Are REITs underrepresented in your clients’ portfolios?

If you are among the 4 out 5 of financial professionals who recommend the use of REITs1, you recognize that:

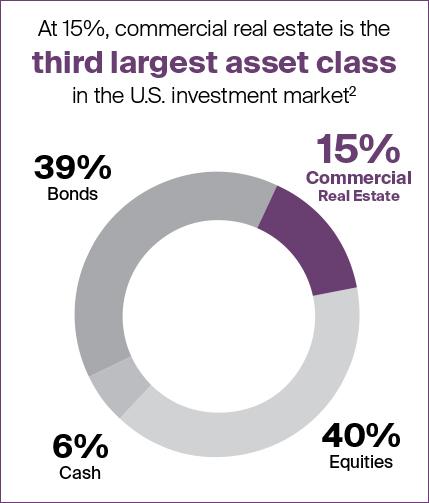

In addition to stocks, bonds and cash, commercial real estate is a fundamental asset class representing 15% of the U.S. investment market2.

REITs have been a low cost, effective and liquid means of investing in this asset class, allowing your clients to build a diversified portfolio that covers the entire U.S. investment market.

Commercial real estate can bring unique attributes to a portfolio including:

1. A distinct economic cycle relative to most other stocks and bonds

2. Potential inflation protection

3. Reliable income returns3

The advantages of investing in REITs

The REIT approach to real estate investing provides investors with a straightforward and transparent means of accessing a fundamental asset class in order to pursue distinct goals.

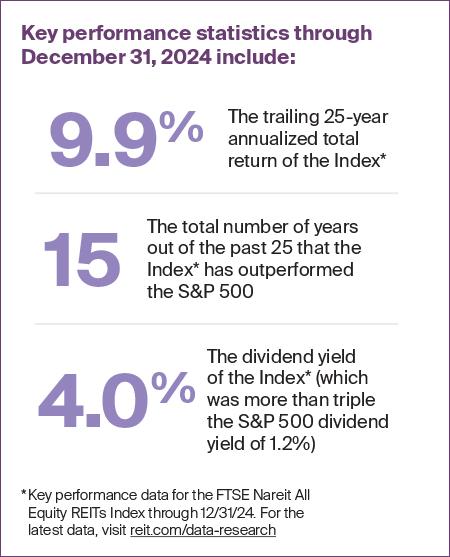

Performance — The real estate market is the primary driver of REIT returns, therefore REITs may be used as a liquid proxy for gaining access to the entire commercial real estate asset class2

Liquidity — Bought and sold like other stocks, mutual funds and ETFs

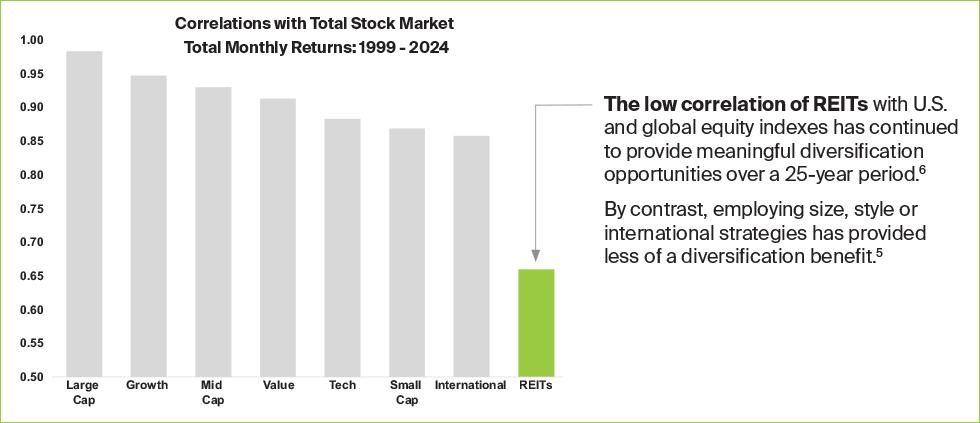

Diversification — Low correlation with other stocks and bonds4

Income — Reliable income returns3 have been driven by high and growing income from rents plus capital appreciation over time

Inflation Protection — Due in part to the fact that many leases are tied to inflation and that real estate values have historically tended to increase in response to rising replacement costs

How to diversify your portfolio using REITs

Over the past few decades, assets have become increasingly correlated. This has challenged advisors to identify investments to better diversify their clients’ portfolios. Fortunately, REITs provide them access to meaningful diversification opportunities.5 In fact, according to NMG Consulting’s research, 4 out of 5 advisors now invest their clients in REITs and the objective they most frequently cite is “portfolio diversification.”1 Following are illustrations of the low correlation REITs have had with the broad stock market and how they could improve a portfolio’s risk-and-return profile.

