REITs, High-Yield Bonds, Preferred Stocks Increased Income

As defined contribution plans, such as 401-k plans, have become increasingly popular, plan participants are faced with the challenge of managing their own assets before and during retirement. One of the key challenges for individuals in retirement is generating sufficient income while minimizing the risk of depleting their assets.

The global financial crisis underscored the reality that global market turbulence can have lasting effects on an individual’s retirement plans. The aftermath of the financial crisis, which ushered in a period of slow economic growth and historically low bond yields, has increased the challenge of generating income while in retirement and, at the same time, limiting portfolio risk to preserve asset value.

The Challenge of Generating Income

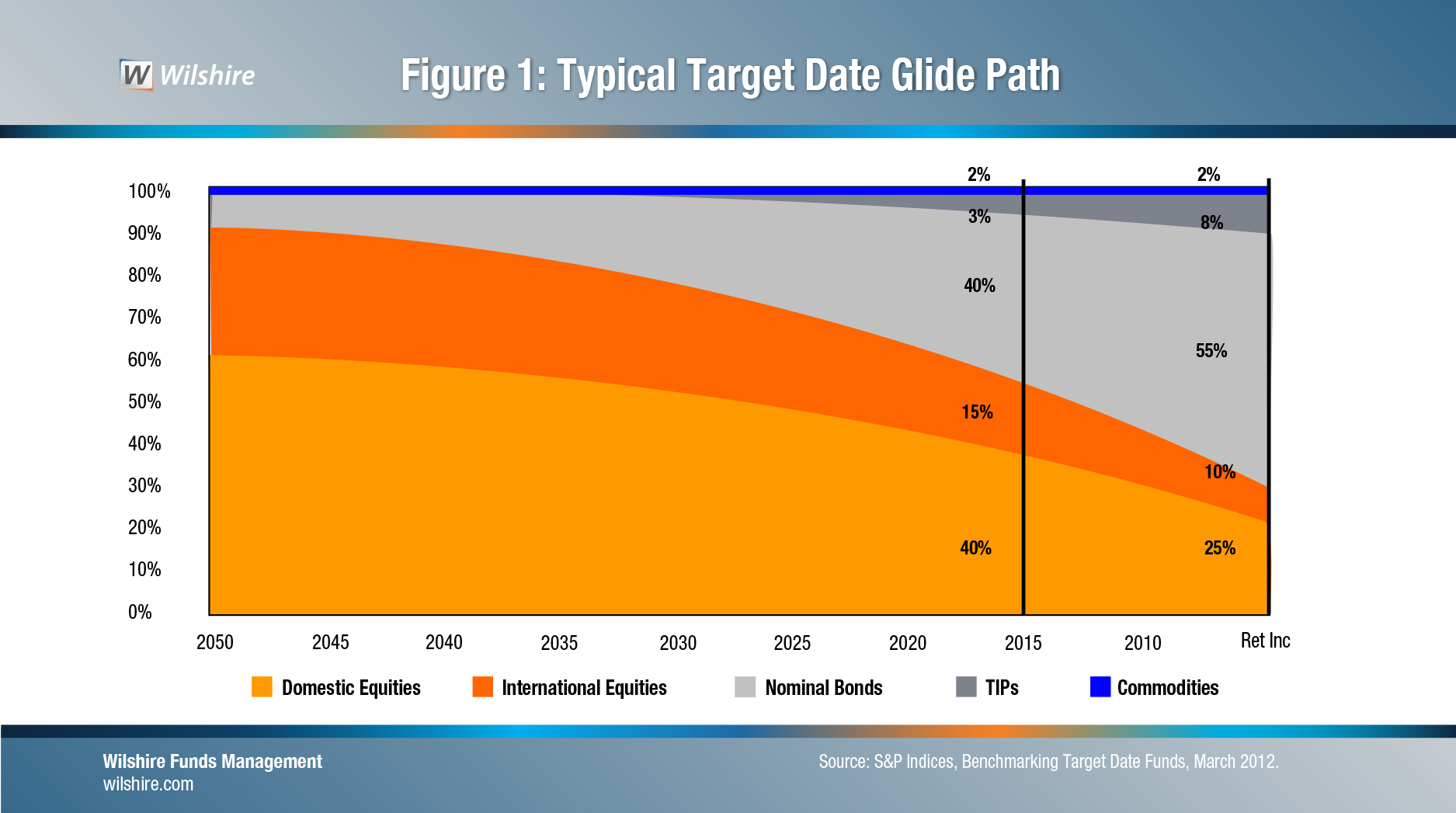

Traditional investment strategies, including target-date funds, aim to reduce risk as retirement approaches by reducing allocations to stocks and increasing allocations to bonds. Figure 1 illustrates this using the S&P Consensus Target Date Glide Path. As the figure shows, the consensus equity allocation declines from 90 percent for an individual with a 2050 retirement date, to 55 percent at retirement in 2015 and 35 percent for 10 years+ in retirement. The consensus of estimated volatilities of these portfolios falls from nearly 15 percent to just over 9 percent for the 2015 retirement date, to 6.5 percent ten years into retirement.

While this investment strategy has reduced perceived risk, it has fallen short in generating income during retirement. A typical retirement portfolio associated with a target-date strategy has an estimated income return of just around 2 percent per year.

An investment strategy that generates income may be critical for retirees. Portfolios that generate less income may require retirees to dig deeper into their savings to fund their expenses. Withdrawals taken in market downturns when asset values are low may amount to a larger percentage of total assets, making it more difficult to recover lost asset value through future investment returns and more likely that a retiree will deplete their assets while still living.

A New Approach

