Health care REITs have seen solid gains so far in 2025, posting returns of 8.5% as of May 28, which positions them as one of the top-performing REIT sectors this year.

Analysts point to favorable supply/demand dynamics, demographic tailwinds, and the recession-resilient nature of the sector as key reasons supporting the sector.

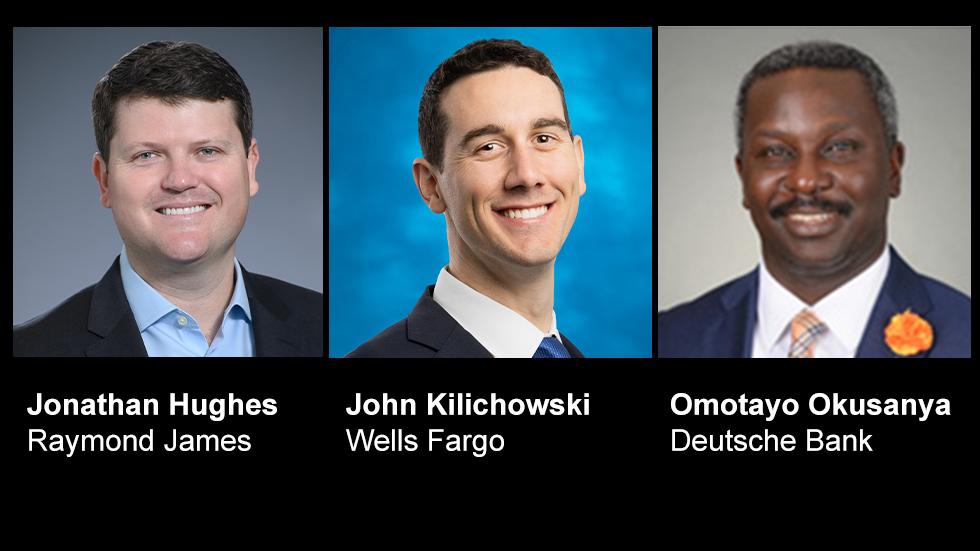

“Health care REITs are well-positioned to capitalize on internal growth via their partnerships with strong operators, and on external growth opportunities with their strong balance sheets, access to capital, and weaker private market competition amid the current uncertain environment,” says Jonathan Hughes, managing director, REIT equity research, at Raymond James.

Hughes, John Kilichowski, vice president, REIT equity research at Wells Fargo, and Omotayo Okusanya, managing director, U.S. REIT equity research at Deutsche Bank, share their perspectives on what’s ahead for the various health care REIT subsectors.

What is the supply/demand dynamic that REITs are currently seeing in senior housing, and is that consistent across geographic markets?

John Kilichowski: The supply/demand dynamic for senior housing REITs is now the best these companies have seen. New deliveries have plummeted due to 1) elevated construction costs, so existing properties are trading at significant discounts to replacement costs, and 2) higher rates and wider credit spreads have made construction financing more expensive.

On the demand side, the 80-plus U.S. population will grow at approximately three times the compound annual growth rate through 2030 that it did during the 2010s. This is generally consistent across all U.S. geographic markets.

Jonathan Hughes: Senior housing supply increased approximately 4% annually leading up to the pandemic, 2%-3% in recent years, and is expected to be 2% or less the next few years. Enthusiasm for the “Silver Tsunami” of aging demographics drove supply growth last decade, but was too early, as the oldest baby boomer is only 79 this year and the average age of a resident in senior housing is in the low-80s.

We’ve been battling unfavorable demographics for the past decade with the aging of the "baby bust" generation, basically the low birth rates during World War II in the early 1940s. But we’re finally past that and at the beginning of a 20-year secular tailwind of strong demand growth. The 80-plus population cohort is expected to grow nearly 5% annually through the end of this decade. The low supply growth and aging demographic trend is consistent across North America.

