Commercial property prices can be a double-edged sword. When they are rising, they can provide investors with solid capital gains above and beyond the income received from rents. But if they rise too rapidly and get ahead of fundamentals, investors risk losses from falling prices.

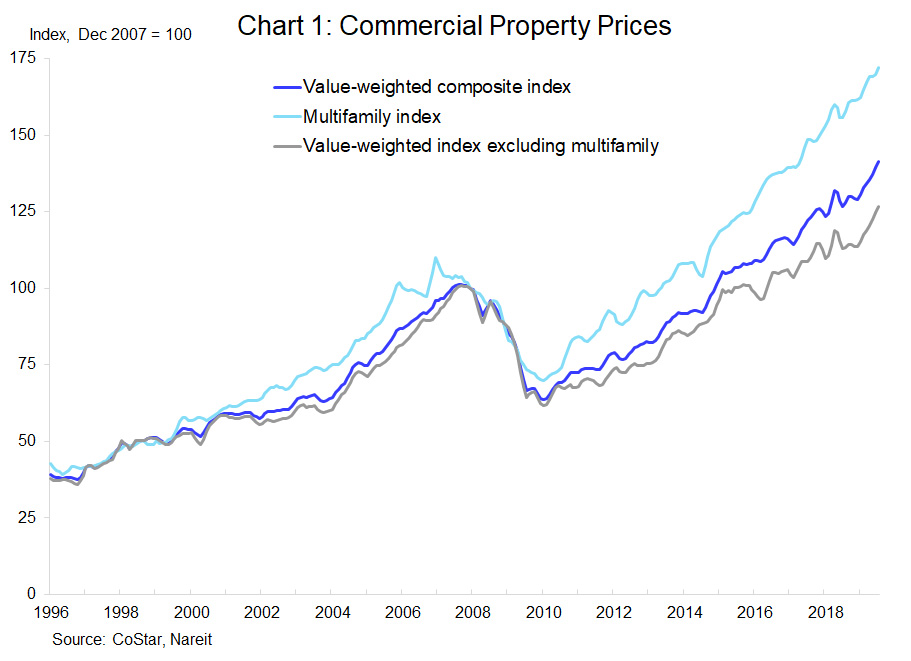

Prices have risen steadily over the past decade, and it is worth taking a look at whether the commercial property market today poses more risk than potential reward. In fact, price gains have accelerated in recent months and in August were 11.5% higher than 12 months earlier, compared to growth in the low single digits since mid-2018. Both the multifamily market and properties excluding multifamily are up at a double-digit rate.

