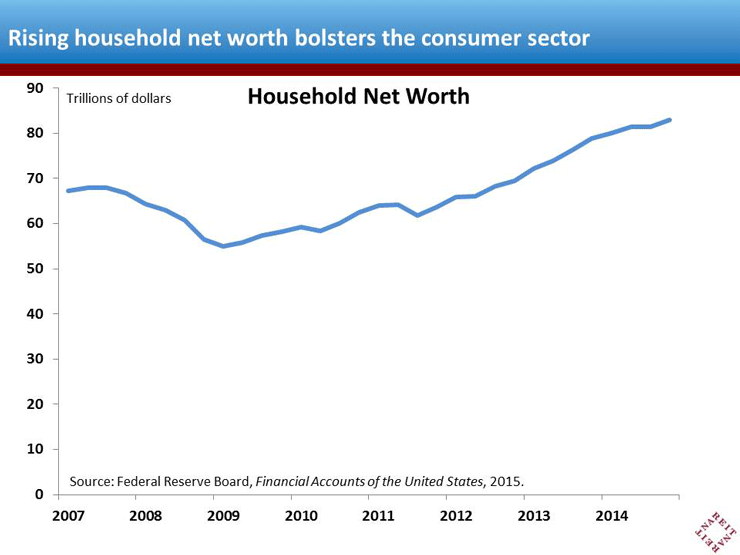

The Federal Reserve’s Financial Accounts of the United States provide a detailed look at the financial health of the U.S. economy, and the latest news is good. Household net worth rose $1.5 trillion in the fourth quarter, to nearly $83 trillion, as both rising stock prices and improving home valuations added to household wealth. Together with recent robust job market gains, this bolsters household financial position and helps ensure that consumer spending will be resilient and keep the growing economy on track.

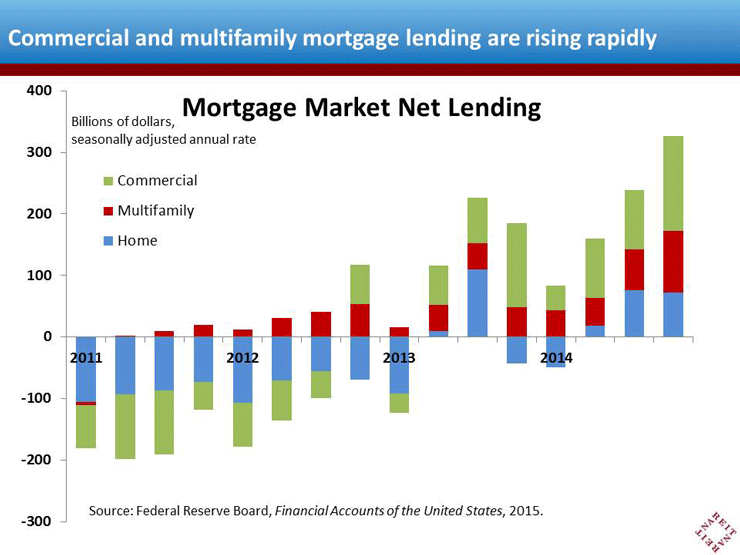

There’s also news that financing conditions for commercial real estate continue to improve. Net lending for commercial and multifamily mortgages ramped up throughout 2014, outpacing home mortgage lending by a wide margin. Fannie and Freddie continue to provide large amounts of financing in the multifamily markets, and bank lending is rising as well. Banks lead the pack in commercial mortgage lending, with significant contributions by life insurance companies and the CMBS market.

Continued access to financing will be important for commercial real estate markets. In addition to the need for new financing for rising transactions volumes, there is a large wave of CMBS coming due over the next three years. The growing availability of financing for commercial real estate will facilitate refinancing this debt as well as support new growth in the sector.