Institutional Investors Embrace REITs to Drive Performance, Innovation

Key Takeaways

- Institutional investors will continue to use REITs as integral components of their real estate portfolios.

- Institutional investors will keep using REITs to achieve geographic and sector diversification as part of their portfolio completion strategies, which appear to be paying off in higher returns for investors.

- REITs will continue to offer investors tactical investment opportunities because of their liquidity and potential for relative outperformance as valuations stabilize across real estate and broader equities.

- Portfolio modeling shows that using public and private real estate together in a completion strategy has outperformed private real estate alone over the past 5-plus years—even accounting for periods of market volatility.

Institutional Investors’ Growing Use of REITs

Most institutional investors recognize REITs as core real estate investments and are using them in increasingly sophisticated ways. A recent Nareit–Coalition Greenwich study underscored this shift: 88% of respondents said investing in REITs is investing in real estate. The research also showed strong momentum going forward—89% of institutions plan to maintain or increase their REIT allocations over the next three years, including 20% that expect to increase exposure. Today, the largest investors widely rely on REITs as a central part of their real estate strategy.

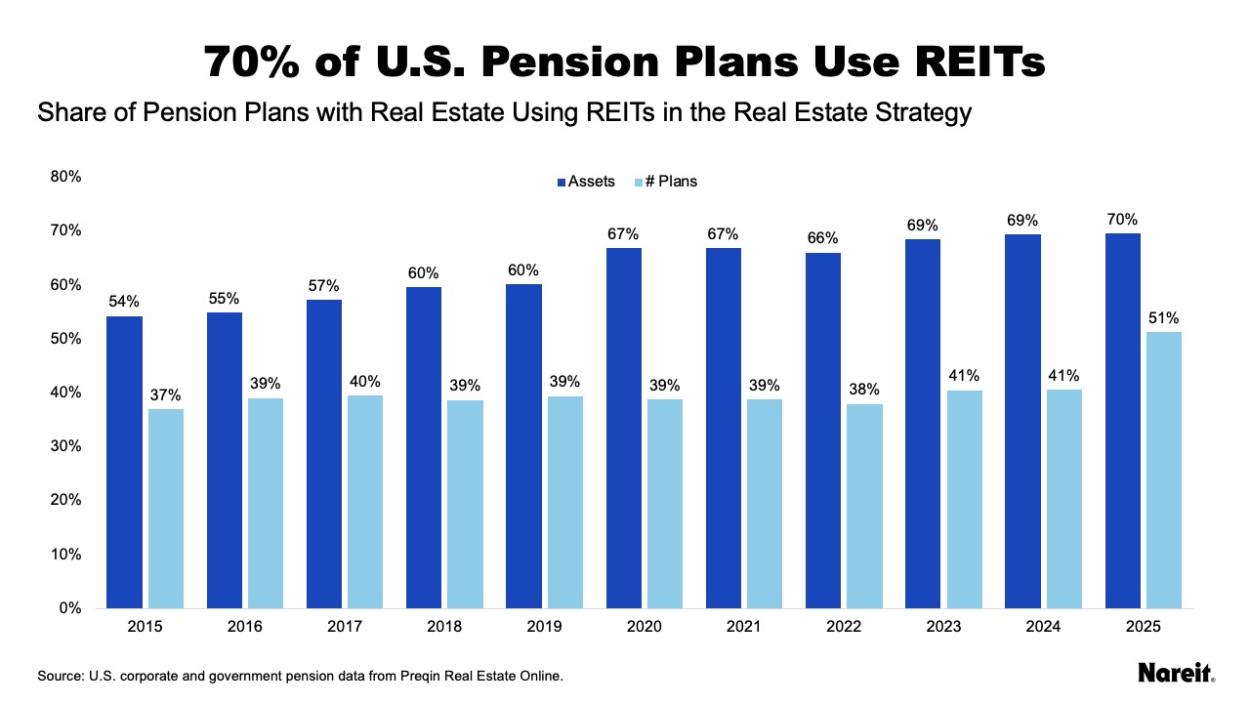

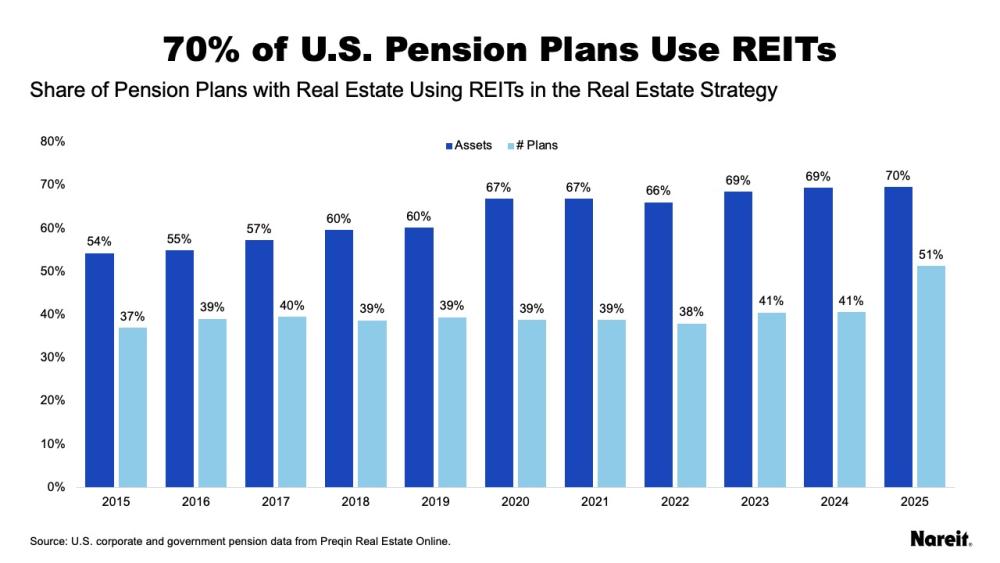

As Nareit research and the chart above illustrate, on an asset-weighted basis, 70% of pensions are using REITs, typically alongside private real estate investments. In addition:

- Larger and more sophisticated pensions are more likely to use REITs.

- More than 75% of pension plans with more than $25 billion in assets use REITs.

The 2025 Hodes Weill Institutional Real Estate Allocations Monitor, based on data from a survey conducted from June 2025 to September 2025, underscored the importance that institutional investors place on using REITs, showing that more than 50% of public pension plans used REITs. The survey shows that investors with $50 billion or more in assets under management not only used REITs more extensively than smaller peers, but they also planned to increase their REIT allocations in 2025.

