Brixmor employees participating in community service events for the Company’s annual Day of Service. Photo courtesy of Brixmor.

Download the PDF of Nareit's REIT Industry ESG Report 2022

The REIT and publicly traded real estate industry competes both for business and for capital in a dynamic environment. To do so successfully, REITs must invest for the long term and intelligently oversee their real estate holdings on a day-by-day basis.

It is increasingly clear to REIT boards, management teams, shareholders, and stakeholders that a real estate enterprise’s total success over time comes about by advancing environmental stewardship, practicing social responsibility, and implementing good governance, among other important corporate pursuits.

The 2022 REIT Industry ESG Report© finds:

- REITs are enhancing ESG data management and data disclosure, as well as reporting rigor, standardization, and quality, in sync with evolving shareholder and stakeholder expectations.

- Tackling climate change and addressing climate risk in the real estate industry requires raising and deploying capital for improvements, dedicated leadership, and a long-term focus, all structural advantages of the REIT industry.

- REITs are putting people first to address prominent and pressing “S” issues tied to health and wellness, as well as to diversity, equity, and inclusion.

- Leaders of the REIT industry are committed to and focused on innovative and impactful ESG practices.

Leading the Way

REITs and publicly traded real estate companies are institutionalizing ESG within their corporate strategy, business management, and operations. Sustainability practices are increasingly integrated into REITs’ corporate and investment strategies and elevated in governance frameworks.

Through sustainable financing mechanisms and publicly disclosed ESG goals, REITs and publicly traded real estate companies are demonstrating accountability for efforts to reduce environmental impacts, promote DEI, and support a healthy and engaged workforce. To ensure transparency on these efforts and meet a growing demand from investors and regulators for high-quality ESG data, REITs continue to proactively align their reporting to leading and emerging ESG frameworks and standards.

Public disclosure of ESG targets and performance is elevating ESG oversight to the highest levels of the organization as more REITs and publicly traded real estate companies link executive compensation to ESG goals, and boards are directly addressing issues of diversity, broader ESG-related risks to the business, and strategic ESG decision-making.

REITs Driving Impact with ESG Investments

More REITs are placing ESG at the forefront of their business, with 82% of REITs surveyed reporting that they integrate ESG risks and opportunities into their strategy and financial planning in 2021, up from 77% in 2020, and offer “green financing” options, such as green bonds and climate bonds, to meet investor interest and provide enhanced accountability for sustainability spending and returns.

Evolving Investor Expectations

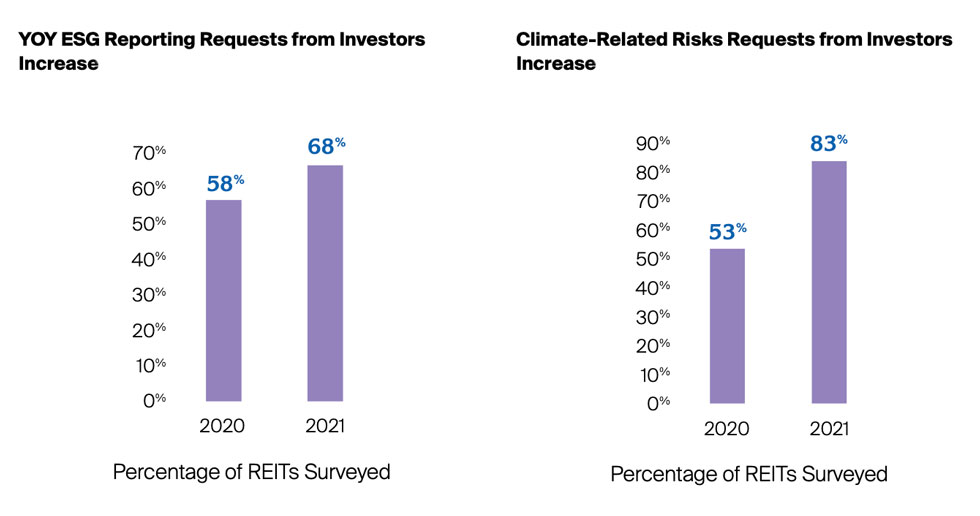

The growing interest in sustainability reflects an emerging generation of values-driven investors that are questioning the impact that business is having on society. In a 2021 EY survey, 90% of investors reported that since the onset of the pandemic, they place greater emphasis on corporations’ ESG performance in their investment strategy and decision-making. In fact, a Nareit survey found that in 2021, 83% of REITs received climate-related risk requests from investors—up from 53% in 2020.

