Converging Forces: REITs, Institutional Investors, and Global Real Estate in 2026

Each year, Nareit conducts about 500 engagements with significant investors from across the globe, spanning the disciplines of asset ownership, management, and consulting. The purpose of these meetings is to help inform these leading investors about the many benefits of REITs. These meetings also provide Nareit with a very useful window into institutional investors’ sentiment: what they value about REITs, where misconceptions persist, and how their approaches toward using REITs are evolving. Against that backdrop, Nareit’s 2026 outlook addresses the topics that have been on the minds of real estate investors, including valuation divergences, compelling opportunities, and global strategies. It also discusses the convergences that may drive global REIT outperformance in 2026.

Dual Divergences

REITs delivered strong operational performance throughout 2025, weathering trade friction and continued higher interest rates, while maintaining sound fundamentals, balance sheet strength, and disciplined access to capital markets, as demonstrated by Nareit’s REIT Industry Tracker. Comparing the first three quarters of 2025 to the same period in 2024, aggregate funds from operations (FFO), net operating income (NOI), and dividends paid all increased markedly; FFO is up 6.2%, NOI is up 4.7%, and total dividends paid are up 6.3%.

Comparing the first three quarters of 2025 to the same period in 2024

6.2%

Increase in FFO

6.3%

Increase in total dividends paid