Nareit Case Studies Showcase Innovative Approaches to Using REITs

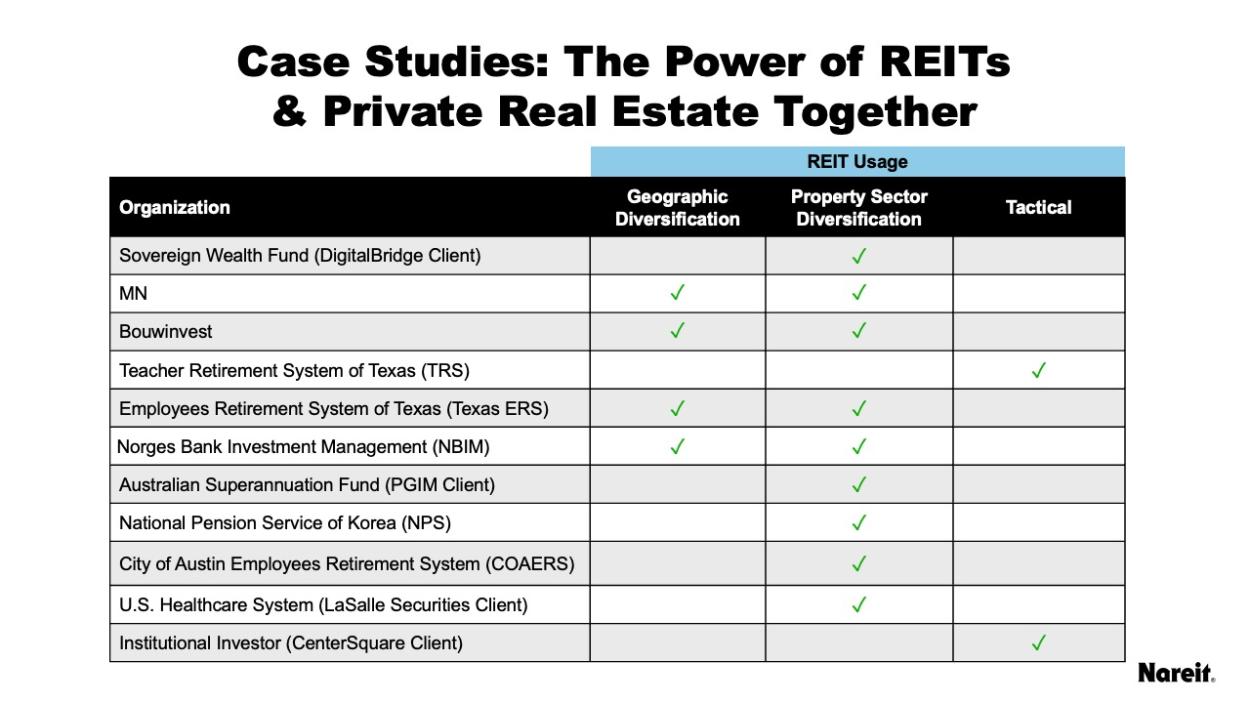

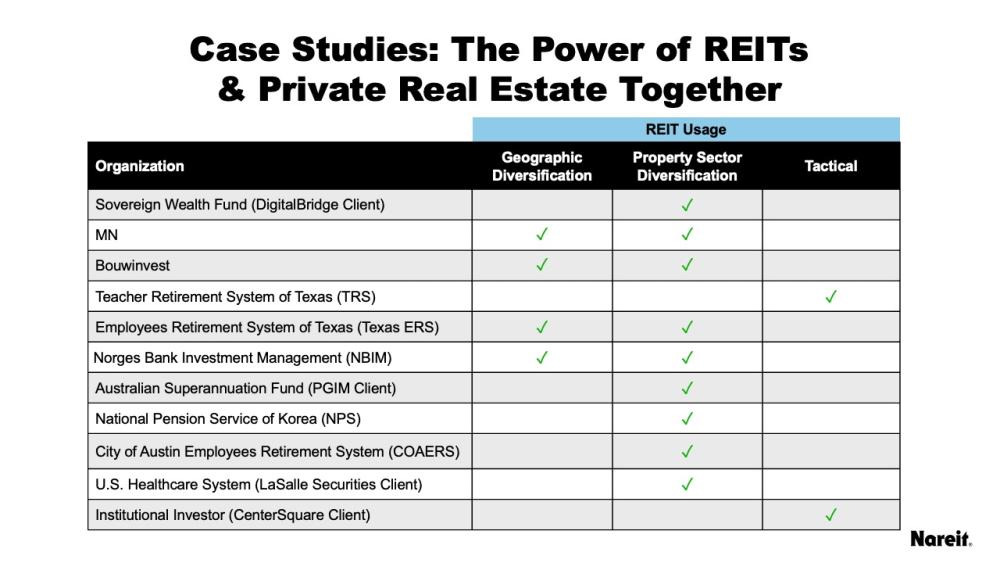

Over the past few years, Nareit has released a series of case studies illustrating how institutional investors have been strategically incorporating REITs into various real estate portfolio objectives, including enhancing sector diversification and driving returns

The chart above summarizes 11 case studies featuring pension plans, institutional investors, and sovereign wealth funds. Notably, Norges is the largest sovereign wealth fund in the world.

During 2025, Nareit published the latest installments in this series—three case studies offering valuable real-world insights for other institutional investors that are considering integrating REITs into their real estate portfolios.

