With a multi-faceted growth strategy, strong brand awareness, and a conservative balance sheet, CubeSmart (NYSE: CUBE) President and CEO Chris Marr says the self-storage REIT is well-positioned to perform in any economic climate and capitalize on growth opportunities that may emerge in the year ahead.

CubeSmart’s operating model cuts across all demographics and geographies, and its mission is clear—to deliver a great product that simplifies the lives of its customers during periods of stress, both positive and negative, Marr explains.

“Everything we do is focused on how we can make the process of using our self-storage facilities simple and straightforward. And if we can do that, we consider ourselves to be a success,” Marr says.

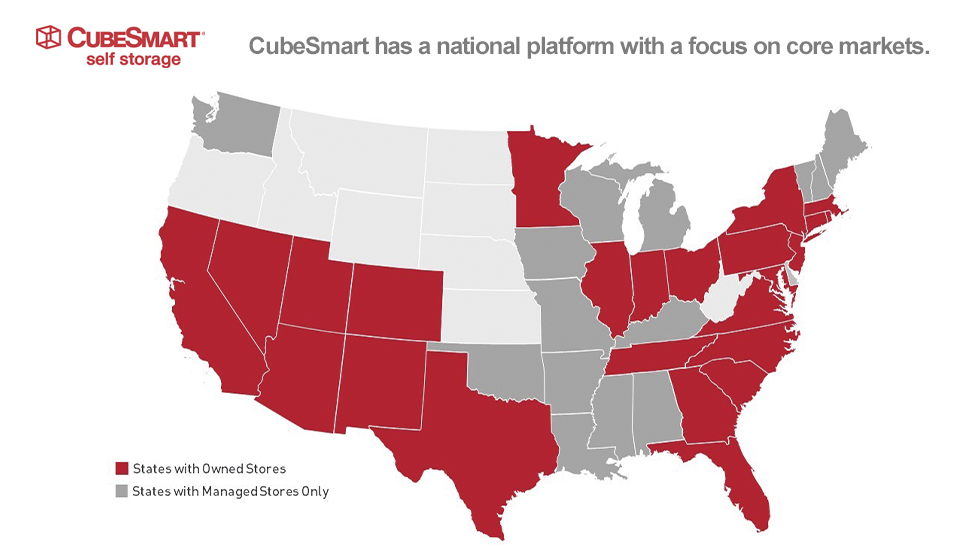

Malvern, Pennsylvania-based CubeSmart owns and operates over 1,200 self-storage properties in 39 states. The REIT was formerly known as U-Store-It but rebranded to CubeSmart in 2011, along with a shift toward enhanced customer service. Today, 89% of owned-store net operating income (NOI) comes from the top 40 MSAs, while CubeSmart’s third-party management program and joint ventures provide exposure to secondary and tertiary markets.

Marr, who joined CubeSmart in 2006 as CFO and treasurer and has been CEO since 2014, says the REIT focuses on stronger demographic markets with good existing population growth, high household incomes, and a solid percentage of renters versus owners.

“People who rent move more often than people who own, so we have focused historically on the top 40 MSAs and will continue to spend most of our energy focused on those markets,” he says.

Gradual Changes

Demand for self-storage space surged during the pandemic as people looked for ways to increase their living and workspaces at home. Since then, there has been a “very gradual” return to more traditional rental trends, Marr says.

“We expect a return to more typical pre-pandemic demand levels in 2023. However, occupancies are still about 100 basis points above pre-pandemic levels and rents are about 25% higher,” he adds.

Michael Goldsmith, analyst at UBS, lists CubeSmart as one of the firm’s REIT top picks for 2023. “We believe CubeSmart’s relatively dense urban portfolio in wealthier areas supports strong demand, leading to robust rent growth.” He added that “wealthier customers are better able to absorb existing customer rent increases (ECRIs), which are an increasingly important factor as length of stay increases.”

As the impact of the pandemic conditions began to ease, Marr says that many customers “found that they were in a hybrid work environment, and so they still needed that space, maybe not five days a week, but two or three days a week. Many families found that having that safe, quiet space for their children to do their homework or otherwise study was very helpful.”

Potential to Grow

With a possible recession looming in 2023, Marr says that self-storage has historically performed well relative to other real estate product types during periods of mild recessions. Beyond that, Marr says balance sheets matter as companies head into uncertain economic times.

