|

December 15, 2014

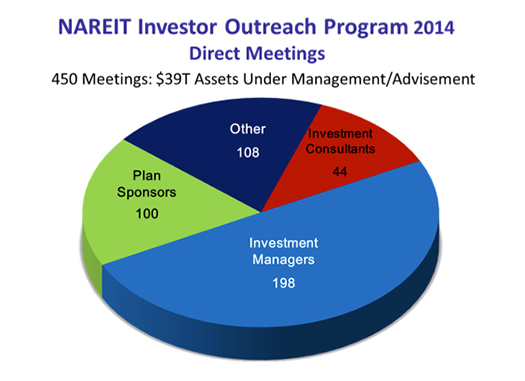

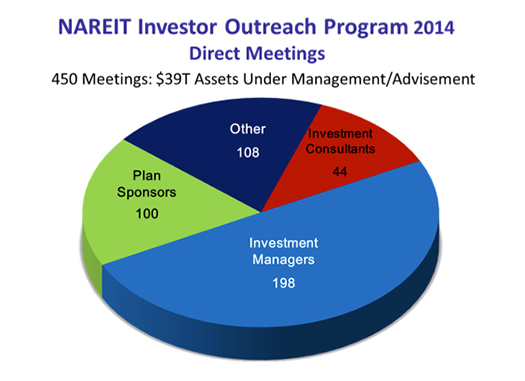

Message from the President

This week’s edition of NewsBrief details a productive year for NAREIT’s investor outreach team that included 450 meetings with key stakeholders in the institutional investment marketplace. That signifies a 17.5 percent year-over-year increase from 2013. This week’s edition of NewsBrief details a productive year for NAREIT’s investor outreach team that included 450 meetings with key stakeholders in the institutional investment marketplace. That signifies a 17.5 percent year-over-year increase from 2013.

Through credible research and a relationship-oriented approach, NAREIT continues to make progress in communicating the investment benefits of REITs to its three primary target audiences in the $20.7 trillion retirement investment marketplace: defined benefit (DB) plans, defined contribution (DC) plans and individual retirement plans (IRAs).

Among DB plans, Citi Research has identified “pension funds, endowments and foundations increasing their allocations to REITs as part of their broader real estate mandates” as one of five key trends that could potentially boost REIT ownership and drive future REIT performance. On an asset-weighted basis, more than half of public and corporate pension plans report gaining some or all of their exposure to real estate through investments in listed REITs.

In the $7.0 trillion DC marketplace, NAREIT has focused on its sponsored research from Wilshire Associates on the role of U.S. REITs and global listed real estate securities within target date funds. During the year, NAREIT shared the Wilshire research with investment managers that control more than 75 percent of target date fund assets combined.

In terms of the $7.2 trillion IRA market, NAREIT continues to implement a comprehensive outreach program targeted at financial intermediaries. Of the 198 meetings with investment managers in 2014, 183 consisted of meetings with managers active in both the DC and IRA markets.

With 2015 quickly approaching, NAREIT is looking forward to opportunities to engage all of these important audiences in dialogues about the REIT approach to real estate investment.

Steven A. Wechsler

President and CEO

Investor Outreach Team Nears End of Busy Year

NAREIT's investor outreach team conducted 450 meetings in 2014 with many of the largest and most influential investment organizations within the institutional investment marketplace.

Collectively, these entities represent close to $39 trillion in assets under management or advisement. To provide perspective, in 2013, the outreach team conducted 383 meetings.

NAREIT was also active on the institutional investment conference circuit in 2014, attending 36 events. Members of NAREIT’s investor outreach team participated in 16 of the events as speakers, board members or sponsors.

(Contact: Kurt Walten at kwalten@nareit.com)

House Passes Bill to Extend TRIA

The House of Representatives passed a six-year extension of the Terrorism Risk Insurance Program Reauthorization Act (TRIA) by a vote of 417 to 7 on Dec. 10. The House of Representatives passed a six-year extension of the Terrorism Risk Insurance Program Reauthorization Act (TRIA) by a vote of 417 to 7 on Dec. 10.

The House’s version of the extension bill increased the amount of total losses needed to trigger the TRIA backstop program. The current $100 million would rise to $200 million over a five-year period beginning in 2016. Also starting in 2016, the mandatory amount paid through deductibles and co-payments by insurance companies would increase from $27.5 billion to $37.5 billion, rising by $2 billion each year for five years.

