|

February 3, 2014

Message from the President

Last week, as the story below reports, the Financial Accounting Standards Board (FASB) decided to remove both the Investment Companies: Real Estate Property Investments and the Investment Property Entities projects from its agenda. The decision means that the current accounting framework for both equity and mortgage REITs will not be changed by the requirements that were part of these proposals. Last week, as the story below reports, the Financial Accounting Standards Board (FASB) decided to remove both the Investment Companies: Real Estate Property Investments and the Investment Property Entities projects from its agenda. The decision means that the current accounting framework for both equity and mortgage REITs will not be changed by the requirements that were part of these proposals.

The impact of these two proposals, generally, would have been to require REITs to report their financial results much as mutual funds do, resulting in significant changes from current reporting practice. REITs, for example, would have been required to present various parts of their financial statements in a manner akin to investment funds that hold securities. The accompanying distortions in REITs’ financial statements would have made our member companies’ financial results more difficult to understand for securities analysts and investors and far less comparable to other companies.

NAREIT and representatives from our member companies have closely monitored FASB’s deliberations on these issues for the past two years and have provided the board with our industry’s perspective through comment letters and participation at FASB public roundtables. We have strongly and consistently objected to FASB’s proposed revised definition of an investment company to include REITs.

The FASB’s decision to terminate both projects is a very positive development for our industry. We appreciate the important contributions of our members who participated in this effort to maintain clarity in the reporting of our industry’s financial performance to the investment community.

Steven A. Wechsler

President and CEO

NAREIT Talks REITs at Institutional Real Estate Events

NAREIT’s investor outreach team uses multiple channels in its efforts to inform and educate investors on the REIT approach to real estate investment to institutional investors worldwide. Participation in industry events and conferences often provides a particularly effective way of conveying the story. During the month of January, Meredith Despins, vice president, investment affairs and investor education, participated in two such events as part of NAREIT’s outreach to the pension and endowment fund investor markets. NAREIT’s investor outreach team uses multiple channels in its efforts to inform and educate investors on the REIT approach to real estate investment to institutional investors worldwide. Participation in industry events and conferences often provides a particularly effective way of conveying the story. During the month of January, Meredith Despins, vice president, investment affairs and investor education, participated in two such events as part of NAREIT’s outreach to the pension and endowment fund investor markets.

The National Council of Real Estate Investment Fiduciaries (NCREIF) recently held its Nuts & Bolts of Institutional Real Estate event in Chicago. The program curriculum, intended to provide a broad-based overview and introduction to institutional real estate investment focusing on strategy development, portfolio management, and risk and performance analysis, is targeted to plan sponsors, investment consultants, investment managers, and other professionals involved in institutional real estate investment. The National Council of Real Estate Investment Fiduciaries (NCREIF) recently held its Nuts & Bolts of Institutional Real Estate event in Chicago. The program curriculum, intended to provide a broad-based overview and introduction to institutional real estate investment focusing on strategy development, portfolio management, and risk and performance analysis, is targeted to plan sponsors, investment consultants, investment managers, and other professionals involved in institutional real estate investment.

While NCREIF’s constituency is predominantly focused on private real estate investment, NAREIT has been exploring opportunities with NCREIF that would bring light to the important role listed real estate plays within the context of real estate investment. As an example, NAREIT and NCREIF have collaborated on a quarterly publication the NCREIF-NAREIT Quarterly Executive Summary that contains NAREIT and NCREIF index performance return data and analysis of property fundamentals and sectors.

Despins also attended the 2014 VIP: Visions Insights & Perspectives Americas conference sponsored by Institutional Real Estate, Inc. (IREI), in Carlsbad, Calif. IREI’s VIP conference is designed for tax-exempt institutional real estate investors and their advisers. The program’s focus was on economic, capital markets and demographic trends and their impact on institutional real estate investment. Despins also attended the 2014 VIP: Visions Insights & Perspectives Americas conference sponsored by Institutional Real Estate, Inc. (IREI), in Carlsbad, Calif. IREI’s VIP conference is designed for tax-exempt institutional real estate investors and their advisers. The program’s focus was on economic, capital markets and demographic trends and their impact on institutional real estate investment.

