The commercial mortgage REIT (mREIT) sector appears to be on the cusp of recovery, due to a combination of factors that include improving returns, expectations of interest rate cuts, shrinking credit challenges, diversification of income, and increasing loan originations.

mREITs help provide essential liquidity for the real estate market on both the residential and commercial side by purchasing or originating mortgages and mortgage-backed securities and earning income from the interest on these investments. Commercial mREITs invest in commercial mortgages, helping to finance the buying and selling of income-producing real estate.

As of Sept.8, commercial mREITs posted total returns of 7.7% year-to-date. Within the sector, Blackstone Mortgage Trust, Inc. (NYSE: BXMT), Starwood Property Trust, Inc. (NYSE: STWD) and Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) are all posting positive total returns year-to-date that are at or close to double digits.

Commercial mREITs have been on the front lines of a commercial real estate correction and rising loan stress that occurred in the wake of Federal Reserve rate hikes, with office loans especially hard hit due to the added challenges created by remote working.

Financial statements show the very real pain these companies are experiencing. Loss reserves have moved from around 1% prior to 2022 to more than 4% of loan portfolios, while the percentage of non-performing loans has increased from near zero to 8.3%, according to Keefe, Bruyette & Woods.

The firm’s research also shows that book value among commercial mREITs is down 21% on a median basis from mid-2022. “That’s a huge decline, and the worst performers are down 50%,” says Jade Rahmani, managing director, commercial real estate finance at Keefe, Bruyette & Woods. Most mREITs have cut their dividend, and there's been an increased risk premium. So, not only did the book value decline, but the valuation multiple that the market uses widened out to reflect more risk and more uncertainty, he adds.

Even bellwether REITs have been challenged. For example, the share price for BXMT dropped from around $32 per share in mid-2022 to around $20 as of early September.

Turning the Corner

Broadly speaking, book values are still falling slowly quarter-over-quarter, notes Harsh Hemnani, a senior analyst at Green Street. Total returns, on the other hand, appear to have come through the worst of it, and the market is starting to price in a recovery.

With regard to book values, problems are rooted in vintage loans made prior to 2022 that were written at peak valuations. According to Green Street, roughly two-thirds of commercial mortgage loans that mREITs held coming into 2025 were made in 2022 or earlier. On average, the value of those vintage loans fell about 25% from the peak.

“What we've seen coming into 2025 through the first half is that the backdrop has improved in such a way that those loans can now refinance into stabilized capital sources,” Hemnani says. The transaction market has improved such that any foreclosure or REO properties that the REITs had to deal with can now be sold at close to where their basis is.

According to Green Street, credit challenges also are shrinking as the healthy 2024-2025 vintage loans—written at above-average spreads and reset valuations—now account for larger shares of mREIT portfolios.

Once the REITs resolve those problem assets and deploy capital into new loans, their return on equity starts to look better, and that’s what the public market is pricing in. So, the overall backdrop for commercial mREITs is healthier, according to analysts.

Another positive is that expected returns for commercial real estate credit are favorable. Whereas corporate credit across the board is pushing all-time tights, commercial real estate spreads are somewhat in line with their long-term average. So, relative to corporate credit, real estate credit offers much better relative value.

More Positive Outlook

Analysts generally have a more positive outlook for commercial mREITs for a variety of reasons including expectations for rate cuts, clearing out of losses, and more confidence on stabilizing book values.

“Despite the tariff uncertainty and the uncertain macroeconomic outlook this year, the momentum in commercial real estate has continued in a positive direction,” Rahmani says. KBW’s outlook for the sector began tilting more positive last fall, in part because mREITs have done the work to resolve problem loans and increase loss reserves. According to KBW’s analysis, a majority of the losses—an estimated 81%—have been recognized. “While there are still more losses to go, we’re most of the way there,” he says.

