A Snapshot of Today’s REIT Industry

In 1960, Congress established REITs to provide everyday American investors the opportunity to invest in income-producing real estate—much like mutual funds were created to give Americans from all income levels access to capital markets.

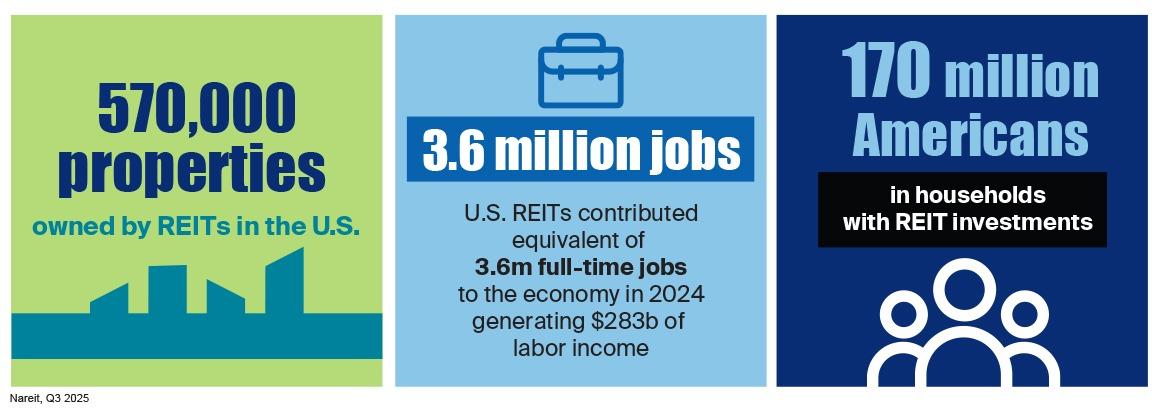

REIT properties are critical to the economy. There are approximately 570,000 REIT-owned properties, which include data centers, hospitals, hotels, housing, industrial facilities, offices, shopping centers, malls, free-standing retail, storage centers, telecommunications infrastructure, and timberlands.

REITs help create jobs. In 2024, REITs supported an estimated 3.6 million jobs and $283 billion in labor income.

Today, 170 million Americans, or approximately 50% of the U.S. population, live in households that are invested in REITs through investment accounts and retirement plans.

REITs support the economy by channeling capital into—and increasing the transparency, liquidity, and stability of—the markets.

Today, U.S. REITs own more than $4.5 trillion of gross real estate with public REITs owning $2.5 trillion in assets.

U.S. listed REITs have an equity market capitalization of more than $1.4 trillion.

In 2024, REITs paid an estimated $112.5 billion in dividends to shareholders.

REITs have historically delivered competitive total returns for investors based on high, steady dividend income and long-term capital appreciation.

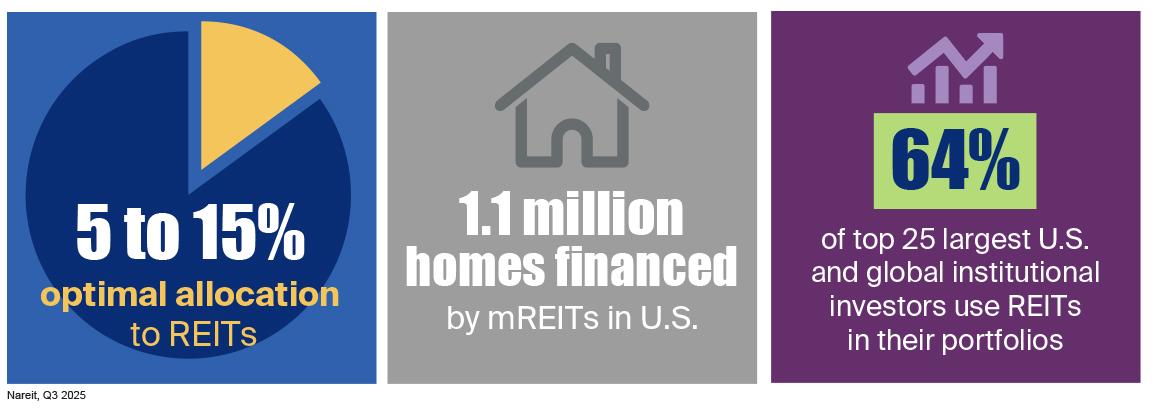

REITs comparatively low correlation with other assets makes them an excellent portfolio diversifier that helps reduce investors’ overall portfolio risk and increases returns. Multiple studies, including those from Ibbotson Associates, Morningstar, and Wilshire Funds Management have found that the optimal REIT portfolio allocation may be between 5% and 15%.

Mortgage REITs (mREITs) provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities and earning income from the interest on these investments. 1.1 million homes have been financed by mREITs in the U.S.

