Editor’s note: This is a guest market commentary written for Nareit by Scott Crowe, president and chief investment strategist at CenterSquare Investment Management.

Throughout 2022 and 2023, the public and private real estate markets have been a tale of two cities. While the public market has rapidly priced in the impact of rising interest rates on valuations, private markets have been much slower to react, creating a meaningful valuation disconnect between public and private real estate. During this time, astute real estate investors have tactically capitalized on this dislocation, gaining access to the same quality real estate, at discounted valuations.

At CenterSquare, we recognized this opportunity and worked closely with our clients to take advantage of this specific valuation dislocation. One such institutional client with more than $300 billion in assets was under allocated to the residential property type across their real estate portfolio. By adding a residential REIT sleeve into their overall real estate allocation, we were able to provide access to undervalued assets, while simultaneously and rapidly addressing their residential under allocation.

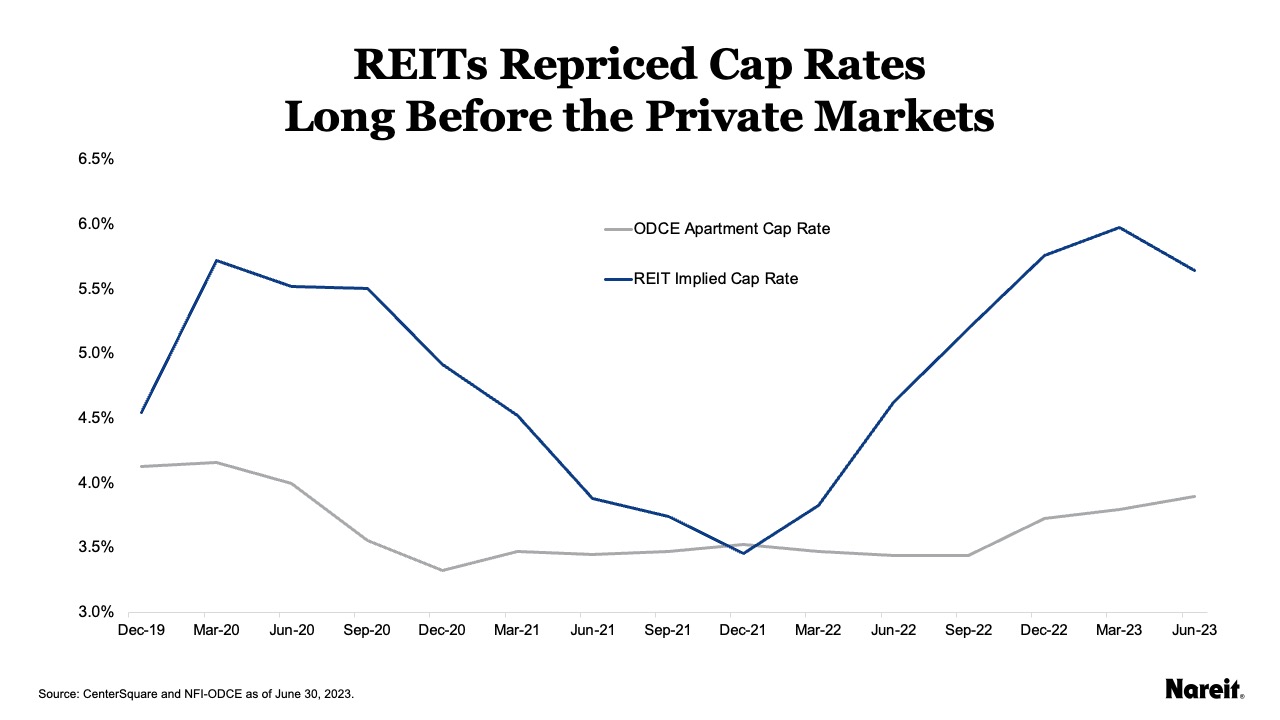

As shown above, REIT cap rates adjusted to changes in interest rates well ahead of the private market. We executed the REIT strategy for our client in mid-2022, when the 10-year Treasury was yielding more than 3.1% and appraisal cap rates for the apartment sector in ODCE funds were still at 3.4%. Meanwhile, REITs in the public market were already beginning to reprice and were trading at a 4.6% implied cap rate. At this higher cap rate, this investor was able to get access to high-quality residential portfolios with best-in-class operating platforms with seasoned industry veterans at the helm.

