The diversification benefits of exchange-traded REITs are built on a long track record combining strong total returns, moderate volatilities, strong returns on a risk-adjusted basis, and low correlations with non-REIT stocks and other assets. Any of those benefits may weaken temporarily, but over the 44+ years that data are available we’ve seen the diversification benefits of listed REITs rebound again and again, and again.

So it is with the early part of 2016. In early February jittery investors wondering about macroeconomic strength and interest-rate policies sent returns down and volatilities up—not very much, but enough to make some wonder whether the diversification benefits of listed REITs had weakened.

If you haven’t been paying attention over the last three months, though, you’ve been missing some really great news, especially for investors in stock exchange-traded equity REITs:

- Returns are up

- Volatilities are down

- REIT-stock correlations are down

- REIT beta is down

In short, early 2016 has provided a good lesson in the resilience of the diversification value of having listed equity REITs in your portfolio.

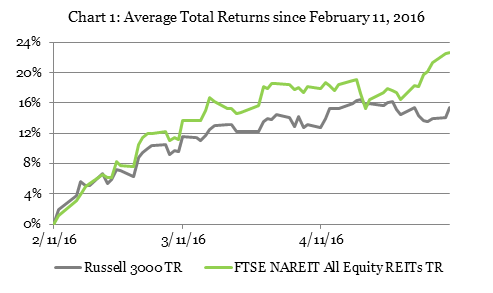

Returns on equity investments, including real estate investments through exchange-traded equity REITs, hit a short-term low three months ago on February 11, 2016. Over the three months from then through May 11, total returns in the broad stock market have been up 15.5%, as Chart 1 shows—but total returns for exchange-traded equity REITs have increased 22.6%, meaning that listed equity REIT investors have done nearly half-again as well as investors in non-REIT stocks. (Exchange-traded equity REIT returns have beaten the broad stock market on 36 of the 61 trading days during that period.)

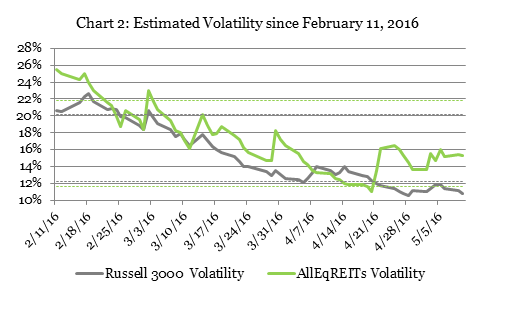

At the same time, volatility has declined sharply for both exchange-traded equity REITs and non-REIT stocks: by 9.8 percentage points (from 20.6% to 10.8%) for a diversified portfolio representing the broad U.S. stock market, and by 10.2 percentage points (from 25.5% to 15.3%) for a smaller but still diversified portfolio of listed U.S. equity REITs. In fact, as you can see by comparing Chart 2 with Chart 1, the more recent increase in REIT volatility—from an abnormally low 11.0% on April 20—has reflected primarily the fact that returns for exchange-traded equity REITs have been much stronger than returns for the rest of the stock market over that period, with total returns for listed equity REITs having averaged 0.48% per day compared to -0.02% per day for the broad stock market. That’s the kind of “volatility” investors can live with! (The dotted lines show the range that has encompassed the middle half of estimated volatilities since daily data became available at the beginning of 1999.)

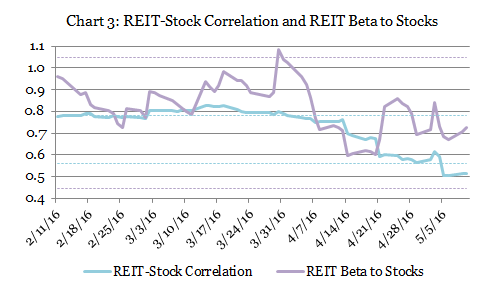

Finally, as Chart 3 shows, after increasing slightly from 77.6% to 82.7% from February 11 through March 14, the estimated correlation between exchange-traded equity REITs and the broad stock market has declined more recently to a just 51.1%, abnormally low by historical standards. Beta for listed equity REITs relative to the broad stock market has likewise declined: after increasing from 0.96 on February 11 to a recent high of 1.09 on March 30, it declined sharply to just 0.60 before rebounding to its most recent value of 0.73. The increase in REIT beta since April 20, like the increase in REIT volatility over the same period, primarily reflects the strong returns for exchange-traded equity REITs over those three weeks. (Again, the dotted lines show the middle-range of estimates of correlation or beta since the beginning of 1999.)

The low beta for exchange-traded equity REITs relative to the broad stock market index means that stock investors gain diversification benefits from adding exchange-traded equity REITs to their portfolio. Put another way, adding an asset to an existing portfolio provides diversification benefits if the risk-adjusted returns of the new asset are greater than the product of the risk-adjusted returns of the existing portfolio multiplied by the correlation between the new asset and the existing portfolio. That means that the combination of strong total returns (especially for listed equity REITs), low volatility, and low correlation has provided particularly strong diversification benefits over the last three months for investors whose portfolios included substantial holdings of exchange-traded equity REITs.

Technical notes: volatilities and correlations are estimated using daily returns and a Dynamic Conditional Correlation model with Generalized Autoregressive Conditional Heteroskedasticity (DCC-GARCH), which has been shown to provide better estimates of volatilities and correlations than commonly used simple methods such as rolling volatilities and rolling correlations. Total returns for the broad U.S. stock market are measured by the Russell 3000 Stock Index, while total returns for exchange-traded U.S. equity REITs are measured by the FTSE NAREIT All Equity REIT Index.