More U.S. REIT Debt Offerings Including Green Bonds

Green bonds are similar to standard bonds and are designed to fund specific projects that have positive environmental or climate benefits. Green bonds constitute a growing part of U.S. REITs’ debt offerings, representing 12.3% or $7.17B of the capital raised through the third quarter of 2021, compared to 11.1% or $8.10B in 2020. These mechanisms are allowing REITs to fund projects that are not only mitigating their climate risk, but also raising asset value through building enhancements, like energy efficiency systems, EV charging stations, HVAC upgrades, or solar installations.

REITs Enhancing ESG Data and Disclosure

Over the past three years, the number of REITs that reported on ESG issues in stand-alone sustainability reports has consistently grown. In 2021, 80 of the largest 100 REITs by equity market cap issued stand-alone sustainability reports, up from 66 in 2020.

According to EY’s 2021 survey, ESG performance disclosures are central to investment decisions, with 78% of investors reporting that they conduct a structured, methodical evaluation of nonfinancial disclosures. The demand for enhanced disclosure is also triggering the need for more advanced data analytics to produce trusted ESG performance reporting.

ESG Accountability and Diversity Improvements at the Board and Executive Level at REITs

Public ESG commitments also help REITs to reinforce accountability at higher levels of the organization, as a growing number of REITs are linking ESG performance to executive compensation. In 2021, 51% of Nareit corporate members surveyed reported linking executive compensation packages to ESG performance, compared to 34% in 2020.

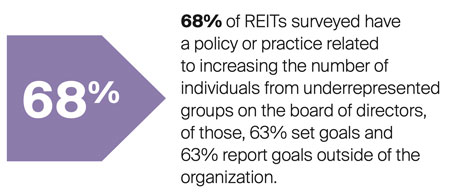

As the awareness of the business and social value of DEI rises among the highest levels of management, REITs are prioritizing diversity among board members and executives. REITs are turning to succession management plans for senior levels that include candidates from underrepresented groups and are being transparent in their decision-making regarding promotions. In 2020, 50% of new REIT directors were women, 31% were people of color—up from 48% and 13% in 2019, respectively.

Case studies:

- Green Bonds Funding Sustainable Projects at Digital Realty

- Equinix’s Green Bonds Utilize Transparent Financing Framework

- Healthpeak Enhances Sustainability Through Green Bonds

- How Hudson Pacific is Addressing Climate Crisis

- Rexford Industrial Strengthens Board Oversight of ESG

- Ventas Sets Comprehensive Goals for DEI

Putting People First

In the third year of the COVID-19 pandemic, society continues to contend with the impacts of viral variants, economic challenges, and social injustices. In response, REITs are doing more to prioritize and elevate their efforts to ensure long-term health and wellness of their employees, to strengthen community engagements, and to advance DEI across their business and the REIT and publicly traded real estate industry.

REITs Ensuring Long-Term Health and Prioritizing Wellness

As developers, owners, and operators of the buildings that many use, work, and reside in, REITs recognize the significant influence that the built environment has on human health, and continue their efforts to upgrade their facilities and meet healthy building certifications to ensure they are providing healthier spaces for people to occupy.

Healthy Buildings

As the pandemic elevated the focus on human health, building certifications aimed at advancing health and wellbeing gained additional prominence for the REIT and publicly traded real estate industry.

Certifications, like WELL and Fitwel, continue to help REITs formalize and advance their efforts to improve the health, wellbeing, and productivity of building occupants by addressing healthy building factors, such as access to clean and fresh air; natural sunlight; active design or access to healthy foods and space for physical activity; and visual, thermal, acoustic, and ergonomic comfort.

