REITs are increasingly pursuing investment-grade ratings to capitalize on unsecured debt.

Unsecured debt has become the choice of financing for many REITs, given its flexibility and lower cost. In fact, many REITs have feverishly worked to improve balance sheets in order to get the investment-grade ratings they need to become an unsecured borrower, or they are trying to improve their scores to further reduce borrowing costs. This comes amidst an environment of historically low interest rates and an expected rate increase in the near term.

Unsecured debt has become the choice of financing for many REITs, given its flexibility and lower cost. In fact, many REITs have feverishly worked to improve balance sheets in order to get the investment-grade ratings they need to become an unsecured borrower, or they are trying to improve their scores to further reduce borrowing costs. This comes amidst an environment of historically low interest rates and an expected rate increase in the near term.

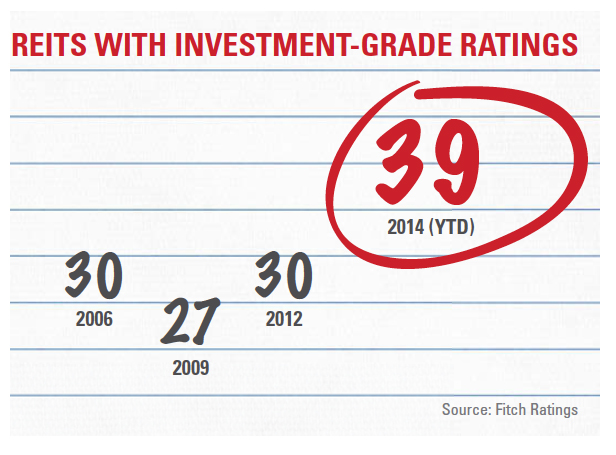

From the start of 2013 to mid-September 2014, about 25 U.S. REITs received an investment-grade rating from Moody’s Investors Service, according to the agency. Similarly, Fitch Ratings has seen the number of Equity REITs with an investment-grade rating continue to rise. In 2006, 30 Equity REITs representing about 87 percent of the equity market capitalization of its entire REIT ratings universe carried investment-grade ratings. As of mid-year 2014, those numbers had risen to 39 companies representing more than 91 percent of the overall equity market capitalization of U.S. REITs rated by Fitch.

The rush certainly hasn’t hurt the record volume of unsecured bond issuance for REITs. The group issued $20 billion worth of unsecured notes in 2014 through July 31, including convertible and exchangeable bonds, compared with $15 billion for the same period a year earlier, according to NAREIT research. REITs were on pace to eclipse last year’s record $32 billion in unsecured bonds.

Unsecured Expansion

The key to unlocking access to the public markets of unsecured debt is in getting coveted investment-grade ratings offered by Moody’s, Fitch Ratings Inc. and Standard and Poor’s. Their blessings at the investment-grade level allow corporations to borrow at lower interest rates and allow REITs not to tie down assets as collateral, as is done with secured loans.

One REIT recently joining the club includes retail specialist Excel Trust Inc. (NYSE: EXL), which announced in January that it received an investment-grade rating from Moody’s. In May, the company issued $250 million in 10-year unsecured bonds at a rate of 4.63 percent. Part of that would be used to pay off the balance of its secured debt held at 5.01 percent.

“It is the most ideal and most flexible way for REITs to finance their acquisitions and to have debt on their balance sheets,” says Spencer Plumb, president and chief operating officer at Excel, of the company’s unsecured debt acquisition. “If we put debt on our corporate balance sheet and we have unencumbered assets, we can move properties in and out of the portfolio more easily.”

Healthcare Trust of America Inc. (NYSE: HTA), a beneficiary of recent upgrades to its investment-grade ratings, recently tapped the unsecured market in June for $300 million of 3.3 percent senior unsecured notes.

“We continue to focus on ways we can access multiple forms of capital, which we think is going to be important going forward,” says Robert Milligan, the REIT’s chief financial officer.

The extra option could help in more ways than one. REITs have come a long way in the last five years in terms of expanding their financing to the unsecured markets. Many REITs that lacked an investment-grade rating ran into trouble when the recession hit. When the market for commercial mortgage-backed securities (CMBS) dried up, REITs without an investment-grade rating were also shut out of the unsecured markets. Instead, they were forced to sell or recapitalize by selling big chunks of equity.

