On Aug. 31, 2016, S&P Dow Jones Indices and MSCI moved stock-exchange listed Equity REITs and other listed real estate companies from the Financials Sector of their Global Industry Classification Standard (GICS®) to a new Real Estate Sector. GICS® is the industry classification methodology that both companies rely on for their proprietary stock market indices and it serves as one of the primary classification systems for equities for investors around the world.

The Real Estate Sector is the first new headline sector added since GICS® was created in 1999.

The change reflected the growth in size and importance of real estate, primarily equity REITs, in the economy. Over the past 25 years, the total equity market capitalization of listed U.S. equity REITs has grown from $9 billion to more than $1 trillion.

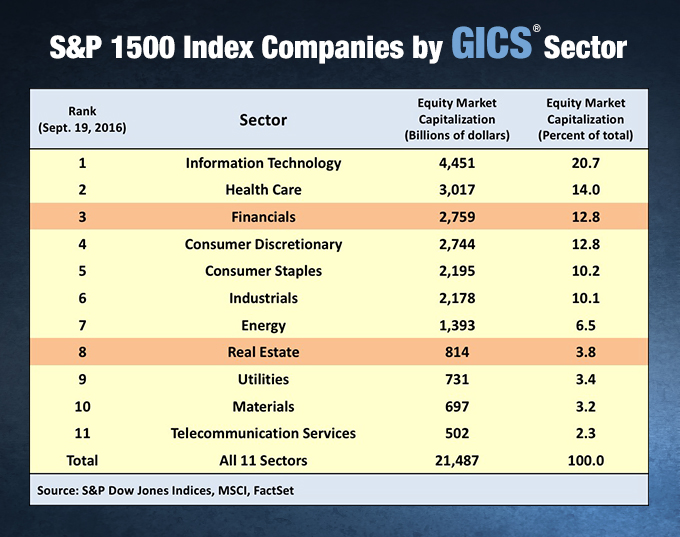

The Real Estate Sector represents nearly 4.0 percent of the equity market capitalization of the S&P 1500. Equity REITs make up about 98 percent of the equity market capitalization of the sector. Real estate management and brokerage companies make up the remainder.

The sector is the eighth largest of the 11 headline sectors in equity market capitalization. That makes it larger than Utilities, Materials and Telecommunication Services.

Equity REITs historically were an important contributor to the performance of the Financials Sector, from which they were reclassified.

Equity REITs helped boost the total return, reduce the volatility and increase the dividends of the Financials Sector:

- Over the approximately 10 years from the end of 2006 through August 2016, a period encompassing the Great Recession, the compound average annual total return of the S&P 500 Financials Sector was -2.05 percent. The non-REIT constituents of the sector averaged -4.06 percent annually, while the equity REITs averaged 9.01 percent annually.

- From the start of the recovery from the recession in May 2009 through August 2016, the average monthly volatility of the S&P Financials Sector was 17.9 percent. The volatility of its non-REIT constituents was approximately 19.1 percent, but the volatility of its equity REITs was 16.8 percent.

- Equity REITs historically have been one of the strongest dividend generating sectors in the stock market. Equity REITs in the S&P 500 delivered a 3.18 percent dividend yield at Aug. 31, 2016 – higher than any S&P 500 sector except Utilities (3.54 percent) and Telecommunication Services (4.54 percent). The non-REIT constituents of the S&P 500’s Financials Sector delivered a dividend yield of 2.02 percent at August 31.

The GICS® Real Estate Sector has increased the visibility of REITs and real estate investment.

The creation of the GICS® Real Estate Sector has increased the visibility of real estate as a distinct asset class, prompting investors, managers and advisors to more actively consider real estate – especially REITs – when developing investment policies and portfolios. The sector also has led to the introduction of new ETFs.

FTSE Russell To Create New Real Estate Industry Group

The creation of the GICS® Real Estate Sector has increased the visibility of real estate as a distinct asset class, prompting investors, managers and advisors to more actively consider real estate – especially REITs – when developing investment policies and portfolios. The sector also has led to the introduction of new ETFs.

Real Estate will become the 11th ICB Industry group when it is segmented out of the ICB’s Financials Industry group, of which it currently is a part. The new ICB Real Estate Industry group will represent approximately 4 percent, or $2 trillion, of the equity market capitalization of the FTSE Global All Cap Index, with the restructured ICB Financials Industry group comprising 20 percent, based on data as of June 30, 2017.

The change will be effective after market close on Dec. 31, 2018.

Related content:

Effects of the Upcoming GICS Classification for the REIT Industry - The unprecedented addition of a Headline Real Estate Sector to GICS should have far-reaching implications for REITs.

S&P Dow Jones Indices Outlines Revised GICS Structure - Under the GICS four-tier classification system, the broad Real Estate Sector will house the Real Estate Industry Group, which is separated into the Equity REITs Industry and the Real Estate Management & Development industry. Those two industries are divided into Sub-Industries, to create the fourth and final tier.

GICS Change a “Watershed Moment” for REITs, says NAREIT Chair - “It’s full recognition and testimony to what real estate and equity REITs have become as an industry,” said Ed Fritsch, 2016 Nareit Chair and president and CEO of Highwoods Properties, Inc.

