Some market participants may be concerned about the future course of stock prices, but the correlation between listed REITs and the broad stock market is at its lowest level in more than 12 years, suggesting that whatever factors happen to drive the non-REIT part of the market will not necessarily spill over to affect the REIT market.

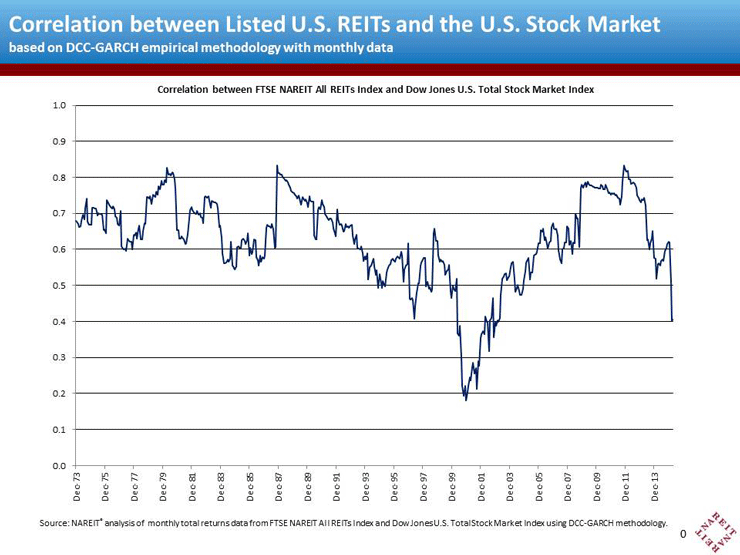

Monthly total returns for listed U.S. REITs and the broad U.S. stock market through April indicate that the correlation between them was just 0.405, the lowest value since it hit 0.400 in March 2003. (The figures are based on a sophisticated empirical method called DCC-GARCH modeling, which Nobel prize-winning economist Robert Engle developed in 2002 for that purpose, and uses monthly total returns from the FTSE NAREIT All REITs Index and the Dow Jones U.S. Total Stock Market Index.)

The REIT-stock correlation fluctuates but has remained between 0.56 and 0.72 for most of the time since REIT returns were first calculated at the beginning of 1972. During the Modern REIT era, which started in about 1992, it has usually been even lower, between 0.51 and 0.66. The REIT-stock correlation was abnormally low at 0.18 in late 2000, a time when the REIT bull market coincided with sharp declines in the stock market, and was abnormally high at 0.83 in the fall of 2011 as a result of the European debt crisis. While it is often noted that correlations tend to “spike” during market crises, it is notable that during the 2008/09 liquidity crisis the REIT-stock correlation reached a maximum value of just 0.788.

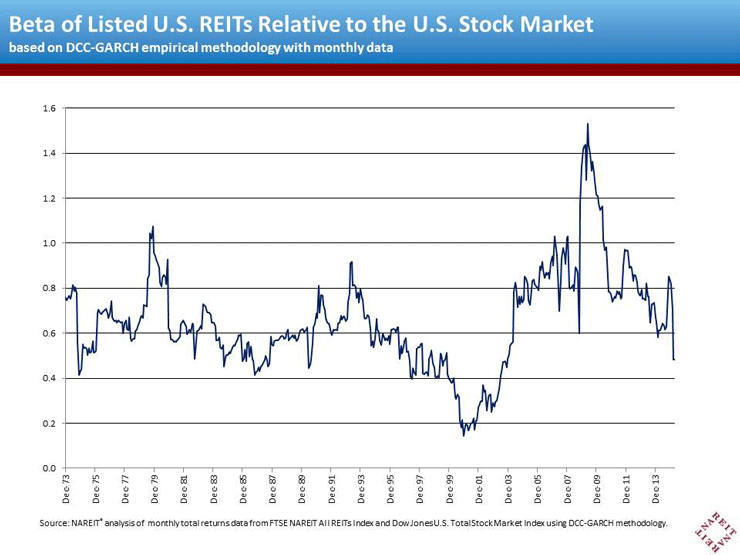

Beta—a measure of systematic risk—also hit a long-time low during April of this year. Beta for listed U.S. REITs relative to the Dow Jones U.S. Total Stock Market (also estimated using the same DCC-GARCH methodology) was just 0.48 as of the end of April, lower than at any time since it reached 0.45 in November 2003. Beta has fluctuated mostly between 0.53 and 0.77 since the beginning of 1972; during the “modern REIT era” beta has generally fluctuated between 0.48 and 0.82, with the highest values coming during the liquidity crisis when REIT and stock volatilities as well as the correlation jumped upward.

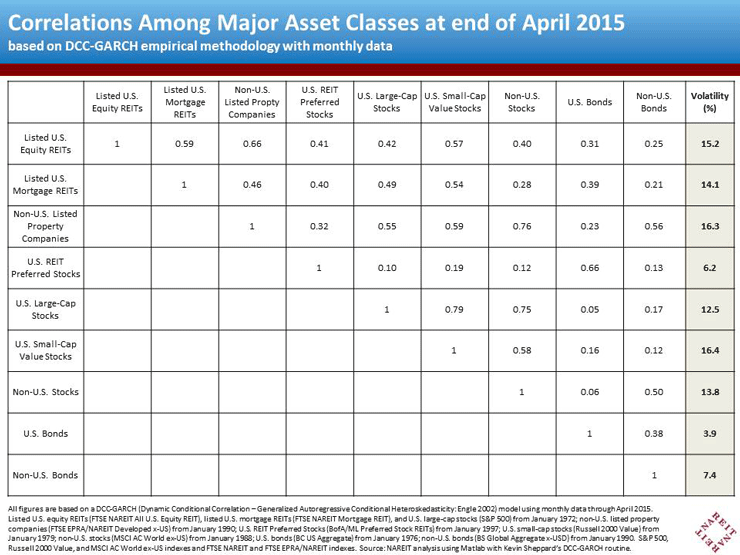

Correlations between listed REITs and other more narrow market segments have been similarly subdued. For example, through April the correlation between listed U.S. equity REITs and small-cap value stocks—the segment of the stock market with which REITs are sometimes erroneously identified—was just 0.57, whereas the correlation between small-cap value stocks (Russell 2000 Value) and large-cap stocks (S&P 500) was much higher at 0.79, as is fairly typical. Similarly, the correlation between listed U.S. equity REITs and non-U.S. stocks was just 0.40, whereas the correlation between large-cap U.S. stocks and non-U.S. stocks was much higher at 0.75. This is because listed equity REITs give investors exposure to an entirely different asset class—income-producing real estate—with its own market cycle that is very different from the business cycle that governs non-REIT stocks both in this country and, increasingly, overseas.

In short, asset class diversification—diversification among non-REIT stocks, bonds, and REITs—continues to benefit investors more, in general, than “diversification” among non-REIT segments of the stock market, whether domestically or globally.