|

April 1, 2013

Message from the President

NAREIT’s core mission is to communicate the REIT investment proposition to all of our industry’s audiences, and several articles in this issue of NewsBrief provide a view into some of the many ways in which we carry out that task. NAREIT’s core mission is to communicate the REIT investment proposition to all of our industry’s audiences, and several articles in this issue of NewsBrief provide a view into some of the many ways in which we carry out that task.

As the article on our first-quarter Investor Outreach activities reports, we conducted 29 meetings in the first three months of this year with defined benefit and defined contribution plans, investment managers and consultants representing more than $25 trillion in assets under management or advisement.

The message we take to these investment professionals centers on the role REITs can play in the portfolios they manage, and it invariably is based on research. Much of that research is produced by our own Investor Outreach staff, which functions as a research resource for the institutional investment community. Important components of it also are produced on a sponsored basis by investment management firms, such as Wilshire Associates. Additionally, as the article on the upcoming REIT Research Conference illustrates, we actively encourage research and dialog about REIT investment within the academic community.

NAREIT will sponsor the REIT Research Conference on June 4 in conjunction with the American Real Estate and Urban Economics Association, the publisher of the leading U.S. real estate academic journal. Ventas Inc. (NYSE: VTR) Chairman and CEO Debra Cafaro and Green Street Advisors Chairman and Director of Research Mike Kirby are program directors for the event. It will feature presentations of academic papers on real estate investment and panel discussions among academics, REIT analysts and executives on issues such as REIT valuation and investment characteristics. It will take place in Chicago in conjunction with REITWeek 2013: NAREIT’s Investor Forum, and the industry’s primary investor conference at which the REIT story will be presented.

As the article on REITs in the Community shows, we also are actively telling the REIT story to our industry’s legislative audience, emphasizing to Members of Congress the positive role REITs play in the lives of their own communities.

Whether the audience is the investment community, the academic establishment or national policymakers, NAREIT’s work in presenting the REIT story is the foundation of our mission.

Steven A. Wechsler

President and CEO

White House Advocates FIRPTA Reform

The Obama Administration released details last week of a plan to encourage infrastructure investment. The plan includes to-be-proposed legislative changes to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) governing non-U.S. investment in domestic real estate assets. The Obama Administration released details last week of a plan to encourage infrastructure investment. The plan includes to-be-proposed legislative changes to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) governing non-U.S. investment in domestic real estate assets.

In a release announcing the plan, the White House noted the deleterious effects of FIRPTA on real estate investment.

“Infrastructure assets can be attractive investments for long-term investors such as pension funds that value the long-term, predictable, and stable nature of the cash flows associated with infrastructure. Under current law, gains of foreign investors from the disposition of U.S. real property interests are generally subject to U.S. tax under FIRPTA, and foreign investors including large foreign pension funds regularly cite FIRPTA as an impediment to their investment in U.S. infrastructure and real estate assets,” the release said. “With U.S. pension funds generally exempt from U.S. tax upon the disposition of U.S. real property investments, the Administration proposes to put foreign pension funds on an approximately equal footing: exempting their gains from the disposition of U.S. real property interests, including infrastructure and real estate assets, from U.S. tax under FIRPTA.”

(Contact: Tony Edwards at tedwards@nareit.com)

REIT.com Videos: REITWise 2013

REIT.com was onsite at REITWise 2013 in La Quinta, Calif., to speak with attendees about some of the latest developments in the commercial real estate industry. REIT.com was onsite at REITWise 2013 in La Quinta, Calif., to speak with attendees about some of the latest developments in the commercial real estate industry.

Jim Sullivan, managing director with Green Street Advisors, said the selective rally of stocks in the REIT industry has been a key trend in the first quarter of 2013. Sullivan said there are a couple of possible explanations behind why share prices in some smaller REITs have risen while other blue-chip companies have lagged.

Sullivan added that the companies benefiting from this rally have typically been smaller companies that generally own higher cap rate properties and maintain higher leverage than the average REIT.

“One theory for why this is happening is that we have an entire investor universe that is searching for yield and it has found that yield in some of these smaller REITs that have higher dividend payouts,” Sullivan said. He added that another theory is that generalist investors got into REITs through blue chip names and have been selling them as they have been searching for other opportunities.

