Aging may slow people down, but rising numbers of seniors and growing longevity are revving up demand for medical services and health care real estate.

Aging may slow people down, but rising numbers of seniors and growing longevity are revving up demand for medical services and health care real estate.

“Owners of health care properties enjoy a luxury very few businesses have, which is that because of the longevity schematic, we do not have to worry about demand,” says Bob Probst, executive vice president and chief financial officer of Ventas (NYSE: VTR). The Pew Research Center says that about 10,000 baby boomers per day have been turning 65 since 2011, a trend that will hold up through 2030. The coming “Silver Tsunami” creates a tremendous need for solutions to health care challenges—and a huge opportunity for health care REITs, says Tom DeRosa, CEO of Welltower (NYSE: HCN).

For instance, DeRosa maintains that health care REITs have a big opportunity to reinvent hospitals and take outmoded, expensive properties out of service.

“To successfully improve the delivery of health care in this country, real estate has to have a seat at the table where innovation is occurring,” he says.

Aging’s Uneven Impact

“The baby boomer generation is like a huge pig that needs to work its way through a snake,” says Jordan Sadler, an equity research analyst at Key Banc Capital Markets. “People in their 80s tend to go to the doctor with more frequency than those below age 65. As the baby boomers age, there will be increased demand throughout the continuum of care that will first impact medical office buildings, then hospitals, then ultimately senior housing and skilled nursing centers.”

DeRosa sees new senior housing facilities, in partnership with academic and super-regional health care systems, as a solution to provide wellness services for the aging population to deal with frailty and dementia.

“Our broad goal is to create a new class of real estate that can improve health outcomes for people while at the same time cutting costs,” he says.

According to the Census Bureau, there were 5.8 million Americans age 85 or older in 2010. By 2030, there will be an estimated 8.7 million. By 2050, an estimated 19 million people will be 85 or older, approximately 21 percent of the entire population.

Generalist investors looking to capitalize on these demographics are investing in health care real estate, according to Probst. Yet, companies within the sector are taking advantage using different strategies. HCP (NYSE: HCP), for example, has limited its exposure to market segments that are dependent on government reimbursement, such as skilled nursing and hospitals. Instead, the company is focusing on private pay lines of business, including senior housing, medical office buildings and life science properties.

“The powerful demographic trend of an aging population should act as a tailwind for health care real estate,” says HCP CEO Tom Herzog. “However, we believe demographics alone will not guarantee increased tenant demand or translate into strong and sustainable real estate returns for all owners across the health care spectrum.”

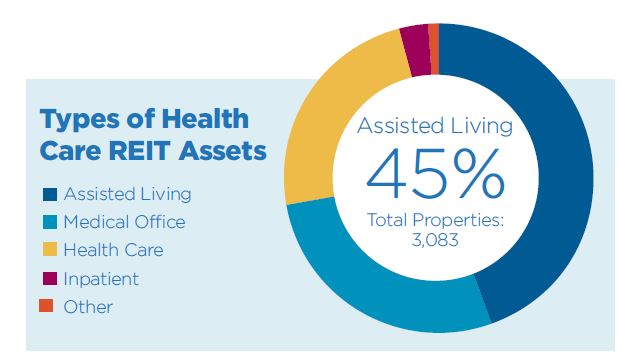

Demographics drive demand for all medical properties, but various asset types react differently.

Senior Housing

Peter Martin, a senior analyst with JMP Securities, says that population growth among those 80 and older will increase demand for senior housing in the future. Still, supply is the watchword for most observers of the senior housing segment.

“There’s a broad-based supply issue in senior housing, although the construction pipeline may have peaked in mid-2017,” says Sadler. “And yet, there is a woefully small supply in New York City and some other gateway cities.”

While Herzog acknowledges the headwinds from new supply on senior housing, he says construction deliveries should normalize by mid-2018. “Additionally, baby boomers begin turning 75 in 2020 and the over-75 population will grow by almost 50 percent over the next decade,” he says.

While Herzog acknowledges the headwinds from new supply on senior housing, he says construction deliveries should normalize by mid-2018. “Additionally, baby boomers begin turning 75 in 2020 and the over-75 population will grow by almost 50 percent over the next decade,” he says.

Sabra Health Care REIT (NASDAQ: SBRA) is focusing on developing senior housing in lower-cost secondary and tertiary markets.