New research from Wilshire Funds Management sponsored by NAREIT evaluated how adding a range of income-generating asset types would have helped meet the twin challenges of producing income and preserving assets. The research aimed to develop optimal portfolios that maximized returns, provided a target level of annual income, and maintained risk levels typical of at-retirement and in-retirement portfolios.

Wilshire’s research considered the roles of broad classes of assets, including stock exchange-listed REITs, as components of income- generating retirement portfolios. One of the key findings was that the addition of stock exchange-listed REITs to retirement portfolios would have allowed a higher level of stable income for any given level of risk tolerance.

Methodology

The most widely-used analytic method for constructing optimal investment portfolios is Mean-Variance Optimization (MVO). For a specific opportunity set of investment choices, MVO identifies the asset allocation across the opportunity set that maximizes expected portfolio return for a target level of portfolio volatility.

Traditional MVO can be modified to address the needs of investors seeking a targeted amount of income from their portfolios to help finance living expenses while also identifying the optimum asset allocation across the opportunity set. To accomplish this objective, Wilshire developed Income-Oriented Mean-Variance Optimization (IOMVO), which incorporates an additional constraint requiring a specified income yield on the portfolio. Wilshire used both MVO and IOMVO strategies based on 40 years of investment return data (from 1975 through 2015) in this study to produce its findings.

Key Results

Figure 2 compares total and income returns for an income oriented portfolio and a traditional portfolio based on MVO design. As the figure shows, the income oriented portfolio with REITs provided nearly 40 percent more income with total returns that were comparable to the returns provided by the traditional portfolio.

.jpg)

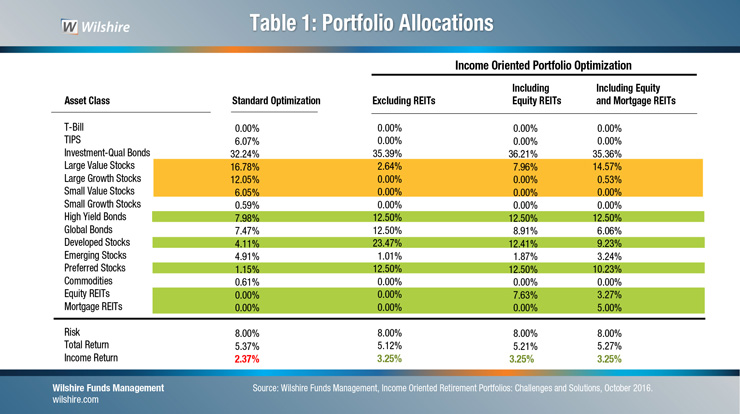

Table 1 highlights a number of the key results derived using the IOMVO methodology. The table compares the optimal portfolio derived using the traditional methodology (Column (1)) with the Income Oriented methodology excluding and including REITs (Columns (2) – (4)).

Comparing the allocations between standard and income oriented portfolios:

- Equity allocations are reduced from 35 percent of the standard portfolio to between 3 percent and 15 percent of the IOMVO portfolio.