Despins was invited to serve as a peer group discussion leader on the topic of the recent trend among plan sponsors away from a discrete allocation to real estate to one of a broader “real assets” allocation, and the implications the trend may have on real estate investment markets and capital flows.

One of the highlights of the VIP conference each year is a discussion of findings from an annual investor survey conducted jointly by IREI and Kingsley associates that intends to capture data on investor sentiment and actual and targeted capital flows into commercial real estate investment. The findings of this year’s survey reveal that investors’ targeted allocation to real estate is approximately 10 percent of total assets, and most investors are currently under invested relative to their targets. The implication of which is that more money is likely to be invested in real estate over the course of 2014 in order to meet targets. The majority of the new investment, approximately three-quarters, will be targeting U.S. real estate, according to the survey.

(Contact: Meredith Despins at mdespins@nareit.com)

FASB Drops Investment Companies Project on REITs

On Jan. 29, the Financial Accounting Standards Board (FASB) held a meeting to discuss future priorities for its standard setting agenda. Among the topics up for discussion was whether the board and its staff should continue work on the Investment Companies: Real Estate Property Investments and Investment Property Entities Projects. On Jan. 29, the Financial Accounting Standards Board (FASB) held a meeting to discuss future priorities for its standard setting agenda. Among the topics up for discussion was whether the board and its staff should continue work on the Investment Companies: Real Estate Property Investments and Investment Property Entities Projects.

The majority of board members voted to eliminate both projects from its agenda. NAREIT has closely followed the deliberations of both projects for the past few years and in 2012 provided the board with input on the Investment Companies and Investment Property Entities Projects. NAREIT strongly objected to the inclusion of equity REITs and mortgage REITs in the Investment Companies Proposal. The board responded by exempting REITs from the Investment Companies Accounting Standards Update issued in June 2013. At that time, the board planned to consider the accounting for investments in real estate in the Investment Companies: Real Estate Property Investments and Investment Property Entities Projects.

Also at the Jan. 29 meeting, the board identified the Financial Statement Presentation Project as a research project. NAREIT provided input to the board on this project and will monitor the board’s progress on this project with a view towards advocating the ability of the global real estate industry to report what are now supplemental metrics in audited financial statements such as funds from operations and net operating income.

(Contact: Chris Drula at cdrula@nareit.com)

NAREIT’s January Outreach Efforts Feature a Visit to the Peach State

NAREIT's Investor Outreach team’s busy January itinerary included 10 meetings in the surprisingly frigid Atlanta metro area. During this southern road show, NAREIT staff met with a diverse range of 10 organizations in the institutional investment market controlling more than $3 trillion in assets. The 10 meetings were held with organizations across all targeted investment cohorts, including: three with prominent pension, retirement, and endowment fund plan sponsors representing more than $41 billion in assets; four with investment consultants with assets under advisement of more than $3 trillion, and three with investment managers sponsoring global and domestic products for the institutional and retail investor markets and representing more than $21 billion in assets under management. NAREIT's Investor Outreach team’s busy January itinerary included 10 meetings in the surprisingly frigid Atlanta metro area. During this southern road show, NAREIT staff met with a diverse range of 10 organizations in the institutional investment market controlling more than $3 trillion in assets. The 10 meetings were held with organizations across all targeted investment cohorts, including: three with prominent pension, retirement, and endowment fund plan sponsors representing more than $41 billion in assets; four with investment consultants with assets under advisement of more than $3 trillion, and three with investment managers sponsoring global and domestic products for the institutional and retail investor markets and representing more than $21 billion in assets under management.

