Editor’s note: This is a guest market commentary written for Nareit by David Stafford of the City of Austin Employees' Retirement System (COAERS) investment team. Stafford also recently sat down for an interview with Nareit’s REIT Report podcast.

During a 2019 strategic review of the structure and implementation of the retirement system’s real estate exposure, the City of Austin Employees' Retirement System (COAERS) investment team noted that its real estate allocation could be improved dramatically by adding a portfolio completion strategy of REITs, which was historically implemented solely through an open-ended, core, private markets fund system. The team determined that the strategy could provide additional benefits to the total fund.

One of the guiding investment beliefs adopted by the COAERS board states that implementation of the strategic asset allocation should occur passively and in public markets, unless a high likelihood of success could be expected from other approaches. As a result of the strategic review, the board adopted changes to the implementation of real estate, including splitting exposure between the existing core, private markets fund and adding a passive completion index of REITs.

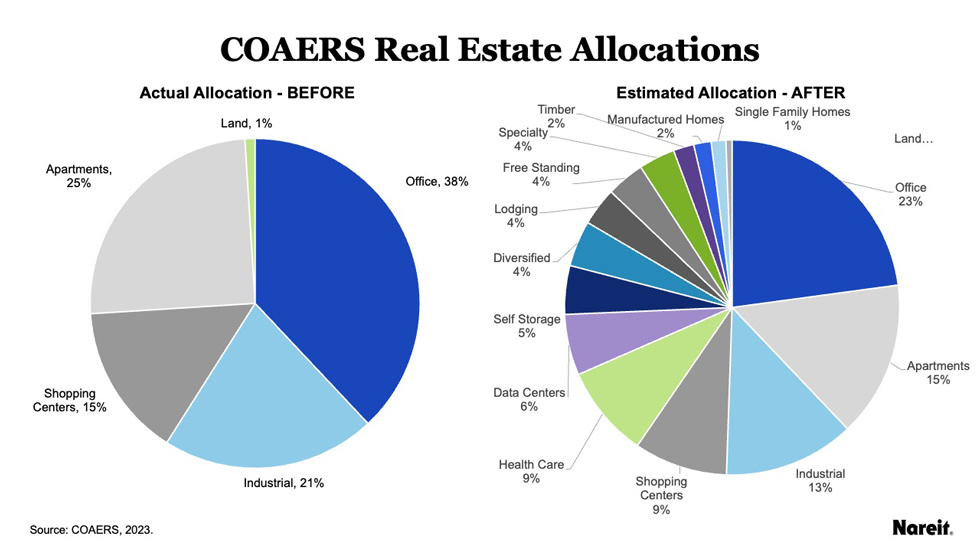

Given that COAERS’s core real estate exposures to office, industrial, multi-family, and retail were well implemented in private markets, the board worked with FTSE Nareit to create a completion index of REIT sectors that the system didn’t have exposure to. The expected benefits of this approach included increased diversification across property types, lower costs, better liquidity, and higher performance over time.

Promoting this Decision to Market

Another key component of the investment process at COAERS includes ongoing review of strategic decisions for continued appropriateness. In reviewing the completion strategy decision, a variety of benefits to the fund become clear, as anticipated, after what has been a very eventful three years:

- Liquidity: In implementing a completion index of publicly traded REITs, COAERS has maintained a source of liquidity for rebalancing across asset and sub-asset classes. Unlike many open-ended, private market strategies in real estate which have gated redemptions over the prior year, this completion index maintains daily liquidity with low transaction costs.

- Diversification: Prior to implementation of this strategy, COAERS had significant exposures to office, multi-family, industrial, and retail. In adding a completion index, the types of strategies that COAERS had exposure to increased significantly. These property types include data centers, among others, which are likely to see increased use and structural demand over the coming years.

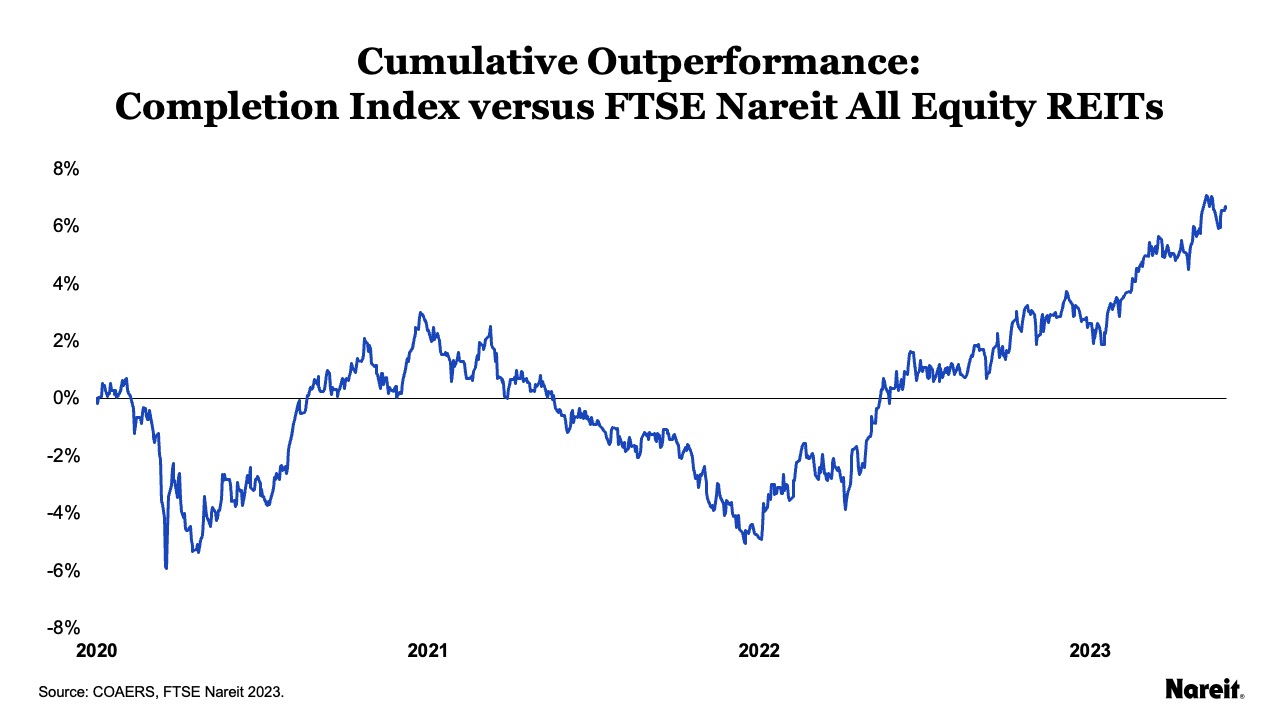

- Outperformance: This increased diversification was extremely timely because many of these property types, particularly office and retail, have struggled significantly since 2019 as underlying demand presents a significant headwind to these properties. Since inception, this outperformance has contributed 6.7% of cumulative outperformance, which equates to 2.7% of excess returns on an annualized basis relative to the broad FTSE Nareit All Equity REITs Index.

In conclusion, COAERS continues to view REITs as an interesting and effective investment exposure in an institutional portfolio context as it evaluates the changing market dynamics in real estate and across the fund more broadly.

Read additional portfolio completion case studies