As we look ahead at mid-year, the roller coaster ride of heightened uncertainty and dramatic market dips during the first half of the year feels like it may be moderating. REITs, commercial real estate (CRE), and broader financial markets appear to be exiting the ride in about the same place where they started, leaving us with a very similar outlook on the remainder of 2025 and 2026 as we had entering the year—and the knowledge that the thrill ride can restart at any moment, and maybe already has.

Coming into 2025, Nareit posited that this could be the year for REIT performance to delink from its inverse relationship with interest rates and that REITs could start a growth trajectory using their efficient access to capital and well-managed balance sheets. After a solid start to the year, the economic and financial market turbulence linked to both new directions in trade policy and growing concerns about the sustainability of the U.S. fiscal trajectory, sent equity, debt, and property markets into sharp declines. The spike in uncertainty, reflected in quantitative and qualitative measures, revived recession fears, chilled credit markets, and derailed the slow progress in property transactions.

Some recent indications suggest that the roller coaster ride may be restarting. If so, we are confident that REITs are well positioned to stomach the ride and even find opportunities during an extended period of heightened volatility.

If uncertainty continues to dissipate, a brighter CRE outlook is (still) believed to be on the horizon. Solid economic conditions and converging public-private real estate valuations remain two critical keys to unlocking the stifled property transaction market. As transactions increase, REITs will likely maintain a competitive edge over many of their competitors in pursuing acquisitions and accretive growth.

Tariff Actions and Investment Reactions

New directions in tariff policies have introduced uncertainty into U.S. financial and economic markets and marked the end of a period of significant REIT outperformance versus broader equities. Recent tariff actions and equity REIT property sector total returns can provide a framework to glean insights into the impact of tariffs on CRE.

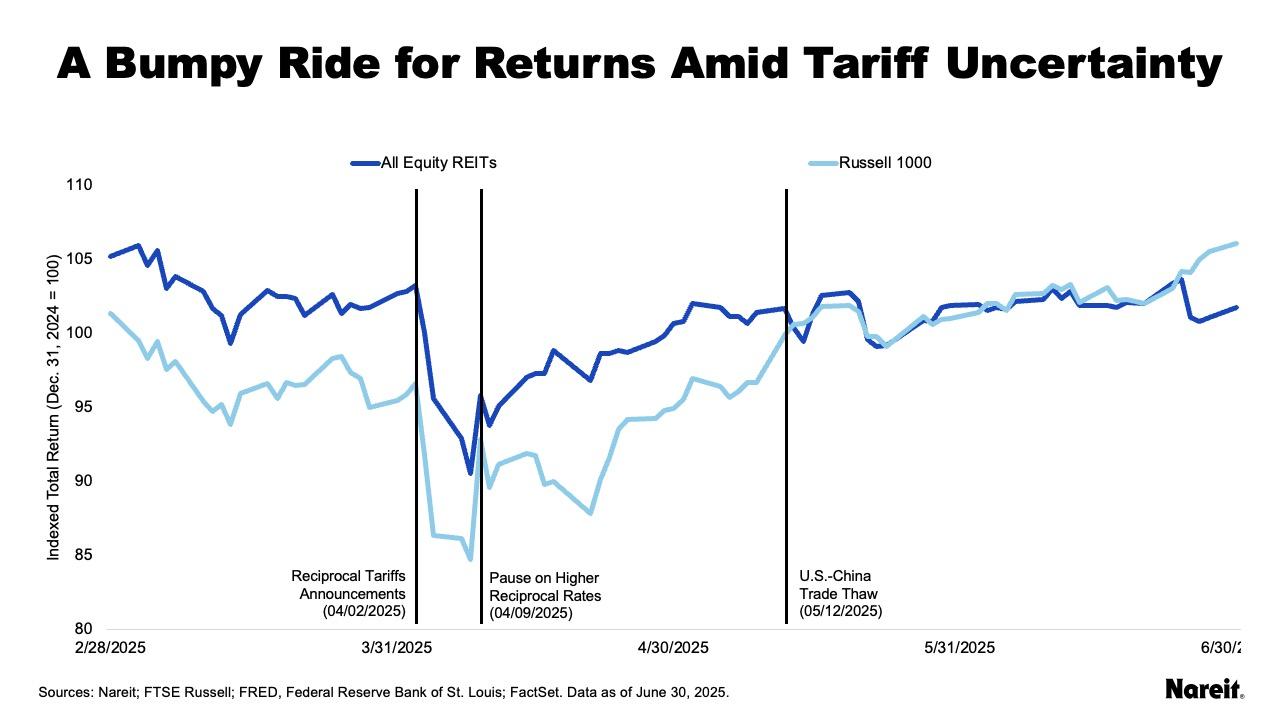

The chart above displays total return indices for the FTSE Nareit All Equity REITs and Russell 1000 indices. Both measures are indexed to 100 as of Dec. 31, 2024. It also highlights the start dates for the reciprocal tariffs announcement (April 2), the limited temporary reprieve from higher reciprocal rates (April 9), and the thaw in U.S. – China trade relationship (May 12).

