With contribution from Chris Battista, LaSalle

As the economy evolves, so too does the real estate that houses the economy. One of the dominant themes among institutional real estate investors of the past few years has been the shift toward “alternative” property types. These “alternative” or “niche” property types, ranging from cell towers and data centers to health care and self storage, are hardly alternative or niche in REIT markets. REITs have been on the forefront of bringing new and emerging property sectors into the institutional real estate space. In fact, today, the share of the FTSE Nareit All Equity REIT index outside of the core four property types (office, retail, residential, industrial) is over 60%.

Because REITs offer access and expertise in new and emerging property sectors, institutional investors are increasingly considering REITs as part of a completion portfolio strategy, as discussed in the Winter 2023 issue of PREA Quarterly and the March 2023 issue of Investing in REITs.

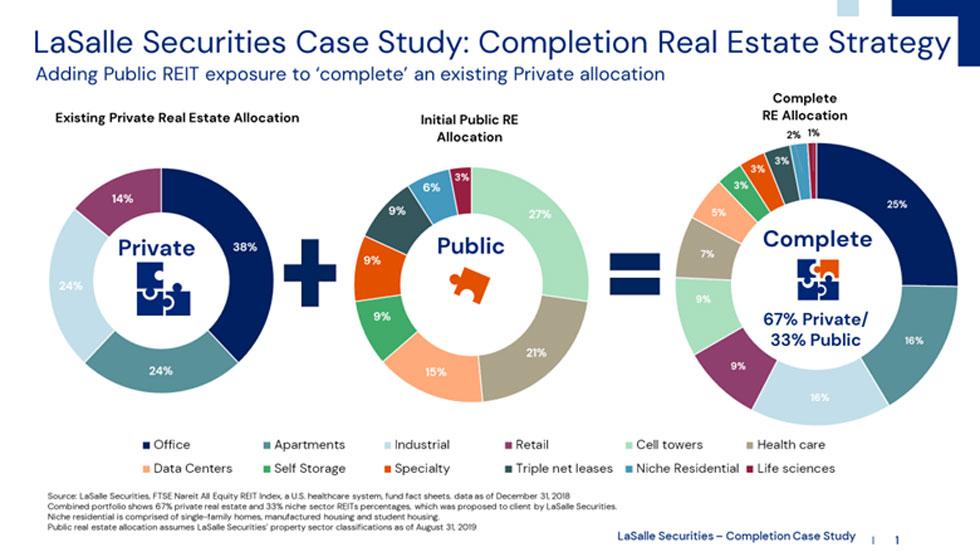

A LaSalle Securities case study provides an illustration of how integrating REITs into an existing real estate portfolio can dramatically change the sector composition of the portfolio. The client is a U.S. health care system in the Northeast, which has total assets ranging from $4-5 billion and a real assets allocation (including real estate) of 3.0-5.5%.

LaSalle Securities’ client was invested in several private real estate funds with heavy retail and office exposure. The client expressed concern to LaSalle Securities about the performance of the funds, as well as the lack of exposure to the new economy or niche property types. The LaSalle Securities team collaborated with the client to map the allocation of their existing real estate portfolio, identify the gaps, and then create a custom universe of REITs that addressed those gaps. The LaSalle Securities team then used this custom universe to “complete” the client’s portfolio.

The pie graphs above detail how LaSalle Securities proposed to reconfigure their client’s existing real estate allocation to better align with today’s real estate universe. As shown on the leftmost pie in the graphic, the existing private allocation was 100% allocated to core-four property sectors, with the largest allocation being office at 38%. LaSalle Securities constructed a completion portfolio (shown in the center pie) comprised of REITs focused on cell towers, health care, data centers, self-storage, triple-net lease, non-apartment residential, life sciences, and other sectors. The proposed real estate portfolio (shown in the right-hand pie) provided a more complete exposure to real estate that houses the modern economy.

This case study shows how LaSalle mapped the look-through exposure of the client’s private funds and successfully designed a REIT allocation which was ultimately used to “complete” the client’s real estate portfolio.

Read additional portfolio completion case studies