Nareit commissioned EY to estimate the current economic contribution of all U.S. REITs (including public listed, public non-listed, and private REITs) in the United States.

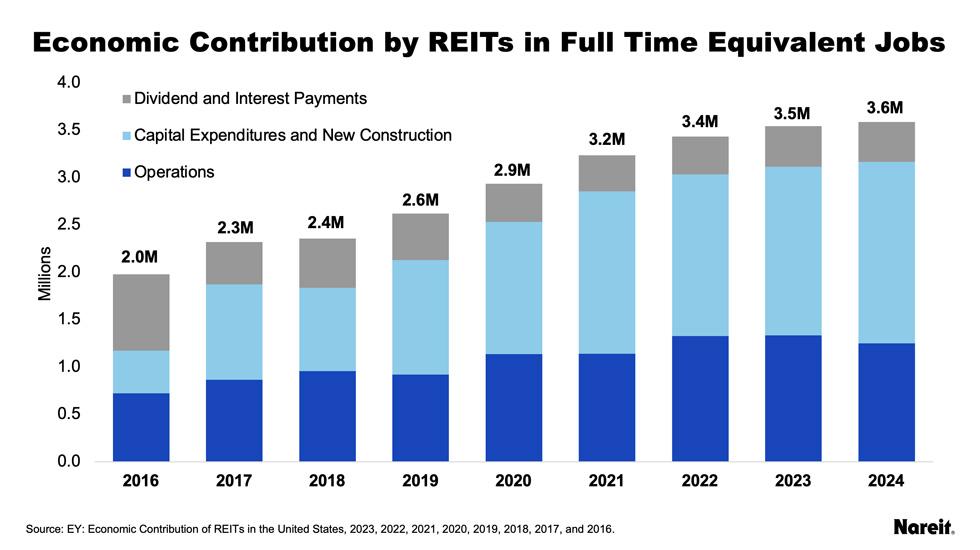

- The total economic contribution of U.S. REITs in 2024, the most recent year of complete information, was an estimated 3.6 million full-time equivalent (FTE) jobs and $283 billion of labor income. The total economic contribution, or “footprint,” of REITs consists of the direct operations of REITs and related businesses in the United States, as well as the impacts from dividend and interest payments by REITs and REIT property improvement and construction investments. The U.S. economic contribution of REITs extends beyond the direct operations of REITs and includes the indirect contributions of their suppliers and the induced contributions of businesses supported by the spending of REIT employees, bondholders, and shareholders.

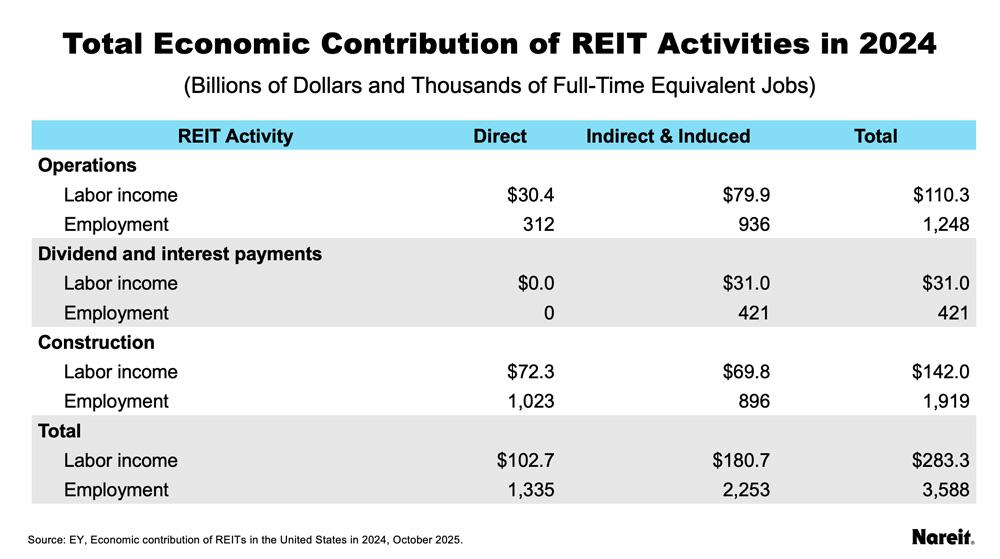

The table above summarizes the direct, indirect, and induced REIT contributions to U.S. employment activity.

- REIT operations supported 1.2 million FTE jobs and $110.3 billion in labor income.

- Capital expenditures and new construction supported 1.9 million FTE jobs and $142.0 billion in labor income.

- Dividends distributed and interest payments to investors supported 431,000 jobs and $31.8 billion in labor income.

Some key results related to REIT economic contributions in 2024 include:

- REITs directly employed an estimated 312,000 FTE employees who earned $30.4 billion of labor income in the United States. REIT supplier purchases and spending by REIT employees supported an additional 936,000 FTE jobs and $79.9 billion of earnings in the United States. In total, the economic footprint of U.S. REIT operations comprised 1.2 million FTE jobs and $110.3 billion in labor income.

- REIT activities also resulted in the payment of an estimated $91.1 billion of interest income and the distribution of $112.5 billion of dividend income by REITs. This interest and dividend income supported 421,000 FTE jobs earning $31.0 billion of labor income through the induced contribution of re-spending by REIT bondholders and shareholders.

- REITs invested an estimated $130.2 billion in new construction and routine capital expenditures to maintain existing property. The related construction activity supported 1 million FTE construction jobs that earned $72.3 billion in labor income. Purchases of goods from suppliers and consumer spending by construction and supplier employees contributed an estimated 896,000 FTE jobs and $69.8 billion in labor income.