REITs are also being used by global institutional investors. In fact, 64% of the top 25 largest U.S. and global institutional investors use REITs in their portfolios.

REITs support the economy by channeling capital into–and increasing the transparency, liquidity and stability of–the markets. Additionally, REITs have been real estate innovators for decades.

Fifty years after its debut, the FTSE Nareit U.S. All Equity REIT Index, which includes more than 190 REITs, remains the default REIT benchmark for many analysts, investment managers, and investors. It also serves as the basis for many market-weighted REIT funds.

Today, more than 28 REITs are included in the S&P 500.

The diversity of REIT real estate sets it apart. Over the years, REITs brought institutional capital into new and emerging areas of real estate. Some of the innovative sectors REITs spearheaded have included data centers, telecommunications towers, self-storage, health care, lodging, billboards, and timberlands, which completed the other REIT real estate sectors, including industrial, office, residential, and retail.

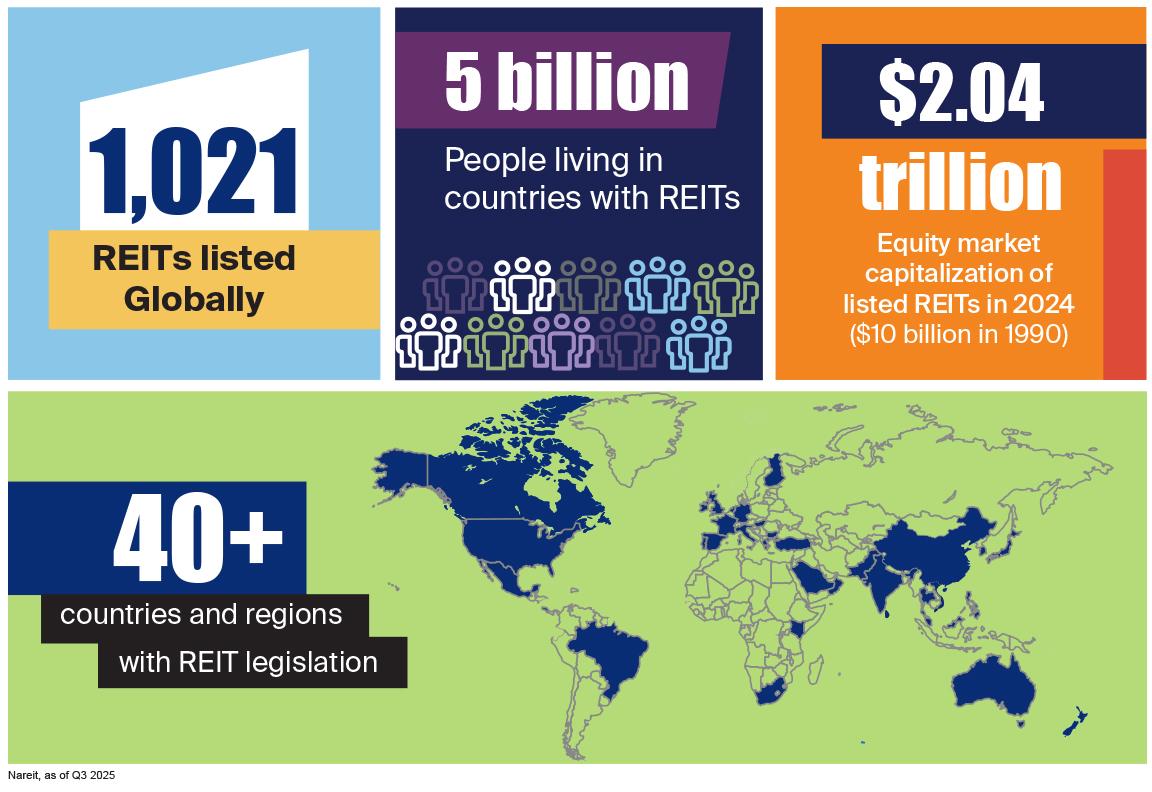

REITs are a model for real estate investment globally. More than 40 countries and regions have adopted the U.S.-based REIT approach to real estate investment offering investors access to portfolios of income producing real estate across the globe. Mutual funds and exchange-traded funds offer the easiest and most efficient way for investors to add global listed real estate allocations to portfolios.

While the U.S. remains the largest listed real estate market, the listed real estate market is increasingly becoming global. The growth is being driven by the appeal of the U.S. REIT approach to real estate investment.

A total of 1021 listed REITs with a combined equity market capitalization of more than $2 trillion are in operation around the world.

Today, more than 40 countries and regions have REITs, including all G7 countries.

Nearly 5 billion people worldwide live in countries that have enacted REITs.