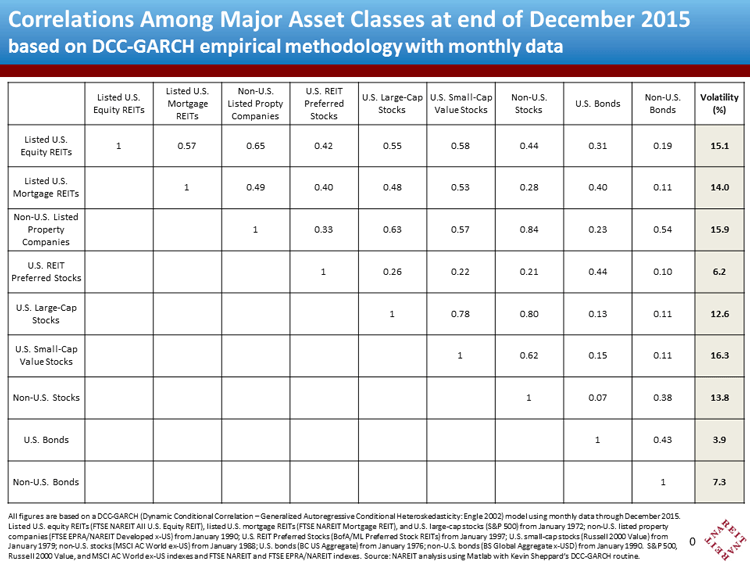

NAREIT’s latest estimates of correlations among nine major asset classes continue to show strong opportunities for portfolio diversification, although correlations have increased slightly since mid-2015.

The correlation between exchange-traded U.S. equity REITs and large-cap U.S. stocks was estimated at 0.55 as of the end of 2015, according to NAREIT’s Dynamic Conditional Correlation / Generalized Autoregressive Conditional Heteroskedasticity (DCC-GARCH) methodology. The method uses data on monthly returns for all asset classes through December 2015, starting as early as January 1972, but computes an estimate of how each correlation changes from month to month rather than a figure for the average correlation covering the entire historical period. Equity REITs dominate the exchange-traded REIT industry, accounting for more than 94% of aggregate market cap in the U.S. and 100% overseas.

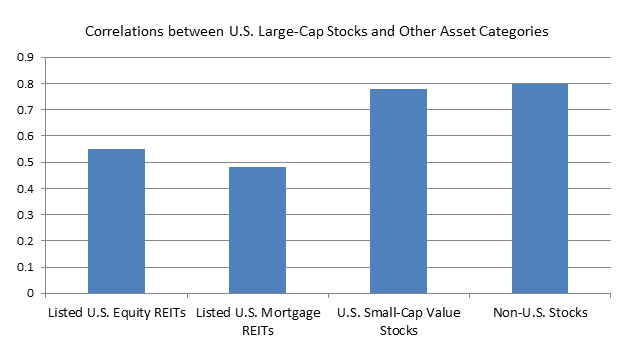

Mortgage REITs, however, also provide a counterbalance to non-REIT stock portfolios, with a correlation of just 0.48 against large-cap stocks. Equity and mortgage REIT returns are measured by the FTSE NAREIT index series, while large-cap stock returns are measured by the S&P 500 Index. Equity and mortgage REITs share a correlation of just 0.57, indicating that the two main categories of exchange-traded REITs in the U.S. provide very different portfolio benefits. Mortgage REITs also have a low correlation of just 0.40 with U.S. bonds, indicating that real estate debt is driven by very different market forces than corporate and government debt. The correlation between equity REITs and bonds is also quite low at 0.31.

REIT preferred stocks, too, have low correlations with both U.S. bonds (0.44) and U.S. mortgage REITs (0.40), as well as with U.S. equity REITs (0.42) and U.S. large-cap stocks (0.26). Estimated volatility for REIT preferreds is also quite low at 6.2%; liquidity is much more limited for REIT preferred stocks, however, which may affect their return measurement and therefore estimates of both correlations and volatility.

International investing does not seem generally to provide the diversification benefits that many investors expect: for example, the correlation between U.S. large-cap stocks and non-U.S. stocks (MSCI AC World ex-US Index) is relatively high at 0.80.

Different segments of the non-REIT U.S. stock market also provide relatively little diversification benefit: the correlation between large-cap U.S. stocks and U.S. small-cap value stocks (Russell 200 Value Index) is fairly high at 0.78, whereas the correlation between U.S. equity REITs and U.S. small-cap value stocks is much lower at just 0.58.

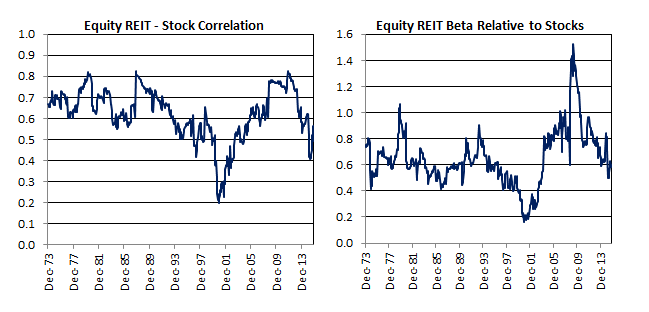

During the summer of 2015 the correlation between exchange-traded U.S. equity REITs and the broad U.S. stock market (Dow Jones U.S. Total Stock Market Index) dipped to as low as 0.40, a level not seen except in the “dot-com bubble” period of 2000-2003. During the latter part of 2015, however, the correlation moved back up to historically more common levels around 0.55. Beta, too, returned to historically normal levels around 0.6 after having dipped as low as 0.50.

These estimates are updated monthly, and can be downloaded here.