Prior to Liberation Day, REITs outperformed the broader equity market. Performance across both markets declined with the announcement of reciprocal tariffs, but rebounded with the limited temporary suspension of higher reciprocal rates and the U.S. – China trade thaw.

The 10-year Treasury yield has also experienced considerable volatility in 2025. It started the year at 4.6%, reaching a peak of 4.8% in mid-January and a low of 4.0% in early April. At the end of June, it was 4.2%.

While the net effects of REIT return movements related to tariff actions were generally neutral, they varied widely across sectors.

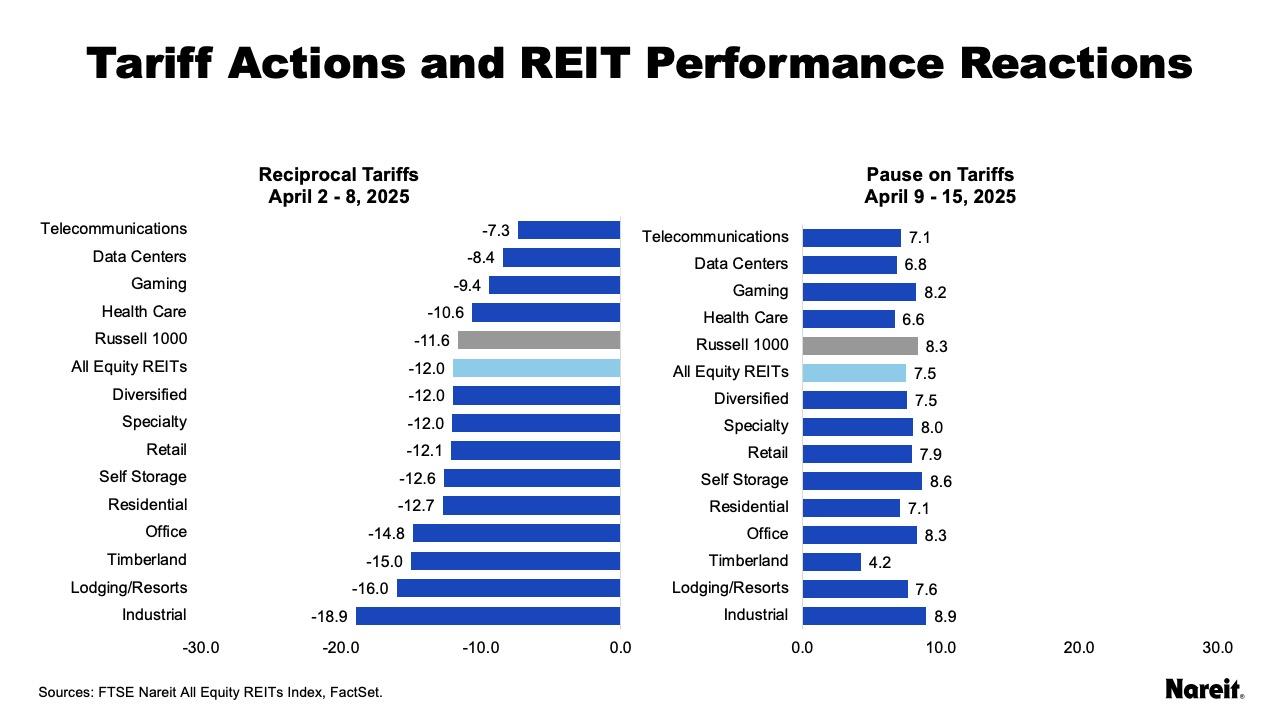

The charts above present total returns for the 13 equity REIT property sectors, as well as the FTSE Nareit All Equity REITs and Russell 1000 indices, from April 2 - 8 and April 9 - 15. The first and second periods highlight market reactions across five trading days after the reciprocal tariffs announcement and the limited temporary reprieve from higher reciprocal rates, respectively.

Total returns from April 2 - 8 showed that the reciprocal tariffs announcement had similar adverse impacts on the broad equity and REIT markets. Performance across all 13 REIT property sectors also declined, but the severity of the declines varied widely. Industrial and lodging/resorts were the weakest performing sectors. Telecommunications and data centers had the strongest performances.

