|

March 26, 2012

Message from the President

REITWise is one of the most important events in NAREIT's conference calendar, providing a wealth of highly focused educational opportunities for REIT law, accounting and finance professionals that aren't available in any other forum. Last week's REITWise 2012 was attended by 950 of these professionals – almost 100 more than were at last year's event. They took part in 25 hands-on sessions that covered a broad range of subjects from financial reporting to tax planning to SEC guidelines – delivering practical knowledge and skills that the participants can readily put to work within their own organizations. REITWise is one of the most important events in NAREIT's conference calendar, providing a wealth of highly focused educational opportunities for REIT law, accounting and finance professionals that aren't available in any other forum. Last week's REITWise 2012 was attended by 950 of these professionals – almost 100 more than were at last year's event. They took part in 25 hands-on sessions that covered a broad range of subjects from financial reporting to tax planning to SEC guidelines – delivering practical knowledge and skills that the participants can readily put to work within their own organizations.

This year's conference was marked by some notable "firsts," including the first session featuring a U.S. Treasury Department speaker, Michael Novey, associate tax legislative counsel, who provided insights into the Obama administration's tax policies impacting real estate. It also included new topics, such as a cross-disciplinary exploration of two actual M&A transactions, and a roundtable on lessons learned from Canada's adoption of IFRS.

The program directors who plan REITWise have a great deal to do with its success, and our thanks go to this year's directors: Dawn Becker, COO and general counsel of Federal Realty Investment Trust; Jeff Clark, senior vice president, Tax, of Host Hotels & Resorts; Glenn Cohen, executive vice president, CFO and treasurer of Kimco; and Scott Schaevitz, chairman, Americas Real Estate IBD of Barclays Capital. Their work helped make this year's conference especially valuable.

Steven A. Wechsler

President and CEO

REITWise 2012 a Success

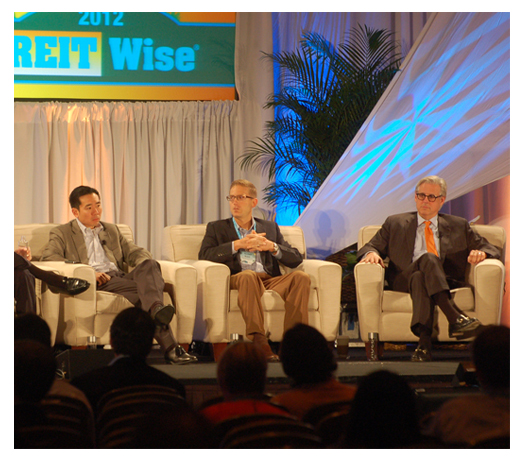

REITWise 2012®: NAREIT's Law, Accounting & Finance Conference® brought together approximately 950 REIT executives and leading service providers that support their legal, financial and accounting needs. The event, held March 21 to 23, in Hollywood, FL. featured more than 40 sessions, roundtables and events highlighting the latest legal, financial and accounting insights concerning capital markets, financial standards, global investment opportunities, SEC policies, tax updates and more.

Heidi Roth (left) of Kilroy Realty Corporation (NYSE: KRC) moderated a session focused on financial reporting hot topics that included insights from Ernst & Young’s Steven Jacobs (center left), Forest City Enterprises' (NYSE: FCE.A) Janet Menko (center right) and DCT Industrial Trust’s (NYSE: DCT) Mark Skomal (right).

Barclays Capital’s Scott Schaevitz (not pictured) moderated the opening REITWise 2012 session focused on the state of the capital markets. The panel included (left to right): Jon Cheigh, portfolio manager, Cohen & Steers Capital Management; Michael Knott, managing director, Green Street Advisors Inc.; and Ted Rollins, co-chairman and CEO, Campus Crest Communities (NYSE: CCG). Brian Summers, CFO, DRA Advisors, was also on the panel.

Kimberly Smith (left), general counsel-capital markets with Cole Real Estate Investments, and Rosemarie Thurston (right), partner with Alston & Bird LLP, were two of the panelists during a discussion that looked at the issues facing public, non-listed REITs.

Jeffrey Clark (center) of Host Hotels & Resorts (NYSE: HST) lead a discussion on tax planning for U.S. REITs investing abroad. Also on the panel were Joseph Howe of Arnold & Porter (left) and Bartjan Zoetmulder of Loyens & Loeff.

(Contact: Tony Edwards at tedwards@nareit.com)

NAREIT Submits Comments on AIFM Directive

On March 21, NAREIT submitted comments to the European Securities and Markets Authority (ESMA) regarding the Alternative Investment Fund Managers (AIFM) Directive.

NAREIT expressed its concerns with the "uncertain scope" of the directive.

"As representatives of commercial businesses which own, develop, operate and manage real estate assets, our principal concern is that the directive, as drafted, could arguably catch any business venture with a number of investors – whether they be direct capital investors, or shareholders of a listed company," NAREIT wrote in the letter to EMSA.

