Bank lending to CRE picks up as commercial property sales, prices recover.

An upswing in bank lending in the fourth quarter signals higher levels of activity across nonresidential real estate, multifamily residential and real estate construction and development.

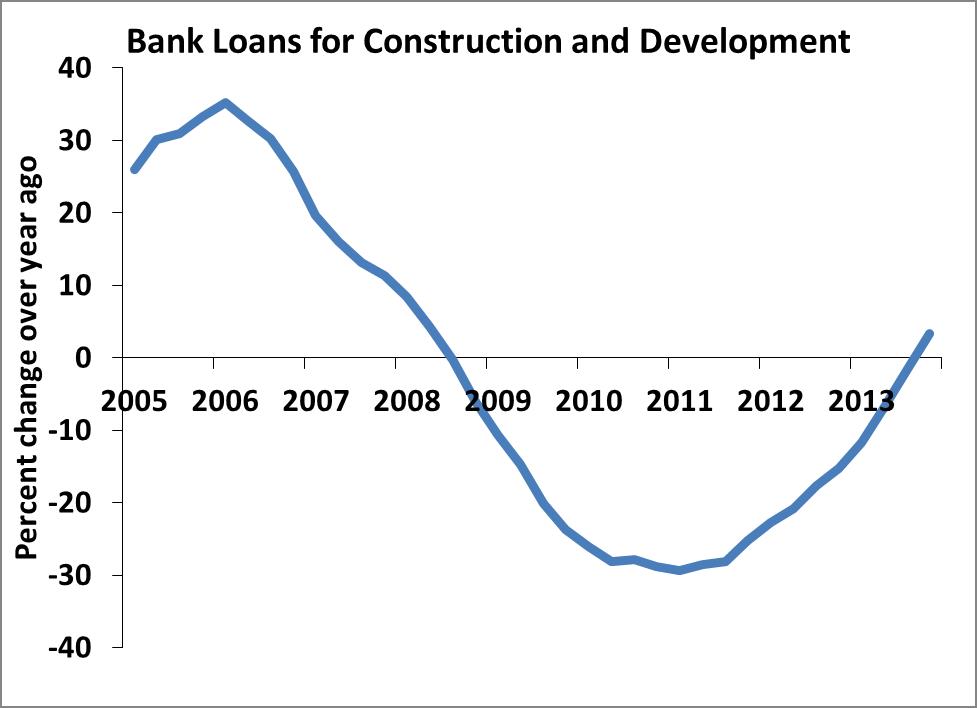

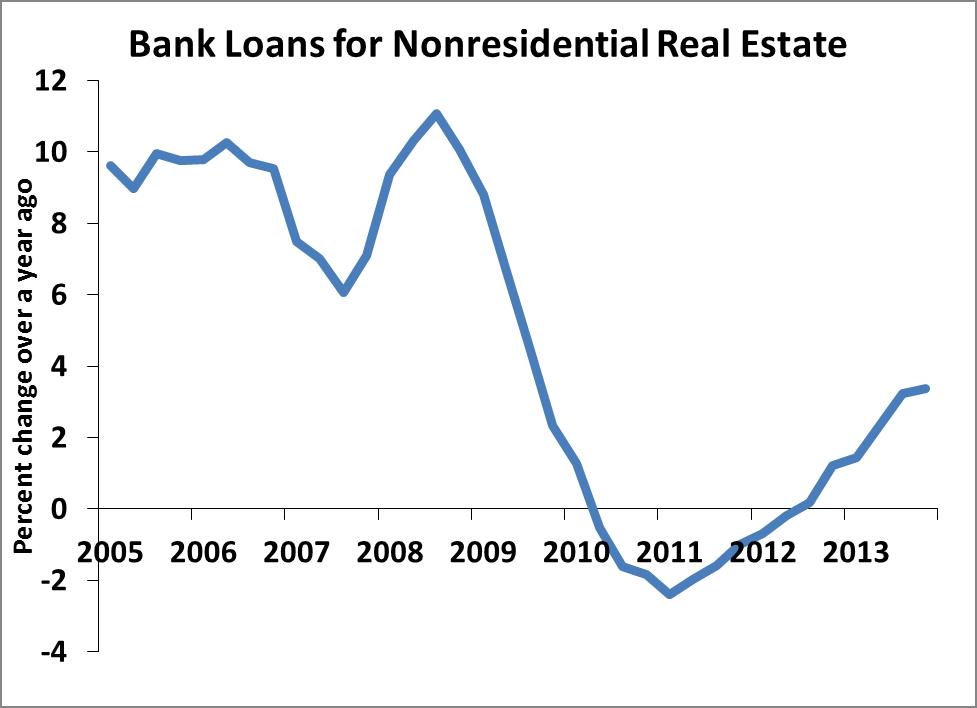

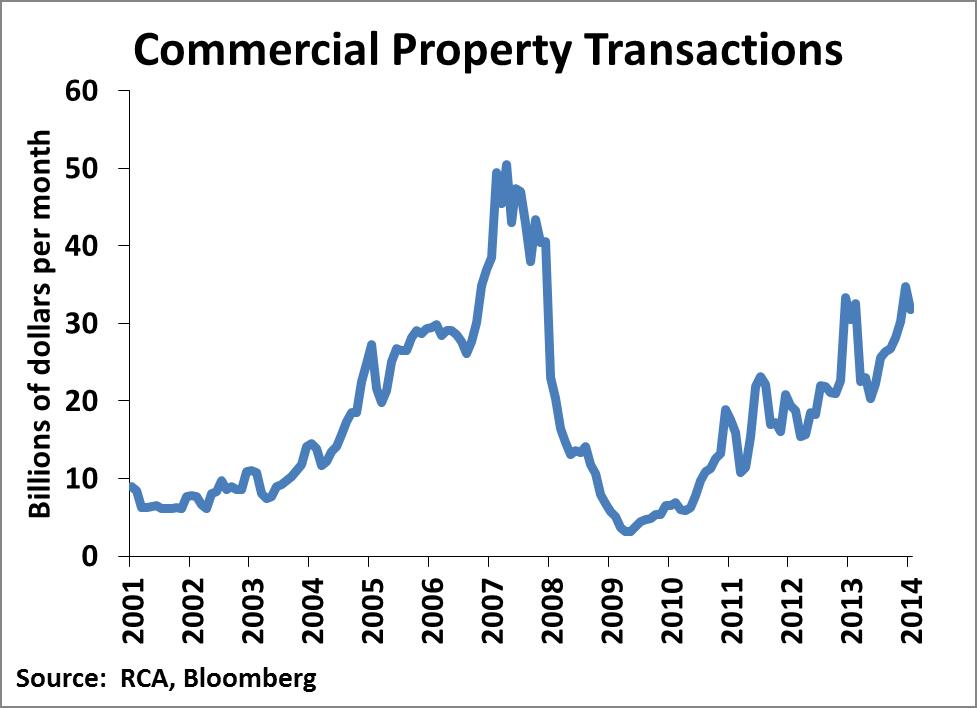

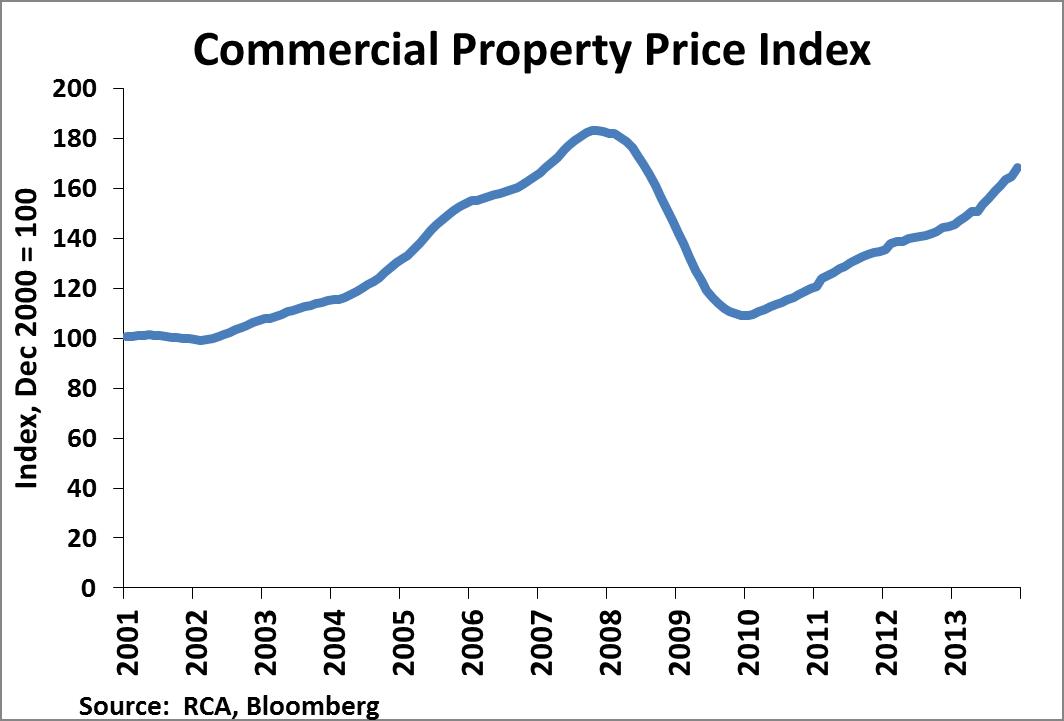