After the temporary pause of higher reciprocal rates, the Russell 1000 and FTSE Nareit All Equity REITs indices bounced back. Each of the 13 equity REIT sectors also posted positive total returns. The gains across all the examined measures were fairly uniform, but they were unable to offset their respective declines related to the reciprocal tariffs announcement. Since April 15, broad equity and REIT total returns have moved higher. Year-to-date through June 30, the Russell 1000 and FTSE Nareit All Equity REITs indices posted positive total returns of 6.1% and 1.8%, respectively.

Listen to the 2025 Mid-Year Update Podcast

Despite abundant investor concerns, the net broad equity and REIT investment performance effects related to tariff actions have been considerably more tempered than many investors feared. Although further tariff actions may influence future investment performance, REITs are generally well-positioned to weather any potential fluctuations due to their solid property operations and strong balance sheets.

Higher Interest Rates and Positive CRE Performance

U.S. bond markets have faced considerable volatility through the first half of 2025 too. Rising and/or high(er) interest rates have been a source of worry for many CRE investors. But, increasing and/or elevated interest rates do not necessarily equate to weak, or poor, real estate performance. Note that REIT total returns have been positive year-to-date through June 30.

Recent analytics of historical data from Nareit have also found that:

- CRE, on average, has performed well across a variety of interest rate regimes with REITs consistently outperforming their private market counterparts.

- REITs have generally enjoyed positive total returns in both rising and falling interest rate environments.

- REIT total returns have exhibited positive and negative correlations with 10-year Treasury yield changes and the current inverse relationship may change with an improving economic outlook.

Today, REITs are particularly well positioned to face a changing interest rate environment. Factors that provide REITs with a competitive edge over typical CRE investors include their market pricing, best-in-class operational expertise, disciplined balance sheets, and efficient and ready access to cost-advantaged capital.

REIT Balance Sheets Continue to Shine

In an environment of economic uncertainty, financial market volatility, and higher interest rates, the strength of a firm’s balance sheet often takes center stage. While U.S. public equity REITs have not been immune from the vagaries of the market, recent data from Nareit’s quarterly REIT Industry Tracker show that they have been reasonably well-insulated from them.

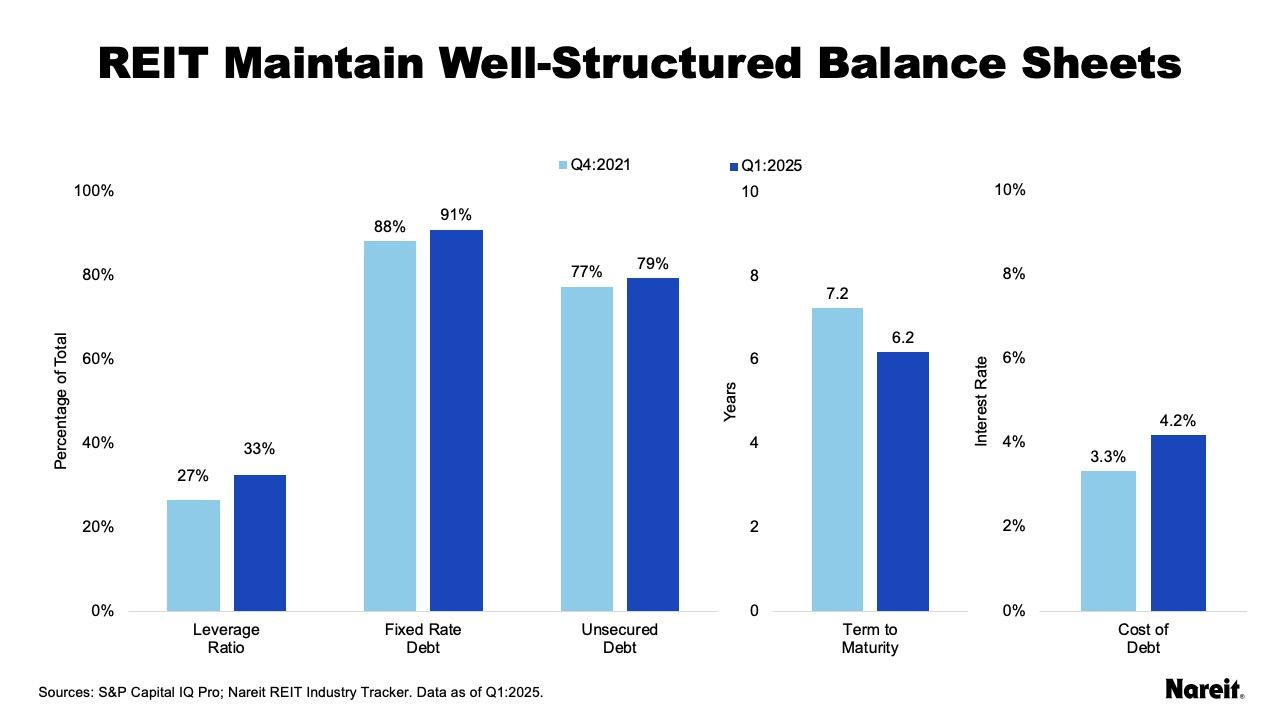

Using data from Nareit’s REIT Industry Tracker, the chart above shows REIT balance sheet metrics for the fourth quarter of 2021 and the first quarter of 2025. The data from the fourth quarter of 2021 showcases the state of REIT balance sheets prior to the surge in the 10-year Treasury yield that occurred in 2022. Since that time, interest rates have remained elevated.

