The Business

The Business

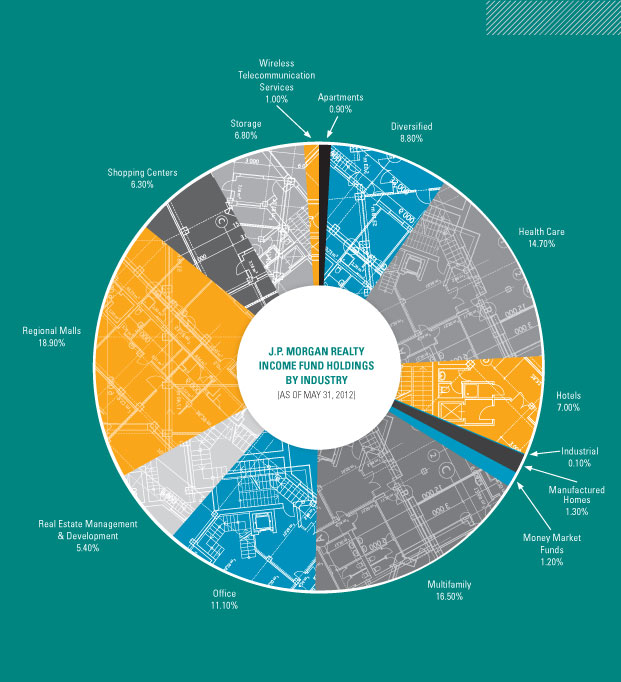

The J.P. Morgan Realty Income Fund aims to achieve high total returns via a combination of capital appreciation and current income. The fund invests nearly 100 percent of its total assets in REIT equity securities. The fund aims to invest in companies that “exhibit superior financial strength and operating returns and attractive growth prospects.”

Investment Philosophy

The strategy behind the J.P. Morgan Realty Income Fund combines a mix of both fundamental quantitative analysis and field research. On the quantitative side, Herr and Ko take a “bottom-up” approach focused on projecting long-term earnings and cash flows. The managers lean on J.P. Morgan’s direct real estate investment team to help keep them apprised

of the situations on the ground in major markets. That complements the information they gather when they visit REITs’ management teams and properties.

Herr says investors are developing a richer appreciation for the attributes that REITs bring to their investment portfolio.

“Right now the attributes that are most important to investors are the income that REITs generate and the inflation protection,” Herr says. “Those characteristics of fixed income, equity and real assets are what we think make REITs a great asset class and investment opportunity.”

J.P. Morgan Realty Income Fund Top 10 Holdings

(as of May 31, 2012)

Simon Property Group Inc. (NYSE: SPG)

Public Storage (NYSE: PSA)

Ventas Inc. (NYSE: VTR)

Prologis (NYSE: PLD)

HCP Inc. (NYSE: HCP)

Equity Residential (NYSE: EQR)

AvalonBay Communities Inc. (NYSE: AVB)

Boston Properties Inc. (NYSE: BXP)

Host Hotels & Resorts Inc. (NYSE: HST)

Vornado Realty Trust (NYSE: VNO)