Listed real estate offers institutional investors access to many of the world’s largest and highest quality real estate businesses. REITs and listed real estate companies are global leaders with essential platforms, available only in the public markets, offering investors exposure to irreplaceable assets, long-term growth drivers, and significantly lower leverage than private markets. Such best-in-class real estate businesses deliver attractive unit economics and can provide strong long-term returns, underpinned by significant barriers to competition.

At the same time, passive capital, yield-chasing behaviour, and institutional fund flows contribute to market inefficiencies in the listed real estate markets. Opportunities to drive outperformance are available to investors who can underwrite complex or special situations where quality assets are priced at attractive discounts. Similarly, the liquidity of public markets allows sector experts to capitalize on volatility, seizing opportunities when high-quality stocks overreact to short-term news or broader selloffs.

A strategy that combines exposure to best-in-class REITs with opportunistic special situation investments can drive meaningful outperformance and attractive long-term returns.

A Strategic Mandate with a Top-Tier Sovereign Wealth Fund

In 2016, one of the world’s largest sovereign wealth funds—ranked among the top ten largest globally—hired the DigitalBridge Liquid Strategies team to establish a dedicated allocation to listed real estate as part of its broader real assets strategy. The objective was to complement its substantial private real estate holdings with a listed strategy that could provide differentiated exposures, dynamic capital allocation, and access to companies with structurally complex business models that are difficult to replicate privately.

The portfolio is managed with a concentrated, high-conviction approach, targeting U.S. and European real estate companies.

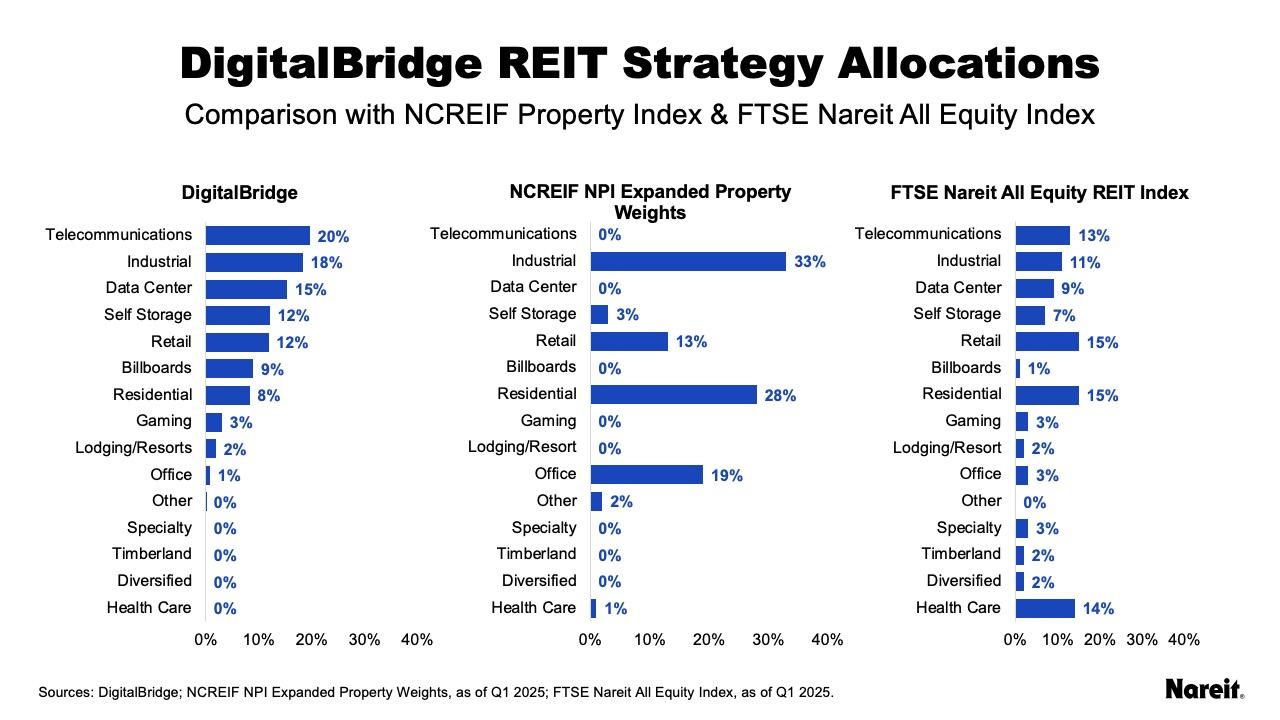

As the chart above shows, with a subsector-agnostic mandate, DigitalBridge pursued opportunities beyond traditional commercial real estate sectors, targeting specialized “modern economy” operating platforms.

Through its mandate with DigitalBridge, the fund sought to implement an actively managed, research-driven strategy designed to take advantage of mispricings, special situations, and market inefficiencies—while remaining aligned with long-term investment goals.

The resultant portfolio enabled access to key property types—such as towers, data infrastructure, and logistics—that supported diversification and long-term portfolio objectives.

A Complement to Private Market Exposure

This case illustrates how listed real estate can act as a strategic complement to private allocations—enhancing liquidity, broadening sector reach, and allowing for more timely and opportunistic portfolio adjustments. Listed real estate also offers a platform to strategically and opportunistically act on views around capital structure, governance, and event-driven catalysts—factors typically inaccessible in private markets.

By integrating a listed real estate strategy alongside private holdings, the sovereign wealth fund was able to enhance returns and diversify its exposures. The listed allocation supported the sovereign wealth fund’s goals of identifying and investing in high quality businesses at discounts to fundamental value and achieving attractive risk-adjusted returns over time.

The information contained herein is provided for general information and is not intended to be a recommendation to invest in any specific security nor is it an offer to sell nor a solicitation of an offer to buy any securities. This article reflects the opinions of the DigitalBridge Liquid Strategies team only as of the date indicated and will not be updated to reflect any changes in such opinions or the data provided. Past performance is no guarantee of any future performance and all securities investing involves the risk of loss. This document contains statistics and other data that has been obtained from or compiled from information available by third-party service providers. We have not independently verified such statistics or data. Neither DigitalBridge Group, Inc. nor any affiliate thereof shall have any liability, contingent or otherwise or any responsibility whatsoever, for the correctness, quality, or completeness of the information provided herein and nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance of DigitalBridge Group, Inc., or any affiliate thereof.