How Do REITs Develop Environmental Goals for Action & Impact?

As environmental issues such as energy, water, and waste management have direct financial implications for business performance of real estate assets, most of the industry has adopted an increasingly sophisticated and integrated approach to managing and measuring environmental impacts and risks.

As custodians of the built environment, representing nearly $2 trillion in gross real estate assets,20 publicly traded REITs are uniquely positioned to put tangible, visible, and effective environmental goals into action. REIT environmental initiatives can have a profound impact—due to both the significant physical footprint they represent and the sheer number of people exposed to their good practices.

Through targeted educational efforts, such as training tenants and staff on recycling and waste management practices, REITs can drive behavior change and inspire positive environmental management practices across the communities they serve.

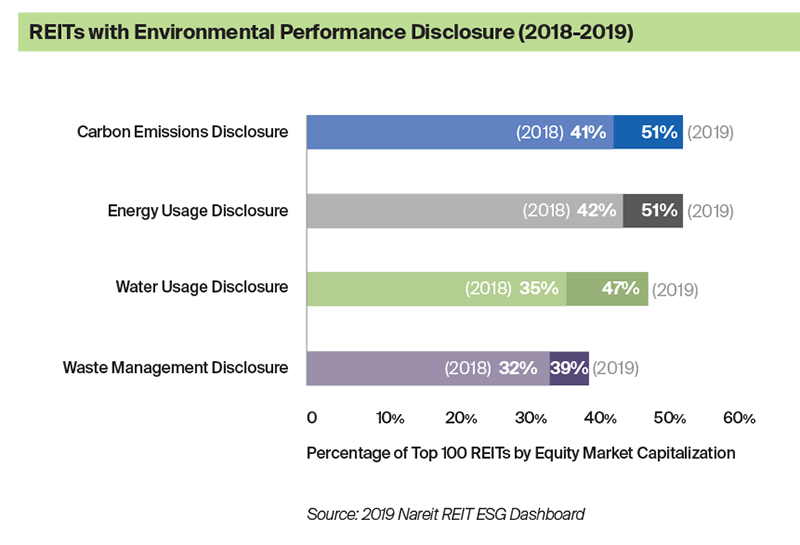

REITs have continued to improve disclosure on key environmental performance areas, demonstrating recognition of the environmental impact of their businesses on the long-term sustainability and health of surrounding communities.

Furthermore, REITs have been increasingly intentional about aligning environmental goals and targets with frameworks.

In What Ways Do REITs Assess Climate Change Opportunities & Risk?

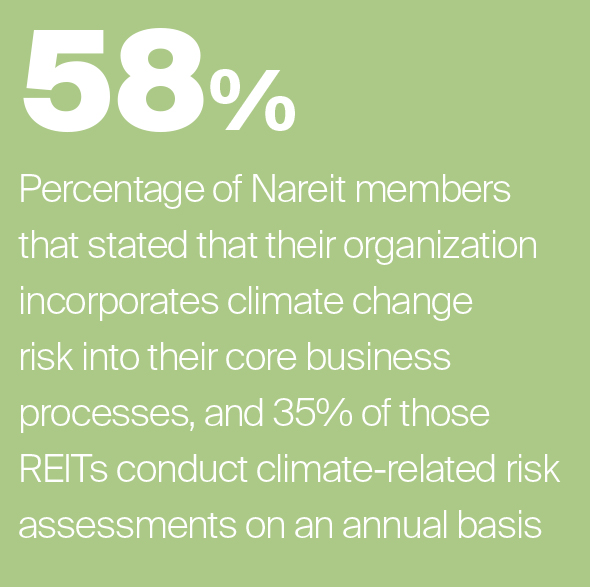

Physical, regulatory, financial, and market risks associated with climate change have the potential to significantly disrupt all businesses, including the REIT and real estate industries in coming years. In order to effectively prepare and identify opportunities for and methods to achieve resiliency, REITs have begun to prioritize the evaluation and disclosure of climate change risk as a core aspect of their governance, management, reporting, and operating processes, as factoring in climate change risk becomes the new normal for the industry.