- High Yield Bonds and Preferred Stocks become key parts of the portfolio. The share of these assets increases from 9 percent of the portfolio to between 22.7 percent and 25 percent.

- Non-US developed stock allocations rise from 4 percent to between 9 percent and 23.5 percent.

- REIT allocations rise to approximately 8 percent. REITs have been an important component of the income oriented portfolio because they have provided strong total returns, consistent income, and diversification benefits.

The Role of REITs

The impact of REITs in improving the performance of the income oriented portfolio was dramatic. Holding risk and income constant, the addition of Equity REITs would have increased the average annual total return by 9 basis points. Adding both Equity and Mortgage REITs would have increased the average annual total return by 15 basis points. To put this in perspective, over a 30 year retirement horizon, increasing average annual total return by 15 basis points would increase the ending portfolio balance by 4.4 percent.

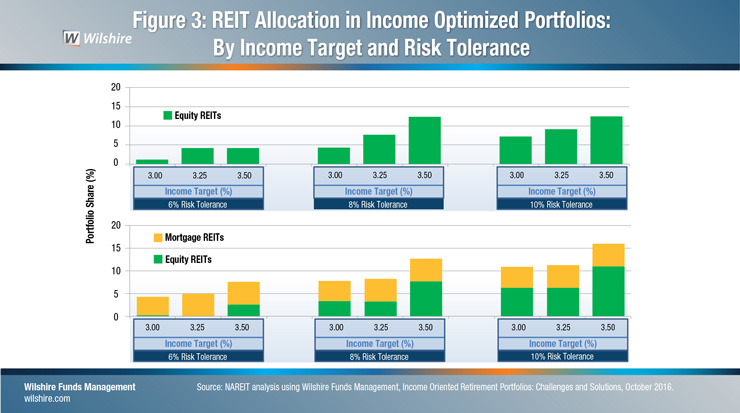

Figure 3 compares the allocation to Equity and Mortgage REITs across income targets and risk tolerances. The top panel of Figure 3 considers the case with only Equity REITs in the opportunity set while the bottom panel considers cases with both Equity REITs and Mortgage REITs in the opportunity set. Allocations to REITs would have increased as more income was needed and when risk tolerance rose.

Impact of Income Requirements on Asset Allocations

As income requirements rose, allocations to income-generating assets such as REITs would have increased. At the 8 percent risk tolerance level, the Equity REIT allocation would have risen from 4.3 percent to 12.4 percent between the 3 percent and 3.5 percent income requirement levels when only Equity REITs were in the opportunity set. When Equity and Mortgage REITs were in the opportunity set, total REIT allocation would have increased from 7.8 percent to 12.7 percent between the 3 percent and 3.5 percent income requirement levels.

Impact of Risk Tolerance on Asset Allocations

As risk tolerance rose, allocations to REITs would have increased as a share of the total portfolio. Focusing on the 3.25 percent income target, when only Equity REITs were in the opportunity set, the Equity REIT allocation would have increased from 4.2 percent to 9.1 percent between the 6 percent and 10 percent risk tolerance levels. When Equity and Mortgage REITs were in the opportunity set, the total REIT allocation would have increased from 5 percent to 11.3 percent between the 6 percent and 10 percent risk tolerance levels.

The highest REIT allocations of 12.5 percent when only Equity REITs were included in the opportunity set, and 16 percent, when both Equity REITs and Mortgage REITs were included in the opportunity set, occurred when the income requirement was 3.5 percent and risk tolerance was 10 percent.

Download the Wilshire Study

Webinar: Maximizing Retiree Income at Targeted Risk Levels

For financial advisors, this 60-minute webinar on the Wilshire retirement income study discusses how the research findings may help you better equip your clients to fund a long and active retirement. Speakers include Wilshire Funds Management Chief Investment Officer Joshua Emanuel and NAREIT Senior Vice President of Research and Investor Outreach John Worth.

- Download the presentation slides for this webinar

NAREIT is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. NAREIT is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made by this Site. The content on this Site is for informational purposes only and the Site is not intended to be a solicitation related to any particular organization, nor does NAREIT intend to provide investment, financial, legal or tax advice, and no information, services, or materials offered by or through this Site shall be construed as such. Past performance does not guarantee future results. Information presented on this Site pertains only to listed securities. Investment results cited are based on research by Wilshire Funds Management sponsored by NAREIT.