TRIA is set to expire at the end of the year if it is not renewed, and the bill now awaits action by the Senate. NAREIT and its partners in the Coalition to Insure Against Terrorism (CIAT), which represents business insurance policyholders, urged the Senate to act quickly on the measure.

“CIAT members are pleased that the TRIA proposal would extend the law for six years while generally adhering to the core principles of the program, which has provided U.S. economic and national security for more than a decade,” said Marty DePoy, a spokesman for CIAT.

NAREIT and CIAT also joined a wide-ranging group of industry organizations in calling on the Senate to pass the bill before going into recess.

“TRIA is a critical public-private partnership that facilitates a private insurance market for terrorism risk insurance,” the organizations wrote in a letter to the Senate. “The program has enabled economic development and supported job growth by assuring that lenders, borrowers and developers have the protection needed to proceed with existing and new projects.”

(Contact: Robert Dibblee at rdibblee@nareit.com)

REIT.com Videos: CEO Spotlights

REIT.com conducted video interviews with REIT CEOs at REITWorld 2014: NAREIT’s Annual Convention for All Things REIT. Here’s a sample of the videos currently available online.

Gary Beasley, co-CEO of Starwood Waypoint Residential Trust (NYSE: SWAY), discussed the importance of creating a strong brand in the single-family rental business. Gary Beasley, co-CEO of Starwood Waypoint Residential Trust (NYSE: SWAY), discussed the importance of creating a strong brand in the single-family rental business.

“Building a brand is setting expectations in the consumer’s mind and then delivering on it,” Beasley said. “The good news is that the bar is pretty low because in our space it hasn’t been professionally managed up until fairly recently.”

CLICK HERE to view Beasley’s interview in its entirety.

Larry Gellerstedt, president and CEO of Cousins Properties (NYSE: CUZ), reviewed the strategic repositioning of the company’s portfolio that has been underway since he became CEO in June 2009. At that time, Cousins was active in five different product types, with a market capitalization of about $400 million and a balance sheet that was more than 70 percent levered. Today, about 97 percent of the company’s income comes from properties in the office sector. The company’s market capitalization is just under $3 billion, while leverage is about 24 percent, according to Gellerstedt. Larry Gellerstedt, president and CEO of Cousins Properties (NYSE: CUZ), reviewed the strategic repositioning of the company’s portfolio that has been underway since he became CEO in June 2009. At that time, Cousins was active in five different product types, with a market capitalization of about $400 million and a balance sheet that was more than 70 percent levered. Today, about 97 percent of the company’s income comes from properties in the office sector. The company’s market capitalization is just under $3 billion, while leverage is about 24 percent, according to Gellerstedt.

CLICK HERE to view Gellerstedt’s interview in its entirety.

Christopher Marr, president and CEO of CubeSmart L.P. (NYSE: CUBE), discussed the company’s capital market activity in 2014. CubeSmart utilized its at-the-market (ATM) equity program and a follow-on offering to raise slightly more than $400 million in equity during the year, which will be used to fund the company’s acquisition program. Christopher Marr, president and CEO of CubeSmart L.P. (NYSE: CUBE), discussed the company’s capital market activity in 2014. CubeSmart utilized its at-the-market (ATM) equity program and a follow-on offering to raise slightly more than $400 million in equity during the year, which will be used to fund the company’s acquisition program.

CubeSmart has also pre-funded all of its 2015 delivery commitments under its build-to-suit program and its joint-venture development program, according to Marr.

CLICK HERE to view Marr’s interview in its entirety.

Thomas Nolan, chairman and CEO of Spirit Realty Capital (NYSE: SRC), provided an update on the flurry of acquisitions that his company has made this year. For the nine months through Sept. 30, Spirit Realty acquired 241 properties for approximately $570 million. Leases on the properties have an average remaining term of 15.1 years. Thomas Nolan, chairman and CEO of Spirit Realty Capital (NYSE: SRC), provided an update on the flurry of acquisitions that his company has made this year. For the nine months through Sept. 30, Spirit Realty acquired 241 properties for approximately $570 million. Leases on the properties have an average remaining term of 15.1 years.

“Between the attractive capital markets and the attractive property markets, it’s a bit of a Goldilocks scenario. We’re a spread-investing organization, and those spreads are pretty high by historical standards, so we see excellent opportunity to add to shareholder value,” Nolan explained.

CLICK HERE to view Nolan’s interview in its entirety.