REIT Employee Wellness and Engagement

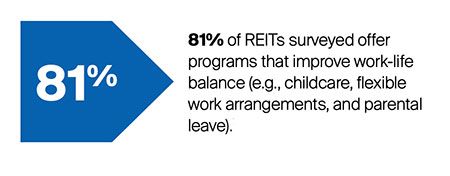

REITs are part of a larger corporate movement to expand resources that support the physical, emotional, and financial health of employees and their families. For example, 51% of REITs participating in the 2021 Nareit Member Survey indicated that they increased health and wellness programming benefits for their employees. In order to offer wellness resources that best suit their employees’ needs, REITs are conducting surveys to collect employee feedback and identify areas of improvement with more than 70% of REITs surveyed reporting that they perform a workforce engagement survey.

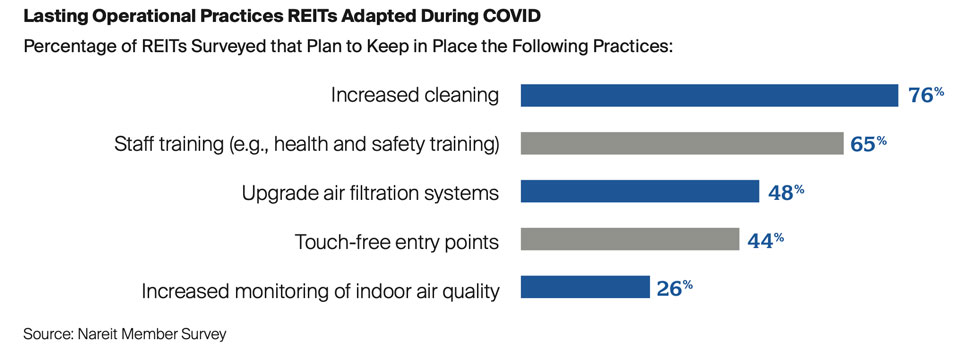

Lasting Practices Adapted by REITs During COVID

Pandemic-inspired initiatives, such as additional staff training on health and safety practices, enhanced cleaning protocols, flexible work programs, and new and expanded health and wellness programs, were established to prevent and mitigate the health risks due to COVID-19 and have since been recognized by REITs as new opportunities to attract and retain top talent, increase human capital resiliency, and reinforce trust with tenants and community members.

Strengthening REIT Tenant and Community Engagement

As businesses that lead the planning, design, and management of infrastructure on which communities rely, REITs are focused on delivering lasting, meaningful, and positive impact to the communities where they operate through philanthropic and outreach efforts.

REIT Philanthropy

REITs implemented community-centered, COVID-19 relief initiatives, such as donating to pandemic-specific efforts, offering rent deferral programs, permitting company property for COVID-19 testing, and distributing personal protective equipment (PPE).

REITs Prioritizing Top-Down Diversity and Inclusion

Prioritizing DEI at the highest levels of an organization sets the tone, allows a DEI-supportive culture to permeate down to all employees, and promotes better business results. Inclusive leaders impact those who work for them by cultivating positive experiences, strengthening team dynamics, and guiding teams more effectively toward achieving their goals.

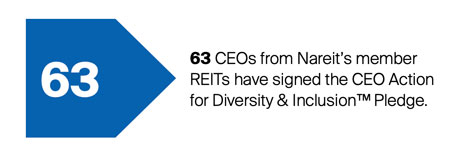

REITs have worked to develop inclusive cultures through comprehensive DEI training for employees. According to Nareit’s 2021 Workforce Development & DEI Survey, 58% of REITs surveyed provide DEI-related training and 14% of overall employee training hours are focused on conscious and unconscious bias management.

DEI in Recruitment, Hiring, and the Supply Chain in the REIT Industry

In addition to developing current employees, the REIT industry is working to build a pipeline of diverse talent, recognizing the opportunity for long-term business value as REITs compete for the best and brightest talent of all backgrounds.

In order to progress in this area, REITs are establishing protocols to ensure inclusive hiring, with 74% of REITs responding to Nareit’s 2021 Workforce Development & DEI survey stating that they have policies or practices in place for recruiting and hiring more individuals from underrepresented groups.

Beyond their immediate operations, and in alignment with the broader corporate landscape, REITs are also addressing diversity in their supply chains. Two-thirds of REITs surveyed in Nareit’s 2021 Member Survey indicated they have a supplier or vendor policy that addresses non-discrimination, and more than half have a policy that addresses DEI.

