How well are stock-exchange listed Equity REITs positioned for the interest rate environment ahead? The Federal Reserve’s recent increase in short-term interest rates has focused attention on debt and leverage positions among investors in commercial real estate, including among Equity REITs. Such attention is warranted, as some commercial real estate investors in the past have experienced financial distress due to high leverage, rising interest expense or low interest coverage ratios, especially during periods of rising interest rates.

Let’s take a look, then, at current exposures in the Equity REIT sector. It would be helpful to have a comparable analysis of non-REIT real estate investors, but alas, the private markets do not share REITs’ appreciation of how transparency can improve performance, and comprehensive data on non-REIT investors are not available. The charts below, though, will show how positions at REITs have changed since the financial crisis, and help to gauge how well the sector is positioned for a period of higher interest rates ahead.

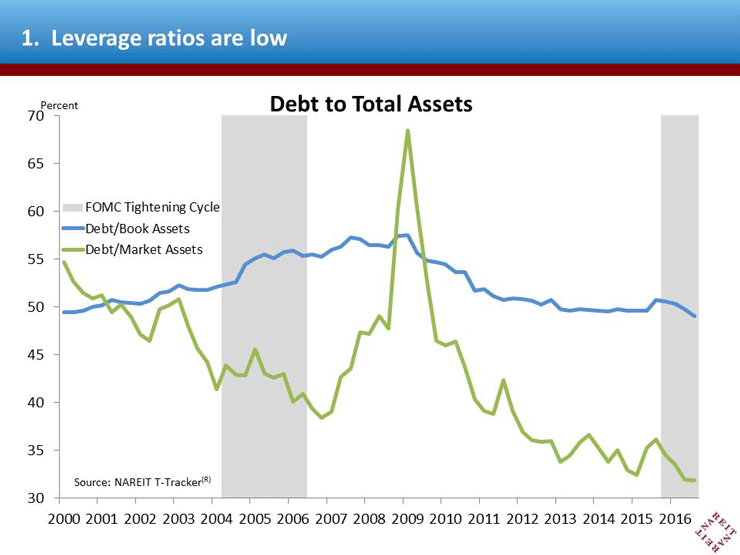

Leverage is down. The debt-to-book-assets ratio of All Equity REITs is 49.0 percent, down from a pre-crisis peak of 57.5 percent. Indeed, book leverage of the REIT industry is at its lowest point since 2000 (Chart 1, blue line. Grey bars indicate periods when the Federal Reserve was raising interest rates). The market leverage ratio, which uses market cap rather than book equity in the denominator, is even lower, at 31.9 percent (green line).

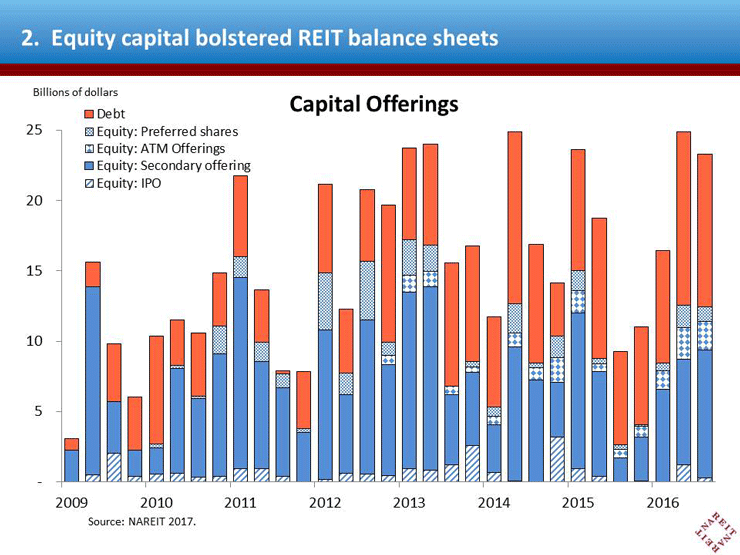

Equity issuance has been strong. It’s not magic how REITs reduced their leverage ratios—they raised significant amounts of equity capital over the past five years, to strengthen their balance sheet positions and fund the acquisitions of new properties. Equity REITs raised a cumulative $464 billion in the capital markets from 2010 through 2016:Q3; 60 percent of this was equity capital, including IPOs, secondary common stock, At-the-market (ATM issuance) and preferred shares (Chart 2). Common shares constituted 50 percent of total capital raised. Far from being a debt-fueled market, REIT balance sheets are built on a large foundation of permanent equity capital.

