Data from CoStar highlight the current state of commercial real estate fundamentals—excess net demand, occupancy rates, and rental growth rates—across the four “core” property sectors (industrial, retail, multifamily, and office). In the fourth quarter of 2022, property fundamentals across most sectors have generally remained solid, but there has been some evidence of softening. The industrial, retail, and apartment property types have maintained occupancy and four-quarter rent growth rates akin to or higher than their respective pre-pandemic levels; but office has continued to struggle. Higher interest rates and debt costs have also been throttling commercial real estate transaction volume. The silver lining of this situation for the broader CRE outlook is that new development has been curtailed.

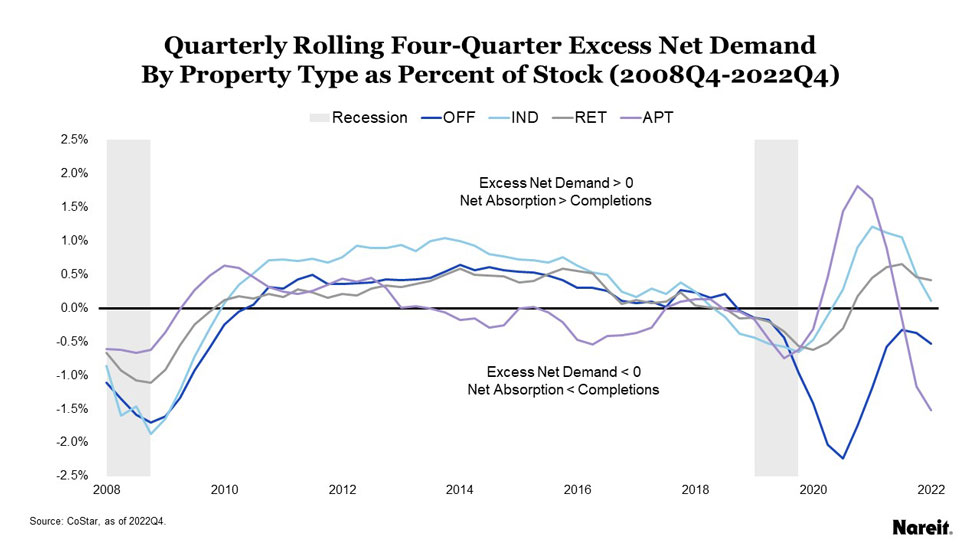

The above chart shows quarterly rolling four-quarter excess net demand (or net absorption less completions) as a percentage of existing stock by property type from the fourth quarter of 2008 to the fourth quarter of 2022; it also displays U.S. recession periods. Excess net demand weakened across each of the four major property types in the fourth quarter of 2022. In 2022, completions as a percentage of existing stock for the industrial, retail, apartment, and office sectors were 2.1%, 0.2%, 2.3%, and 0.5%, respectively. Although they experienced materially different new supply rates, net absorption exceeded completions for the industrial (0.4%) and retail (0.1%) sectors. Demand fell short of supply for apartments (-1.5%) and office (-0.5%). The plunge in apartment excess net demand has piqued investor attention. With the transition from elevated occupancy and rental growth rates back to pre-pandemic levels, some investors are worried that the bloom has come off the rose. With the ongoing uncertainty related to work-from-home trends, demand and supply balance has remained elusive for office.