Omotayo Okusanya: Demand /supply fundamentals are universally strong across geographic markets, which is driving strong rent growth and occupancy gains. From a supply perspective, new starts and inventory growth are at record lows nationally. There is more of a difference across price points, with stronger performance at the higher end of the market versus the lower end.

What trends are you seeing in terms of REIT outpatient medical development today?

Hughes: Outpatient medical supply under construction versus existing inventory is currently about 2%, down from the approximately 3% max in recent years. Absorption has outpaced supply growth since the pandemic. Supply/demand dynamics in this subsector are among the most stable across commercial real estate.

Okusanya: Like most real estate sectors, MOB development does not really pencil today given higher cost of financing and higher cost of construction. Tariffs on materials probably makes things worse. We believe that build-to-suit opportunities may still exist with high quality hospital systems, but these are unique relationship-driven deals. There certainly is no speculative MOB development going on currently.

The life science real estate segment faced headwinds in 2024. Are you seeing any easing in 2025?

Kilichowski: While 2025 had a better start to the year than 2024, we’ve seen a material downtick in sentiment around the sector as the confluence of NIH funding cuts, headcount reductions at the FDA, and significant tariffs have materially impacted the ability of REITs to underwrite new deals in life science. We are seeing some steadiness in mark-to-market rents, which is a positive, but we don’t expect pricing power to return materially in the near-term.

Okusanya: 2025 feels just as tough to start the year. Per several broker reports, demand metrics remain challenging despite some industry green shoots. In the first quarter of 2025, eight new drugs received FDA approval. Additionally, the life science sector has seen nine companies go public year-to-date, keeping IPO activity in line with last year’s volumes. Biotech employment was also relatively stable in the first quarter.

However, recent proposed changes in federal funding to the NIH is likely to create downside risks to scientific grants and talent development within life science hubs. In addition, there is rising concern that pharmaceutical companies may face tariffs under the new Trump administration. Venture capital funding has also gotten much more selective by focusing on targeted investments that enhance the growth of a select pool of venture-backed life science companies. This is all against a backdrop of higher supply in key biotech clusters like South San Francisco and the Boston suburbs.

Hughes: Leasing activity within life science has been resilient, though releasing spreads have cooled lately. This is not surprising as life science vacancy and new supply remains high and will take years to be absorbed. The 27% vacancy in the three major cluster markets of Boston, San Francisco, and San Diego, new supply pipeline representing 4% of existing inventory, and tepid demand support our more guarded outlook.

Life science capital raising is back to pre-pandemic levels but is volatile. We expect life science real estate headwinds to continue.

In what property segments of the health care real estate sector are transactions most likely to occur in the months ahead?

Okusanya: Capital always gravitates to where there are the best fundamentals, so we believe senior housing is where you likely see the most action. REITs have good cost of capital with several names trading well above NAV, so we expect to see decent deal flow from the health care REITs in this regard. We are also seeing more international action in the UK—both in senior housing and care homes (a mix between senior housing and skilled nursing).

Hughes: We expect robust transaction activity to continue within senior housing and skilled nursing facilities. Upcoming loan maturities, forced private sellers, and the challenging capital market backdrop lay the foundation for the senior housing and skilled nursing facility-focused health care REITs to utilize their strong balance sheets to continue consolidating market share.

Kilichowski: We continue to expect senior housing to see the greatest amount of transactions in the REIT space. This is due to the impaired agency lending environment slowing the private buyer market while REITs are benefitting from access to ample amounts of attractively priced capital to fund accretive investments.

To what extent do you see technology impacting the REIT health care sector going forward?

Okusanya: We believe technology is at the early innings of revolutionizing the senior housing sector. There are many similarities between senior housing and classic multifamily housing, yet senior housing is struggling to be a 30% margin business today while multifamily is in the 60% to 70% range. Technology will help bridge that gap in terms of 1) better tools for revenue management (including dynamic pricing), and 2) better tools to lower operating costs, all while providing a higher level of service.