Real Estate's Big Debut - Becoming a core part of new GICS real estate sector reflects growth of REIT-based real estate investment.

GICS Move Will Raise Institutional Investment in REITs, Hogan Says - APG's Mary Hogan says REITs will become a “have-to-own” sector.

Facts on ETFs, GICS Changes - Dave Nadig, director of exchange-traded funds with FactSet, spoke with REIT magazine about the market for ETFs and the implications of the GICS move for listed REITs and real estate companies on the buy side of the investing industry.

GICS Brings More Visibility to the REIT Industry - A Headline Sector under GICS further validates the REIT approach to real estate investment and affirms the role REITs play in our everyday lives.

What Accounts for REITs’ Relative Performance vs S&P 500 During the Recent Stock Market Turbulence? - The divergent trends of major market sectors since last August, and the performance of equity REITs exceeding seven of the 10 current GICS sectors, underscore the importance of holding a diversified portfolio across all asset classes, including listed equity real estate.

Key classification system changes - With real estate recognized as a top-line asset class, these changes further affirm that allocations to real estate and REITs are fundamental to a well-diversified portfolio.

Real Estate Slated for Eleventh Headline Sector in GICS® - Stock exchange-listed equity REITs and other listed real estate companies will be reclassified from the Financials Sector and elevated to an 11th headline Real Estate Sector of the Global Industry Classification Standard (GICS).

Global Industry Classification Standard (GICS®) FAQs

What is GICS?

The Global Industry Classification Standard was created by MSCI and Standard & Poor’s in 1999 and is a four-tired, hierarchical classification system for listed equities worldwide. As a widely accepted global standard, GICS provides a structure for investors, analysts and economists to consistently identify and analyze investment performance and economic activity, as well as to develop investment policies, products and research.

What’s going on with GICS and real estate?

On Aug. 31, 2016, S&P Dow Jones Indices and MSCI elevated stock-exchange listed equity REITs and other listed real estate companies from under the GICS Financials Sector to a new 11th headline Real Estate Sector. Real Estate is the first new headline Sector created since GICS was established. At the same time, the Real Estate Investment Trusts Industry was renamed Equity Real Estate Investment Trusts (Equity REITs) within the GICS system. MREITs remain in the Financials Sector under a newly created Industry and Sub-Industry classification called Mortgage REITs.

How much of the GICS Real Estate Sector is made up of REITs?

However, the new Real Estate Sector includes companies classified in two Industry classifications: Equity REITs and Real Estate Management & Development companies. Equity REITs represent approximately 98 percent of the combined equity market capitalization of the two groups.

Why were real estate companies reclassified?

S&P Dow Jones Indices and MSCI said that the reclassification of Real Estate to the Sector level “recognizes its growing position in today’s global economy as well as [highlights] the progressive nature of the GICS structure.” According to Remy Briand, Managing Director and Global Head of Equity Research at MSCI, “Feedback from the annual GICS structural review confirmed that Real Estate is now viewed as a distinct asset class and is increasingly being incorporated separately into the strategic asset allocation of asset owners.” David Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices, added, “Real Estate is an important and growing part of major economies throughout the world. To reflect this and support good financial analysis, GICS is introducing an 11th sector for Real Estate and redefining Financials to exclude Real Estate.”

What are the implications of a Real Estate headline Sector classification for investment advisors and managers?

The creation of the headline Real Estate Sector has increased the visibility of real estate as a distinct asset class and may encourage investors, their advisors and managers to more actively consider real estate – especially REITs – when developing investment policies and portfolios. The new Real Estate headline sector also may lead to the creation of new investment products, such as active and passive mutual funds and exchange traded funds, giving advisors and managers more real estate fund options to recommend to their clients.

What are some additional implications of the headlineReal Estate Sector classification?

- May increase and diversify the ownership of real estate equities.

- May lower day-to-day trading volatility as well as correlations with other asset classes, thereby further enhancing the potential diversification benefits already provided by listed Equity REITs.

- With a larger and more diverse investor base, the reclassification may help further moderate the severity of real estate market cycles, with attendant benefits for the broader economy.

Are there other examples of systems reclassifying Equity REITS?

- In 2007, the U.S. Office of Management and Budget (OMB) reclassified Equity REITs from “Finance and Insurance” to “Real Estate and Rental and Leasing”. The change was reflected on the North American Industry Classification System (NAICS).

- In 2010, Morningstar reclassified Equity REITs from the Financial Services sector to a new and distinct Real Estate sector.

Disclaimer: This information is solely educational in nature and is not intended by NAREIT to serve as the primary basis for any investment decision. Indices cannot be invested in directly. Inclusion of a security in an index is not a recommendation to buy, sell or hold such security. Index returns do not represent the results of the actual trading of investable assets. Any investment returns or performance data (past, hypothetical or otherwise) shown herein or in such data are not necessarily indicative of future returns or performance. NAREIT is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made. GICS® is a registered trademark of McGraw Hill Financial and MSCI Inc.