Sovereign Wealth Fund Uses REITs for Diversification, Strategic Alpha

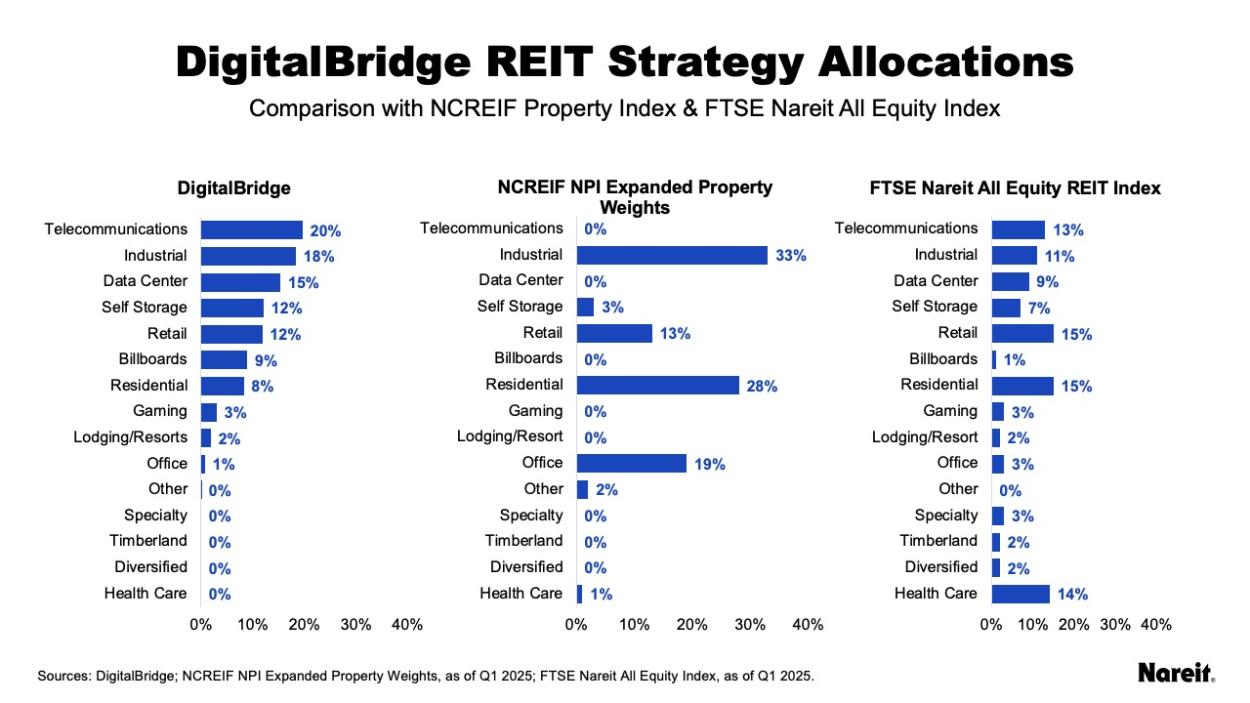

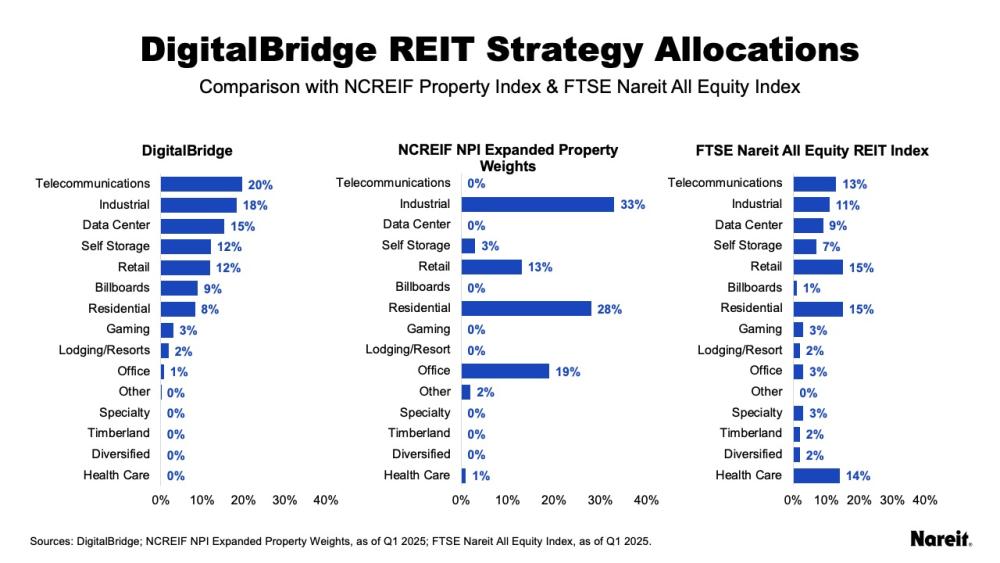

A sovereign wealth fund with substantial private holdings—ranked among the top 10 largest globally—adopted a global REIT mandate with DigitalBridge to gain liquidity, sector diversification, and strategic alpha.

The chart above shows how Digital Bridge used REITs to access key property types—such as cell towers, data centers, and logistics facilities—to achieve sector diversification and long-term portfolio objectives.

To gain strategic alpha, the sovereign wealth fund adopted an active approach with a high-conviction strategy that targeted best-in-class REITs and special situations to enhance returns. This approach is consistent with recent CEM Benchmarking research showing that REIT active management generates positive alpha.