The focus of the discussion in each of the 10 meetings varied to a significant degree, as did the internal, academic and sponsored research that was presented to each organization. For some of the visits, the message began at a very fundamental level. The focus for these meetings was on making the case for real estate as a core asset class representing the third largest asset in the United States market basket, and for the fact that an investment in REITs is an investment in real estate. In instances where organizations have already embraced real estate, the focus was more on the utility REITs bring to investment portfolios, and the fact that REITs have both strategic and tactical portfolio applications.

Using a combination of internal and sponsored research, practical examples were provided of how REITs may be employed within institutional investment portfolios. Finally, in response to growing investor interest, a number of our meetings featured an outlook on the current domestic macroeconomy and its implications for commercial real estate and REITs, as well as the global real estate market.

(Contact: Kurt Walten at kwalten@nareit.com)

NAREIT Podcast: Bruce Schanzer, Cedar Realty Trust

The latest edition of the NAREIT Podcast features an interview with Bruce Schanzer, president and CEO of Cedar Realty Trust (NYSE: CDR). The latest edition of the NAREIT Podcast features an interview with Bruce Schanzer, president and CEO of Cedar Realty Trust (NYSE: CDR).

Schanzer offered insight into what he considers to be the company’s most significant achievements heading into the third year of his tenure as CEO. He noted that Cedar Realty Trust has “dramatically” repositioned its portfolio of property. Furthermore, he said he has tried to cultivate a collaborative culture throughout the company.

Schanzer also discussed the plans for capital raised in a recent secondary equity offering. Additionally, he explained Cedar Realty Trust’s strategy for recycling capital and moving from “defense to offense” in terms of bringing new assets into the company’s portfolio. Lastly, he talked about the role of grocery-anchored shopping centers within investment portfolios and Cedar Realty Trust as a countercyclical investment play.

“We’re feeling pretty confident in our portfolio, almost irrespective of whatever the economy throws our way in the next few years,” Schanzer said.

(Contact: Allen Kenney at akenney@nareit.com)

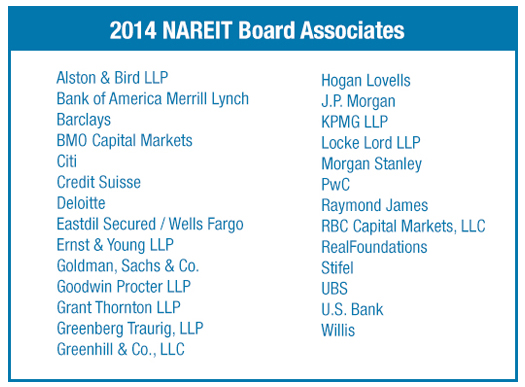

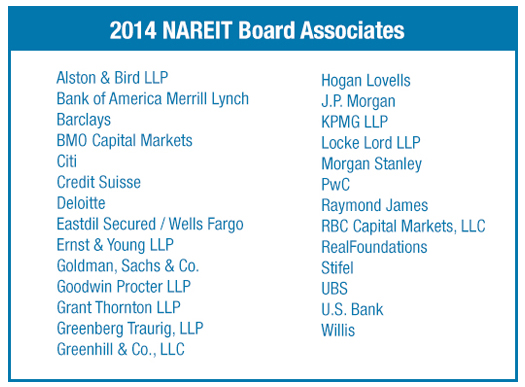

NAREIT Welcomes 2014 Board Associate Program Members

NAREIT would like to thank the 27 firms that have renewed their participation in the 2014 NAREIT Board Associate Program. NAREIT’s Board Associate Program is comprised of leading senior real estate professionals representing their respective firms that service and/or support the REIT and publicly traded real estate industry through active participation and patronage of NAREIT programs and activities conducted throughout the course of the year.

(Contact: Chris Flood at cflood@nareit.com)

REIT.com Videos: Sustainability Insights

During last month’s 2014 Leader in the Light Working Forum, REIT.com sat down with a number of attendees to gain more insights into how REITs are addressing sustainability concerns and what are the latest trends in the industry. Below is a summary of some of the interviews posted on the site.