Kilichowski: We believe there is significant room for technology to positively impact the health care REIT sector. Evidence of this can be seen in Welltower’ Inc.’s (NYSE: WELL) performance over the past few years, driven in part by its revolution of the senior housing business with its Welltower Business System and data science platform. These technologies have influenced both property-level and transaction market performance.

Technology will also continue to play a large part in life science, but we see this outcome as more of an unknown given it could effectuate positive change via further scientific breakthroughs, or negative change by reducing the amount of real estate needed to perform intensive scientific research.

Hughes: Senior housing and skilled nursing facility operators have leveraged technology to optimize operations, improve portfolio management, and drive value creation. Life science companies have utilized artificial intelligence to improve productivity and R&D, though it’s unclear if this will help or hurt demand for lab space.

Where do you see the greatest opportunities and challenges for health care REITs in the year ahead?

Kilichowski: The greatest opportunity ahead for health care REITs remains the supply/demand imbalance. Addressing the needs of the 80-plus cohort will provide significant upside for REITs.

The greatest challenge for senior housing and skilled nursing facility REITs will be their ability to maintain a competitive advantage as inevitably more institutional money comes into the space to take advantage of the strong secular tailwinds and investment yields. For life science, the challenge will be maintaining pricing power while trying to drive absorption in the face of historic supply and an uncertain biotech funding backdrop following the current administration’s policy decisions.

Hughes: Perhaps the biggest sector-wide opportunity/positive attribute is the recession-resilient and defensive, needs-driven nature of health care that is increasingly top of mind for investors in the current uncertain environment.

The greatest challenge might be disciplined capital allocation. The highest IRR real estate asset classes—senior housing and skilled nursing facilities—unsurprisingly carry the highest risk, highlighting the importance of senior housing and skilled nursing facility-focused health care REIT management teams’ underwriting abilities and partnerships with strong operators. Balancing disciplined underwriting while satisfying investor demands for accretive external growth activity is a difficult balancing act.

Okusanya: Technology will be a great differentiator in terms of senior housing operational performance over the next few years. We believe the current world of haves and have-nots in terms of access to attractive capital also creates a competitive advantage for those that are in the enviable position of being able to transact.

In terms of challenges, we are in a new administration under President Trump, which also means risk of regulatory change. This is most apparent today in life sciences due to the cuts to NIH funding and potential tariffs on pharmaceutical companies. Potential privatization of government sponsored enterprises like Fannie Mae and Freddie Mac could have real ramifications in terms of changes to a major funding source for senior housing private market transactions.

Is there anything else you’re closely watching in the REIT health care sector that you haven’t already mentioned?

Hughes: Within skilled nursing facilites, reimbursement and government pay exposure is perhaps the most misunderstood aspect, though during the pandemic, that was an undeniable positive attribute. Interestingly, because of that perceived risk, the skilled nursing facility-focused health care REITs have been able to acquire properties at over 9% yields for the past 20-plus years, despite declining interest rates (until recently), and arbitraging those yields versus their lower costs of capital. This dynamic has driven strong shareholder returns over the past 20-plus years and given the more favorable outlook for skilled nursing facilities today, we expect that to continue, if not improve further.

Okusanya: Over the years, the very definition of health care real estate has evolved/expanded and we believe further expansion/evolution could still occur. For example, behavioral health is a growing segment, and some REITs are already acquiring behavioral hospitals. This is a space we continue to watch as we currently do not believe there is a lot of institutional capital chasing this opportunity.

We also continue to monitor the tastes of baby boomers that all are rapidly turning 80 years old over the next decade. With so much health care real estate (especially in senior housing and skilled nursing) being 30 to 40 years old and hardly changed over that period, will these assets be functionally obsolete given baby boomers will likely want something different versus their parents in terms of accommodations to meet their long term health care needs.