Stuart Gabriel, finance professor and director of the Richard S. Ziman Center for Real Estate at the UCLA Anderson School of Management, offered his thoughts on the future role of Freddie Mac, Fannie Mae and the Federal Reserve in the single-family and multifamily mortgage system, as well as the impact on mortgage REITs. Stuart Gabriel, finance professor and director of the Richard S. Ziman Center for Real Estate at the UCLA Anderson School of Management, offered his thoughts on the future role of Freddie Mac, Fannie Mae and the Federal Reserve in the single-family and multifamily mortgage system, as well as the impact on mortgage REITs.

“The unfortunate element is that there are pretty divergent views of what might be the future of our housing finance system coming out of Congress and the White House. The views are sufficiently divergent that the topic is no longer being discussed. Literally, in the course of the last six to nine months, we’ve heard almost no mention of housing or housing finance among the domestic priorities in the second term of the Obama administration," Gabriel said.

Mike McTiernan, assistant director in the division of corporate finance with the Securities and Exchange Commission (SEC), discussed some of the latest trends in registered public offerings being held by REITs. Mike McTiernan, assistant director in the division of corporate finance with the Securities and Exchange Commission (SEC), discussed some of the latest trends in registered public offerings being held by REITs.

“It’s actually a really interesting time,” he said. “Really, on all fronts of the real estate capital markets, we’re seeing activities in our traditional, traded, firm-commitment-underwritten IPOs by large portfolio property companies. We’re still seeing a lot of activity in the non-traded space, with some of it moving to having NAV-based offerings. We’re still seeing activity in the mortgage REIT space also, mostly filings by people who are going to be playing in the agency MBS space or hybrid MBS space. And now we’re also starting to see a fair amount of M&A activity, most of it originating with either non-traded REITs that are being bought by public companies and then merging or by listing.”

(Contact: Matt Bechard at mbechard@nareit.com)

NAREIT Reaching Out to Defined Benefit Plans

NAREIT’s Investor Outreach team spent March visiting with a diverse range of 35 organizations in the institutional investment market controlling close to a combined $10.7 trillion in assets. The 35 meetings were held with organizations across all targeted investment cohorts, including nine with prominent domestic and international pension, retirement and sovereign wealth fund plan sponsors representing over $543 billion in assets; three with investment consultants with assets under advisement of over $2 trillion; and 19 with investment managers sponsoring global and domestic products for the institutional and retail investor markets with close to $8 trillion in assets under management.

Defined benefit (DB) pension plans have faced a number of challenges over the past decade. However, with total assets of nearly $6 trillion as of the close of 2012, they remain the largest and most highly concentrated segment of the $15 trillion U.S. pension and retirement market.

NAREIT has positioned itself as a resource for pension plan investors, making its research and the expertise of its staff available to assist them in determining the most effective ways to use REITs in their portfolios. Through investor meetings and participation at industry conferences and related events, NAREIT’s Investor Outreach team identifies emerging investment themes and contemporary trends challenging investors today, as well as investor perceptions of the role REIT-based real estate investment might play in addressing such challenges. Highlighting findings from NAREIT’s internal and sponsored research on topics tailored to meet the needs of pension investors, the outreach team delivers a perspective on the role of REITs in managing risk within the real estate portfolio and how investors can optimally allocate investment capital across the real estate investment class in order to best meet portfolio goals and the dimensions of diversification.

The combination of providing significant, credible research, staff expertise and a relationship-oriented approach has helped to boost REIT investment in the defined benefit plan marketplace. Pensions & Investments magazine recently reported that the top 200 DB plans held $22.4 billion in REITs in 2012, an increase of over $5 billion from the amount reported in 2011. Furthermore, data from the Standard & Poor's Money Market Directory indicate that 23 of the 25 largest public pension plan sponsors in the U.S. invest in REITs. Sixteen of the 25 largest corporate pension plan sponsors report REIT holdings, including the five largest.

Through the end of March, NAREIT has conducted 109 meetings with many of the largest and most influential investment organizations within the institutional investment marketplace. Collectively, these entities represent over $25 trillion in assets under management or advisement.

NAREIT has also been active on the institutional investment conference circuit during the first three months of the year, participating in 11 events and speaking at six. To provide perspective, during the same time period in 2012, NAREIT participated in 10 such conferences.

(Contact: Meredith Despins at mdespins@nareit.com)

NAREIT Comments on Repurchase Agreements and Similar Transactions Proposal

On March 29, NAREIT submitted a comment letter to the Financial Accounting Standards Board (FASB) on its proposal that would impact the accounting for repurchase agreements and similar transactions. On March 29, NAREIT submitted a comment letter to the Financial Accounting Standards Board (FASB) on its proposal that would impact the accounting for repurchase agreements and similar transactions.