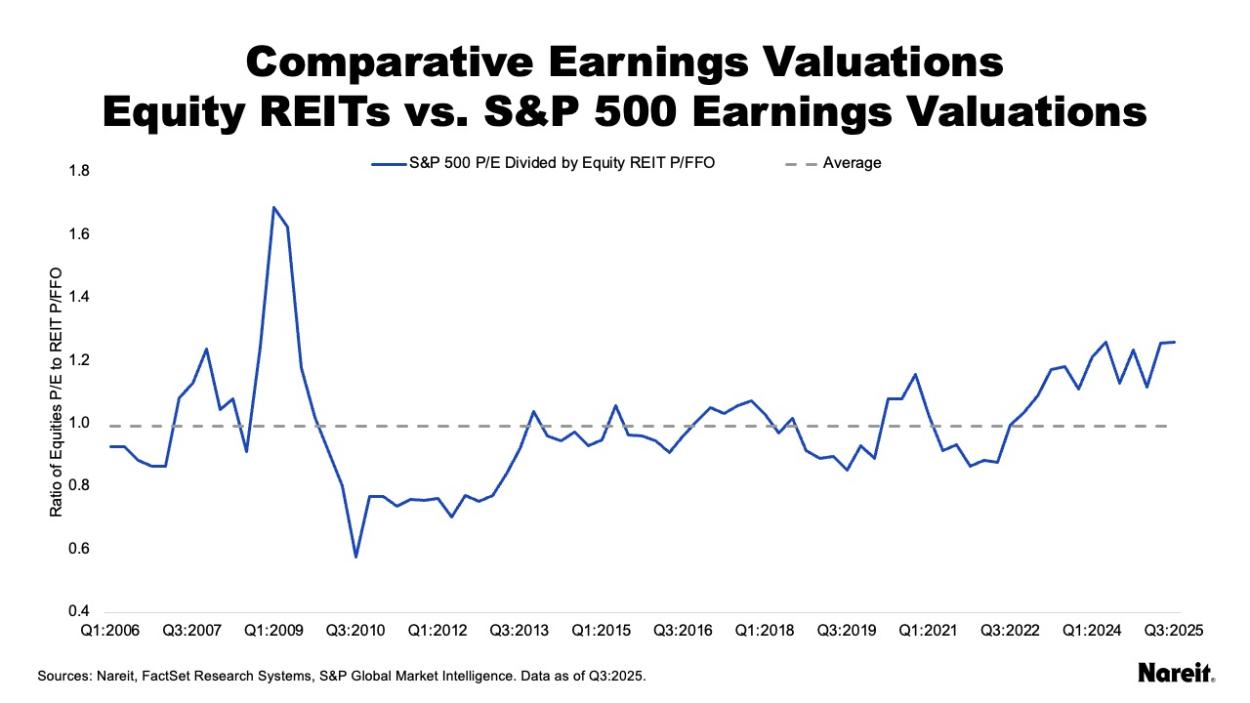

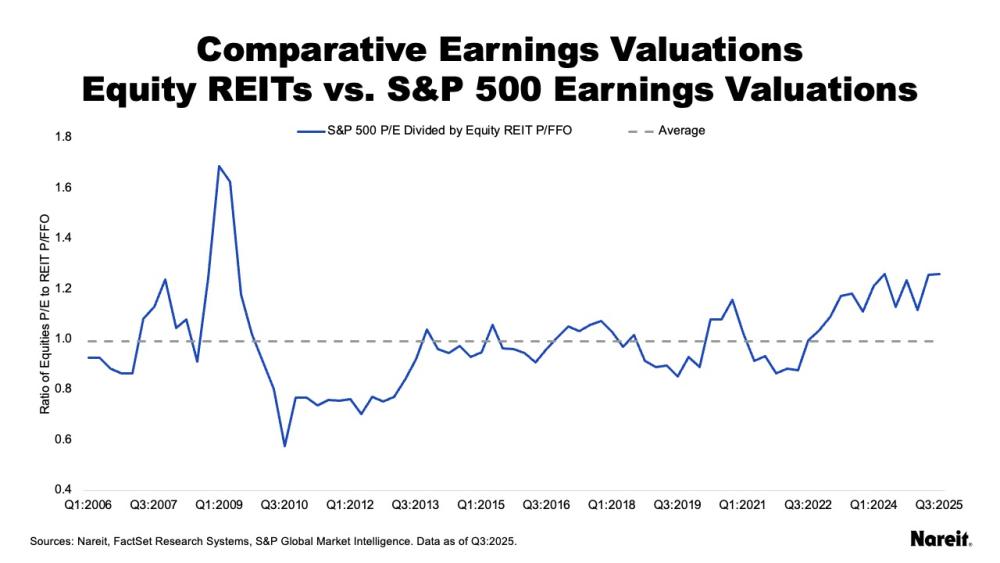

Despite this operational performance, U.S. REITs spent much of 2025 with their valuations stuck in neutral as generalist investors bid up the valuations of tech stocks. This dynamic—reminiscent of the late 1990s tech boom—resulted in a striking divergence between REIT and broader valuation multiples.

Nareit’s analysis of the broad equity-REIT valuation ratio, as depicted above, shows that the gap between equity and REIT valuations today is only rivaled by what was seen during the global financial crisis and the early months of the COVID-19 pandemic. This divergence adds to a persistent gap between REIT and private real estate valuations, which is now the longest of its kind since the early 2000s.

The outlook explains why it’s a question of when, not if, these valuation gaps close—and how REITs and their investors are positioned to benefit from relative outperformance and renewed opportunities for accretive acquisitions.

REITs and Institutional Investors

Nareit’s conversations with investors in 2025 highlighted a recurring theme: many market participants still underestimate how widely REITs are integrated into real estate portfolios and are unaware of how institutional investors are continually evolving their use of REITs. Today, more than 70% of U.S. pensions by assets incorporate REITs into their real estate strategies, and usage is even higher among the largest, most sophisticated plans; more than 75% of pension plans with above $25 billion in assets use REITs.