Physical, regulatory, financial, and market risks associated with climate change have the potential to significantly disrupt all businesses, including the REIT and real estate industries in coming years. In order to effectively prepare and identify opportunities for and methods to achieve resiliency, REITs have begun to prioritize the evaluation and disclosure of climate change risk as a core aspect of their governance, management, reporting, and operating processes, as factoring in climate change risk becomes the new normal for the industry.

REIT participation in the GRESB Climate Change Resilience Module, a tool used to evaluate how real estate and infrastructure companies and funds are preparing for potentially disruptive events and changing conditions by assessing long-term trends and becoming more resilient over time, increased by nearly double, to 316 participants, in 2019. Demonstrating their commitment to identifying climate threats and building resiliency at the asset level, participating REITs help protect not just their individual properties, but also their communities, from climate-related impacts on essential infrastructure and services.

At least two REITs have also signed on as National Oceanographic and Atmospheric Administration

(NOAA) Weather-Ready Ambassadors, a program that seeks to share preparedness and resiliency success stories and educate employees and citizens on severe-weather preparedness.

By engaging in climate resiliency and weather-preparedness initiatives and working to better integrate leading practices for risk assessment, mitigation, and disclosure into operational processes, REITs can plan effectively and positively impact their businesses and communities.

Case Study:

Boston Properties, Inc.: Battery-powered Innovation

How Do REITs Utilize Environmental Policies & Management Systems to Guide Progress & Reporting?

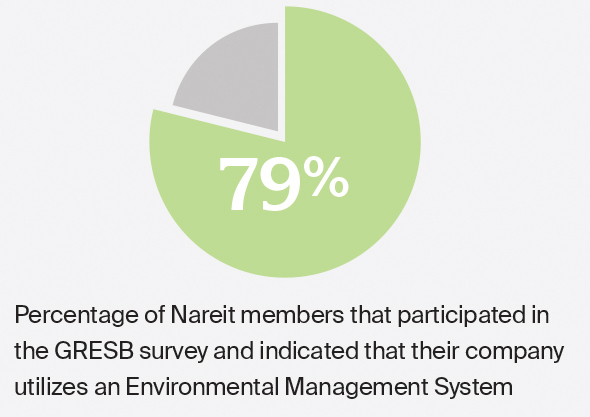

Companywide environmental policies and environmental management systems (EMS) enable the effective monitoring and reporting of environmental performance and help guide compliance with environmental laws and regulations. In 2019, 98% of Nareit members reported to GRESB that they have a policy on environmental issues and 100% of those reporting actively monitor energy and water consumption through either a data or environmental management system.

Companywide environmental policies and environmental management systems (EMS) enable the effective monitoring and reporting of environmental performance and help guide compliance with environmental laws and regulations. In 2019, 98% of Nareit members reported to GRESB that they have a policy on environmental issues and 100% of those reporting actively monitor energy and water consumption through either a data or environmental management system.

Establishing such clear, publicly disclosed policies and reporting on environmental impacts can help REITs foster positive relationships with tenants, communities of operation, investors, and other key stakeholders.

Case Studies:

Host Hotels & Resorts, Inc. : Structuring a Successful Environmental Management System

Equinix, Inc.: Internal Policies and Industry Advocacy Drive Renewable Energy Goals

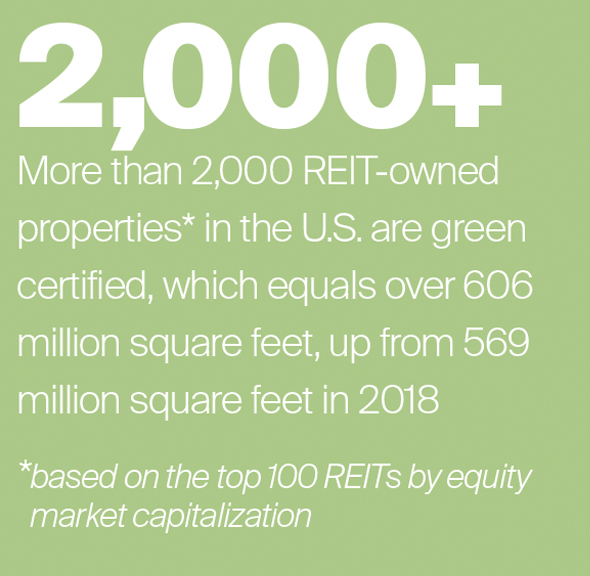

Why are REITs taking an Integrated Approach to Green Buildings?

