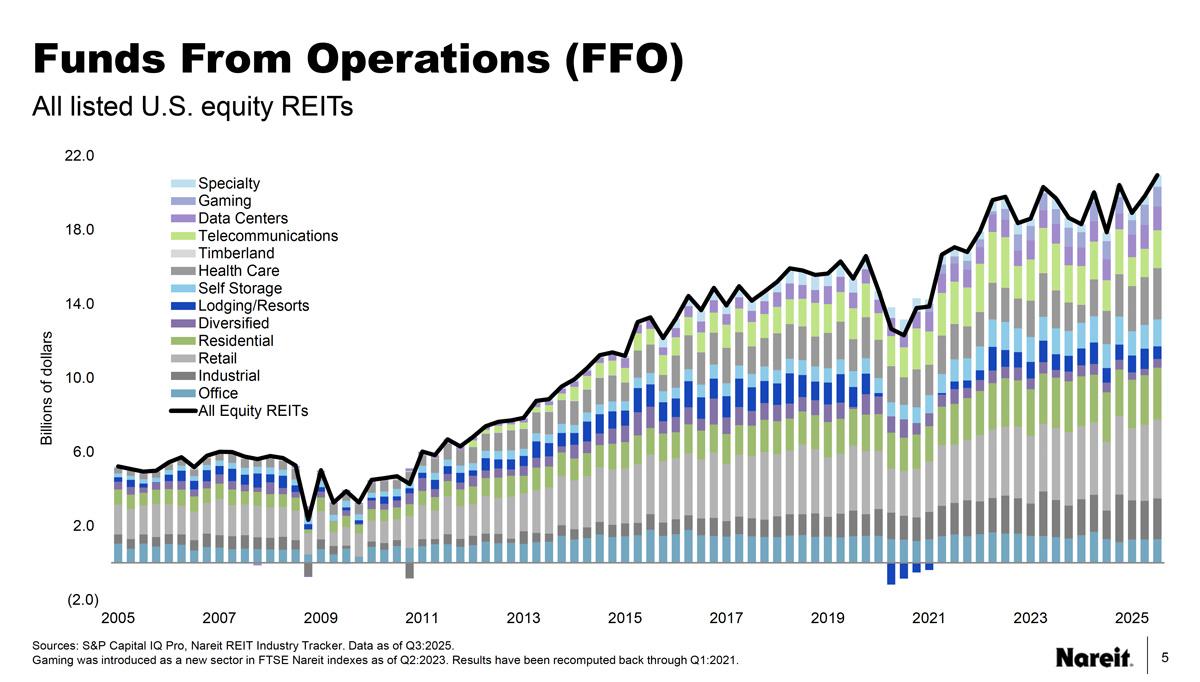

Nareit’s Total REIT Industry Tracker Series – the Nareit T-Tracker– is the first quarterly performance measure of the heartbeat of the U.S. listed REIT industry. The series includes three key REIT industry measures: the Nareit FFO Tracker, which monitors equity REIT Funds From Operations; the Nareit NOI Tracker, which reports the equity REIT industry’s Net Operating Income; and the Nareit Dividend Tracker, which monitors the dividends U.S. listed equity and mortgage REITs pay to their shareholders.

Key Takeaways for REIT Industry Tracker Q3:2025

17.3%

YOY FFO increase

32.9%

Leverage ratio

5.6%

REIT implied cap rate

- Over 60% of REITs reported year-over-year increases in Funds From Operations (FFO), with FFO increasing 17.3% from one year ago

- Over 60% of REITs reported year-over-year increases in Net Operating Income (NOI), with NOI increasing 5.2% from one year ago

- Same Store NOI experienced 2.8% year-over-year gain

- Occupancy for All Equity REITs was at 93.0%

- Weighted average term to maturity of REIT debt was 6.2 years

- Weighted average interest rate on total debt was 4.1%

- 88.7% of REITs’ total debt was at a fixed rate

- 80.6% of REITs’ total debt was unsecured

- Net acquisitions totaled $4.7 billion