NAREIT member companies generally welcomed the proposal, given that most that use repurchase agreements as a source of financing already account for the instruments in a manner consistent with the proposal (i.e., secured borrowings). Further, NAREIT believes that the essence of the proposal that would require transactions meeting these characteristics to be accounted for as secured borrowings provides a more transparent depiction of a company’s leverage.

NAREIT requested that the FASB permit early adoption of the proposal and provide preparers with the ability to retroactively restate prior periods that are presented in the financial statements. While NAREIT recognizes that providing companies with optional transition methods and effective dates may reduce the comparability of application of the proposal across companies, NAREIT believes that the ability to early adopt and restate prior periods would result in consistent application of the proposal within a company’s financial reporting at the earliest possible date. This would enhance comparability among accounting periods within the comparative financial statements and, therefore, make operating trends of individual companies much easier to understand.

(Contact: Christopher Drula at cdrula@nareit.com)

REIT.com Videos: Leader in the Light Working Forum

Attendees of the Leader in the Light Working Forum talked with REIT.com about some of the latest developments in sustainability. Attendees of the Leader in the Light Working Forum talked with REIT.com about some of the latest developments in sustainability.

Will Teichman, director of sustainability with Kimco Realty Corp. (NYSE: KIM), discussed the company’s recent sustainability efforts as well as how sustainability initiatives in the retail sector differ from others.

“The biggest factor that differentiates retail is the landlord-tenant relationship in the triple net lease sector. When you look at a typical shopping center environment, about 85 percent of the energy use takes place inside the building and the other 15 percent is driven by the common area,” he said. “So, in order to pursue those opportunities in energy efficiency, it requires breaking down some of those traditional barriers between landlords and tenants and finding ways to do projects that mutually benefit both parties.”

Joe Lopez, vice president of property management and director of environmental impact with retail REIT Equity One (NYSE: EQY), discussed some of the key factors in establishing a well-regarded sustainability program and measuring the company’s results. Equity One was recognized as a Leader in the Light Award winner in Nov. 2012 in the retail small cap category. Joe Lopez, vice president of property management and director of environmental impact with retail REIT Equity One (NYSE: EQY), discussed some of the key factors in establishing a well-regarded sustainability program and measuring the company’s results. Equity One was recognized as a Leader in the Light Award winner in Nov. 2012 in the retail small cap category.

“I really think the key for us has been top-down support from the most senior level,” he said.

Lopez said one of the big evolutions in sustainability initiatives of the future will center on reporting methods, as sustainability efforts are more recognized today among investors.

“They are asking a lot of questions and they want to know what you’re doing and what the results are. So, I think that a lot to people are getting pushed to put together more structuralized reporting.”

(Contact: Matt Bechard at mbechard@nareit.com)

NAREIT Welcomes New Member

NAREIT is pleased to welcome GLP J-REIT as its newest Corporate Member. GLP J-REIT is a new public, externally managed equity REIT in Japan. GLP is the largest public logistics REIT in Japan with 33 facilities located primarily in Tokyo and Osaka. GLP J-REIT’s sponsor is Singapore REIT Global Logistic Properties, a NAREIT member. GLP J-REIT, based in Tokyo, is listed on the Tokyo Stock Exchange (TSE stock code: 3281; Reuters ticker: 3281.T; Bloomberg ticker: 3281: JP). Masato Miki is the company’s president and CEO. NAREIT is pleased to welcome GLP J-REIT as its newest Corporate Member. GLP J-REIT is a new public, externally managed equity REIT in Japan. GLP is the largest public logistics REIT in Japan with 33 facilities located primarily in Tokyo and Osaka. GLP J-REIT’s sponsor is Singapore REIT Global Logistic Properties, a NAREIT member. GLP J-REIT, based in Tokyo, is listed on the Tokyo Stock Exchange (TSE stock code: 3281; Reuters ticker: 3281.T; Bloomberg ticker: 3281: JP). Masato Miki is the company’s president and CEO.