Bank lending for real estate investment is closely related to trends in transactions and prices. Recently-released data from the FDIC on bank lending reveal increased lending for investment in nonresidential real estate, multifamily residences, and construction and development:

- Bank loans for nonresidential real estate accelerated to 6.4 percent annualized growth, the fastest since 2008 (Chart 1):

- Commercial property transactions have ramped up to a $30 billion monthly rate, ahead of the pace during 2005-6 but well below the market peak in 2007 (Chart 2):

- Commercial property prices are approaching pre-recession levels (Chart 3):

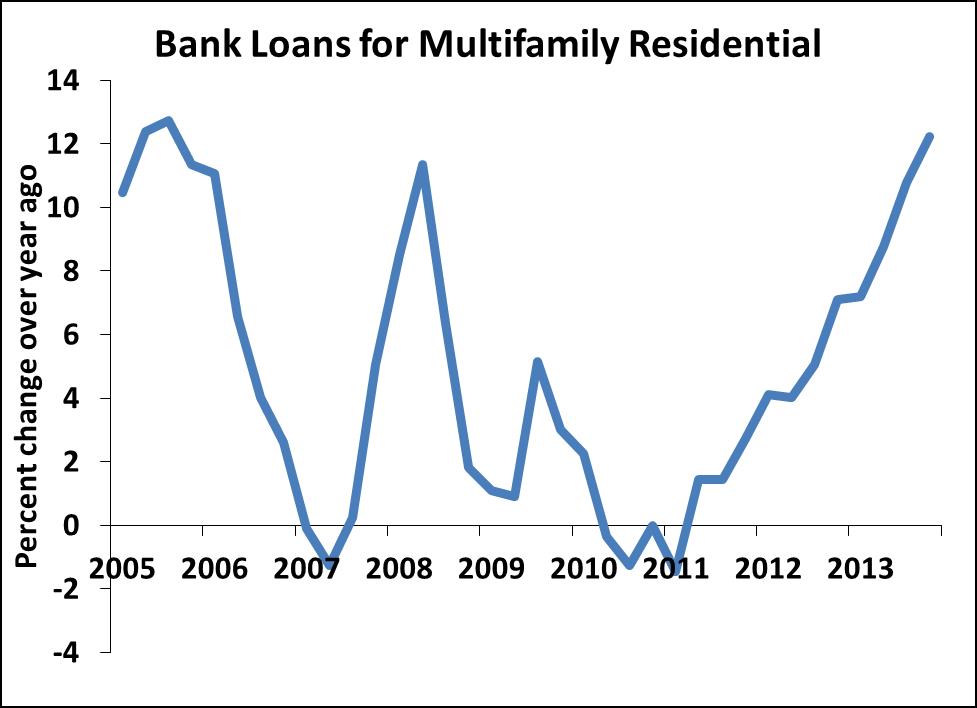

- Lending for multifamily residential real estate is rising as well, with growth in Q4 accelerating to a 17.5 percent annual rate (Chart 4):

- Construction and development is responding to the increase in transactions and prices. Bank lending has turned up to a 7.8 percent annual growth rate (Chart 5):