting entity to categorize the assets within the IFRS and U.S. Generally Accepted Accounting Principles (GAAP) fair value hierarchy. At the same time, NAREIT strongly objects to requiring that the valuation report state at which level of the IFRS and US GAAP hierarchy the valuation of an investment property be placed. This requirement would be contrary to the fundamental financial reporting premise that a company’s management is responsible for the company’s financial statements.

Contact

For further information, please contact George Yungmann, NAREIT's SVP, Financial Standards, at gyungmann@nareit.com or Christopher Drula, NAREIT's Vice President, Financial Standards, at cdrula@nareit.com.

|