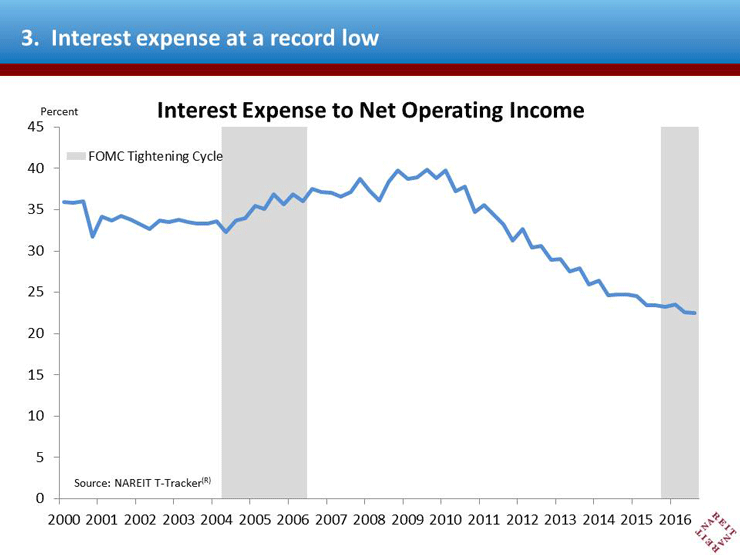

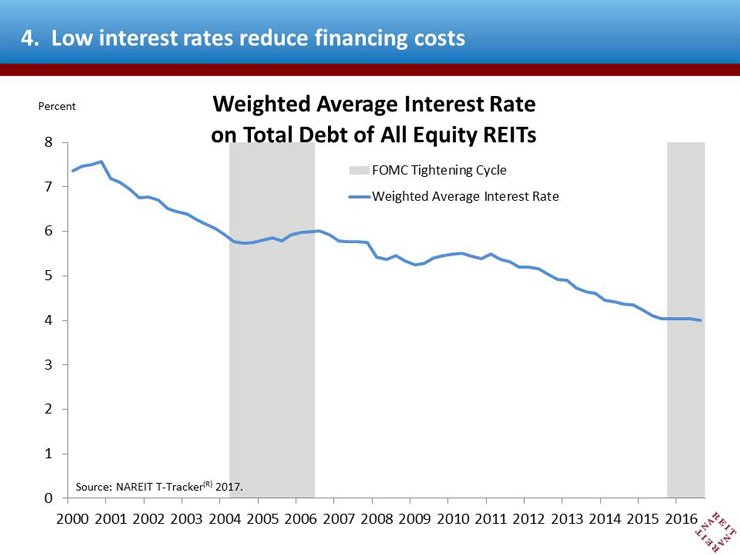

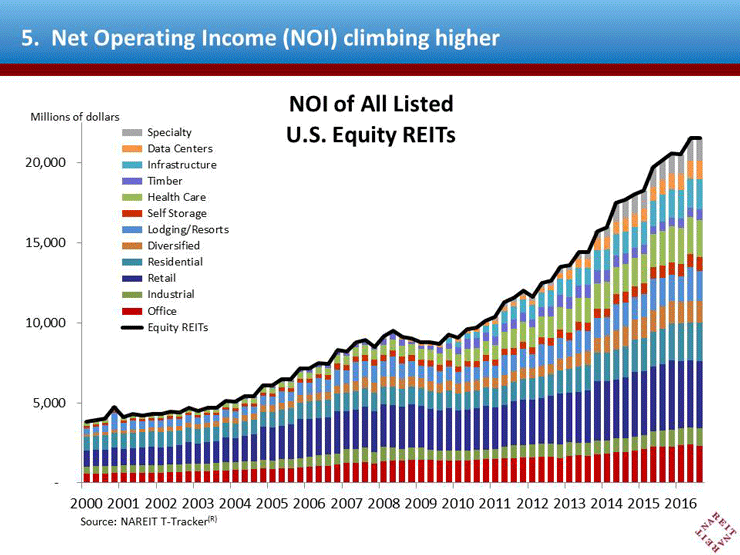

Interest expenses are low. Interest expense as a share of net operating income (NOI) is at a record low of 22.5 percent, down from a 40 percent share in 2009 (Chart 3). Three factors have contributed to reducing interest costs. First is the reduction in leverage discussed above. Second, REITs have benefited from the decline in market interest rates, including opportunities to finance their liabilities. The weighted average interest rate paid on total debt by all equity REITs is 4.0 percent, down 200 basis points from the rate paid in 2006 (Chart 4). And finally, REITs have enjoyed solid increases in NOI due to the strong fundamentals in their property markets (Chart 5).

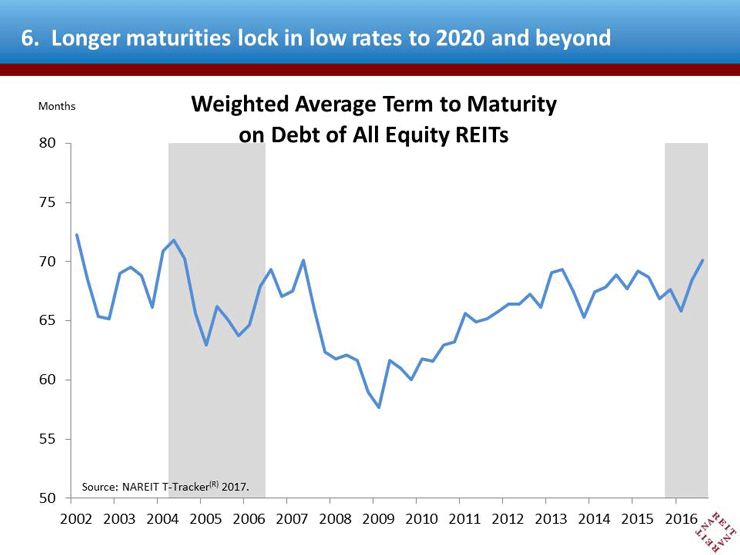