“Senior housing was overbuilt in many markets and then hurt badly by the recession, but now they’ve adopted a new philosophy that these are centers for residents to age-in-place and get help with mobility and cognitive issues,” says Rick Matros, CEO of Sabra. “They have become a private-pay, lighter version of skilled nursing facilities.”

Matros believes construction of senior housing will slow in some markets as developers wait for absorption and vacancy rates to rise.

Probst says that while there are pockets of the country where construction of senior housing has outpaced demand, Ventas focuses on markets with high barriers to entry, high-income households and sturdy home values.

“We looked at data from high- and low-cost markets and found that its twice as expensive to stay at home and receive the services provided in senior housing,” Probst says. “So we see the economic value of senior housing as well as the social value of increasing the quality of life and the sense of community for seniors.”

Skilled Nursing

Sadler notes the supply of skilled nursing centers is limited, with the number of available beds falling. Yet, demand is anticipated to rise as the population ages. From an investment viewpoint, the risk of investing in skilled nursing facilities comes from the volatility of government reimbursement, which puts pressure on the operations side of the business.

“Ventas, HCP and Welltower have been selling or spinning off their skilled nursing center investments because of the overall fear of the squeeze of government reimbursements,” Sadler says.

According to John McRoberts, CEO of MedEquities Realty Trust (NYSE: MRT), there’s no oversupply of acute or post-acute facilities. The greying of America means that demand will be there, he says.

“The big challenge is all about reimbursement and finding successful operators,” says McRoberts. “Our job is to identify those successful operators who can adapt, to invest in their IT and to provide the capital to help them adapt. Ultimately, we try to see which companies can provide sustainable cash flow and still provide quality outcomes for patients.”

Matros points out that Sabra has a more bullish view of the skilled nursing segment than many real estate investors.

“Skilled nursing facilities sometimes feel like ping-pong within the REIT world, since they were the darlings of investors a few years ago and then became less popular,” he says. “We like skilled nursing because we know the business and we have good operators. We feel the investment community just doesn’t understand them very well.”

Hospitals

Hospitals

Fifty percent of hospital utilization comes from people older than 65, and an 80-year-old is eight times more likely to use a hospital than an 18-year-old, says Edward Aldag, CEO of Medical Properties Trust (NYSE: MPW). Medical Properties Trust’s portfolio is 100 percent invested in hospitals, about 30 percent of which are in Western Europe, with the rest in the U.S.

“Very few new hospitals are being built, but value can be added through the reconfiguration of existing space,” Aldag says.

Aldag points out that hospital utilization went up during the recession. That helped investors understand how hospitals can provide protection from downside risks, according Medical Properties’ CEO. That can be a selling point to investors, even if the assets don’t have the same level of growth potential.

Medical Office Buildings

Medical office buildings are among the lowest cost settings for medical services, says Sadler. As a result, demand is strong for this property type, particularly in locations affiliated with hospitals.

HCP is investing in the segment, betting that the current direction of health care delivery will hold up.

“HCP has benefitted from the trend of acute services shifting out of high-cost hospitals to lower-cost outpatient settings like those in our medical office buildings,” Herzog says. “A continuation of the outpatient trend, along with a rapidly aging population that requires more health care services, should provide tailwinds to our medical office properties.”

Future Challenges and Opportunities

There’s no denying that changing government policies and fallout within the health insurance industry impact health care REITs, Probst notes. On the other hand, he says diversification within REIT portfolios and increased emphasis on private pay assets, such as senior housing, help make the property sector resilient.

In the current market environment, investing in health care REITs can be considered a flight to safety for many investors; a safe space anticipated to become more so as Americans age.

In the current market environment, investing in health care REITs can be considered a flight to safety for many investors; a safe space anticipated to become more so as Americans age.

“When investors are concerned about global conflicts and an uncertain economy, particularly when it comes to fights over health care reform and tax reform, they rush into more defensive investments like health care REITs,” Martin says. “The health care REITs have done a decent job with their balance sheets, and they’re able to pay decent dividends.”

Whatever changes may be in store for the business of health care, health care REITs are ready to face them, according to Probst.

“The things that impact share prices tend to be macro issues, such as the expectation of interest rate hikes or tax policy changes,” Probst says. “But the demand for health care real estate is in place to offset any of those headwinds.”