Case studies:

- AvalonBay Builds Strong Communities through Philanthropic Partnerships

- Building Relationships at Brixmor Through Community Service

- How a Data Center REIT Standardizes Health and Safety Measures

- How One REIT Ensured Equitable Practices for Employees

- How Equity LifeStyle Supported Communities During COVID-19

- Equity Residential’s Top-Down Inclusivity Strategy

- Enriching Employee Health and Wellbeing at Healthcare Realty

- Expanding Efforts to Foster a Culture of Diversity, Equity, and Inclusion

- Host Engages Suppliers for Procurement Diversity

- JBG SMITH Prioritizes Long-Term Health and Wellbeing for all Stakeholders

- Kimco Delivers Impact Through Community Engagements

- How Piedmont Office Realty Fosters a Diverse and Inclusive Future

- Regency Centers Advances DEI with a Structured, Employee-Driven Approach

- Educational Programming and Tutoring Services Support Sun Communities’ Team Members

Building Resilience

In 2021, the U.S. experienced 20 climate-related disasters. REITs are deploying innovative approaches and new technologies. They are proactively mitigating environmental impact and building resilience for the long term by:

- Conducting climate change risk assessments and setting greenhouse gas (GHG) reduction targets to decarbonize their portfolio;

- Investing in green certified and resilient buildings that perform better and enhance property values;

- Conserving or restoring green spaces that also attract employees, tenants, and community members while protecting biodiversity; and

- Implementing new and innovative climate adaptation strategies to reduce water and energy consumption, and to be prepared against climate events.

REITs Addressing Climate Change Risks and Opportunities

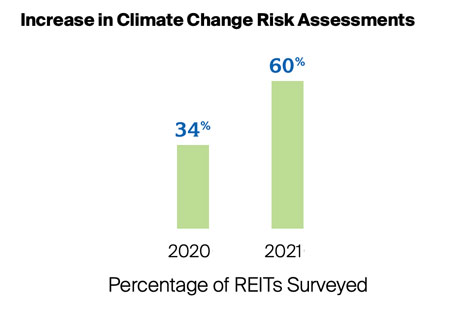

Investors are increasingly taking climate risk into account when evaluating their portfolios’ exposure to climate change. REITs are increasingly conducting climate risk assessments to better understand and more effectively manage issues that impact strategic, operational, and economic performance.

Increasing Alignment by REITs to the Task Force on Climate-Related Financial Disclosures (TCFD)

REITs are enhancing corporate reporting with the inclusion of climate change risk assessment disclosures and strengthening their credibility by aligning with the recommendations of the TCFD—nearly two-thirds of REITs surveyed aligned their strategy and goals to TCFD in 2021, up from 35% in 2020.

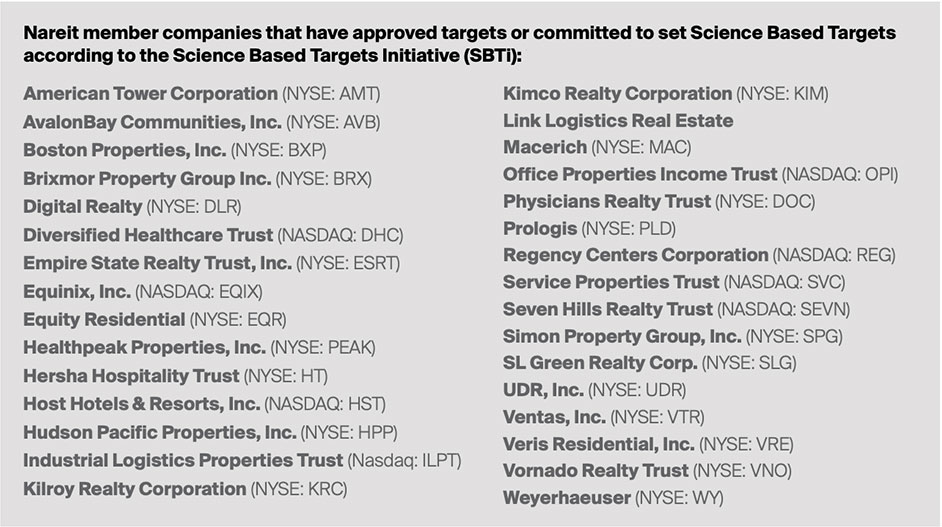

REITs Setting Science-Based Emissions Reduction Targets

Setting science-based targets provides a clear pathway for companies to reduce their emissions in a way that is considered meaningful, helping to avoid the worst impacts of climate change for long term resiliency.