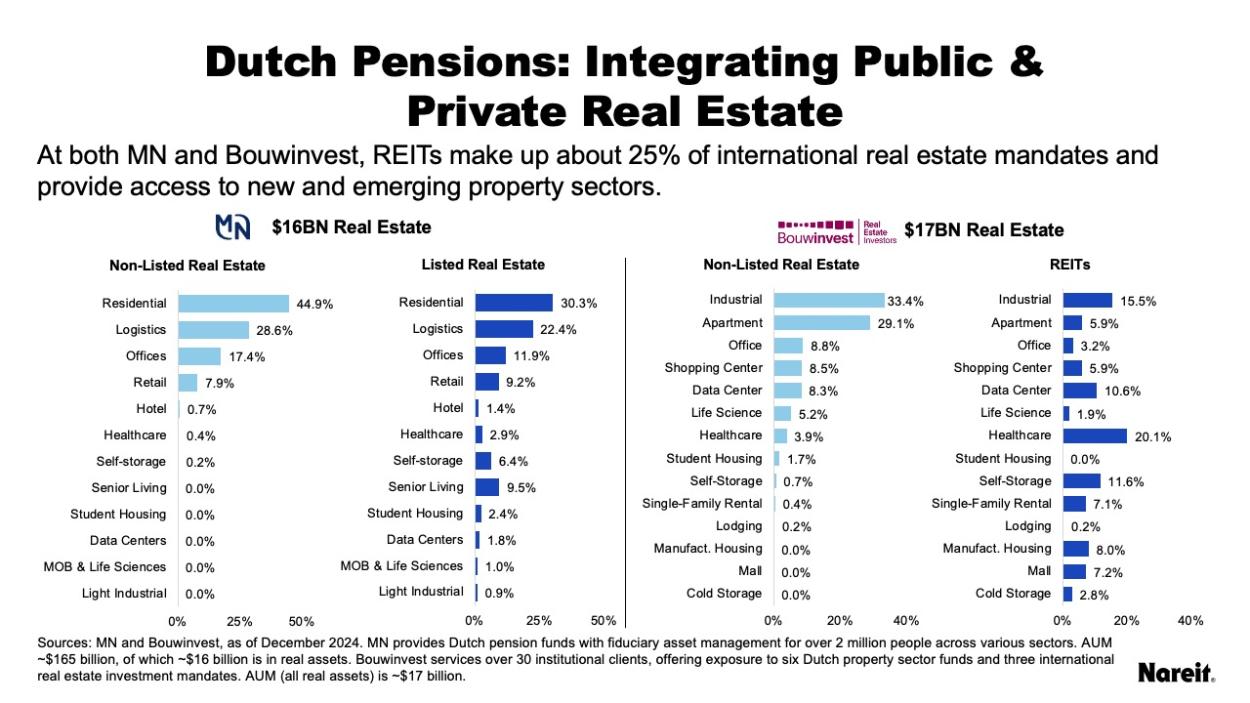

Dutch Pension Plans Exemplify the Power of REITs

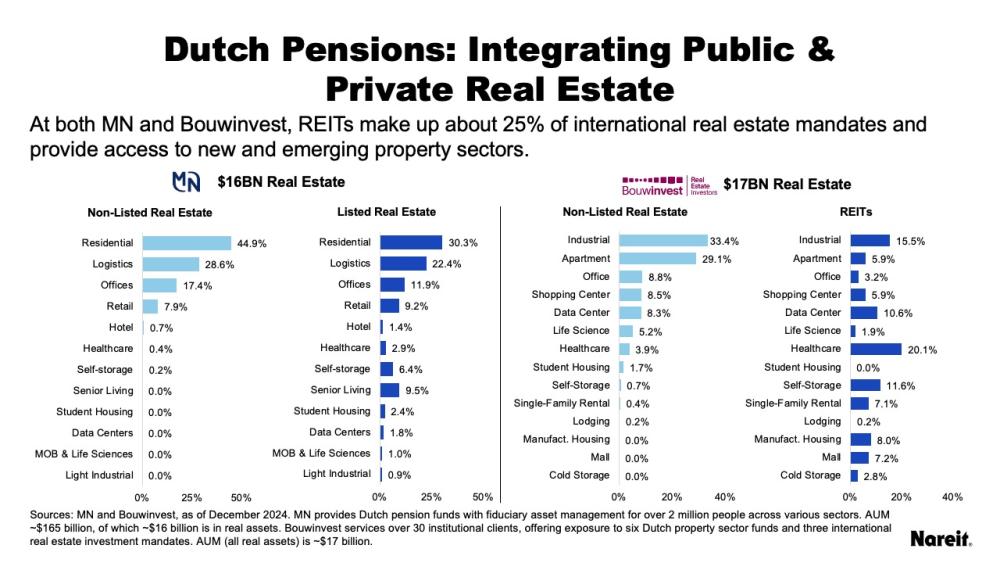

Recognized worldwide as innovative real estate investors, Dutch institutions have long embraced REITs for their global property exposure, efficient capital access, strong governance, and diversification benefits—making them a natural complement to illiquid private holdings. This is exemplified by Dutch fiduciary asset managers MN and Bouwinvest, which integrate listed REITs within their broader institutional real estate and real asset strategies.

