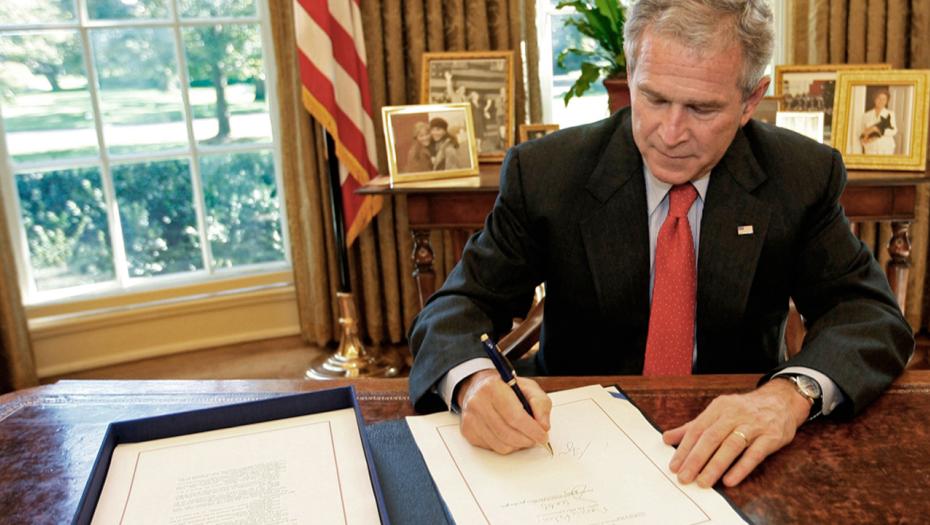

Sept. 14, 1960

REITs Are Created

REITs are created when President Dwight D. Eisenhower signs the REIT Act title law contained in the Cigar Excise Tax Extension of 1960. REITs were created by Congress in order to give all investors the opportunity to invest in large-scale, diversified portfolios of income-producing real estate.

Learn more about REITs