As published in PREA Quarterly, Summer 2025

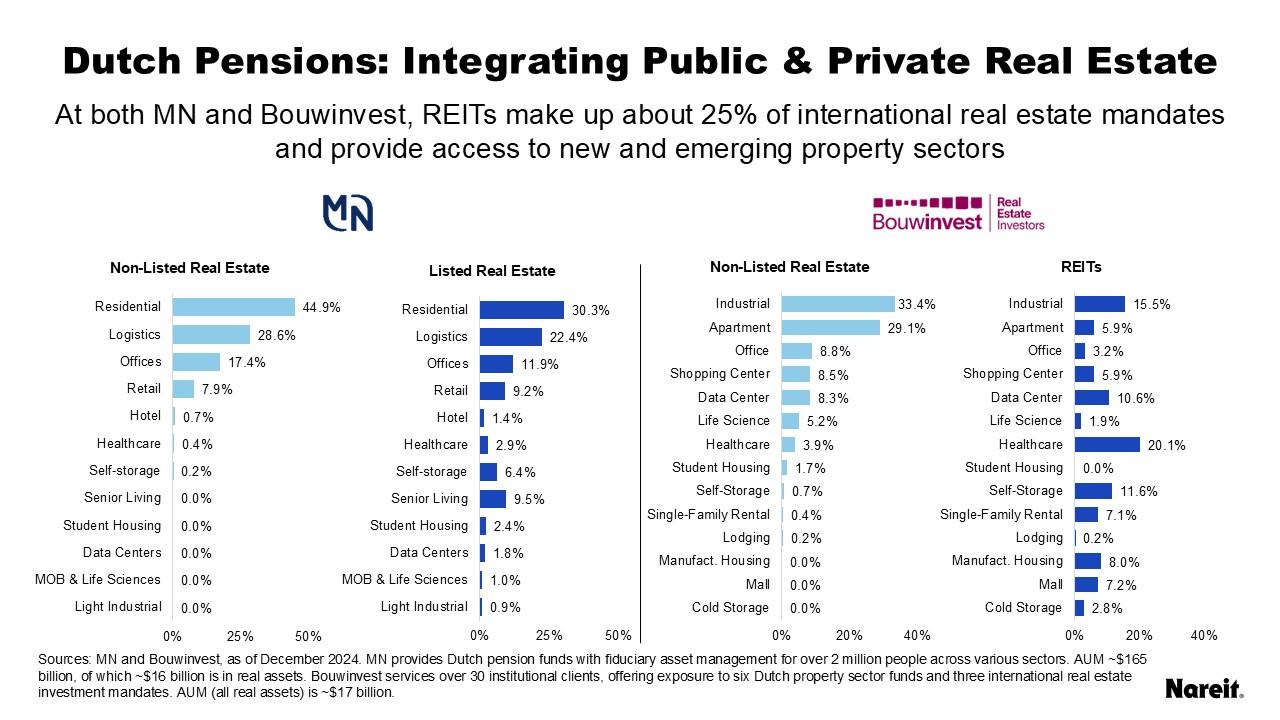

Dutch pension fiduciary asset managers MN and Bouwinvest have embraced the use of listed real estate within their investment portfolios and both have made strategic, long-term allocations to REITs within their broader real estate/real assets frameworks.

MN has been managing listed real estate products and portfolios since the 1990s, investing the pensions of approximately two million people from various sectors, including the metalworking, electrical engineering, and maritime industries. Over the past few years, listed real estate has evolved from a component of the equities asset class to a vital part of the real assets cluster.

Bouwinvest manages real estate investments for more than 30 institutional clients in the Netherlands, including bpfBOUW, the Dutch construction workers’ pension fund. Realizing that ignoring listed REITs would hamper its ability to create an optimal, well-diversified portfolio, Bouwinvest incorporated listed real estate as an integral part of its real estate strategy.

To read the full story visit PREA QUARTERLY (pdf).