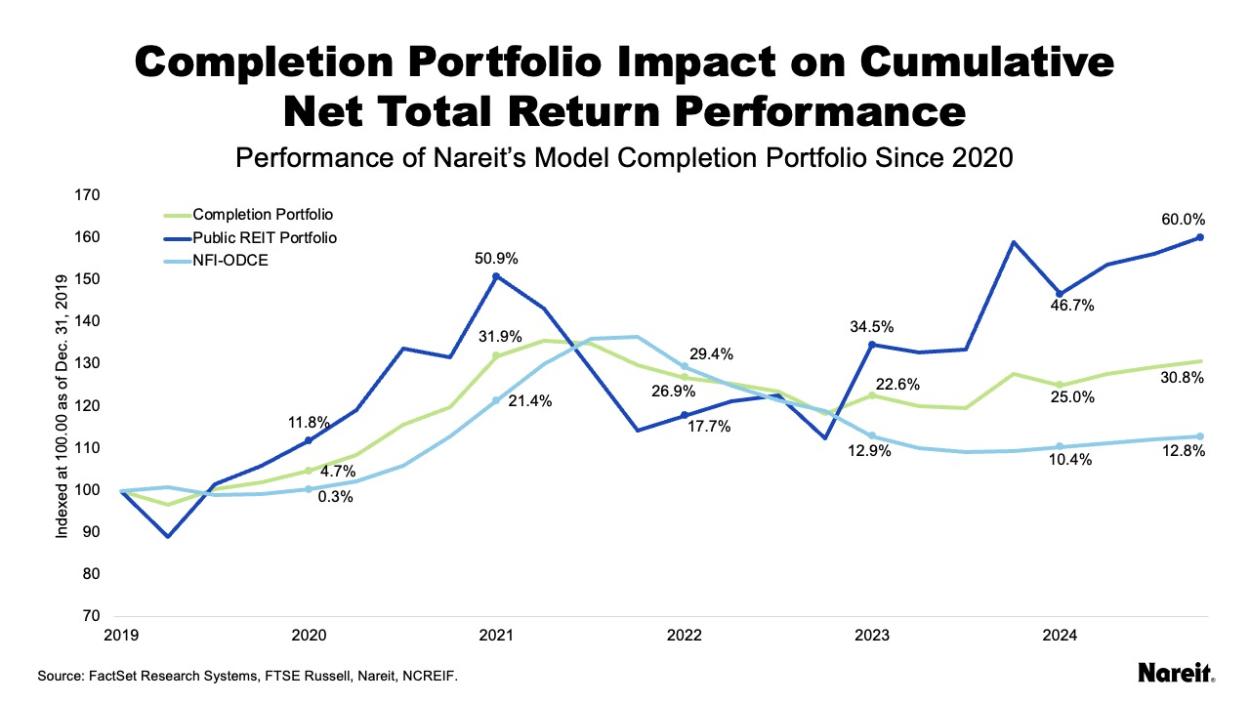

Leading institutional investors, including pensions and sovereign wealth funds, are expanding their use of REITs, drawn to their higher total returns, strong operations, scale, access to emerging sectors, and efficient global exposure. Nareit’s compilation of case studies highlight how institutions are using REITs to meet key portfolio objectives, including completion strategies. The outlook builds on this work by presenting three new real-world examples of how leading investors are integrating REITs into their real estate allocations.