Green building certifications provide important visibility into the industry’s commitment to environmental stewardship. Through their design, construction, and/or operation, green buildings mitigate negative impacts and create positive value for the world’s climate and natural environment, as well as economies and quality of life. According to a 2018 Harvard University study, green certified buildings provide approximately $6 billion in health and climate benefits, in addition to $7.5 billion in energy savings.

Green building certifications provide important visibility into the industry’s commitment to environmental stewardship. Through their design, construction, and/or operation, green buildings mitigate negative impacts and create positive value for the world’s climate and natural environment, as well as economies and quality of life. According to a 2018 Harvard University study, green certified buildings provide approximately $6 billion in health and climate benefits, in addition to $7.5 billion in energy savings.

Green buildings also deliver financial benefits to REITs, including reduced operating costs and increased property value. By making properties more attractive to investors and tenants alike, green building certifications can lead to up to 23% higher occupancy rates, 8% higher rental income and up to 31% higher sale premiums than realized for traditional buildings. The consistent demand is also reflected by greater tenant retention and lower vacancy rates.

Case Studies:

Federal Realty Investment Trust: Building a LEED-Certified Neighborhood Development

WashREIT: Showcasing Sustainable Practices in the Urban Ecosystem

How Do Emission Reduction Efforts Create Shared Value?

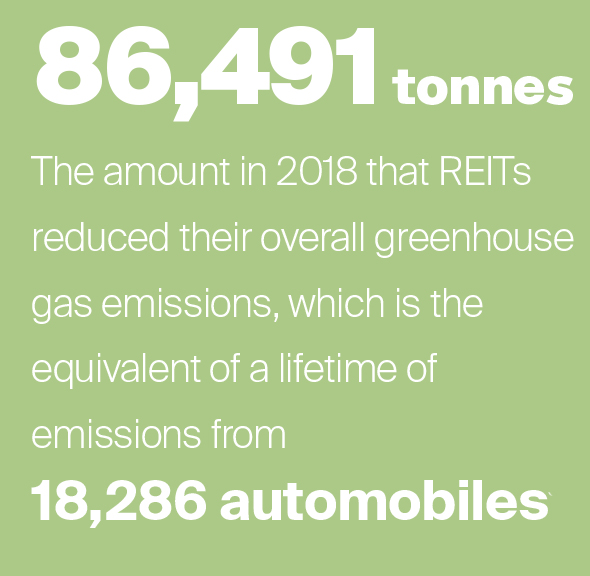

Recognizing both the benefits and necessity of curtailing greenhouse gas (GHG) emissions globally, REITs have steadily reduced emissions from their portfolio properties. Acknowledging commercial real estate’s sizable environmental footprint, the REIT industry is committed to making continued progress toward emission reduction. Last year, 58% of respondents to the 2019 Nareit Member Survey said they have reduced their like-for-like, year-over-year GHG emissions, with 53% reducing their GHG emissions by between 5% and 20%.

Recognizing both the benefits and necessity of curtailing greenhouse gas (GHG) emissions globally, REITs have steadily reduced emissions from their portfolio properties. Acknowledging commercial real estate’s sizable environmental footprint, the REIT industry is committed to making continued progress toward emission reduction. Last year, 58% of respondents to the 2019 Nareit Member Survey said they have reduced their like-for-like, year-over-year GHG emissions, with 53% reducing their GHG emissions by between 5% and 20%.

REITs also strive to align GHG emissions targets to leading global initiatives, such as Science Based Targets (SBTi) and the Sustainable Development Goals (SDGs), specifically SDG 13, Climate Action. In 2019, several U.S. REITs achieved a significant milestone after receiving approval by SBTi for their emissions reduction targets.

REITs are increasingly addressing Scope 1 emissions— direct emissions from owned or controlled sources— through the use of low-carbon materials in construction. Indirect Scope 2 emissions—indirect emissions from the generation of purchased energy—are being addressed through energy efficiency measures, such as upgrading HVAC and lighting systems, as well as replacement of fossil fuel electricity with on-site or grid-sourced renewables. Looking beyond Scope 1 and 2, REITs have introduced innovative measures to begin addressing Scope 3 emissions—indirect third-party emissions that businesses often have limited control over and are therefore widely considered to be the most difficult to address. Locating near—or building new—transit hubs, installing bike lanes and electric vehicle charging stations, REITs seek to reduce Scope 3 emissions by supporting new habits in tenants and patrons, such as installing bike lanes and electric vehicle charging stations.