Across the two time periods, REITs, on average, have consistently maintained well-structured balance sheets with low leverage ratios. Emphasis on fixed rate debt and longer terms to maturity have limited REIT exposure to higher interest rates and highlight REITs’ typical long-term investment focus. While the 10-year Treasury yield surged by 2.9% from the fourth quarter of 2021 to the first quarter of 2025, the average cost of REIT total debt only increased by 0.9%. Access to unsecured debt has also provided REITs with a competitive advantage and low debt costs have afforded REITs considerable operational flexibility to address property and firm needs. REITs have been, and continue to be, well-equipped to weather potential future market turbulence.

A New World Order?

Tariff actions, higher 10-year Treasury yields, and declines in the U.S. dollar have upended REIT outperformance over the broader equity market in 2025. These conditions have also placed pauses on issuance, financing, and transaction activities. They have helped in the reordering of recent regional REIT performances too.

The charts above highlight compound average annual total returns for the 10 years through 2024 and year-to-date through June 30 performances for global REITs across North America, Asia, and Europe.

On average, North America has been the top-performing region over the last 10 full calendar years, posting an average annual total return of 4.9% that handily outpaced average gains of 0.2% in both Asia and Europe. While this strong North American performance may cause some investors to question the need for regional REIT allocations, recent performance has been a keen reminder of the benefits of global REIT diversification.

Through mid-year 2025, the regional REIT performance rankings have experienced a complete reversal. Europe has become the top-performing region with a total return of 24.6%, followed by Asia at 17.8%, and North America at just 0.2%. Declines in the dollar have bolstered performance in Europe and Asia; local currency REIT total returns for Europe and Asia were 9.9% and 4.0%, respectively.

The Roller Coaster Ride Ends or Restarts

After a period of turbulence, stability appeared to be returning to the marketplace in June. With continued healthy economic growth, steady unemployment, and a moderating pace of inflation, U.S. economic conditions are expected to remain solid. With broad uncertainty measures declining, financial markets appeared to be “pricing-in” less economic and tariff-related turbulence.

The charts above exhibit the Bloomberg Consensus Forecast Survey’s probability of a recession in 12 months, the Cboe VIX Index, and the Baa corporate bond yield spread over 10-year Treasuries for January 2025, the post-Liberation Day peak, and June 2025. The VIX is often referred to as the “fear index” as it tends to rise with increased market stress or uncertainty. Baa is the lowest investment grade corporate bond rating and its spread over Treasuries is believed to capture perceived stress or risk in the bond market, with wider spreads reflecting increased risk.

Each uncertainty measure started the year at a low level. As uncertainty rose, each metric increased and reached its maximum level post-Liberation Day. As investors and markets became more comfortable with the prevailing environment, each uncertainty metric fell. The VIX index and Baa corporate bond spreads have retreated to levels that they experienced at the beginning of the year. The probability of a recession has fallen, but it remains elevated compared to the start of the year. The stickiness of the recession outlook metric stems from its hybrid quantitative-qualitative nature and sourcing from a survey of experts. In the end, uncertainty at mid-year was generally very similar to what it was at the beginning of the year. It is currently unclear whether recent new tariff actions will drive these uncertainty metrics higher.

Déjà Vu All Over Again

With heightened economic uncertainty and financial market volatility, REIT investors had a front row seat on the roller coaster ride of the first half of 2025 (whether they liked it or not). At mid-year, the ride may have ended, with REIT, CRE, and broader markets exiting the roller coaster in about the same place where they started at the beginning of the year. However, if the ride restarts with the spate of new tariff threats and announcements, the experience of the last six months gives us confidence that REITs are well positioned to weather additional volatility and thrive.

Looking forward, REITs are expected to find accretive growth opportunities as CRE transactions increase. In a world marked by increasing and accelerating change, REITs are anticipated to continue to lead globally, as they embody the megatrends that will define real estate for the next decade: specialization, scale, innovation, and sustainability. They will also likely make critical inroads with institutional investors seeking efficient access to CRE with those characteristics.