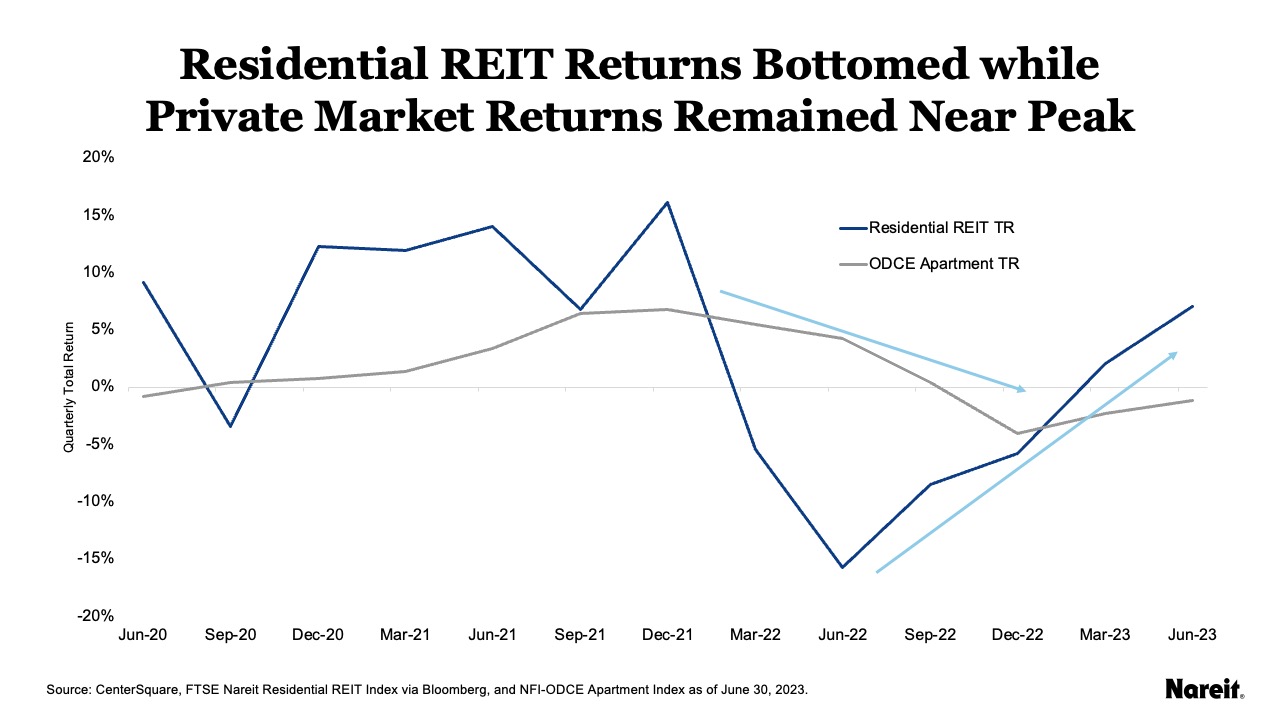

The rapid repricing in the public markets followed by a lagging repricing in the private markets is not a novel pattern. We have seen this phenomenon play out repeatedly in the past. In fact, we find repeatedly that the public market returns tend to bottom at the same time that private market returns remain at or near their peak as shown in the above chart. We anticipated that this phenomenon will play out once again, creating a compelling case for this investor to invest their incremental dollar in the residential sector through the listed REIT market.