“The current outlook for mREITs today is actually as good as it’s been since well before the pandemic, and the outperformance this year over their equity REIT peers has certainly been warranted,” adds Alex Pettee, president and director of research & ETFs at Hoya Capital Real Estate.

mREITs are “spread investors,” borrowing short-term and investing in longer-term mortgage-backed securities (MBS) or directly in loans. They use leverage, often at between 5x and 10x to amplify those spreads. Their profitability depends on this net interest spread. Put simply, a steep yield curve environment is good for mREITs, and a flat curve presents challenges, Pettee notes.

Most spread indicators are showing a far healthier investing environment in recent months compared to the prior two years. For example, the spread between the 30-year mortgage rate minus the two-year Treasury spread bottomed in early 2023 at 1.70% and is now hovering at 3.0% as of early September.

“We think that this spread will improve further as the Fed resumes its rate-cutting cycle, particularly if there are still some lingering inflation worries that keep the longer end of the curve more buoyant,” Pettee says. “This improved spread should translate into better earnings power, and thus better dividend coverage, and less of a need to layer on additional leverage.” However, the credit-focused mREITs tend to be less interest rate sensitive and are reliant on the performance of their underlying collateral.

Deploying Capital

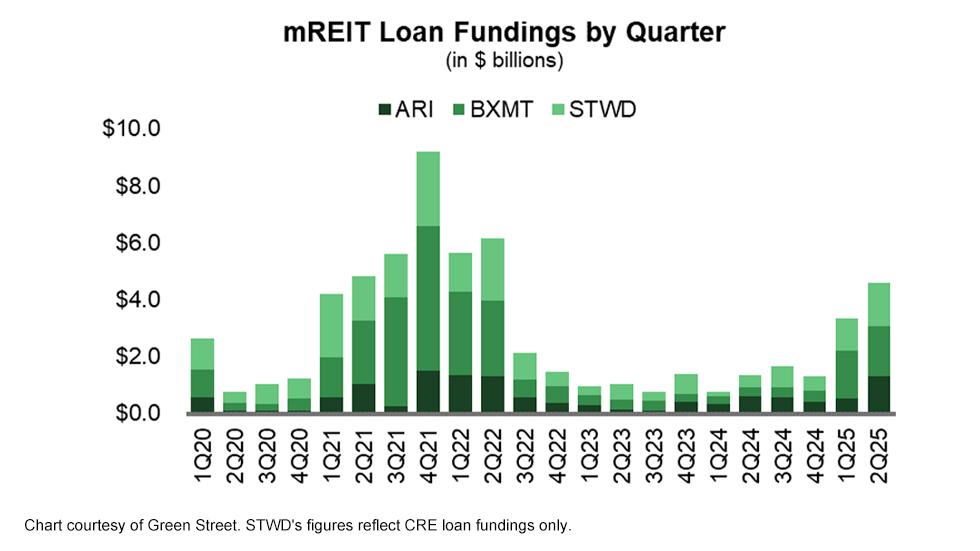

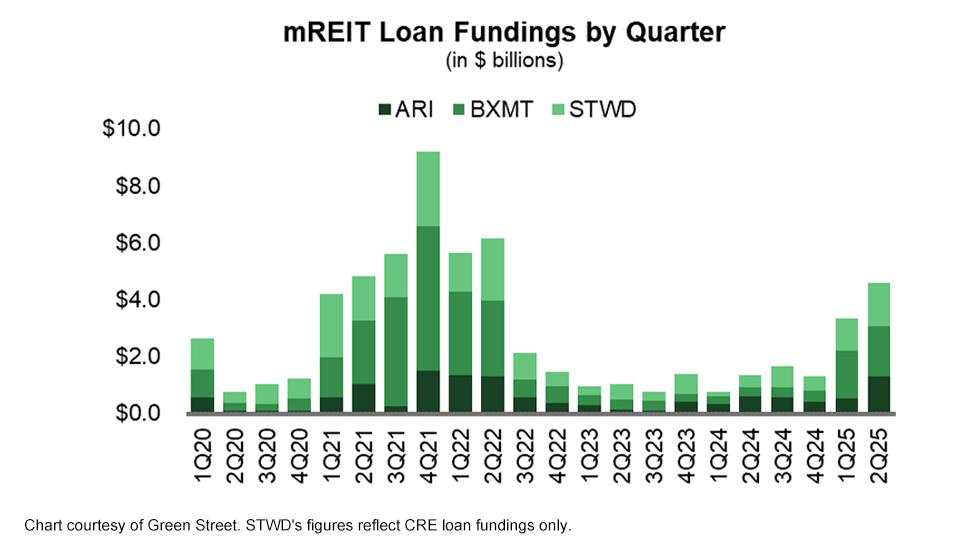

The big story with commercial mREITs is that they are now in a position where they are increasing loan originations. New originations for the three commercial mREITs that Green Street follows (Blackstone Mortgage Trust, Starwood Property Trust, and Apollo Commercial) came to a halt for the most part after 2021, but have taken a big leap forward in the first half of 2025.

Although equity issuances are off the table for the vast majority of commercial mREITs that are trading below book value, they are seeing improving liquidity on two fronts. Loan repayments have accelerated over the past year. In addition, REITs are finding that capital markets are more receptive, with banks eager to provide warehouse lines and a securitization market that is more active, allowing mREITs to apply incremental leverage.

Despite competition from a variety of different capital sources and capital providers, mREITs are benefiting from the pullback from banks that are reducing their exposure to CRE loans. For the most part, mREITs are largely avoiding office and are focusing on lending to sectors such as multifamily, student housing, and industrial. Data centers have become a big part of the origination story for Apollo and Starwood. mREITs also are willing to do select retail loans, while they remain cautious on hotels, analysts say.