Debt maturities are longer. REITs have locked in these low rates for several years into the future. The weighted average maturity of debt has risen to 70 months, or nearly six years, from 60 months or less in 2009 (Chart 6). With interest rates on the majority of debt locked in until sometime in the next decade, REITs are well prepared for higher rates in the years immediately ahead.

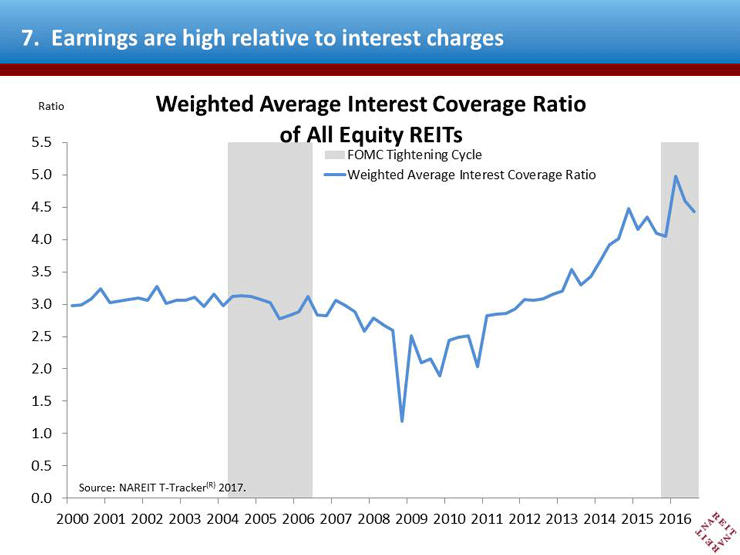

Interest coverage ratios are high. Strong earnings growth and low leverage and interest rates have raised interest coverage ratios to 4.4x interest charges, the highest coverage ratios in the past decade and a half (Chart 7). High earnings and low interest charges leave the sector well positioned to handle rising rates or any unexpected shocks.

Low leverage, low interest costs, long maturities and high coverage ratios—Equity REITs are indeed well prepared for the interest rate environment ahead.