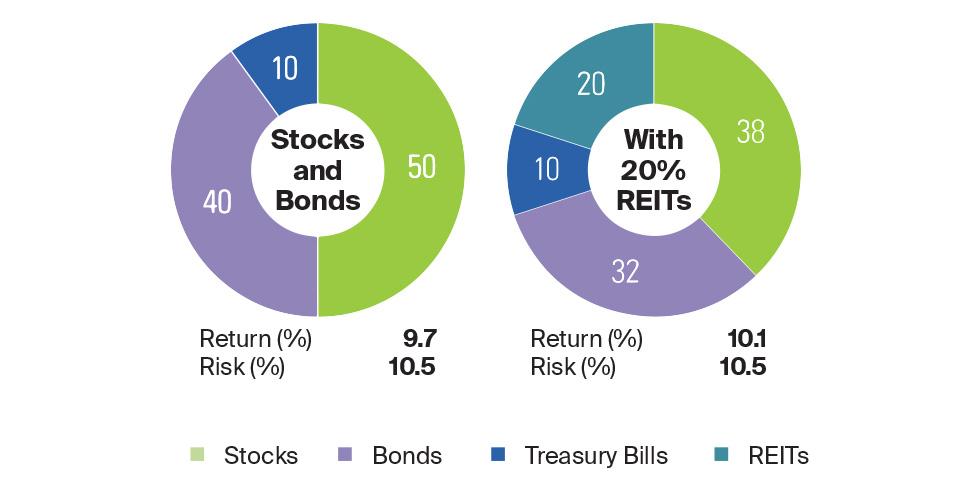

Considering the impact on risk-and-return profiles

Morningstar has found that adding an allocation of REITs to a hypothetical portfolio:

- Increased returns without increasing risk (1972-2024)5

- Added meaningful diversification—other stocks are subject to the business cycle while REITs represent a separate and unique asset class subject to the real estate market cycle

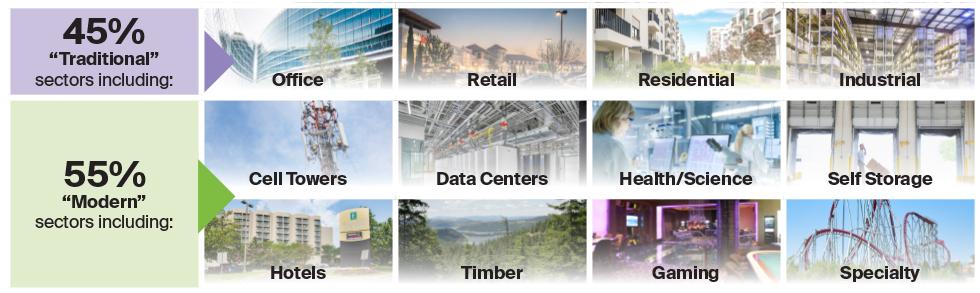

Achieving diversification through both traditional and modern property sectors

Over the past two decades, our work, shopping, and leisure activities have become increasingly connected to the digital world. As the economy has changed, the real estate that houses the economy has also evolved.

REITs are helping investors keep pace with an effective, low cost and liquid way to invest in commercial real estate that not only captures essential traditional property sectors but also evolving sectors driven by the modern economy.

In fact, the share of the FTSE Nareit All Equity REIT index outside of the four “traditional” REIT property types is now over 55%.7

REITs can help with other real estate diversification goals, from a geographic footprint that can span more than 40 countries to REITs best-in-class sustainability and corporate responsibility.

What is an appropriate allocation to REITs?

The answer will vary based on each investor’s goals, risk tolerance and investment horizon, but here are some key insights that can help:

Multiple studies have found that the optimal REIT portfolio allocation may be between 5% and 15%.5

David F. Swensen, PhD, noted CIO of the Yale endowment and author of Unconventional Success: A Fundamental Approach to Personal Investment, recommends a 15% allocation to REITs in his model portfolio for investors.

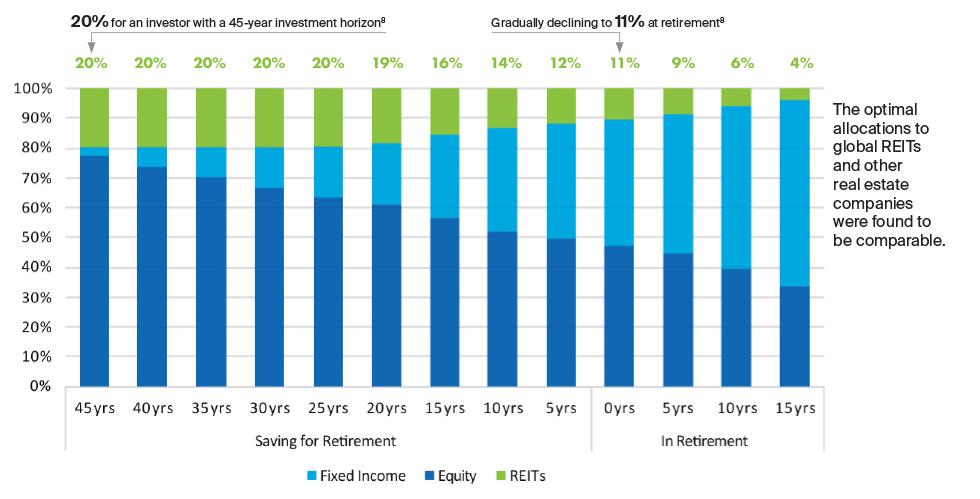

How does age affect the optimal REIT allocation?