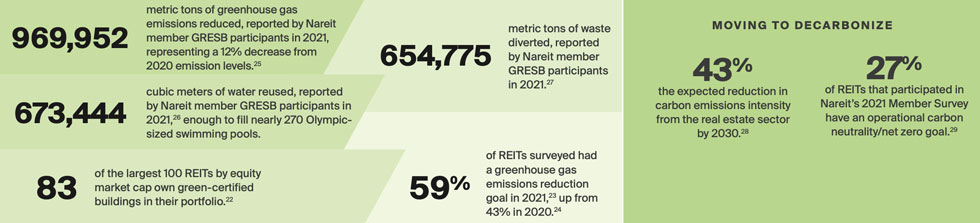

An emissions reduction target is considered to be “science-based” if it aligns to the goals of the Paris Agreement and what the latest science deems necessary to limit global warming to well-below 2 degrees Celsius and seek actions to limit warming to 1.5 degrees Celsius. 59% of REITs surveyed had a greenhouse gas emissions reduction goal in 2021, up from 43% in 2020. And in 2021, 70% of REITs surveyed report on Scope 1, 70% report on Scope 2, and 40% report on Scope 3 emissions.

Energy Efficiency and Clean Energy Commitments by REITs

REITs are committing to improve energy efficiency with 58% of REITs surveyed having an energy efficiency goal in place in 2021. REITs that do not have direct control over their energy usage, such as REITs with triple net lease structures, are working to engage and educate tenants on how they can reduce usage while also saving on utility expenses.

In addition to improving energy efficiency, REITs are decarbonizing their footprint by sourcing more clean energy and reducing their reliance on fossil fuels. REITs are expanding renewable energy use by generating their own renewable energy on site through projects, such as rooftop solar. Alternatively, REITs are procuring renewable energy off site by purchasing renewable energy credits (RECs) or buying renewable energy from their utility providers. In 2021, REITs reporting to GRESB consumed 3,888,067 MWh of renewable energy—a 50% increase from 2020 to 2021.

Green REIT-Owned Buildings

Building on the momentum from 2020, REITs continue to develop and certify green buildings as a way to reduce their environmental impact with 83 of the largest 100 REITs by equity market cap owning green certified buildings in their portfolios.

The average green building is worth as much as 9% more than its traditional counterpart, driving financial returns in addition to environmental benefits.

REITs Deploy Water Use Solutions

REITs are adopting solutions to reduce future water risk, including implementing leak detection systems, retrofitting building fixtures to increase efficiency, and employing water-conscious landscaping, such as planting drought-tolerant plants. In 2021, REITs reporting to GRESB reused 673,444 cubic meters of water, enough to fill nearly 270 Olympic sized swimming pools.

Sustainable Waste Management in Real Estate Industry

For the REIT and publicly traded real estate industry, sustainable waste management practices, such as the “circular economy” concept, can deliver economic, social, and environmental benefits, including the potential to reduce procurement and disposal costs, enhance corporate reputation, and reduce Scope 3 greenhouse gas emissions from waste disposal. REITs continue to take actions to reduce their waste production by engaging tenants on proper disposal and recycling or working with suppliers focused on limiting waste generation. In 2021, REITs reporting to GRESB diverted 654,775 metric tons of waste, and decreased their total waste production by 33%.

Case studies:

- Applying Data for Innovative Water Conservation Solutions in Student Housing

- How American Tower is Achieving its Science-Based Greenhouse Gas Reduction Targets

- Brookfield Properties Accelerating Decarbonization Strategies

- Empire State Realty’s Technical Playbook Supports Path for Industry Decarbonization

- Federal Realty Revitalizes Properties to Support Local Conservation

- How The Howard Hughes Corporation Protects Biodiversity

- Iron Mountain Propels Innovation in Clean Power Generation

- Prioritizing Business Continuity Plans at Macerich

- Paramount Group Drives Long-Term Resiliency with Climate-Related Risk Assessments

- How Physicians Realty Trust is Utilizing Software to Enhance Environmental Performance

- Prologis Establishes Portfolio-Wide Innovations to Achieve Decarbonization

- W.P. Carey Engages Tenants to Reduce Environmental Impact