Nobody likes a wet blanket. But the current economic cycle is six years old, and the commercial real estate party has been a raging good time for five years now. Kind of begs the question: When is the next recession?

Nobody likes a wet blanket. But the current economic cycle is six years old, and the commercial real estate party has been a raging good time for five years now. Kind of begs the question: When is the next recession?

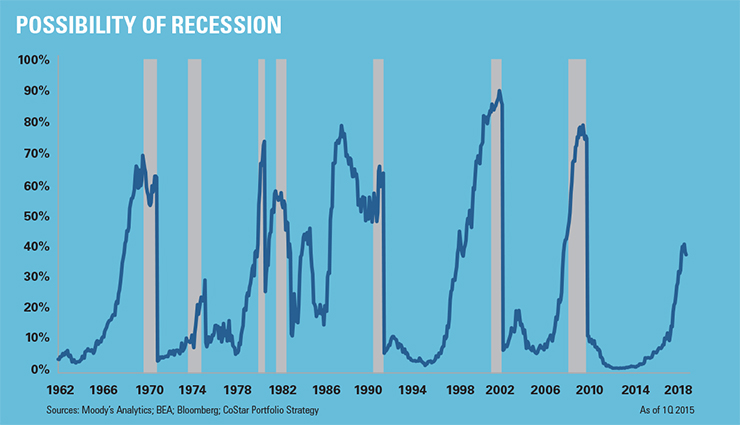

Recessions are wicked hard to predict, but our shop at CoStar Group has devised a model—we love models … we were the kids who liked math in high school—that has a strong historical fit with past recessions. It gives a longer lead time on when that recession should occur, compared with predictions based on the most common economic indicators. Our model predicts whether the economy will be in recession in two and a half to three years— the first half of 2018.

The model is fairly simple, based on interest rates, stock prices, capital investment and the length of time since the last recession.

As shown in the exhibit below, this model successfully predicted all seven of the recessions since 1970. The model failed to predict the 1973 recession, but since that was brought on by the exogenous shock of the Arab oil embargo, I would argue that it didn’t really screw up there. The model does predict a recession that never happened (a “false positive”) in 1987, when the stock market crashed but the economy did just fine.

And now, the $64 question: Does the model predict a recession for three years hence?

Not at the time of this writing. It calculates the likelihood of a recession in 2018 at about 40 percent; on the other hand, that could rise by the time you read this, depending on how fast the Fed raises rates. If this sounds equivocal, you may want to paraphrase Harry Truman–send me a one-armed economist!

Of course, for investors with patience—and perhaps just as importantly, patient capital sources—recessions don’t determine whether to invest in commercial real estate or not. Those investors have a much longer view. Further, the types of real estate, financial leverage, cities and even neighborhoods in which you would invest would differ in recession and non-recession scenarios.

So while the party is still going strong, it might be time to start drinking some water. Even good parties end eventually.

Hans Nordby is a managing director with CoStar Portfolio Strategy.