The chart above shows how MN and Bouwinvest use listed real estate and REITs to efficiently and cost-effectively gain exposure to modern economic sectors, many of which are difficult to access through private real estate. Two main themes emerge from their approaches:

- MN’s strategy emphasizes core mandates in developed markets with low leverage, stable income, and strong sustainability standards. Listed real estate allocations are roughly 25% for clients that have listed real estate in their portfolios, providing flexibility, diversification, and access to sectors such as logistics, residential, and senior living.

- Bouwinvest follows a similar philosophy, integrating listed and private allocations across Europe, North America, and Asia-Pacific to optimize portfolio balance and gain exposure to modern economy sectors—like data centers, self-storage, and single-family rental—that are harder to reach privately.

Notably, both firms view REITs and private real estate as fundamentally the same asset class, differentiated by liquidity and access. PREA Quarterly offers an in-depth examination of both asset managers’ approaches to using public and private real estate together and how using REITs enhances liquidity, responsiveness, and diversification.

Incorporating REITs in a Completion Strategy Generated Outperformance

Many of the case studies that Nareit has published—including studies from the City of Austin Employees' Retirement System (COAERS) and LaSalle Securities—focus on how pension funds and investors implement completion strategies.

Nareit meets with hundreds of investors each year in countries around the world, and many have asked how a recent completion strategy would have performed over the past several years in light of the pandemic and the sharp rise in interest rates.