“Companies that operate lean and agile in terms of always focusing on operational excellence and making sure that your cost structure is appropriate regardless of the cycle, will do better if we in fact enter into a recessionary climate,” Marr says. “At CubeSmart, we've always been very focused on making sure that our cost structure is appropriate and that we don't get too far ahead of ourselves.”

From an external growth perspective, Marr does not expect movement to happen too quickly. “We definitely are in a period of uncertainty and a period of price discovery and have been since probably the third quarter of last year,” he says.

However, Marr adds that there is still potential to grow the portfolio this year. “I do think we may find some opportunities from the typical self-storage developer who may have financed their development with a shorter-term construction loan and are getting squeezed by the rapid shift in interest rates,” he says.

That may create opportunities for a well-capitalized company like CubeSmart, he says, to do some acquisitions that may be “very accretive to us on a yield perspective relative to our cost of capital.”

Key Markets

With properties in 39 states, CubeSmart has its eyes on a wide geographic footprint. One market where CubeSmart sees a lot of potential going forward is the outer boroughs of New York City, where in 2011 the company made a transformative acquisition by purchasing a $560 million portfolio of 22 class-A facilities from privately held Storage Deluxe.

Per-capita supply across the Bronx, Brooklyn, and Queens is the lowest nationally and less than half the national average, according to CubeSmart. Marr notes that although supply in New York increased dramatically over the last several years, now that some of the opportunity zone tax benefits have been effectively removed from self-storage as a real estate product type, new future supply will be constrained.

“When you think about markets with excellent demographics and excellent supply versus demand characteristics, New York City is number one in all of those attributes,” Marr says.

“Over the long term, a market like New York City, which we think is the best self-storage market in the United States, will have more sustainable, more predictable, and less volatile growth in its cash flows,” Marr says. He notes, however, that it is getting more challenging for CubeSmart, as the largest owner/operator in the outer boroughs, to find pockets where it doesn’t already have an existing store or to find assets that meet its quality conditions.

The typical storage customer is only going to shop within a mile of an urban area, and three miles within a suburban area, “so we look for those holes in our portfolio within those submarkets and if we can find attractive opportunities, we absolutely would be interested in continuing to grow,” Marr says.

UBS’s Goldsmith says the firm believes that operating conditions in CubeSmart’s largest market, New York City, will improve through 2023 and into 2024.

Goldsmith noted that performance in New York City was weak from 2019 to the third quarter of 2022 due to excess supply as well as COVID-driven migration. Going forward, “we expect supply to slow as the remaining development properties under the Industrial and Commercial Abatement Program are completed.”

Stephen Manaker, analyst at Stifel, wrote in the firm’s latest research report that, “we believe New York will continue to be a tailwind with growth that is flat to rising, while other markets should see deceleration (off extremely strong numbers). And CubeSmart’s large exposure should help provide a boost to growth and the stock's relative return.”

CubeSmart has also made inroads on the other side of the country, most recently with the $1.7 billion acquisition of Storage West in 2021. The 59 properties in that portfolio are located in markets where CubeSmart was previously underrepresented—Southern California, Las Vegas, Phoenix, and Houston. The assets have not only enhanced CubeSmart’s market share in attractive markets, Marr says, but were complimentary to the stores already owned and effectively helped lift their performance as well.

“We think we will continue to see that growth in the performance of those stores in 2023,” Marr says.

Collaborative Culture

As he assesses the post-pandemic environment for self-storage, Marr says that one of the most interesting things to have come out of the past few years is the shift in consumer preferences to digital transactions and self-service.

“We find that in focus groups, there's a segment of our customer base who are perfectly happy in a completely digital experience. However, we still have a pretty sizable segment of our customer base who are at the opposite extreme of that,” he says.

For CubeSmart, the next several years will see a focus on how the REIT uses its technology, and its years of experience, to find ways to marry those two segments of the customer base. Marr points out that the company is considering a variety of video options, one of which would be a vestibule at the front of the store, similar to using an automatic teller machine.

“We're experimenting with a variety of ways to meet the changing needs of our customer in terms of how they want to interact and how they would define great customer service,” Marr says.

Meanwhile, underlying all of CubeSmart’s success, according to Marr, is the respect and the commitment that the company makes to the personal and professional development of its staff. “It really is a hallmark of the culture at CubeSmart.”

Ultimately, Marr says, “we view it as a collaborative place to work where everyone's opinion is respected and we are striving to just continue to get better. Creating that kind of culture obviously has a benefit of high engagement and teammates who are highly engaged tend to stay longer, be happier, be more productive. We think there's a lot of value in that.”