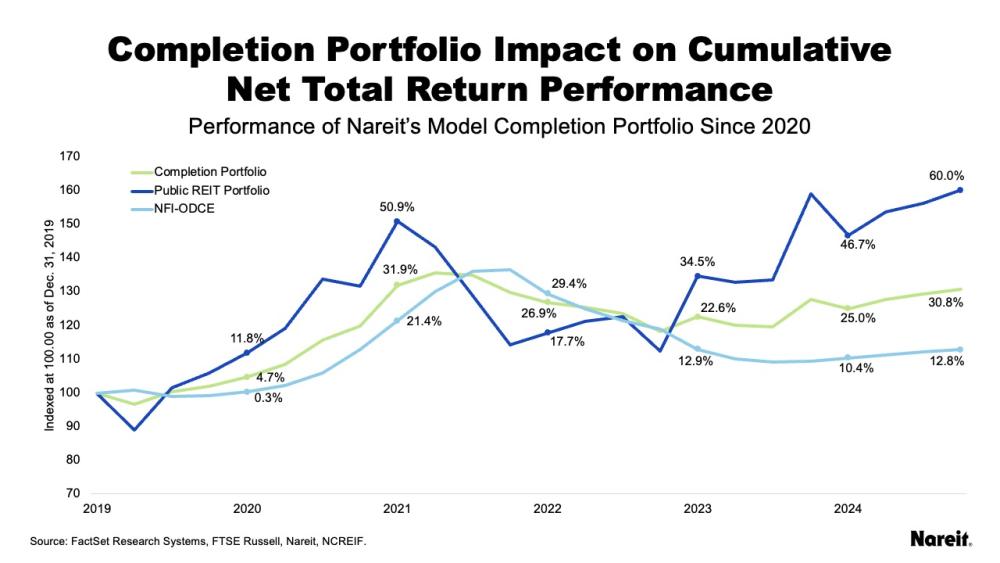

Reflecting investor conversations, the outlook also addresses a frequent question about REITs and portfolio completion strategies: how have these strategies performed through the pandemic and sharp rise in interest rates? As demonstrated in the chart above, Nareit’s comparison of model portfolios, which starts at the beginning of 2020, shows that after a bumpy start in early 2020 and a difficult 2022 as rates surged, REIT-based completion portfolios meaningfully outperformed a status quo approach.

