|

September 8, 2014

Message from the President

Sustainability as a dedicated discipline may be relatively new to the business world, but that hasn’t stopped the real estate industry, particularly REITs, from pushing forward in its commitment to eco-friendly operations. This is evident in the results of the annual survey from the Global Real Estate Sustainability Benchmark (GRESB), a NAREIT partner organization that is committed to improving the assessment of sustainability performance of real estate portfolios worldwide. Sustainability as a dedicated discipline may be relatively new to the business world, but that hasn’t stopped the real estate industry, particularly REITs, from pushing forward in its commitment to eco-friendly operations. This is evident in the results of the annual survey from the Global Real Estate Sustainability Benchmark (GRESB), a NAREIT partner organization that is committed to improving the assessment of sustainability performance of real estate portfolios worldwide.

According to the results of the latest survey of listed property companies and private equity real estate funds around the globe, participants have shown “significant improvement” in their individual performances, producing tangible results. Notably, the GRESB survey revealed that on average, listed property companies received overall sustainability scores that were approximately 15 percent higher than private funds.

Not only are real estate companies and funds enhancing their operations, they’re building out their abilities to monitor and communicate their performance to investors, who increasingly view going green as more of a requirement and less of an option.

Through our partnership with GRESB, NAREIT is working to establish a useful framework for measuring and reporting this performance.

Steven A. Wechsler

President and CEO

GRESB Survey Shows Improved Sustainability in Real Estate Industry

The Global Real Estate Sustainability Benchmark (GRESB) 2014 survey results released last week point to strong improvement in the sustainability performance of the global real estate industry as a whole, according to the organization. The Global Real Estate Sustainability Benchmark (GRESB) 2014 survey results released last week point to strong improvement in the sustainability performance of the global real estate industry as a whole, according to the organization.

The survey looked at data from listed property companies and private equity real estate funds around the world. In total, the respondents’ portfolios cover 56,000 buildings with an aggregate value of $ 2.1 trillion.

Results from the 2014 survey indicated that in the last year, the commercial real estate industry cut energy consumption by nearly 1 percent. Additionally, water consumption fell by 2.3 percent. Carbon emissions were cut 0.3 percent for the year.

GRESB said the results show “significant improvement” of participants’ individual scores. GRESB noted that organizations appear to be more aware of the importance of implementing policies and of proper monitoring and reporting on metrics.

“The need for reliable, investment grade data continues to increase with the advent of capital market interest in the topic of energy efficiency and sustainability in real estate,” said Nils Kok, executive director of GRESB, an industry-driven organization that assesses the sustainability performance of real estate portfolios around the globe.

On average, listed property companies received overall sustainability scores that were approximately 15 percent higher than private funds.

GRESB recognized a number of U.S. REITs for their performances. Host Hotels & Resorts, Inc. (NYSE: HST), Ventas, Inc. (NYSE: VTR) and HCP, Inc. (NYSE: HCP) were named global sector leaders.

A number of U.S. REITs were also named as sector leaders for the North America region, including General Growth Properties, Inc. (NYSE: GGP), Kilroy Realty Corp. (NYSE: KRC), Prologis, Inc. (NYSE: PLD), Equity Residential (NYSE: EQR) and Inland Real Estate Investment Corp.

(Contact: Sheldon Groner at sgroner@nareit.com)

Investor Outreach Team Holds 22 Meetings in August

In August, NAREIT's Investor Outreach team held direct meetings with a diverse group of 22 investment organizations controlling nearly $523 billion in assets in the institutional investment market. The meetings were held with organizations across all targeted investment cohorts, including prominent domestic pension plans, investment managers sponsoring global and domestic products for the institutional and retail investor markets, and several meetings with industry organizations and associations active in the pension and retirement industry. In August, NAREIT's Investor Outreach team held direct meetings with a diverse group of 22 investment organizations controlling nearly $523 billion in assets in the institutional investment market. The meetings were held with organizations across all targeted investment cohorts, including prominent domestic pension plans, investment managers sponsoring global and domestic products for the institutional and retail investor markets, and several meetings with industry organizations and associations active in the pension and retirement industry.

Through the end of August, NAREIT conducted 284 meetings in 2014 with many of the largest and most influential investment organizations within the institutional investment marketplace. Collectively, these entities represent more than $29 trillion in assets under management or advisement.