Drew Sims, chairman and CEO of SoTHERLY Hotels Inc. (NASDAQ: SOHO), told REIT.com that the last nine months have been the best in the nearly 60-year history of the company. He underscored that SoTHERLY has seen growth across its portfolio, with total revenue almost 40 percent higher year-to-date and adjusted funds from operations (AFFO) about 41 percent higher. Drew Sims, chairman and CEO of SoTHERLY Hotels Inc. (NASDAQ: SOHO), told REIT.com that the last nine months have been the best in the nearly 60-year history of the company. He underscored that SoTHERLY has seen growth across its portfolio, with total revenue almost 40 percent higher year-to-date and adjusted funds from operations (AFFO) about 41 percent higher.

“Clearly we’re in the sweet spot,” he said. “We’re very pleased with what’s transpired.”

CLICK HERE to view Sims’ interview in its entirety.

(Contact: Matt Bechard at mbechard@nareit.com)

NAREIT’s Meredith Despins Participates in NAST Issues Conference

Meredith Despins, NAREIT vice president of investment affairs and investor education, participated last week in a National Association of State Treasurers (NAST) conference on public fund management. Meredith Despins, NAREIT vice president of investment affairs and investor education, participated last week in a National Association of State Treasurers (NAST) conference on public fund management.

The conference provides an opportunity for NAREIT to engage directly with treasurers and their investment staffs, an important audience for NAREIT’s outreach initiatives.

NAST’s members include all state treasurers or state finance officials with comparable responsibilities from the United States, its commonwealths, territories and the District of Columbia. More than 30 state treasurers serve as trustees and board members of the public pension systems within their states. In many cases, they serve on multiple pension boards at the state, county and municipal levels.

(Contact: Meredith Despins at mdespins@nareit.com)

REIT.com Videos: Market Insights

REIT.com conducted video interviews with dozens of REIT investors, analysts, bankers and industry stakeholders at REITWorld 2014: NAREIT’s Annual Convention for All Things REIT. Here’s a sample of the videos currently available online.

Merrie Frankel, vice president and senior credit officer at Moody’s Investors Service, offered insights into the increasing number of REITs that are obtaining investment-grade credit ratings. She emphasized that liquidity in the market is an important factor. Merrie Frankel, vice president and senior credit officer at Moody’s Investors Service, offered insights into the increasing number of REITs that are obtaining investment-grade credit ratings. She emphasized that liquidity in the market is an important factor.

“It’s access to the public debt market. It’s the ability to finance your assets, your growth [and] your company with the best instrument at the best spreads,” she said.

CLICK HERE to view Frankel’s interview in its entirety.

Andrew McCulloch, managing director and head of real estate analytics at Green Street Advisors, commented on the recent run-up in real estate valuations. According to Green Street’s Commercial Property Price Indices, asset values for all the major property sectors are at or above 2007 levels, McCulloch observed. In fact, mall and apartment values are 20 percent to 30 percent above 2007 levels, he said. Andrew McCulloch, managing director and head of real estate analytics at Green Street Advisors, commented on the recent run-up in real estate valuations. According to Green Street’s Commercial Property Price Indices, asset values for all the major property sectors are at or above 2007 levels, McCulloch observed. In fact, mall and apartment values are 20 percent to 30 percent above 2007 levels, he said.

CLICK HERE to view McCulloch’s interview in its entirety.

Lisa Sarajian, managing director with Standard & Poor’s Rating Services, discussed S&P’s annual report on the REIT industry, which offered a positive outlook for the coming year. Sarajian attributed the optimism to a strengthening economy, which is increasing business and consumer confidence. As a result, REITs are enjoying “solid” operating fundamentals, according to Sarajian. Sarajian also weighed in on the impact of possible interest rate increases on the REIT industry. Lisa Sarajian, managing director with Standard & Poor’s Rating Services, discussed S&P’s annual report on the REIT industry, which offered a positive outlook for the coming year. Sarajian attributed the optimism to a strengthening economy, which is increasing business and consumer confidence. As a result, REITs are enjoying “solid” operating fundamentals, according to Sarajian. Sarajian also weighed in on the impact of possible interest rate increases on the REIT industry.

“We pretty much assume interest rates are going to rise,” she said. “It’s just a function of when they rise and how they rise.”

CLICK HERE to view Sarajian’s interview in its entirety.

