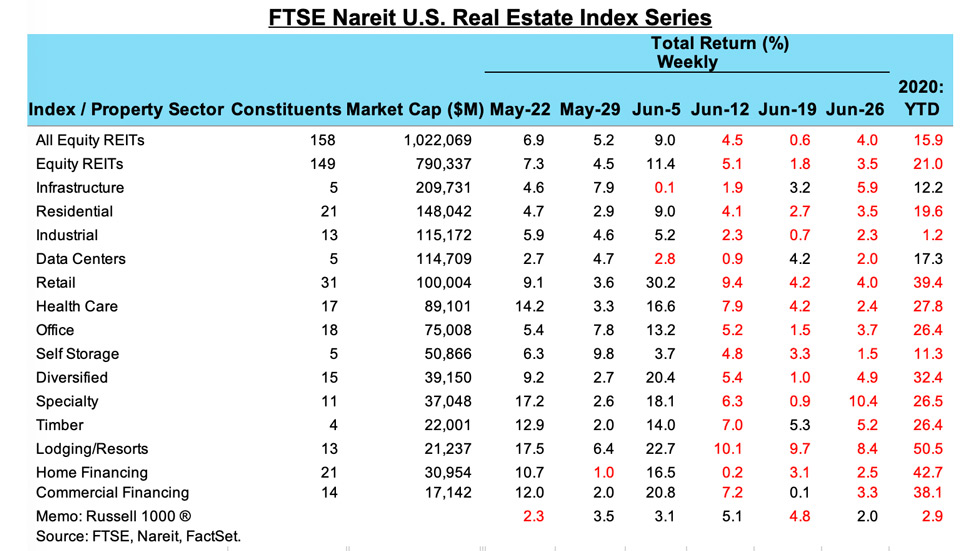

All property sectors of the REIT universe declined last week as a surge in new cases of COVID-19 in many states raised concerns that the economic reopening may be delayed. The All Equity REITs total return index was down 4.0% in the week ended June 26, the third consecutive weekly loss. These declines, however, follow a string of weekly increases and erase a portion of the gains in prior weeks, leaving the sector little changed for the month. Over a bit longer time horizon, REITs are still in positive territory for the second quarter with total returns of nearly 10%. The declines year-to-date remain significant, at 15.9%.

Several of the sectors that had been most vulnerable to negative news on the virus in prior weeks did not respond strongly last week. For example, retail REITs had a total return of -4.0%, matching the decline in the overall index; health care REITs had a total return of -2.4%, and home financing mREITs had a total return of -2.5%. Lodging/resorts, however, had the second-largest decline last week of -8.4%, following the -10.4% total return of specialty REITs.

An improvement in rent collections in some of these sectors may have buffered the headline news on the virus. Nareit last week released results of a survey that showed rent collections improving in June compared to May and April. Shopping centers collected more than 60% of typical rents in June, compared to less than 50% in April and May. Several other sectors saw an increase, with rent collections of free standing retail rising from 70.6% to 79.4% and health care REITs increasing from 89.8% to 95.0%. Rent receipts continued to be high at industrial, apartment, and office REITs.