Case Studies:

Simon Property Group, Inc.: Reducing Emissions Through Electric Vehicle Infrastructure

SITE Centers Corp.: Reimagining Land Use and Stakeholder Engagement Through Partnership and Technology

In What Ways Can Companies Identify Opportunities to Increase Energy Efficiency & Utilize Renewables?

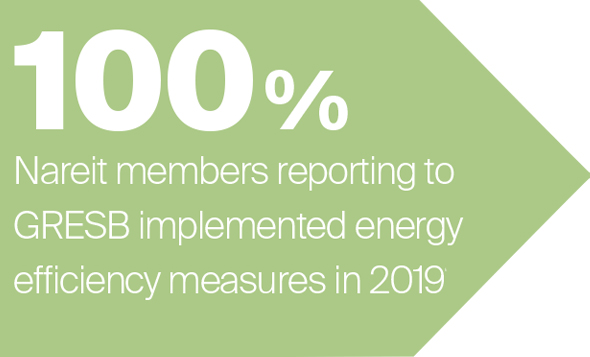

Supporting U.N. SDG Target 7.3, to double energy efficiency by 2030, energy efficiency has proven to be among the highest priorities for REITs, as well as their investors and tenants. Improved building efficiency can significantly reduce pollution and save companies millions of dollars in energy costs.39 In fact, one estimate predicts that the implementation of better building efficiency policies around the world could result in a global reduction in energy demand from the built environment by 25% to 50%.

Supporting U.N. SDG Target 7.3, to double energy efficiency by 2030, energy efficiency has proven to be among the highest priorities for REITs, as well as their investors and tenants. Improved building efficiency can significantly reduce pollution and save companies millions of dollars in energy costs.39 In fact, one estimate predicts that the implementation of better building efficiency policies around the world could result in a global reduction in energy demand from the built environment by 25% to 50%.

REITs have implemented a variety of innovative energy efficiency solutions, both through operational and capital investments. In addition to upgrading, or retrofitting, existing lighting and energy-intensive equipment to more efficient alternatives, the use of sensors, smart meters and building management systems enable property managers and owners to schedule, automate, and optimize buildingwide energy use, further increasing efficiency.

REIT investment in on-site renewables further reduces reliance on grid electricity, often serving as a cleaner alternative to utility power and offering greater resiliency in the face of increasingly frequent utility brown and blackouts. Global solar, wind, hydro, and biofuel usage currently represent 26% of all electrical generation,41 and 23% of REITs reported having on-site renewables, up from 18% in 2018.

Financial incentives, such as rebates and subsidies, have made energy retrofits and renewable energy alternatives attractive investments that stand to pay dividends in the long term as energy-related infrastructure risks grow in frequency and severity, and fossil fuel markets become increasingly volatile.

While an unprecedented number of REITs have implemented energy efficiency measures in recent years,44 energy efficiency and renewables still represent areas of significant opportunity for REITs to further support global sustainability goals while simultaneously improving operating margins.

Case Studies:

JBG SMITH : A Systematic Approach to Energy Audits

Brookfield Properties: Combining Technology and Engagement to Improve Energy Efficiency

How Can REITs Create Value & Change Behavior Through Waste Reduction Efforts?