Vivek Seth, managing director and head of real estate investment banking at Raymond James, moderated a panel during REITWorld 2014 focusing on trends in the capital markets. According to Seth, some of the main themes that emerged from the panel included the robustness of the markets and capital flows today, as well as the earnings power that REITs currently enjoy. Vivek Seth, managing director and head of real estate investment banking at Raymond James, moderated a panel during REITWorld 2014 focusing on trends in the capital markets. According to Seth, some of the main themes that emerged from the panel included the robustness of the markets and capital flows today, as well as the earnings power that REITs currently enjoy.

“Fundamentals are strong, and the tailwinds are there for us to really see some capital formation occur,” Seth said.

CLICK HERE to view Seth’s interview in its entirety.

(Contact: Matt Bechard at mbechard@nareit.com)

Register for RETIWise 2015

Registration for REITWise 2015®: NAREIT’s Law, Accounting & Finance Conference® opens Tuesday, Dec. 16.

REITWise 2015 will be held at the JW Marriott Desert Ridge in Phoenix. The conference will run from Tuesday, Mar. 31 through Thursday, April 2, 2015. The 2015 REITWise program is now available on REIT.com.

Topics are specific to financial, tax, legal and accounting professionals in the REIT industry, as well as service providers. The REITWise SourceBook, which includes thousands of pages of presentation material, primary sources and documents used in presentations given at the event, will be made available to registered attendees in advance of the event.

The most recent REITWise conference set new attendance records with more than 1,130 attendees, and attendance should be strong again this year. A variety of highly visible conference sponsorships are available to reach this influential audience. To view the full range of sponsorship opportunities, visit the conference website or contact Chris Flood, NAREIT’s vice president for business development.

(Contact: Chris Flood at cflood@nareit.com)

|

NAREIT® is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. Members are REITs and other businesses that own, operate and manage income-producing real estate, as well as those firms and individuals who advise, study and service those businesses. NAREIT is the exclusive registered trademark of the National Association of Real Estate Investment Trusts, Inc.®, 1875 I St., NW, Suite 600, Washington, DC 20006-5413. Follow us on REIT.com.

Copyright© 2014 by the National Association of Real Estate Investment Trusts, Inc.® All rights reserved.

This information is solely educational in nature and is not intended by NAREIT to serve as the primary basis for any investment decision. NAREIT is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made. Investments and solicitations for investment must be made directly through an agent, employee or representative of a particular investment or fund and cannot be made through NAREIT. NAREIT does not allow any agent, employee or representative to personally solicit any investment or accept any monies to be invested in a particular security or real estate investment.

All REIT data are derived from, and apply only to, publicly traded securities. While such data are believed to be reliable when prepared or provided, such data are subject to change or restatement. NAREIT does not warrant or guarantee such data for accuracy or completeness, and shall not be liable under any legal theory for such data or any errors or omissions therein. See /TermsofUse.aspx for important information regarding this data, the underlying assumptions and the limitations of NAREIT’s liability therefor, all of which are incorporated by reference herein.

Performance results are provided only as a barometer or measure of past performance, and future values will fluctuate from those used in the underlying data. Any investment returns or performance data (past, hypothetical or otherwise) shown herein or in such data are not necessarily indicative of future returns or performance.

Before an investment is made in any security, fund or investment, investors are strongly advised to request a copy of the prospectus or other disclosure or investment documentation and read it carefully. Such prospectus or other information contains important information about a security’s, fund’s or other investment’s objectives and strategies, risks and expenses. Investors should read all such information carefully before making an investment decision or investing any funds. Investors should consult with their investment fiduciary or other market professional before making any investment in any security, fund or other investment. |

This week’s edition of NewsBrief details a productive year for NAREIT’s investor outreach team that included 450 meetings with key stakeholders in the institutional investment marketplace. That signifies a 17.5 percent year-over-year increase from 2013.

This week’s edition of NewsBrief details a productive year for NAREIT’s investor outreach team that included 450 meetings with key stakeholders in the institutional investment marketplace. That signifies a 17.5 percent year-over-year increase from 2013.

The House of Representatives passed a six-year extension of the Terrorism Risk Insurance Program Reauthorization Act (TRIA) by a vote of 417 to 7 on Dec. 10.

The House of Representatives passed a six-year extension of the Terrorism Risk Insurance Program Reauthorization Act (TRIA) by a vote of 417 to 7 on Dec. 10.

Meredith Despins, NAREIT vice president of investment affairs and investor education, participated last week in a National Association of State Treasurers (NAST) conference on public fund management.

Meredith Despins, NAREIT vice president of investment affairs and investor education, participated last week in a National Association of State Treasurers (NAST) conference on public fund management.