NAREIT has also been active on the academic and institutional investment conference circuit through August, attending 18 events and participating as a speaker, board member or exhibitor at six.

(Contact: Meredith Despins at mdespins@nareit.com)

REIT.com Video: Debra Cafaro, Ventas

Debra Cafaro, chairman and CEO of health care REIT Ventas, Inc., joined REIT.com for a CEO Spotlight video interview. Debra Cafaro, chairman and CEO of health care REIT Ventas, Inc., joined REIT.com for a CEO Spotlight video interview.

The health care sector has witnessed a flurry of deal-making activity. Cafaro described the pace of growth in the sector as “quite heated.”

“We are in a great sector where external growth is really part of our value proposition for investors,” she said. “The market is ripe for the additional continued transition of assets from private hands to public hands as we’ve seen in the REIT sector over the past couple of decades.”

Cafaro noted that so little of the health care real estate in the United States currently is owned by stock exchange-listed REITs that it creates an opportunity for more growth within the sector.

CLICK HERE for more of Cafaro's interview with REIT.com.

(Contact: Matt Bechard at mbechard@nareit.com)

IRS Issues Guidance on Distressed Debt

The IRS last month issued guidance regarding distressed debt. The IRS last month issued guidance regarding distressed debt.

Rev. Proc. 2014-51, issued on Aug. 22, modifies guidance previously outlined by the IRS in Rev. Proc. 2011-16. Rev. Proc. 2011-16 provided a safe harbor applicable to modifications of existing mortgage loans and acquisitions of new mortgage loans in which the value of the real property securing the debt is less than the principal amount of the loan, which otherwise could create possible REIT asset or income test disqualification issues.

Rev. Proc. 2014-51 comes after NAREIT requested clarification on the previous guidance.

For more information, see NAREIT’s Tax Report on the subject.

(Contact: Dara Bernstein at dbernstein@nareit.com)

REIT.com Video: Quick Study with NAREIT’s Brad Case

In the latest edition of Quick Study, Brad Case, NAREIT’s senior vice president for research and industry information, offered an analysis of REIT market gains in August. In the latest edition of Quick Study, Brad Case, NAREIT’s senior vice president for research and industry information, offered an analysis of REIT market gains in August.

The total return on the FTSE NAREIT All REITs Index increased 3.4 percent for the month, slightly below the 4.0 percent gain in the S&P 500 Index during the same period. As of the end of August, the FTSE NAREIT All REITs Index was up 19.8 percent, compared to a 9.9 percent gain for the broader market.

According to Case, investors are generally more comfortable with the notion that the economic recovery is going to continue, which will increase demand across all types of commercial real estate. At the same time, investors have become aware of how little new construction is occurring nationwide in all property types, he said.

CLICK HERE for more of Case’s analysis on REIT.com.

(Contact: Brad Case at bcase@nareit.com)

NAREIT Joins Amicus Brief on Michigan Case

NAREIT and a number of real estate industry organizations filed an Amicus Curiae brief last month in regards to the constitutionality of Michigan’s Nonrecourse Mortgage Loan Act.

In their brief, the organizations said their interest in the case, Borman, LLC v. 18718 Borman, LLC and Joseph Schwebel, stemmed from the issues in the case associated with nonrecourse lending that will "impact the commercial real estate industry in Michigan and beyond."

The coalition asked the United States Court of Appeals for the 6th Circuit to affirm a lower court’s decision upholding the Michigan law’s constitutionality.

(Contact: Victoria Rostow at vrostow@nareit.com)

NAREIT Welcomes New Corporate Member

NAREIT is pleased to welcome Iron Mountain, Inc. (NYSE: IRM) as its newest Corporate Member. Iron Mountain provides space to store, protect and manage information assets for customers of all sizes in every major industry in 36 countries. Iron Mountain is based in Boston. William Meaney is the company’s president and CEO. NAREIT is pleased to welcome Iron Mountain, Inc. (NYSE: IRM) as its newest Corporate Member. Iron Mountain provides space to store, protect and manage information assets for customers of all sizes in every major industry in 36 countries. Iron Mountain is based in Boston. William Meaney is the company’s president and CEO.