(Contact: Tony Edwards at tedwards@nareit.com)

NAREIT Addresses ING Investment Management Conference

Last week, Calvin Schnure, NAREIT's vice president for research and industry information, spoke at the ING Investment Management Conference in Scottsdale, Ariz. Nearly 100 of ING's top-producing financial advisors attended the conference. Last week, Calvin Schnure, NAREIT's vice president for research and industry information, spoke at the ING Investment Management Conference in Scottsdale, Ariz. Nearly 100 of ING's top-producing financial advisors attended the conference.

Schnure's talk, "Equity Real Estate Investment through the Public Markets," covered how three attributes of REITs – performance, income and diversification – can enhance financial advisors' client portfolios. Schnure also discussed how recent improvements in the macroeconomic environment are likely to support further recovery in commercial property markets.

(Contact: Calvin Schnure at cschnure@nareit.com)

NAREIT Comments on Form 1120-REIT

On March 19, NAREIT submitted comments to the Office of Management and Budget regarding Form 1120-REIT. On March 19, NAREIT submitted comments to the Office of Management and Budget regarding Form 1120-REIT.

NAREIT requested that the Treasury Department and Internal Revenue Service add a number of modifications to Form 1120-REIT.

The changes included: modifying Part III of Form 1120-REIT so that calculating a REIT’s gross income for purposes of Section 857(b)(5)1 begins with gross, rather than net, income; modifying Part III of Form 1120-REIT to exclude income from hedging transactions under Section 856(c)(5)(G) for purposes of section 857(b)(5); and clarifying in the instructions to Form 1120-REIT how the passive loss limitations of Section 469 and at risk limitations of Section 465 apply to a REIT.

(Contact: Dara Bernstein at dbernstein@nareit.com)

REITs Included on Updated ETF Portfolio List

This past week, IndexUniverse.com, an independent authority on ETFs, indexes and index funds, featured an article entitled, "The World's Cheapest ETF Portfolio."

IndexUniverse.com has been tracking "…a well diversified, broad-based ETF portfolio holding stocks (international and domestic), bonds, REITs and commodities" since June 2007. The model portfolio has consistently included a 5 percent allocation to REITs through the Vanguard REIT Index Fund (VNQ) since its inception. This is further evidence that REITs increasingly are included in mainstream investment policy recommendations.

(Contact: Abby McCarthy at amccarthy@nareit.com)

REIT.com Videos: Industry Insights

REIT.com spoke with a number of industry observers in March to get their take on developments in various areas of commercial real estate. Below is a summary of some of those interviews. Click on the person's name to play the video.

Investors and lenders are more careful today as a result of the Great Recession, according to Scott Hileman, director, real estate consulting at Deloitte Financial Advisory Services. Investors and lenders are more careful today as a result of the Great Recession, according to Scott Hileman, director, real estate consulting at Deloitte Financial Advisory Services.

"I think going forward, people will be a lot more cautious whenever they're making new investments, in terms of understanding the market and the properties," Hileman said.

That caution is expected to remain in place; Hileman doesn't expect to see the "irrational exuberance that came out of the market in 2007." Banks, in particular – which face strong regulatory pressures – will be more cautious when making new loans, Hileman noted.

Regulatory uncertainty is the biggest challenge facing the health care real estate sector, according to Jeffrey Cooper, executive manager, Savills U.S., a global real estate services provider. Regulatory uncertainty is the biggest challenge facing the health care real estate sector, according to Jeffrey Cooper, executive manager, Savills U.S., a global real estate services provider.

Cooper spearheads the firm's health care real estate practice. Cooper said the sector is in limbo until the Supreme Court rules later this year on the health care bill signed into law by President Barack Obama in 2010.

"It has created a tremendous amount of uncertainty, not only with respect to economics and how I use my real estate, but with what health care delivery looks like," he said.

In terms of the best investment opportunities within the health care sector, Cooper said ambulatory facilities that offer outpatient care are showing the most promise. As more baby boomers begin to utilize medical facilities, service providers' reimbursement amounts are decreasing, according to Cooper. Meanwhile, an increase in "bundling" of health care services is occurring.

Todd Lillibridge, president and CEO of Lillibridge Healthcare Services Inc. and executive vice president of medical property operations for Ventas Inc. (NYSE: VTR), agreed there is a growing need for outpatient services. Todd Lillibridge, president and CEO of Lillibridge Healthcare Services Inc. and executive vice president of medical property operations for Ventas Inc. (NYSE: VTR), agreed there is a growing need for outpatient services.

With more Medicare-eligible patients in need of medical care, the demand for outpatient facilities continues to rise, Lillibridge told REIT.com. Lillibridge said his firm, which invests in health care real estate, is projecting a 30 percent increase in the growth of outpatient health care services in the next 10 years, and general shifting away from inpatient procedures performed in hospitals.

"There has just been an extraordinary amount of pressure on reducing the amount of inpatient care," he said. "As a result, we see a whole new revenue stream and percentage of revenue around the outpatient more often today than ever before."

A limited supply of new development coupled with a growing number of college graduate renters will ensure continued strength in the multifamily sector, according to Susan Ansel, executive vice president and chief operating officer of Gables Residential. A limited supply of new development coupled with a growing number of college graduate renters will ensure continued strength in the multifamily sector, according to Susan Ansel, executive vice president and chief operating officer of Gables Residential.

"We have the demographics behind us with the age cohorts, and we'll continue to grow into the foreseeable future," Ansel said.

Ansel said Gables Residential has a number of new projects already under construction in light of the favorable market dynamics.

"That will be a big part of our growth, but we anticipate strong growth from our stable, core properties as well," she said.

The multifamily sector is poised to take advantage of positive fundamentals as demographics continue to favor renting over buying, according to Edward Kobel, president and chief operating officer of the Tampa-based DeBartolo Development. The multifamily sector is poised to take advantage of positive fundamentals as demographics continue to favor renting over buying, according to Edward Kobel, president and chief operating officer of the Tampa-based DeBartolo Development.

Among the company's investment sectors, which include multifamily, limited service hotels, anchored retail and a "special situations" category that primarily consists of land, Kobel said the highest returns have been in the multifamily sector.

"The fundamentals in the multifamily space are a long-term paradigm shift for America," he said. "We now have renters by choice."

Kobel noted that in addition to a new, younger generation of renters who are choosing to rent instead of buy, he has noticed that the baby boomer generation is also turning more to apartment communities by choice.

(Contact: Matt Bechard at mbechard@nareit.com)

Supreme Court Rules Favorably in Clean Water Act Case

In January, NAREIT joined in the submission of an amicus curiae brief for a U.S. Supreme Court case related to the Clean Water Act and its impact on future developments. Last week, the court ruled unanimously in favor NAREIT's position. In January, NAREIT joined in the submission of an amicus curiae brief for a U.S. Supreme Court case related to the Clean Water Act and its impact on future developments. Last week, the court ruled unanimously in favor NAREIT's position.

On Jan. 9, the Supreme Court heard oral arguments in the case of Sackett v. U.S. Environmental Protection Agency, 622 F.3d 1139 (9th Cir. 2010). The case involved a dispute between the Environmental Protection Agency (EPA) and a family trying to build a home on a lot in a residential subdivision in Priest Lake, Idaho. The EPA determined that the site contained jurisdictional wetlands under the Clean Water Act (CWA) and that the family, the Sacketts, had failed to obtain an appropriate permit, in violation of the CWA. The EPA issued an administrative compliance order preventing further construction work on the site, requiring the Sacketts to restore the wetlands and threatening the family with fines of as much as $32,500 a day.

The Sacketts did not believe that the wetlands on their site were jurisdictional under the CWA and asked the EPA for a hearing before enforcement of the order commenced. When the hearing was denied, the family then sued the EPA in federal district court in Idaho, arguing that the wetlands on their property are not "waters of the United States." The district court dismissed the case, which was affirmed by the Ninth Circuit.

Along with other interested real estate and business entities, NAREIT joined in the submission of the amicus curiae brief in this case because current case law, as evidenced by the Ninth Circuit's decision, had narrowly limited the circumstances under which a landowner or other entity could obtain judicial review of the EPA's or the Army Corps of Engineer's assertion of CWA jurisdiction.

(Contact: Robert Dibblee at rdibblee@nareit.com)

|

REITWise is one of the most important events in NAREIT's conference calendar, providing a wealth of highly focused educational opportunities for REIT law, accounting and finance professionals that aren't available in any other forum. Last week's REITWise 2012 was attended by 950 of these professionals – almost 100 more than were at last year's event. They took part in 25 hands-on sessions that covered a broad range of subjects from financial reporting to tax planning to SEC guidelines – delivering practical knowledge and skills that the participants can readily put to work within their own organizations.

REITWise is one of the most important events in NAREIT's conference calendar, providing a wealth of highly focused educational opportunities for REIT law, accounting and finance professionals that aren't available in any other forum. Last week's REITWise 2012 was attended by 950 of these professionals – almost 100 more than were at last year's event. They took part in 25 hands-on sessions that covered a broad range of subjects from financial reporting to tax planning to SEC guidelines – delivering practical knowledge and skills that the participants can readily put to work within their own organizations.

Last week, Calvin Schnure, NAREIT's vice president for research and industry information, spoke at the ING Investment Management Conference in Scottsdale, Ariz. Nearly 100 of ING's top-producing financial advisors attended the conference.

Last week, Calvin Schnure, NAREIT's vice president for research and industry information, spoke at the ING Investment Management Conference in Scottsdale, Ariz. Nearly 100 of ING's top-producing financial advisors attended the conference. On March 19, NAREIT

On March 19, NAREIT

In January, NAREIT joined in the submission of an

In January, NAREIT joined in the submission of an