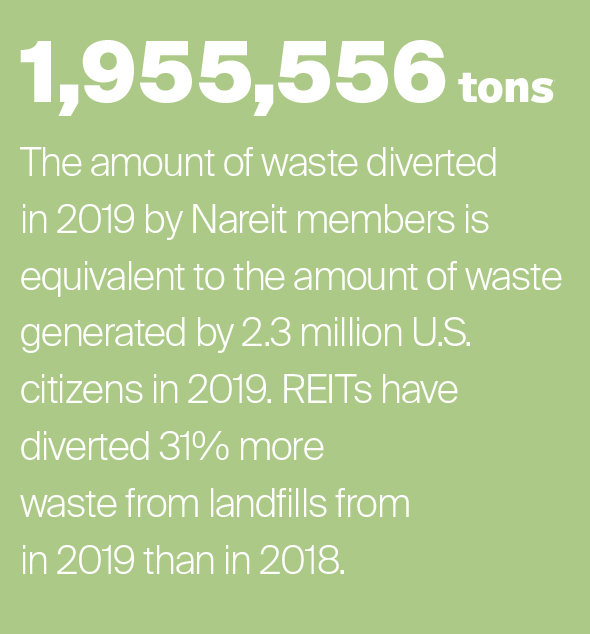

REITs can have a sizable impact on helping communities achieve waste reduction and diversion targets through implementing practices that improve waste management for the construction and operation of buildings, two areas which are estimated to account for nearly 40% of global waste.

REITs can have a sizable impact on helping communities achieve waste reduction and diversion targets through implementing practices that improve waste management for the construction and operation of buildings, two areas which are estimated to account for nearly 40% of global waste.

With the cost of landfilling solid waste in the U.S. exceeding all predictions, proper waste management supports cost efficiency and drives long-term value across the real estate sector. REITs are finding ways to work collaboratively with building operators and tenants to both reduce waste generation and divert waste from landfills and incinerators through recycling and other creative reuses. In 2019, 48% of Nareit Member Survey respondents reported having a waste reduction and management policy in place.

Case Study:

SL Green Realty Corp.: Achieving Waste Reduction Through Education and Engagement

What Are Some Water Conservation Measures for Local & Global Impact?

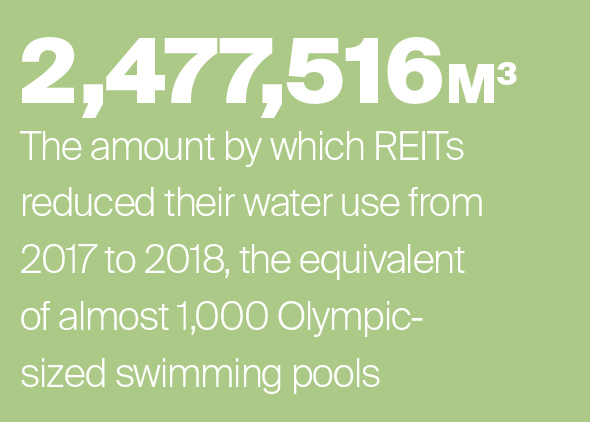

An estimated 2.1 billion people around the world lack access to safe drinking water, making water conservation a critical focus area for global environmental stewardship efforts. Through their efforts to contribute to global goals, such as UN SDG 6—promoting clean water and sanitation—REITs have refined water conservation targets to guide internal and external initiatives for long-term community impact.

An estimated 2.1 billion people around the world lack access to safe drinking water, making water conservation a critical focus area for global environmental stewardship efforts. Through their efforts to contribute to global goals, such as UN SDG 6—promoting clean water and sanitation—REITs have refined water conservation targets to guide internal and external initiatives for long-term community impact.

Some of the most innovative programs engage tenants, visitors, and customers to monitor and reduce their own water usage by example and through programs highlighting the relative scarcity of potable water. Other efforts involve infrastructure that reduces water usage, such as low-flow fixtures, submetering, and facilities that reuse stormwater runoff or grey water where potable water isn’t required.

REITs continue to find ways to monitor and reduce water usage, resulting in resiliency against water shortage incidents and operational cost savings. In 2019, 87% of REITs surveyed had implemented water use reduction measures at the asset level, and 44% reported reductions in water use.

Case Study:

Hersha Hospitality Trust: Aligning Business Priorities and Community Initiatives to Create Long-term Impact

Download the 2020 REIT Industry ESG report

2019 Environmental Case Studies

Boston Properties: Green Building Leaders

Alexandria Real Estate Equities: Green Building Leaders

Kilroy Realty: Carbon Neutral Operations Goals

SL Green: Generating Impact Through Emission-Reducing Activities

Equinix: Harnessing Renewable Energy

Essex Property Trust: Leveraging Leading Practice Energy Systems

Macerich: On the Path to Zero Waste

Digital Realty: Leveraging Water Conservation Efforts

Simon Property Group:, Inc. Surpassing Energy Targets and Improving Efficiency