(Contact: Bonnie Gottlieb at bgottlieb@nareit.com)

REITs in the Community

Aug. 27: Sen. Martin Heinrich (D-NM), right, toured Simon Property Group’s (NYSE: SPG) ABQ Uptown lifestyle center in Albuquerque, N.M. The senator met with mall manager B Janecka, left, as well as store managers for local and national retail tenants. Among other things, Heinrich was thanked for his support of the Marketplace Fairness Act and the Terrorism Risk Insurance Act.

Sept. 2: Rep. Mark Pocan (D-WI), far right, visits the Tanger Factory Outlets Centers, Inc. (NYSE: SKY) property in the Wisconsin Dells. Pocan, a cosponsor of the Marketplace Fairness Act as well as bills that would reauthorize the Terrorism Risk Insurance Act, toured the property and was briefed about Tanger’s operations as a stock exchange-listed REIT. Pocan was joined by (left to right): Heather Sweet, regional marketing director, and Michelle Zuelke, general manager.

Sept. 4: During a visit to the offices of Crown Castle International Corp. (NYSE: CCI), Sen. John Cornyn (R-TX), center, met with executives from several Houston-based REITs to discuss a variety of issues critical to the REIT and publicly traded real estate industry. Cornyn, the Senate Minority Whip and a senior member of the Senate Finance Committee, was also briefed on the current status of REITs based in Texas and the economic impact these and other REITs provide in communities across the country. In addition, several federal issues, including reauthorization of the Terrorism Risk Insurance Act, passage of the Marketplace Fairness Act, FIRPTA reform and comprehensive tax reform, were discussed. Pictured with Cornyn (from left to right): Blake Hawk, executive vice president and general counsel, Crown Castle; Jay Brown, CFO, Crown Castle; Keith Oden, president, Camden Property Trust (NYSE: CPT); Stanford Alexander, chairman, Weingarten Realty Investors (NYSE: WRI); Andrew Alexander, president and CEO, Weingarten Realty; and Ben Moreland, president and CEO, Crown Castle.

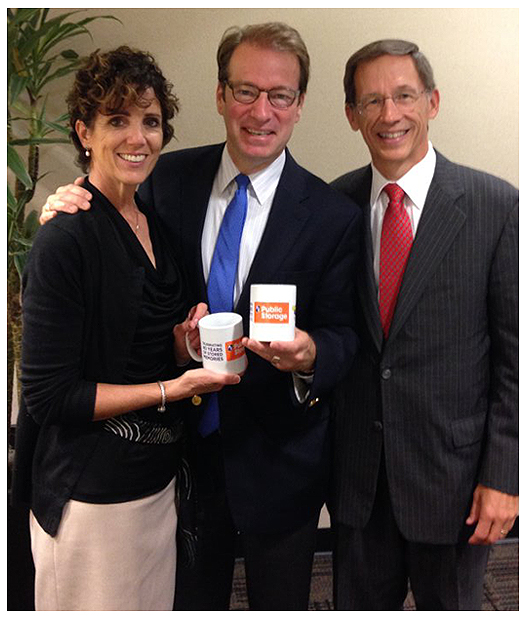

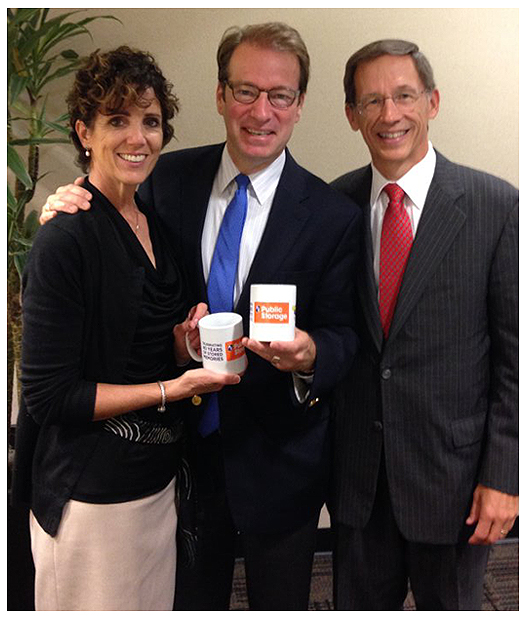

Sept. 4: Rep. Peter Roskam (R-IL), center, a member of the House Ways & Means Committee, visited the offices of Public Storage (NYSE: PSA) in Glendale, Calif. Roskam met with Public Storage Chairman, CEO & President and current NAREIT Chair Ron Havner (right). During the meeting, Roskam was briefed on Public Storage’s portfolio of assets and the company’s recent activities across the country, especially in Illinois. Havner discussed several key federal issues of concern to REITs and the real estate industry, including reauthorization of the Terrorism Risk Insurance Act, FIRPTA reform, the Marketplace Fairness Act and comprehensive tax reform. Also pictured: Elizabeth Roskam, the congressman's wife (left).