Focusing on Diversification

Another key theme among commercial mREITs is diversification. For example, Starwood recently acquired Fundamental Income Properties, a fully integrated net lease real estate operating platform and portfolio for $2.2 billion.

According to Rahmani, the move diversifies the income stream because net lease has a longer duration cash flow than floating rate loans, which helps with the forecasting ability of the earnings outlook and gives increased resilience of earnings and dividends. “That is helpful not only for stockholders, but also for their own lenders and improves the financing ability of the overall franchise,” he says.

Commercial mREITs also are finding diversification outside of the U.S. Green Street expects that roughly half of 2025 origination activity across mREITs will come from non-U.S. markets, including Europe, Canada, and Australia. Among the three mREITs that Green Street follows, roughly one-third of loan portfolios already come from international loan originations.

In particular, commercial mREITs are finding more opportunities in the European market, which unlike the U.S., doesn't have a single-asset single-borrower (SASB) CMBS market. That gap in the market is driving demand for capital for large institutional-sized deals at attractive spreads. Blackstone Mortgage Trust is one mREIT that has pivoted towards Europe quite aggressively, with more than two-thirds of its second quarter origination volume coming from Europe, according to Green Street.

Challenges and Opportunities Ahead

Going forward, some analysts believe that the commercial mREIT sector could benefit from consolidation. Creating greater scale would help with concentration risk as the average loan size at many of the commercial mREITs is well north of $50 million. The challenge at the moment is that most companies in the sector are trading at sharp discounts, and boards don't want to sell at a discount. “I hope we see M&A, because it would make for a stronger sector with more stability in book value and dividends, which would benefit the investor base,” Rahmani says.

The risk to commercial mREITs is that the real estate market doesn't recover as everyone expects, which could result in problem assets staying on REIT balance sheets longer and creating a drag on earnings. Another potential risk for mREITs is interest rate volatility.

“We often say that mREITs are a play on “calm” market conditions; it can offer an attractive high yield under normal market conditions, but when things go haywire in bond markets, watch out below,” Pettee says

Despite potential challenges, analysts remain cautiously optimistic on a recovery and greater upside ahead. “To the extent that mREITs are able to clean up all of their troubled assets, that will be a significant uplift for 2026 and beyond,” Hemnani says. That uplift also could result in dividend increases ahead for some commercial mREITs, he adds.