Daniele Horton, founder and principal of Verdani Partners and head of sustainability at Parkway Properties, Inc. (NYSE: PKY), discussed the huge push for transparency in sustainability, with more than 30 cities now having their own disclosure requirements. “This will reward owners who are already efficient and penalize owners who are not there yet,” she said. She also emphasized the need for increased tenant engagement and technological improvements within buildings. Daniele Horton, founder and principal of Verdani Partners and head of sustainability at Parkway Properties, Inc. (NYSE: PKY), discussed the huge push for transparency in sustainability, with more than 30 cities now having their own disclosure requirements. “This will reward owners who are already efficient and penalize owners who are not there yet,” she said. She also emphasized the need for increased tenant engagement and technological improvements within buildings.

Sukanya Paciorek, senior vice president for corporate sustainability at Vornado Realty Trust (NYSE: VNO), discussed the next area of focus for companies that have been at the forefront of sustainability. She pointed out that after a big focus on energy efficiency, a shift towards human health is now evident. Sukanya Paciorek, senior vice president for corporate sustainability at Vornado Realty Trust (NYSE: VNO), discussed the next area of focus for companies that have been at the forefront of sustainability. She pointed out that after a big focus on energy efficiency, a shift towards human health is now evident.

“I think everyone is realizing that it’s not just about the environment and the building’s relationship with the environment, but perhaps, more importantly, it’s the impact of buildings on humans. It’s really about indoor air quality, the wellbeing of the occupants of the building,” she said.

Jennifer Senick, executive director of Rutgers University Center for Green Buildings,discussed some of the challenges REITs face regarding sustainability programs, particularly as it applies to geographically diverse portfolios. These include developments such as mandatory disclosure laws, which require companies to start providing portfolio-wide information, and increased regulatory reporting at the state level. Jennifer Senick, executive director of Rutgers University Center for Green Buildings,discussed some of the challenges REITs face regarding sustainability programs, particularly as it applies to geographically diverse portfolios. These include developments such as mandatory disclosure laws, which require companies to start providing portfolio-wide information, and increased regulatory reporting at the state level.

“You have different building code and other regulatory influences, and in some states or cities you have, on the flip side, incentives that are driving people to reinvest or invest in those assets in a different way,” she said.

(Contact: Matt Bechard at mbechard@nareit.com)

Highwoods, Campus Crest and Glimcher Featured in January/February REIT Magazine

The January/February issue of REIT: Real Estate Investment Today magazine is now available in print and online. "Hitting the High Notes” profiles how office REIT Highwoods Properties (NYSE: HIW) has strategically avoided the intense competition in gateway markets and instead capitalized on the growth of mid-tier markets, particularly in the Sun Belt. The January/February issue of REIT: Real Estate Investment Today magazine is now available in print and online. "Hitting the High Notes” profiles how office REIT Highwoods Properties (NYSE: HIW) has strategically avoided the intense competition in gateway markets and instead capitalized on the growth of mid-tier markets, particularly in the Sun Belt.

Also featured in this issue, Campus Crest Communities (NYSE: CCG) continues to expand in the student housing sector by focusing on purpose-built communities at primary, non-flagship universities.

In “Retail Refined,” REIT magazine sits down with Glimcher Realty Trust (NYSE: GRT) Chairman and CEO Michael Glimcher to discuss a number of topics including how the firm has evolved from its origins in community centers and smaller markets to its current focus on high-end malls throughout the country.

Also in this issue, a Q&A with noted author and investor Burton Malkiel, a look at how larger macroeconomic factors will impact REITs and REIT shares in 2014, as well as a roundtable with leading REIT analysts discussing their expectations for 2014.

(Contact: Matt Bechard at mbechard@nareit.com)

|

Last week, as the story below reports, the Financial Accounting Standards Board (FASB) decided to remove both the Investment Companies: Real Estate Property Investments and the Investment Property Entities projects from its agenda. The decision means that the current accounting framework for both equity and mortgage REITs will not be changed by the requirements that were part of these proposals.