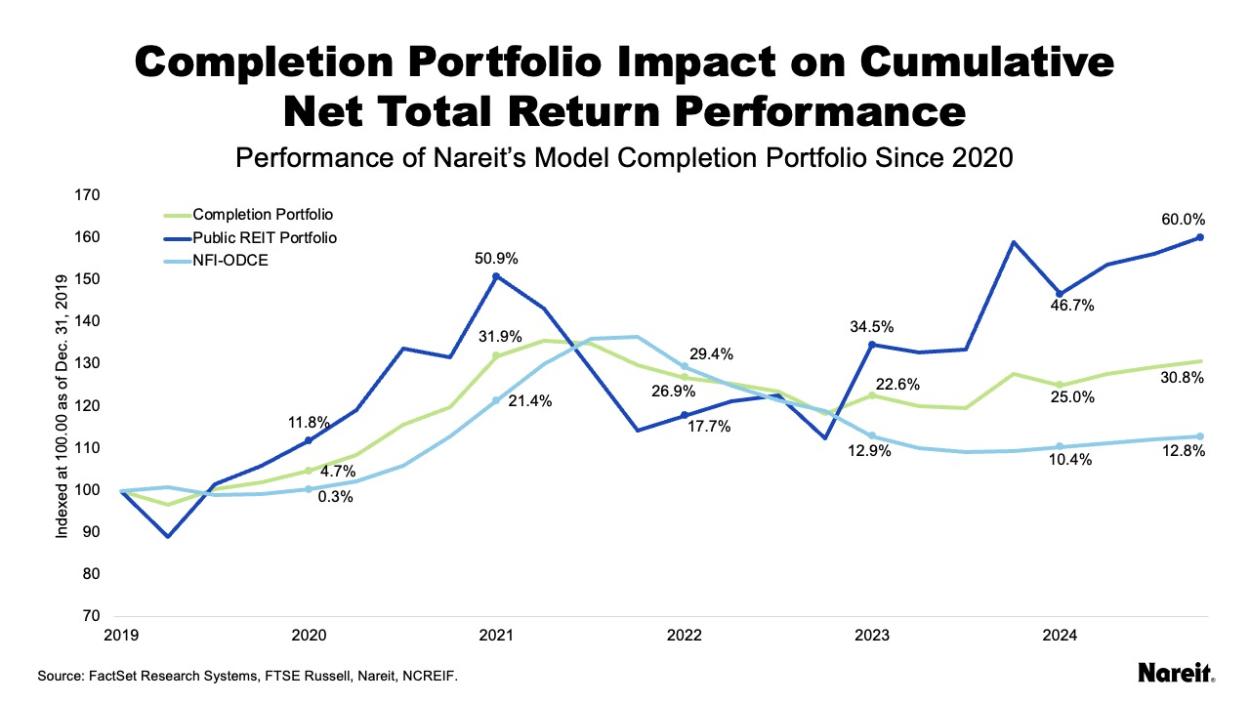

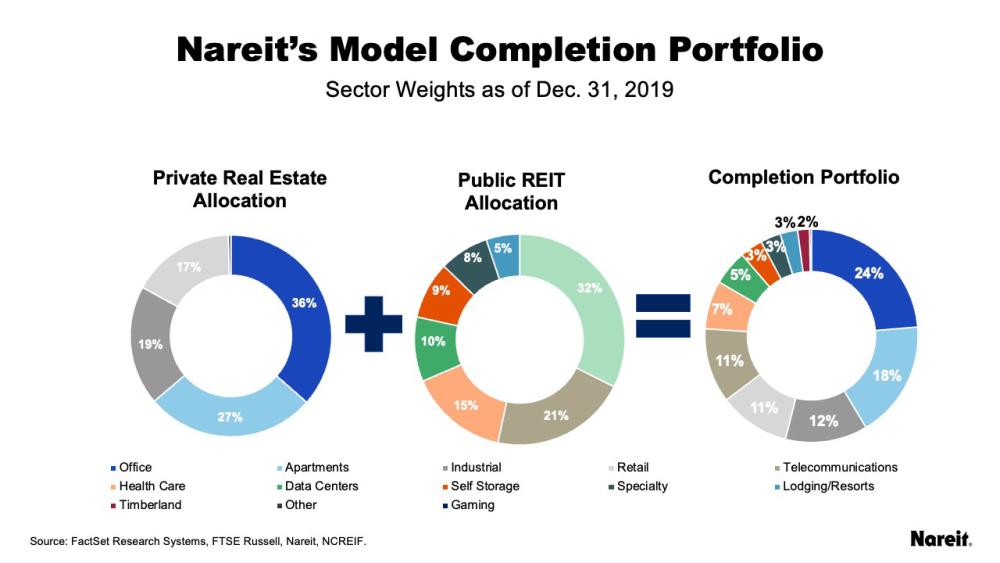

To address this question, Nareit created a simple hypothetical example of a completion portfolio and examined total return performance from 2020 through the second quarter of 2025. This example provides a useful way to explore how a completion strategy may have performed during a period of meaningful market disruption. Obviously real-world performance is influenced by a range of complex factors that may not be fully captured in a model portfolio.