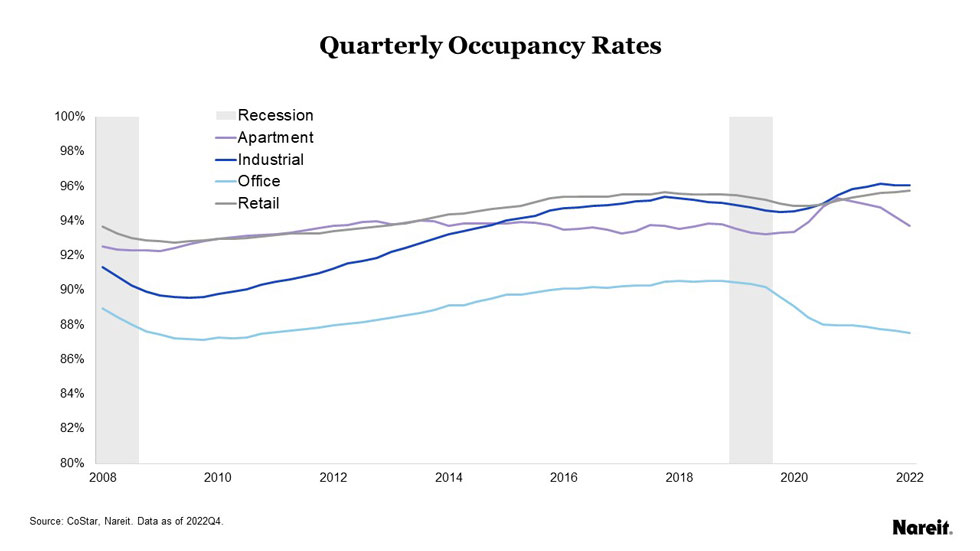

The above chart shows quarterly occupancy rates by property type, as well as U.S. recessionary periods, from the fourth quarter of 2008 to the fourth quarter of 2022. Occupancy rates for the industrial, retail, apartment, and office sectors were 96.0%, 95.8%, 93.7%, and 87.5%, respectively, in the fourth quarter of 2022. While the industrial and retail property types maintained their lofty occupancy rates, the apartment and office sectors continued to follow their downward trajectories. The fall off in apartment occupancy may raise investor concerns, but the current occupancy rate remains at a healthy level consistent with its pre-pandemic (2019Q1 to 2019Q4) experience. Office occupancy has fallen 3% from its 2019 average. Despite demand struggling since 2020, office completions have not yet slowed; they have sustained a consistent pace since 2015.

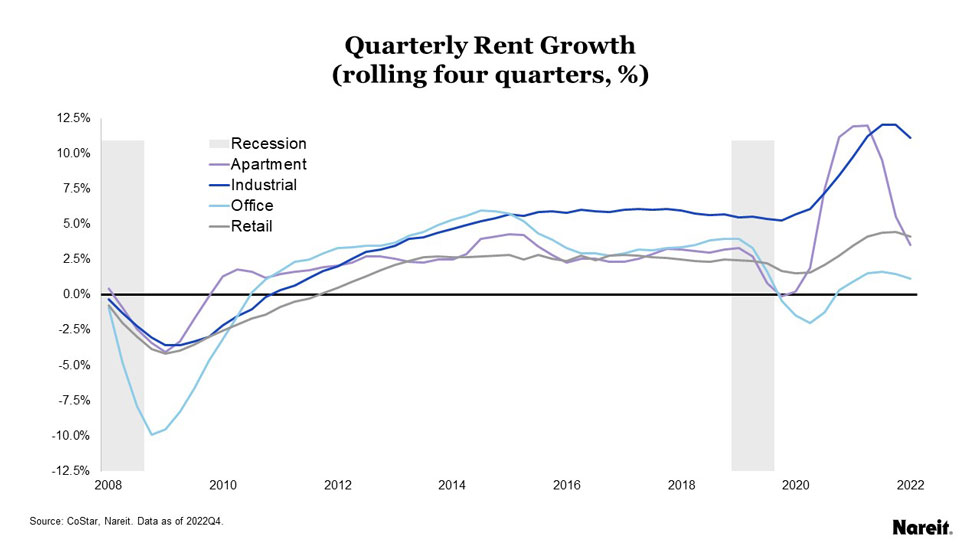

The above chart displays quarterly rolling four-quarter rent growth rates by property type, as well as periods of U.S. recession, from the fourth quarter of 2008 to the fourth quarter of 2022. Rental growth rates weakened across each of the four major property types in the fourth quarter of 2022. Property type trends were also similar to those observed in occupancy rates where the industrial and retail sectors exhibited more strength than their apartment and office counterparts. As of the fourth quarter of 2022, one-year rental growth rates for the industrial, apartment, retail, and office sectors were 11.1%, 4.1%, 3.5%, and 1.1%, respectively. The drop in the apartment rent growth rate is glaring, but it is important to note that the current growth rate is similar to its pre-pandemic levels. While office has been lagging the other sectors, it continued working toward achieving positive rent gains.