Last week, as the story below reports, the Financial Accounting Standards Board (FASB) decided to remove both the Investment Companies: Real Estate Property Investments and the Investment Property Entities projects from its agenda. The decision means that the current accounting framework for both equity and mortgage REITs will not be changed by the requirements that were part of these proposals.

NAREIT’s investor outreach team uses multiple channels in its efforts to inform and educate investors on the REIT approach to real estate investment to institutional investors worldwide. Participation in industry events and conferences often provides a particularly effective way of conveying the story. During the month of January, Meredith Despins, vice president, investment affairs and investor education, participated in two such events as part of NAREIT’s outreach to the pension and endowment fund investor markets.

NAREIT’s investor outreach team uses multiple channels in its efforts to inform and educate investors on the REIT approach to real estate investment to institutional investors worldwide. Participation in industry events and conferences often provides a particularly effective way of conveying the story. During the month of January, Meredith Despins, vice president, investment affairs and investor education, participated in two such events as part of NAREIT’s outreach to the pension and endowment fund investor markets. The National Council of Real Estate Investment Fiduciaries (NCREIF) recently held its Nuts & Bolts of Institutional Real Estate event in Chicago. The program curriculum, intended to provide a broad-based overview and introduction to institutional real estate investment focusing on strategy development, portfolio management, and risk and performance analysis, is targeted to plan sponsors, investment consultants, investment managers, and other professionals involved in institutional real estate investment.

The National Council of Real Estate Investment Fiduciaries (NCREIF) recently held its Nuts & Bolts of Institutional Real Estate event in Chicago. The program curriculum, intended to provide a broad-based overview and introduction to institutional real estate investment focusing on strategy development, portfolio management, and risk and performance analysis, is targeted to plan sponsors, investment consultants, investment managers, and other professionals involved in institutional real estate investment. Despins also attended the 2014 VIP: Visions Insights & Perspectives Americas conference sponsored by Institutional Real Estate, Inc. (IREI), in Carlsbad, Calif. IREI’s VIP conference is designed for tax-exempt institutional real estate investors and their advisers. The program’s focus was on economic, capital markets and demographic trends and their impact on institutional real estate investment.

Despins also attended the 2014 VIP: Visions Insights & Perspectives Americas conference sponsored by Institutional Real Estate, Inc. (IREI), in Carlsbad, Calif. IREI’s VIP conference is designed for tax-exempt institutional real estate investors and their advisers. The program’s focus was on economic, capital markets and demographic trends and their impact on institutional real estate investment. On Jan. 29, the Financial Accounting Standards Board (FASB) held a meeting to discuss

On Jan. 29, the Financial Accounting Standards Board (FASB) held a meeting to discuss  NAREIT's Investor Outreach team’s busy January itinerary included 10 meetings in the surprisingly frigid Atlanta metro area. During this southern road show, NAREIT staff met with a diverse range of 10 organizations in the institutional investment market controlling more than $3 trillion in assets. The 10 meetings were held with organizations across all targeted investment cohorts, including: three with prominent pension, retirement, and endowment fund plan sponsors representing more than $41 billion in assets; four with investment consultants with assets under advisement of more than $3 trillion, and three with investment managers sponsoring global and domestic products for the institutional and retail investor markets and representing more than $21 billion in assets under management.

NAREIT's Investor Outreach team’s busy January itinerary included 10 meetings in the surprisingly frigid Atlanta metro area. During this southern road show, NAREIT staff met with a diverse range of 10 organizations in the institutional investment market controlling more than $3 trillion in assets. The 10 meetings were held with organizations across all targeted investment cohorts, including: three with prominent pension, retirement, and endowment fund plan sponsors representing more than $41 billion in assets; four with investment consultants with assets under advisement of more than $3 trillion, and three with investment managers sponsoring global and domestic products for the institutional and retail investor markets and representing more than $21 billion in assets under management. The

The

The January/February issue of REIT: Real Estate Investment Today magazine is now available in print and

The January/February issue of REIT: Real Estate Investment Today magazine is now available in print and