REITs have historically provided high dividends plus the potential for moderate, long-term capital appreciation.

Why should I invest in REITs?

REITs are total return investments. They typically provide high dividends plus the potential for moderate, long-term capital appreciation. Long-term total returns of REIT stocks tend to be similar to those of value stocks and more than the returns of lower risk bonds.

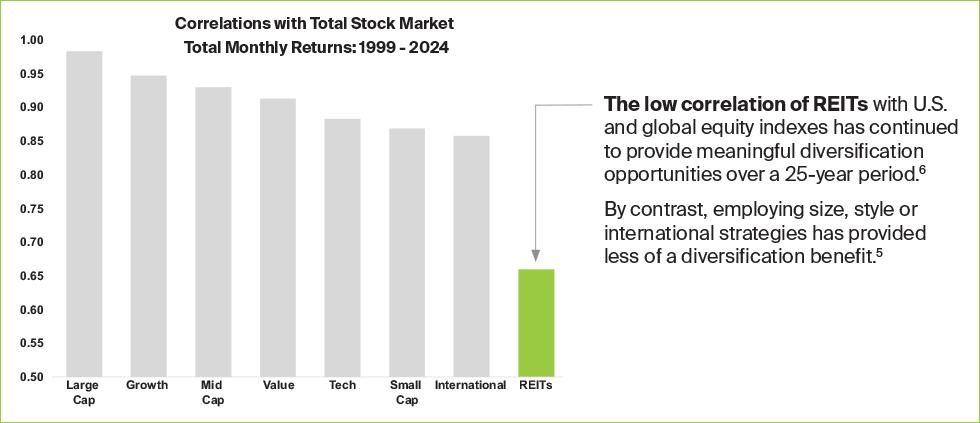

Because of the strong dividend income REITs provide, they are an important investment both for retirement savers and for retirees who require a continuing income stream to meet their living expenses. REITs dividends are substantial because they are required to distribute at least 90% of their taxable income to their shareholders annually. Their dividends are fueled by the stable stream of contractual rents paid by the tenants of their properties. The relatively low correlation of listed REIT stock returns with the returns of other equities and fixed-income investments also makes REITs a good portfolio diversifier. REIT returns tend to “zig” when those of other investments “zag,” helping to reduce a portfolio’s overall volatility and improve its returns for a given level of risk.

REITs historically offer investors:

- Competitive Long-Term Performance: REITs have provided long-term total returns similar to those of other stocks.

- Substantial, Stable Dividend Yields: REITs’ dividend yields historically have produced a steady stream of income through a variety of market conditions.

- Liquidity: Shares of publicly listed REITs are readily traded on the major stock exchanges.

- Transparency: Independent directors, analysts and auditors, as well as the business and financial media monitor listed REITs’ performances and outlook. This oversight provides investors with a measure of protection and more than one barometer of a REIT's financial condition.

- Portfolio Diversification: REITs offer access to the real estate market typically with low correlation with other stocks and bonds.

Will investing in REITs diversify my portfolio?

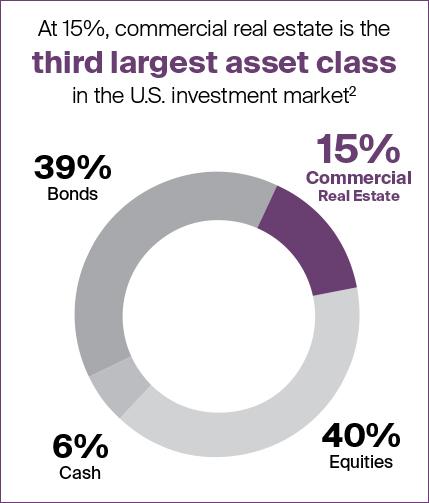

Over the past few decades, assets have become increasingly correlated. This has challenged advisors to identify investments to better diversify their clients’ portfolios. Fortunately, REITs provide them access to meaningful diversification opportunities. In fact, according to NMG Consulting’s research, 4 out of 5 advisors now invest their clients in REITs and the objective they most frequently cite is “portfolio diversification.” Following are illustrations of the low correlation REITs have had with the broad stock market and how they could improve a portfolio’s risk-and-return profile.

Following are illustrations of the low correlation REITs have had with the broad stock market and how they could improve a portfolio’s risk-and-return profile.

Who invests in REITs?

Currently approximately 170 million Americans live in households that are invested in REITs directly or access them through REIT mutual funds or exchange-traded funds (ETFs).

- Institutional investors like pension funds, endowments, foundations, insurance companies and bank trust departments invest in REITs.

- There are millions of Thrift Savings Plan (TSP) participants who have access to REITs in their stock choices.

- Nearly 100% of target date funds, which are prevalent in 401k plans, have REIT allocations.

Is homeownership a substitute for investing in REITs?

A house is a consumption good, not an investment, particularly when financed with a sizable mortgage. It does not produce current income, but rather requires regular mortgage interest, real estate tax, insurance payments and maintenance costs. In contrast, REITs represent investment in commercial real estate, which generates continuing income flow from rents.

Additionally, a REIT is a liquid investment that is diversified across a range of real estate properties in a variety of geographic locations. By comparison, a house is a comparatively illiquid asset whose investment risk is not diversified, but rather highly concentrated. REITs are real estate working for you.

Related: