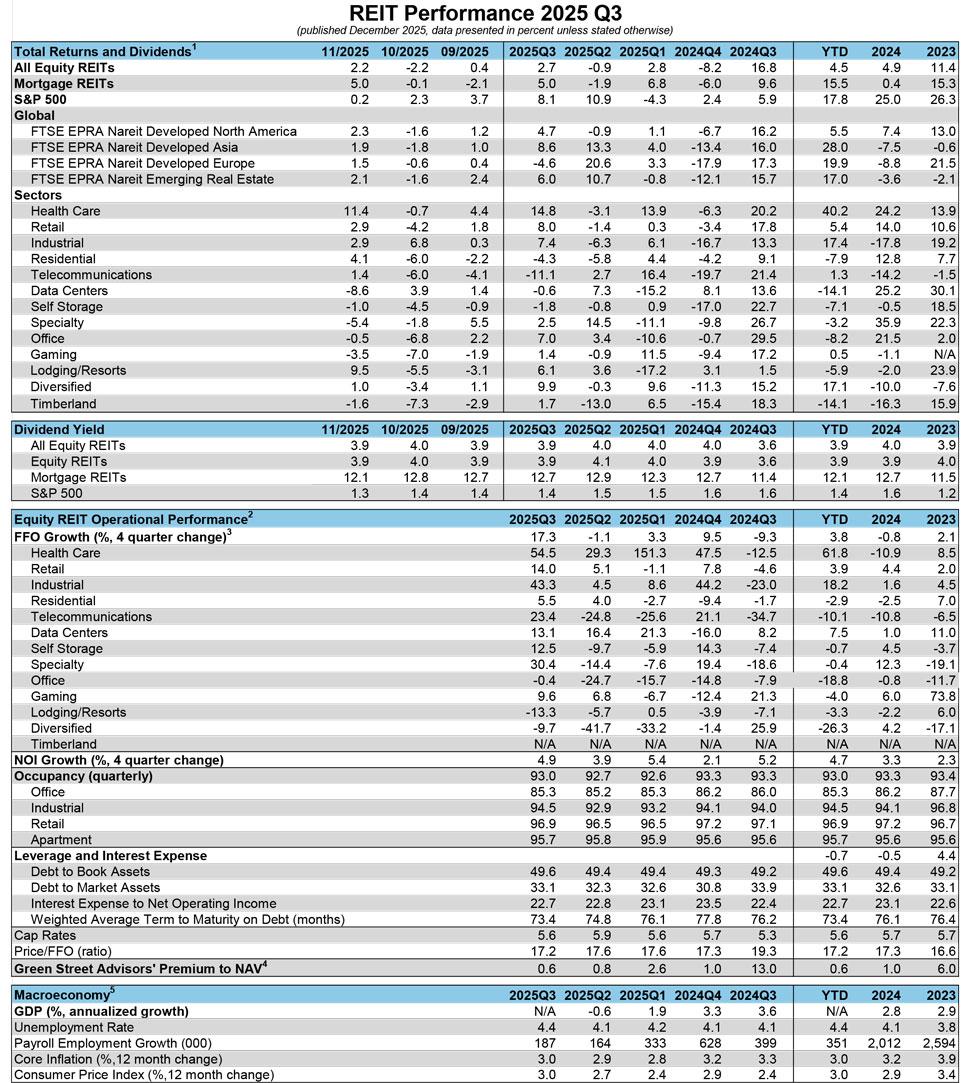

REIT year-to-date (YTD) total returns have been modestly positive in 2025, with all equity REITs and mortgage REITs up by 2.3% and 14.4%, respectively. The 2025 returns have seen a rebound in U.S. and global REIT performance, with YTD returns of 2.3% for the FTSE Nareit All Equity REITs Index and 9.5% for the FTSE EPRA Nareit Developed Index. Mortgage REITs have posted a YTD gain of 22.2% for home financing mREITs and 0.1% for commercial mREITs. REITs also continue to offer attractive dividends. As of December 2025, all equity and mortgage REITs offered dividends of 4.0% and 12.2%, respectively.

Get quarterly REIT performance data and the latest REIT-related research sent to your inbox. Subscribe to Nareit Research.

- Footnotes

1Source: FactSet, FTSE Nareit US, FTSE EPRA/Nareit Global

2Source: Nareit REIT Industry Tracker, except where noted. Operational Performance is dollar weighted from the FTSE Nareit All Equity REITs index.

3YTD % change

4Source: Green Street Advisors All REIT Premium to NAV

5Source: Bureau of Economic Analysis GDP report and Bureau of Labor Statistics Employment and CPI reports