“That is the real lesson companies learned during the downturn,” Milligan says. “You need to maintain your flexibility and liquidity to really survive and perform long term.”

That signifies a big shift in thinking, according to Steven Marks, a managing director at Fitch. “Companies that had not been issuers and primarily relied on the mortgage market or other forms of secured debt were now viewing having access to unsecured markets as critical,” he explains.

Cutting Capital Costs

Unsecured bonds give REITs another way to finance deals, in addition to tools such as equity, secured debt and private placements.

“As a result of the recession, companies that weren’t rated realized that access to the four quadrants is very helpful,” says Merrie Frankel, vice president and senior credit officer at Moody’s. “If the mortgage market is closed, at least you can generally access the unsecured debt market.”

CMBS: A Rising or Setting Sun?

Issuance of commercial mortgage-backed securities (CMBS) hasn’t met industry expectations this year, but lenders are nonetheless fighting for quality borrowers while loosening underwriting standards.

On the one hand, volume has slowed after a strong year in 2013. About $51 billion was issued this year in the United States through Sept. 1, according to research by the Commercial Real Estate Finance Council. That’s not even on pace to match the $80 billion worth of CMBS issued last year, a figure well above the $44 million issued in 2012.

Yet, at the same time, competition for high-quality borrowers is on the rise, says Sam Chandan, chief economist of Chandan Economics and a professor of real estate development at the Wharton School. With each successive quarter, more banks come back to lending in commercial real estate, he notes. “You have had debt capital that has been competing increasingly aggressively for a finite number of high-quality borrowers,” Chandan says.

Yet, this demand for good borrowers has outstripped supply. “Underwriting standards have deteriorated somewhat,” he says. Chandan points to apartments as an example. By one measure, underwritten net operating income to most recently reported NOI is on the rise. About 39 percent of all underwritten NOI for apartments in 2014 is 100 percent or greater than recently reported NOI, compared with just 21 percent in 2013.

With the recovery passing the five-year mark last June, Chandan expects loans to see some challenges in the coming years.

“We don’t see the lenders doing a lot of stress testing for the business cycle,” he says. “That is particularly worrisome.”

While REITs might be well positioned to weather any storms, they’ll at least be indirectly affected by another retrenchment by lenders, Chandan says: “The spillover affects everyone.”

All the more reason for REITs to have access to the unsecured markets, he said.

REIT CFOs appear to concur. In particular, having an additional financing instrument gives REITs another tool to reach for when opportunities arise. Farzana Mitchell, chief financial officer of mall REIT CBL & Associates Properties Inc. (NYSE: CBL), notes that as an unsecured borrower, CBL can access the lending market “at any given time in a very short duration.” That allows REITs also to take advantage of distressed sales when they arise.

Furthermore, some CFOs face an easy decision in terms of borrowing costs. Many rated REITs could issue a bond at a 4 percent rate, whereas issuing equity might mean they’re paying a rate between 4.5 percent and 5 percent in dividends. “As long as you are not leveraging up the company too much, it may make sense to issue bonds,” Frankel says.

But size also matters: Many REITs need another form of capital to sustain their growth. Healthcare Trust, for example, had amassed $2.3 billion in assets by the end of 2010. After reaching what Milligan describes as a “critical size,” he says the company determined that it needed a rating to achieve an appropriate cost of capital.

Earning Stripes with Unsecured Lines

The characteristics that REITs must have to obtain a rating vary by agencies and real estate sectors. By and large, it comes down to the likelihood of default and how much can be recovered in a default. Moody’s, for example, looks at the quality, diversity and sustainability of a company’s earnings and cash flows relative to the cash it consumes, according to a 26-page report by the agency entitled “Global Rating Methodology for REITs and Other Commercial Property Firms.”

Yet, for each REIT, the methodology will be slightly different, depending on its story. A well-known company in the industry, CBL had for a long time relied on secured debt. Two years ago, when banks started providing unsecured lines of credit once again, Mitchell says the REIT started its move to reduce its reliance on mortgages by obtaining unsecured facilities from a few banks.

