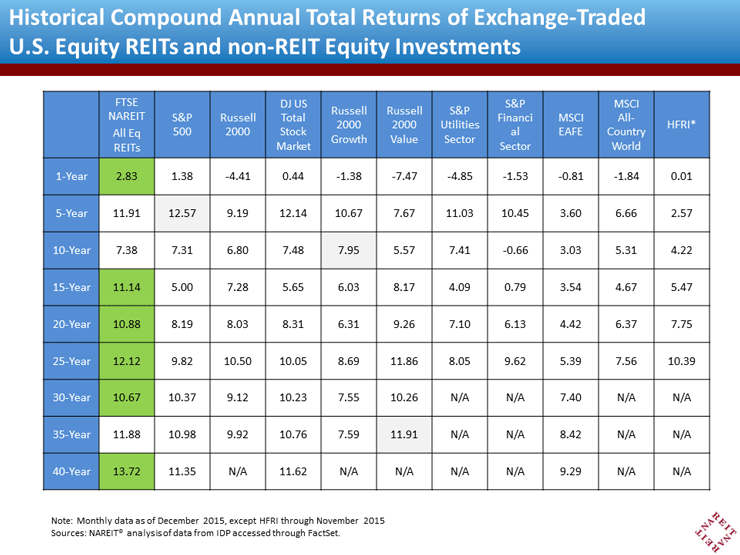

Anybody could be forgiven for having the impression that 2015 was a bad year for REIT investors. It was full of headlines about the impending increase in interest rates, and equally full of speculation that the Fed’s action would spell trouble for real estate. And the truth is that REIT total returns were weak by historical standards: exchange-traded REITs provided total returns averaging just 2.29% during 2015, compared to an average of 9.75% per year since NAREIT began collecting data at the end of 1971. Equity REITs—which now comprise more than 94% of the total exchange-traded REIT market—did slightly better with total returns averaging 2.83%, but that too was well below their average of 12.00% since the end of 1971.

Look at how other asset categories performed in a generally dismal year, however, and REITs suddenly start looking like the brightest jewel in any investor’s portfolio. Try these segments of the equity market for comparison:

- Large-cap stocks (S&P 500) gained just 1.38%

- Small-cap stocks (Russell 2000) lost -4.41%

- The broad stock market (DJUSTM) gained just 0.44%

- Small-cap growth stocks (R2000G) lost -1.38%

- Small-cap value stocks (R2000V) lost -7.47%

- Utility stocks (S&P Utilities Sector), often thought of as competitors for income-oriented investors, lost -4.85%

- Financial stocks (S&P Financial Sector), the sector that—until August 2016—includes equity REITs, lost -1.53%

- Non-U.S. developed country stocks (MSCI EAFE) lost -0.81%

- World stocks (MSCI AC World) lost -1.84%

- Hedge funds (the commonly cited HFRI Fund Weighted Composite) gained just 0.05% through November, and the similar HFRU index showed a loss of -1.16% in December

So REITs—especially the market-dominating equity REITs—outperformed during 2015. Does that surprise you? It shouldn’t:

- Exchange-traded equity REITs outperformed large-cap stocks not just during 2015 but also over the past 10 years, 15 years, 20 years, 25 years, 30 years, 35 years, 40 years, and over the longest time period available, since the end of 1971. The past 5 years was a good period for large-cap stocks: they outperformed equity REITs by 12.57% per year to 11.91% per year.

- Exchange-traded equity REITs outperformed small-cap stocks not just during 2015 but also over the past 5 years, 10 years, 15 years, 20 years, 25 years, 30 years, 35 years, and over the longest period available since the end of 1977.

- Exchange-traded equity REITs outperformed small-cap value stocks not just during 2015 but also over the past 5 years, 10 years, 15 years, 20 years, 25 years, and 30 years. (Over the past 35 years small-cap stocks edged out equity REITs by three hundredths of a percentage point, 11.91% per year to 11.88% per year.)

You get the idea. In fact, not a single one of those equity categories outperformed exchange-traded U.S. equity REITs over the past 1-, 15-, 20-, 25-, 30-, or 40-year period. There’s more: over the past 15-, 20-, and 25-year periods, not a single one of the 10 sectors measured by S&P outperformed equity REITs: not Information Technology, not Health Care, not Telecommunication Services, not any of them.

Will 2016 bring more of the same? I can’t foresee the future, although macroeconomic fundamentals continue to be very favorable. But it’s hard to bet against an industry with such a consistent 44-year history of outperformance.