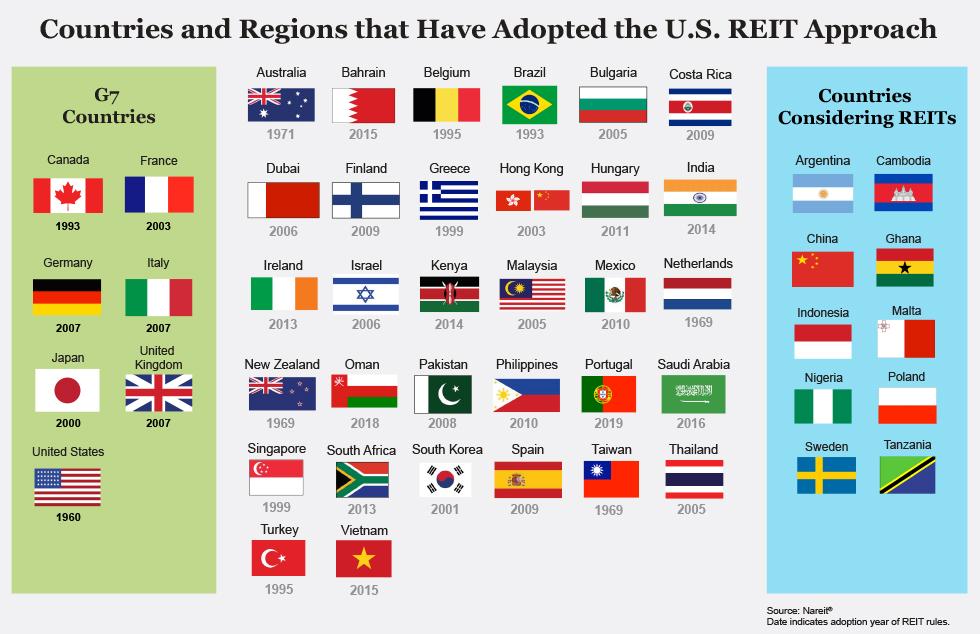

While the U.S. remains the largest listed real estate market, the listed real estate market is increasingly becoming global. The growth is being driven by the appeal of the U.S. REIT approach to real estate investment. Today nearly 40 countries have REITs, including all G7 countries.

What Benefit Does a Global Listed Real Estate Allocation Provide in a Diversified Investment Portfolio?

Research done by the investment consulting firm Wilshire Associates showed that an allocation to global listed real estate improved the returns of a diversified investment portfolio.

Analyzing the risks and returns for various asset classes (stocks, bonds, real estate and cash) for the period of 1976-2014, Wilshire constructed optimized portfolios of these assets – with and without an allocation to global listed REITs – for a variety of investment horizons. Over the period of the analysis, Wilshire found that a portfolio including global listed REITs produced a higher annualized portfolio return and lower annualized portfolio risk than a portfolio without global listed REITs, resulting in an ending portfolio value that was 6.5 percent higher

How Can I Add a Global Listed Real Estate Allocation to My Portfolio?

The easiest and most cost-efficient way to add a global listed real estate allocation to a portfolio is purchasing an investment in a mutual fund or exchange-traded fund of these securities.

How can I track the Global Listed Property Market?

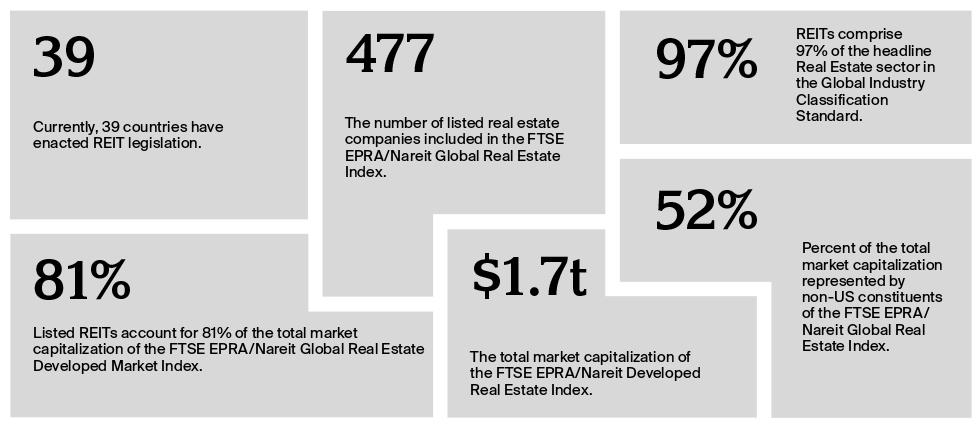

The most common index for the REIT and global listed property market is the FTSE EPRA/Nareit Global Real Estate Index Series, which was created jointly by the index provider FTSE Russell, Nareit and EPRA, the European Public Real Estate Association. The index is used by a variety of institutional investors, money managers and funds to manage real estate investment on a global basis. It contains both REITs and non-REIT listed property companies. The Global Index Series contains the Developed Markets indices and the Emerging Markets indices.

Are there other organizations like Nareit across the world?

Yes, Nareit is a member of the Real Estate Equity Securitization Alliance (REESA). Members of the REESA include the Asian Pacific Real Estate Association, (APREA); the Association for Real Estate Securitization (ARES); the British Property Federation (BPF); the European Public Real Estate Association (EPRA); the Property Council of Australia (PCA,); the Real Property Association of Canada (Realpac) and Nareit.