(Contact: Bonnie Gottlieb at bgottlieb@nareit.com)

REITs in the Community

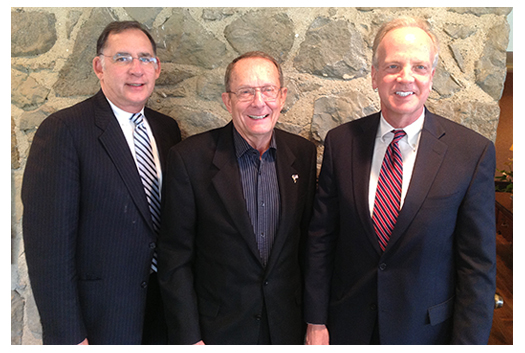

March 26, 2013: Rep. Kenny Marchant (R-TX), right, a member of the House Ways and Means Committee, visited the offices of Capstead Mortgage Corporation (NYSE: CMO) and met with Capstead’s president and CEO, Andy Jacobs, left. Marchant received a detailed briefing during his visit on the company's recent activities in Texas and across the nation. In addition, Marchant was briefed on NAREIT's legislative agenda for 2013, including the subject of tax reform and its potential impact on REITs and the publicly traded real estate industry.

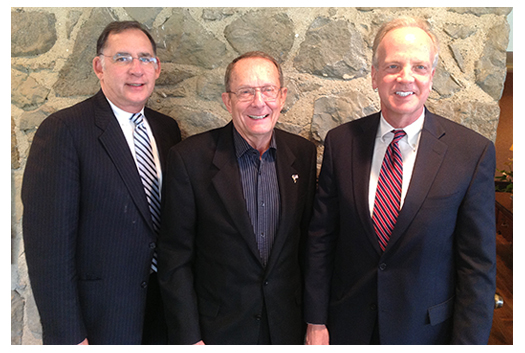

March 27, 2013: During a visit to Southern California, Sens. Jerry Moran (R-KS), right, and John Boozman (R-AR), left, were hosted by Macerich (NYSE: MAC) Vice Chairman Dana Anderson, center. Moran, chairman of the National Republican Senatorial Committee (NRSC) and a member of the Senate Banking Committee, and Boozman, NRSC vice chair and a member of the Senate Appropriations Committee, met with Anderson and other individuals to provide an update on the NRSC’s activities for the coming year. The NRSC is the official committee working to elect Republicans to the U.S. Senate in 2014.

(Contact: Kate Smith at ksmith@nareit.com)

Conference to Highlight Latest in REIT Research

NAREIT is co-hosting a complimentary, one-day REIT Research Conference to discuss results of leading REIT research papers submitted to AREUEA, publisher of Real Estate Economics, the premier academic journal for real estate investment related topics. This event takes place on June 4 at the Hilton Chicago, one day before REITWeek 2013 begins.

Important real estate investment related topics include:

-

Valuation of REITs, listed property companies (LPCs), and other real estate assets.

-

Investment characteristics of REITs and LPCs, both within real estate portfolios and in mixed-asset portfolios.

-

Organizational and Operational issues for REITs and non-REIT LPCs, e.g., financing, capital structure, executive compensation, operating expenses, economies of scale, property type or geographic focus/diversification, ownership structure, etc.

This event is complimentary and open to anyone interested in the latest research related to REITs. Ventas Inc. (NYSE: VTR) Chairman and CEO Debra Cafaro and Green Street Advisors Chairman and Director of Research Mike Kirby are program directors for the event. To attend the REIT Research Conference, a separate registration form from REITWeek must be completed.

(Contact: Megan Peichel at mpeichel@nareit.com)

|

NAREIT’s core mission is to communicate the REIT investment proposition to all of our industry’s audiences, and several articles in this issue of NewsBrief provide a view into some of the many ways in which we carry out that task.

NAREIT’s core mission is to communicate the REIT investment proposition to all of our industry’s audiences, and several articles in this issue of NewsBrief provide a view into some of the many ways in which we carry out that task.

The Obama Administration released details last week of a plan to encourage infrastructure investment. The plan includes to-be-proposed legislative changes to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) governing non-U.S. investment in domestic real estate assets.

The Obama Administration released details last week of a plan to encourage infrastructure investment. The plan includes to-be-proposed legislative changes to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) governing non-U.S. investment in domestic real estate assets.

On March 29, NAREIT submitted a comment letter to the Financial Accounting Standards Board (FASB) on its

On March 29, NAREIT submitted a comment letter to the Financial Accounting Standards Board (FASB) on its

NAREIT is pleased to welcome

NAREIT is pleased to welcome