New Study Focused on Portfolio Design to Boost Income

As defined contribution plans, such as 401-(k) plans, have become widespread, plan participants are faced with the challenge of managing their own assets before and during retirement. One of the key challenges for individuals in retirement is generating sufficient income while minimizing the risk of depleting their assets.

The global financial crisis underscored the reality that global market turbulence can have lasting effects on an individual’s retirement plans. The aftermath of the financial crisis, which ushered in a period of slow economic growth and historically low bond yields, has increased the challenge of generating income while in retirement and, at the same time, limiting portfolio risk to preserve asset value.

The Challenge of Generating Income

Traditional investment strategies, including target-date funds, aim to reduce portfolio risk as retirement approaches, but may fall short in generating income during retirement. A typical retirement portfolio associated with a target-date strategy has an estimated income return of just around 2 percent per year.

An investment strategy that generates income may be critical for retirees. Portfolios that generate less income may require retirees to dig deeper and more frequently into their savings to fund their expenses. Withdrawals taken in market downturns when asset values are low may amount to a larger percentage of total assets, making it more difficult to recover lost asset value through future investment returns and more likely that a retiree will deplete their assets while they are still living.

A New Approach

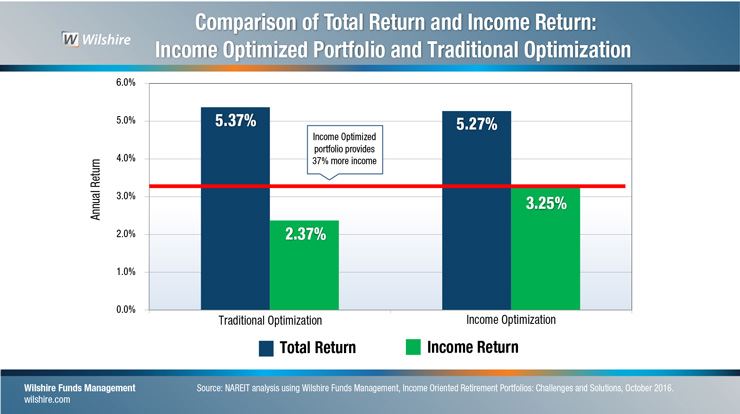

New NAREIT-sponsored research from Wilshire Funds Management using an advanced income optimization portfolio-modelling technique and based on 40 years of investment data, from 1975 through 2015, showed that adding a range of high income-producing assets to a traditional retirement-stage portfolio would have boosted income returns by nearly 40 percent, while still providing comparable total returns and no increase in risk.

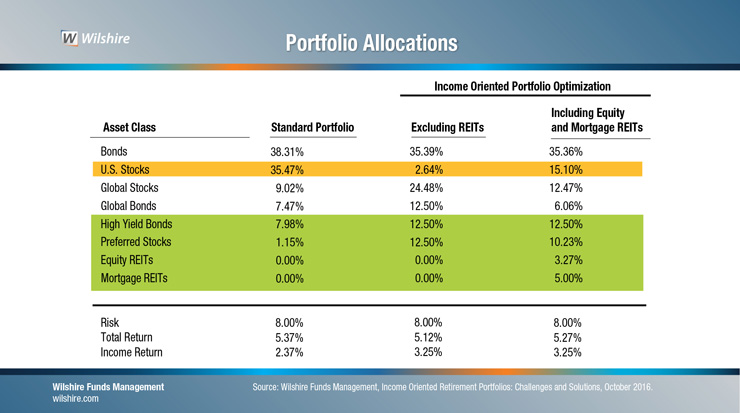

Wilshire’s income optimized portfolio contained significant allocations to stock exchange-listed REITs, high-yield bonds, preferred stocks and non-U.S. developed market stocks. One of the key findings of the research was that the addition of stock exchange-listed REITs to the retirement portfolio would have helped produce a higher level of stable income for any given level of risk.

These charts comparing total and income returns for an income optimized portfolio and a traditional retirement-stage portfolio are based on Wilshire’s research. They illustrate how REITs and other strong income-generating investments would have helped meet the twin challenges of producing income and preserving assets in retirement portfolios.

Download the Wilshire Study

NAREIT is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. NAREIT is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made by this Site. The content on this Site is for informational purposes only and the Site is not intended to be a solicitation related to any particular organization, nor does NAREIT intend to provide investment, financial, legal or tax advice, and no information, services, or materials offered by or through this Site shall be construed as such. Past performance does not guarantee future results. Information presented on this Site pertains only to listed securities. Investment results cited are based on research by Wilshire Funds Management sponsored by NAREIT.