(Contact: Jessica Davis at jdavis@nareit.com)

|

NAREIT® is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. Members are REITs and other businesses that own, operate and manage income-producing real estate, as well as those firms and individuals who advise, study and service those businesses. NAREIT is the exclusive registered trademark of the National Association of Real Estate Investment Trusts, Inc.®, 1875 I St., NW, Suite 600, Washington, DC 20006-5413. Follow us on REIT.com.

Copyright© 2014 by the National Association of Real Estate Investment Trusts, Inc.® All rights reserved.

This information is solely educational in nature and is not intended by NAREIT to serve as the primary basis for any investment decision. NAREIT is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made. Investments and solicitations for investment must be made directly through an agent, employee or representative of a particular investment or fund and cannot be made through NAREIT. NAREIT does not allow any agent, employee or representative to personally solicit any investment or accept any monies to be invested in a particular security or real estate investment.

All REIT data are derived from, and apply only to, publicly traded securities. While such data are believed to be reliable when prepared or provided, such data are subject to change or restatement. NAREIT does not warrant or guarantee such data for accuracy or completeness, and shall not be liable under any legal theory for such data or any errors or omissions therein. See /TermsofUse.aspx for important information regarding this data, the underlying assumptions and the limitations of NAREIT’s liability therefor, all of which are incorporated by reference herein.

Performance results are provided only as a barometer or measure of past performance, and future values will fluctuate from those used in the underlying data. Any investment returns or performance data (past, hypothetical or otherwise) shown herein or in such data are not necessarily indicative of future returns or performance.

Before an investment is made in any security, fund or investment, investors are strongly advised to request a copy of the prospectus or other disclosure or investment documentation and read it carefully. Such prospectus or other information contains important information about a security’s, fund’s or other investment’s objectives and strategies, risks and expenses. Investors should read all such information carefully before making an investment decision or investing any funds. Investors should consult with their investment fiduciary or other market professional before making any investment in any security, fund or other investment. |

Sustainability as a dedicated discipline may be relatively new to the business world, but that hasn’t stopped the real estate industry, particularly REITs, from pushing forward in its commitment to eco-friendly operations. This is evident in the results of the annual survey from the Global Real Estate Sustainability Benchmark (GRESB), a NAREIT partner organization that is committed to improving the assessment of sustainability performance of real estate portfolios worldwide.

Sustainability as a dedicated discipline may be relatively new to the business world, but that hasn’t stopped the real estate industry, particularly REITs, from pushing forward in its commitment to eco-friendly operations. This is evident in the results of the annual survey from the Global Real Estate Sustainability Benchmark (GRESB), a NAREIT partner organization that is committed to improving the assessment of sustainability performance of real estate portfolios worldwide.

The Global Real Estate Sustainability Benchmark (GRESB) 2014 survey results released last week point to strong improvement in the sustainability performance of the global real estate industry as a whole, according to the organization.

The Global Real Estate Sustainability Benchmark (GRESB) 2014 survey results released last week point to strong improvement in the sustainability performance of the global real estate industry as a whole, according to the organization. In August, NAREIT's Investor Outreach team held direct meetings with a diverse group of 22 investment organizations controlling nearly $523 billion in assets in the institutional investment market. The meetings were held with organizations across all targeted investment cohorts, including prominent domestic pension plans, investment managers sponsoring global and domestic products for the institutional and retail investor markets, and several meetings with industry organizations and associations active in the pension and retirement industry.

In August, NAREIT's Investor Outreach team held direct meetings with a diverse group of 22 investment organizations controlling nearly $523 billion in assets in the institutional investment market. The meetings were held with organizations across all targeted investment cohorts, including prominent domestic pension plans, investment managers sponsoring global and domestic products for the institutional and retail investor markets, and several meetings with industry organizations and associations active in the pension and retirement industry.

The IRS last month issued guidance regarding distressed debt.

The IRS last month issued guidance regarding distressed debt. In the latest edition of

In the latest edition of  NAREIT is pleased to welcome

NAREIT is pleased to welcome