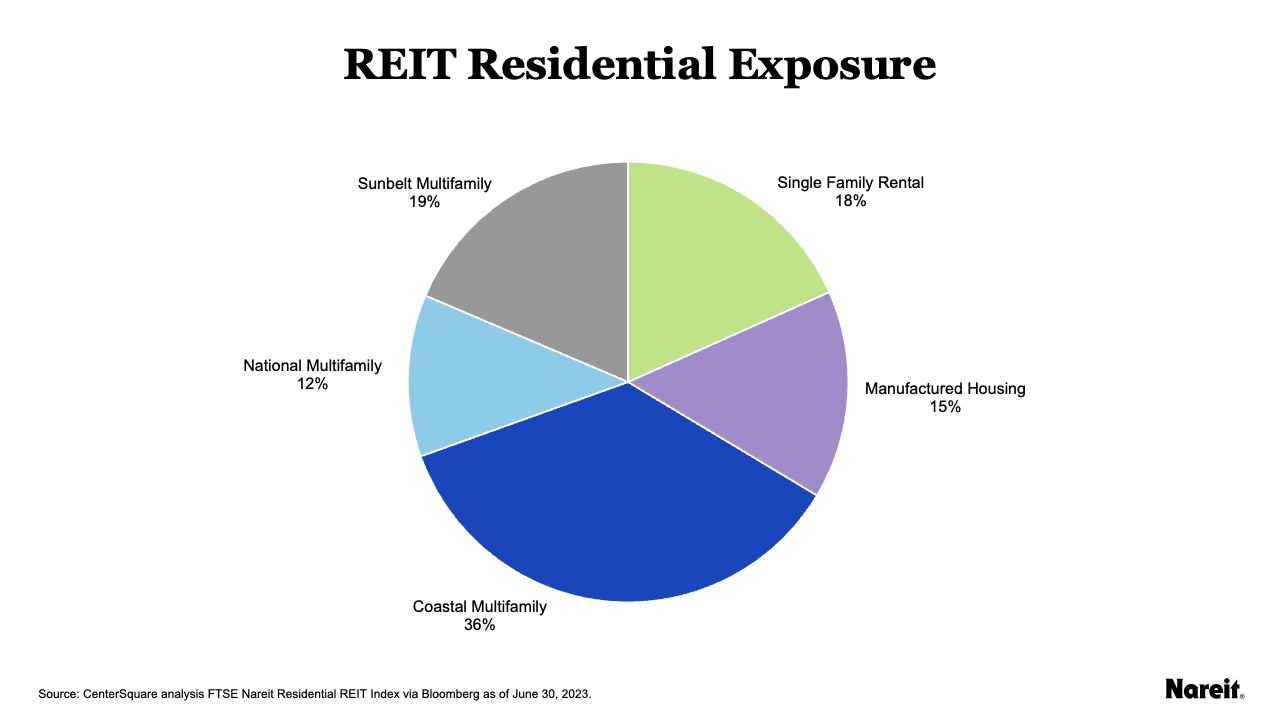

Moreover, investing in residential REITs in the public market allowed this investor to gain exposure not only to the multifamily product type across different markets, but also to single-family rentals and manufactured housing. The ability to allocate capital across these various residential sub-sectors also allowed us to shift the portfolio exposures between these property types as we saw fundamentals shifting. While multifamily benefitted from historic levels of growth in 2022, concerns about oversupply, especially in sunbelt markets, in tandem with a slowing labor market, made us incrementally more cautious on sunbelt multifamily properties. Against this backdrop, we were able to shift the residential REIT sleeve to have greater exposure across coastal multifamily and single-family rentals, a sector where the aging millennial cohort is driving outsized demand, while an undersupply of new single-family housing is creating a secular tailwind for the property type.

Being able to strategically access the REIT market allowed this investor to tactically take advantage of favorable pricing. Using REITs also enabled us to leverage the liquidity in public markets to quickly shift the property type allocation and nimbly manage not just their total real estate exposure, but also their allocation across property types as fundamentals were changing. At CenterSquare, we firmly believe these opportunities will continue to be prevalent for our REIT clients with whom we work closely to identify and take advantage of an ever-changing real estate investment landscape.

The statements and conclusions made in this article are not guarantees and are merely the opinion of CenterSquare and its employees. Any statements and opinions expressed are as of the date of this article and are subject to change as economic and market conditions dictate. Material in this article is for general information and is not intended to provide specific advice or recommendations for any purchase or sale of any specific security or commodity.

Read additional portfolio completion case studies