As this Morningstar Glide Path Model shows, an optimal allocation for certain investors could start at 20% for an investor with a 45-year investment horizon, gradually declining to 11% at retirement and 4% after 15 years in retirement.8

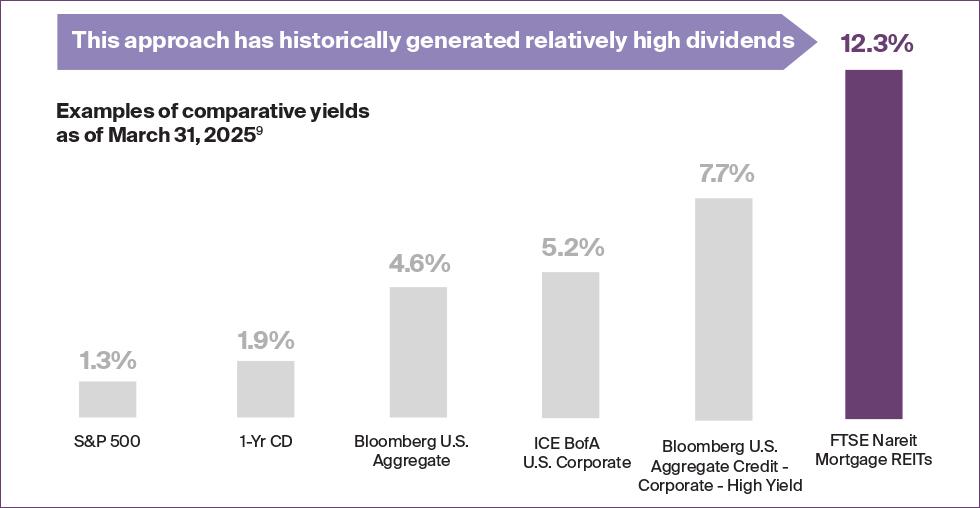

Considering Mortgage REITs (mREITs) as an added tool for pursuing income

Unlike other types of REITs which invest directly in income-producing property, mREITs specialize in providing financing for commercial and residential properties.

This is a key reason why many of the financial advisors who recommend the use of REITs also recommend mREITs as a simple, transparent and liquid way to invest in the mortgage market and commercial real estate debt1.

Research from Morningstar® on REIT performance

Here’s what these Morningstar® Fact Sheets reveal about past REIT performance for the 53-year period ending December 31, 2024 (the longest period for which data are available):

- Largest increase — Compared to bonds, T-bills and other stocks, REITs provided the largest increase in wealth in over 53 years.

- Increased returns — Adding REITs to a hypothetical portfolio increased returns with no increase in risk.

- Extended lifespan — Adding REITs to a hypothetical portfolio reduced the risk of outliving assets for retirees.

Additional Resources

- Disclaimer

1. Source: Nareit sponsored REIT Utilization Study of 503 financial advisors by NMG Consulting, 2024

2. Sources: Stock and bond data from Board of Governors of the Federal Reserve, Financial Accounts of the United States 3-year average through 2024: Q4;commercial real estate market size data based on Nareit analysis of CoStar property data and CoStar estimates of commercial real estate market size. REITs represent between 10 and 20 percent of commercial real estate ownership.

3. Source: Nareit sponsored study by Wilshire Funds Management – Income Oriented Portfolios – Challenges and Solutions, October 2016

4. Source: CEM Benchmarking, 2024

5. Examples of studies within the stated range include: Ibbotson Associates, Morningstar, and Wilshire Funds Management.

6. Source: Nareit, FactSet. Data as of December 2024. Total Stock Market: Dow Jones U.S. Total Stock Market Index; Large Cap: S&P 500; Mid Cap: S&P 400; Small Cap: S&P 600; Growth: Russell 1000 Growth; Value: Russell 1000 Value; Tech: Nasdaq Composite; International: MSCI EAFE; REITs: FTSE Nareit All Equity REIT Index.

7. Source: FTSE Nareit All Equity REIT Index, March 2025

8. Source: Nareit sponsored study by Morningstar, 2024

9. Source: FTSE Russell, Nareit, FactSet Research Systems, Bloomberg.