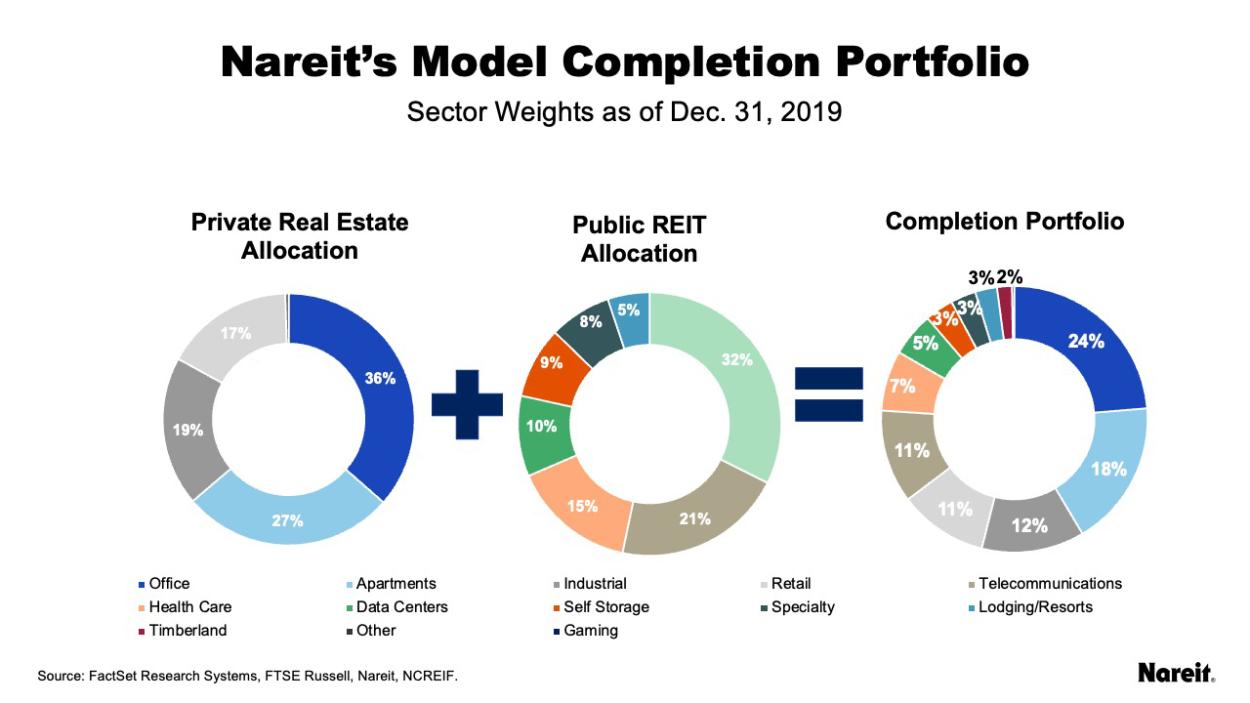

The model completion portfolio mirrored the approach used by many pension plans, with a portfolio split of 65% private real estate and 35% REITs. Private real estate returns were based on the NFI-ODCE total returns net of fees. REIT total returns reflected the eight new and emerging sectors in the FTSE Nareit All Equity REITs Index; the REIT portfolio excludes the office, industrial, residential, retail, and diversified sectors that dominate the private portfolio. Consistent with the findings in the CEM Benchmarking study, REITs were assessed an investment management fee of 12.5 basis points per quarter. The analysis tracks the net of fee quarterly performance for the NFI-ODCE, REIT modern economy, and completion portfolios from the first quarter of 2020 through the second quarter of 2025.

The pie charts illustrate the weights of the private real estate mix, the modern economy REIT sectors added for broader diversification, and the combined completion portfolio. In the REIT allocation, telecommunications, health care, and data centers make up the largest sector weights.

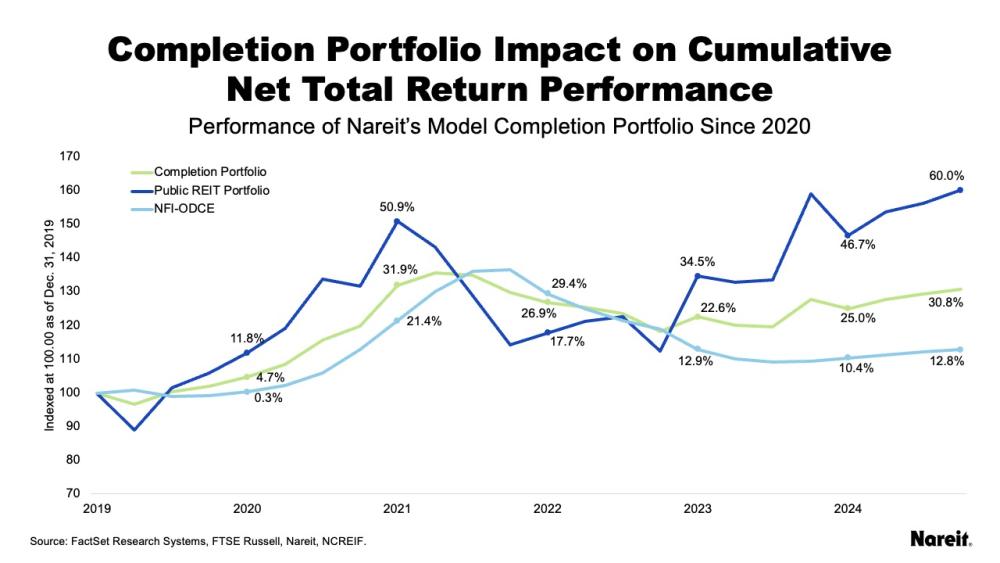

As the chart above shows, the model completion portfolio outperformed the NFI-ODCE portfolio on a cumulative net total return basis in five of the six examined periods. From the fourth quarter of 2019 through the third quarter of 2025, the private real estate, REIT, and model completion portfolios had cumulative net total returns of 12.8%, 60.0%, and 30.8%, respectively. These translate into compound annualized total returns of 2.1% for the private real estate portfolio, 8.5% for the REIT portfolio, and 4.8% for the completion portfolio. Notably, the model completion portfolio outperformed the private real estate portfolio by 2.7% on a net of fee annualized basis. This demonstrates that even during a period of meaningful market disruption and volatility, using REITs with private real estate would have resulted in higher returns.

Institutional Investors Will Likely Lean More on REITs

Institutional investors increasingly view REITs as essential tools for achieving efficient exposure to high-quality real estate, accessing emerging sectors, and enhancing geographic diversification. Real world and hypothetical case studies show that combining private real estate with REITs enhances liquidity, improves portfolio flexibility, provides access to specialized operating platforms at scale—and can deliver higher returns than private real estate alone.

Nareit expects the role of REITs to likely continue expanding as investors deploy them in more advanced and targeted strategies

Given these findings, Nareit expects the role of REITs to likely continue expanding as investors deploy them in more advanced and targeted strategies—leveraging listed real estate’s scale, transparency, and operational excellence to strengthen portfolio performance across both traditional and modern property sectors.