“We had been an investment-grade company, but needed to be recognized as such,” Mitchell says. “We needed to tap the unsecured market, and that was really a starting point.”

It’s a starting point to becoming rated since it provides the company with a way to retire secured debt. The less secured debt on the balance sheet, the better in the eyes of the agencies. It means fewer properties in the portfolios are encumbered. With secured properties, REITs must often get approval from the lender to sell them or make upgrades.

It’s a starting point to becoming rated since it provides the company with a way to retire secured debt. The less secured debt on the balance sheet, the better in the eyes of the agencies. It means fewer properties in the portfolios are encumbered. With secured properties, REITs must often get approval from the lender to sell them or make upgrades.

Excel focuses on high-quality shopping centers nationwide and first went public in April 2010. In less the three months, executives convinced Wells Fargo Securities and KeyBanc Capital Markets to fund an unsecured facility of up to $125 million with the option to increase it to $400 million. It was an unusual development for a new stock exchange-listed company. Many banks said no to its overtures, but the management team, led by CEO Gary Sabin, tapped existing contacts from its prior days running previous incarnations under the name Excel.

“We relied on our relationships,” Milligan says.

The unsecured credit lines were one tool that Excel eventually used to lower its secured debt to total debt to 47 percent by the end of 2013, down from 82 percent a year earlier. That, in turn, helped open the door to its investment grade rating by Moody’s, which was announced in January. While the rating was unusual for a company of its size ($1.2 billion in assets as of year-end 2013), several factors helped Excel’s cause. Management’s experience and high-quality retail centers anchored by grocery stores or big tenants played a part. So did a diversified tenant base and a conservative balance sheet.

The agencies also look at franchise value. CBL scored points in part by its dominance in local markets, Mitchell notes. For example, its Fayette Mall in Lexington, Ky., is 200 miles away from any other mall. Its malls also serve more as community hubs when compared with shopping centers in major cities. Furthermore, its properties are stable. For instance, the Hamilton Place Mall in Chattanooga, Tenn., is near a major auto plant and Amazon.

Giving a forward-looking view helps, too. CBL stressed that while its encumbered debt was still high, much of it would be coming due in the next two years, debt that would be replaced by unsecured notes.

“That is really what prompted Fitch and Moody’s to give us the rating as soon as they did,” Mitchell says.

Similarly with Excel, there was an expectation that the company would continue to grow. “It really has a lot to do with your strategy and setting out a clear path so they can know you are going to be an unsecured borrower going forward,” says Spencer Plumb, Excel’s president and chief operating officer.

Moving Up the Rating Stack

Once REITs have obtained an investment-grade rating, the work has only begun, as CFOs work to bolster the balance sheet. Healthcare Trust received the first upgrade of its investment-grade rating in December 2013 by Moody’s, then S&P in April. The move translates to about $2.5 million in annual borrowing costs, about a penny of earnings—nothing to sneeze at, according to Milligan.

During the first quarter of 2014, CBL paid off a $122 million loan at 3.4 percent secured by St. Clair Square in Fairview Heights, Ill. Similarly, for its Mall de Norte in Laredo, Tex., it plans to pay off a secured $113 million loan coming due in December. That will be replaced by a line of credit until CBL’s next bond issuance, Mitchell noted. The aim is to get an upgrade by mid-2016 at the latest, Mitchell says.

“Every rating level upgrade that we get, we improve pricing not only on bonds, but lines of credit,” Mitchell says. “Our goal is to get a rating upgrade from the agencies and also obtain the investment grade rating from S&P.”

All About Capital Flexibility

All told, investment-grade ratings bring opportunity for growth and protect REITs for the rough times.

“Having unencumbered assets creates more financial flexibility,” Marks says. “It’s just a more valuable tool than having to cobble together 10 or 15 mortgages.”

As long as REITs stick to reasonable leverage levels, that flexibility will carry over to any rough economic periods if they focus on not using property as collateral.

“If it’s all unsecured, you can borrow against it when times get tough,” says Jason Moore, a manager of the quantitative analytics team at Green Street Advisors. “You’ve got real assets that someone will lend you something against.”

“The important thing is to stay nimble,” Mitchell comments. “It totally gives us the opportunity to go out into the market when we think it’s the right time, when we have the need.”