Global REITs and Listed Real Estate

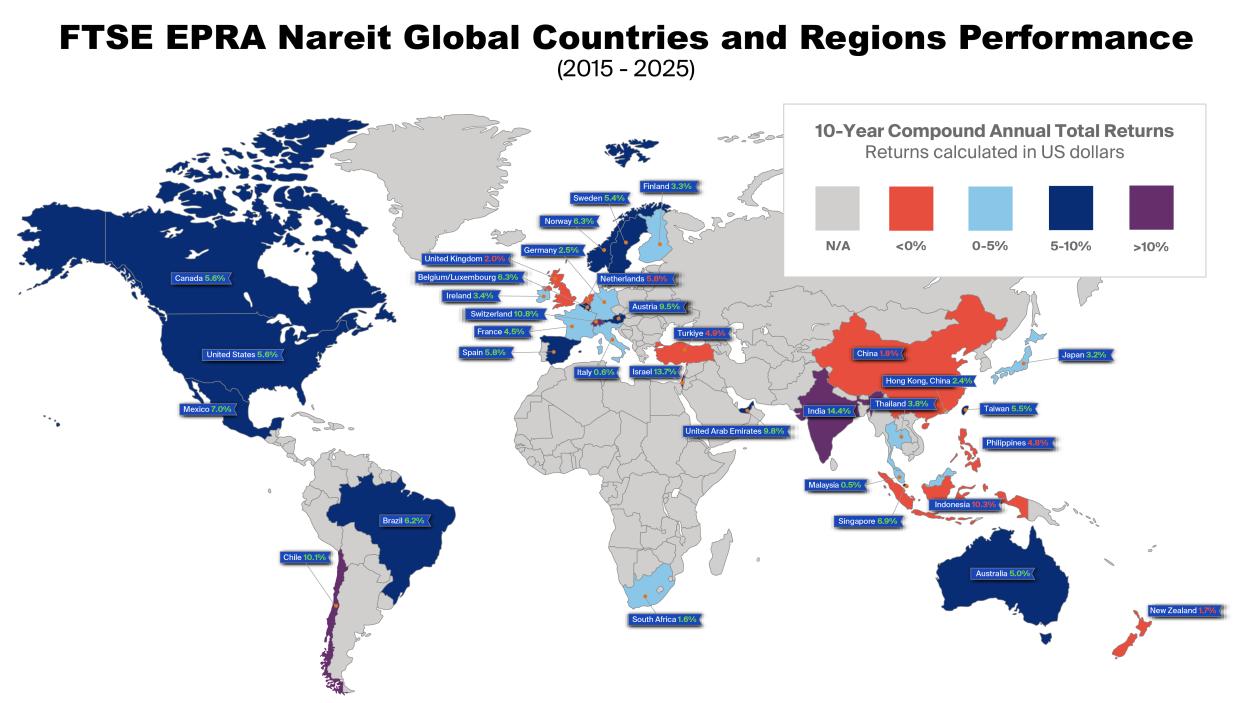

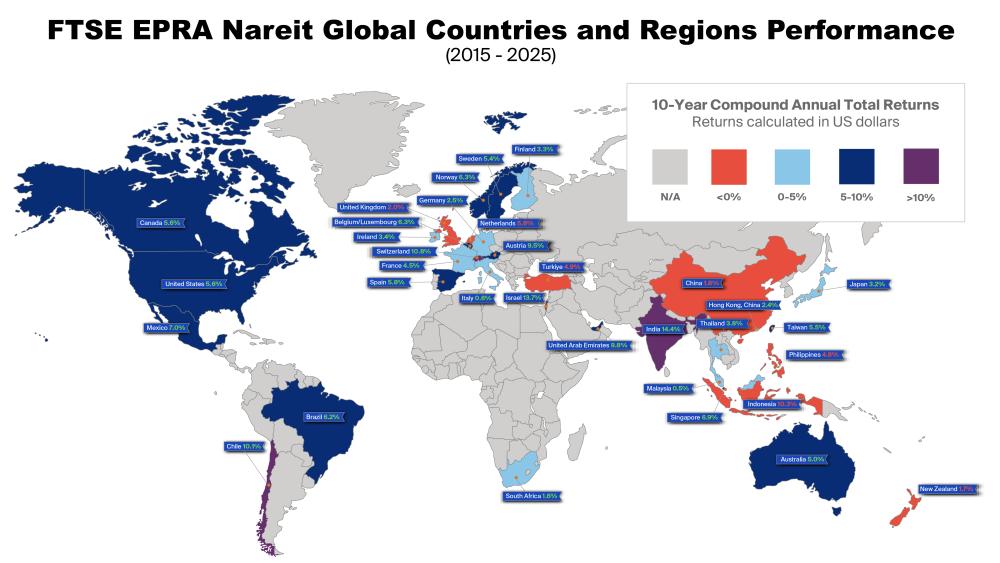

Another frequent question from investors focuses on the added value of global REIT investing compared to a U.S.-only strategy. This is a reasonable question; over the past five- and 10-year periods, U.S. REITs—and the broader North America region of the FTSE EPRA Nareit Developed Index—meaningfully outperformed Europe and Asia. Yet 2025 provided a powerful reminder of the benefits of global diversification. The volatility driven by trade policy uncertainty and sharp dollar declines against global currencies combined to highlight the value of global investing. As of the end of November, the FTSE EPRA Nareit Developed Index returned 10.6% versus the U.S.-only FTSE Nareit All Equity Index at 4.5%. During 2025, the Americas total return (5.5%) significantly lagged Asia (28.0%) and Europe (19.9%).

As shown in the map above, the FTSE EPRA Nareit Global Real Estate Index illustrates the returns of real estate companies in all regions, illustrating how real estate markets perform differently around the world. The outlook provides an in-depth analysis of 2025 performance and the power of global diversification, complemented by a detailed examination of the portfolios of actively managed mutual funds and ETFs specializing in global real estate. That examination provides a unique outlook on the use of global real estate, showing active managers’ allocations by region and sector.

2026 has the potential to generate new opportunities for REITs and their investors.

Looking ahead to 2026, Nareit will continue to meet with investors across the globe, providing research, insights, and practical examples of how REITs can help them navigate uncertainty while offering significant benefits. Whether through valuation convergences, renewed transaction activity, or the expanding role of global listed real estate, 2026 has the potential to generate new opportunities for REITs and their investors.