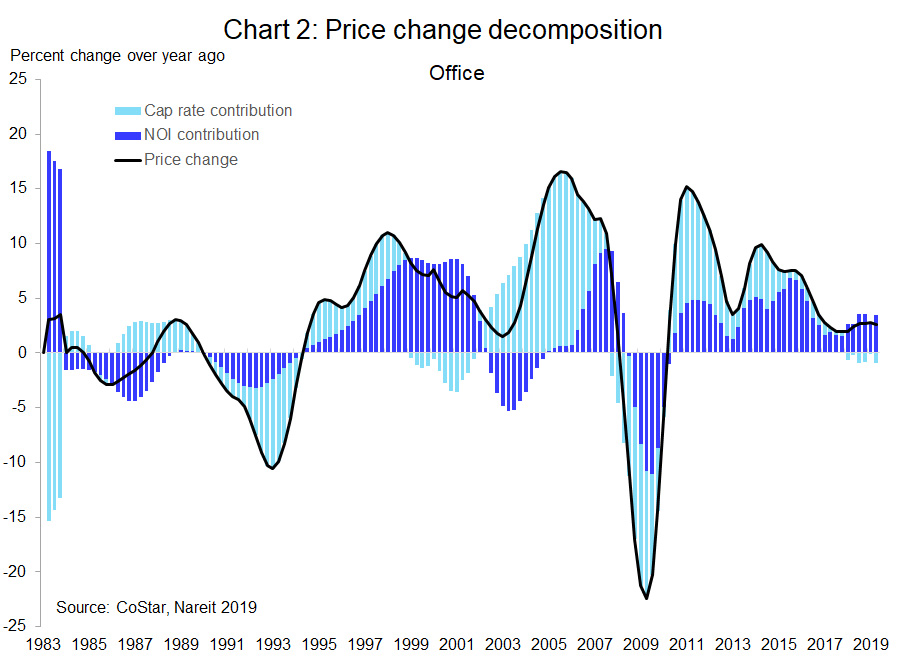

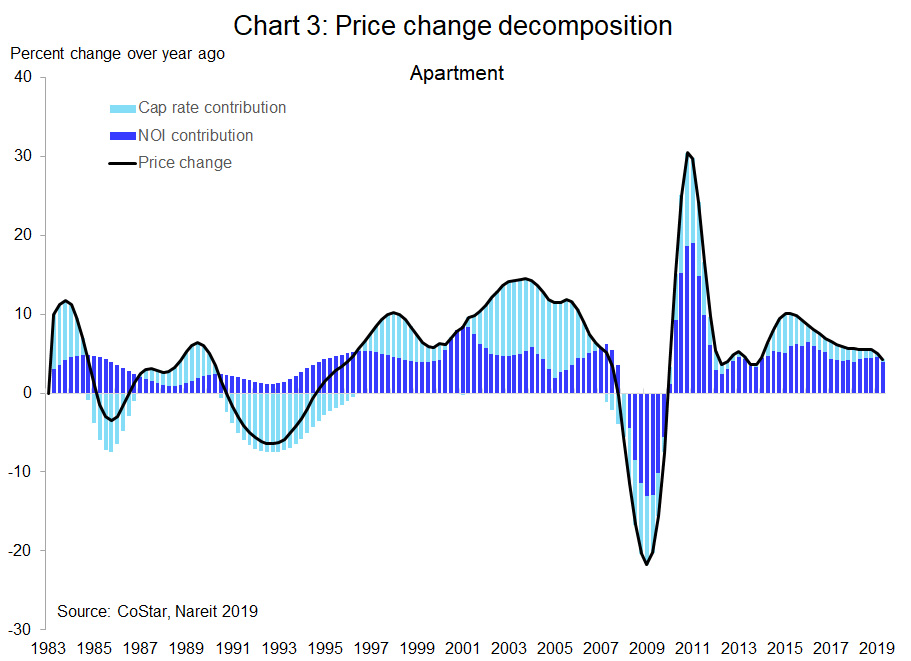

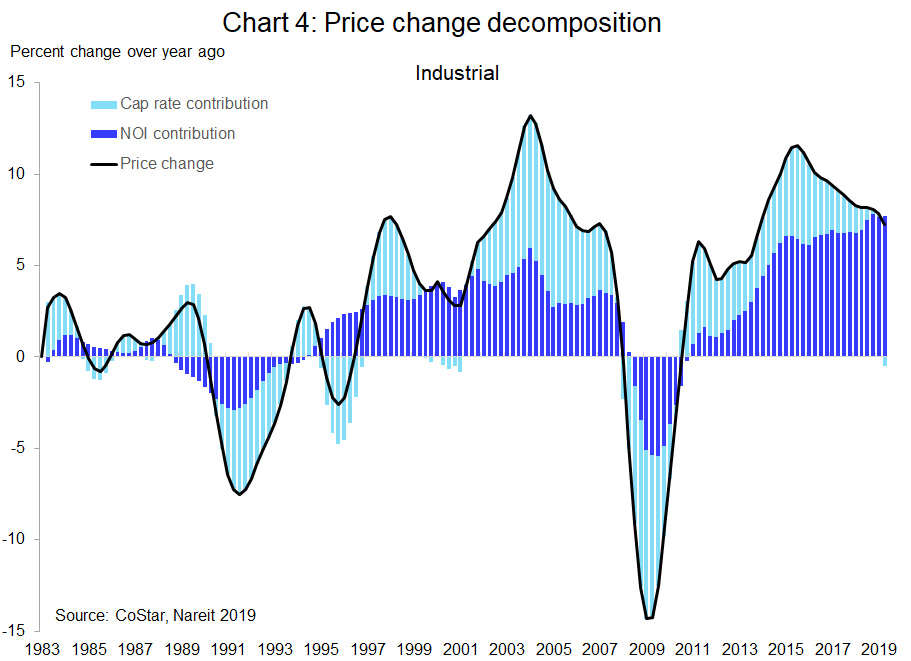

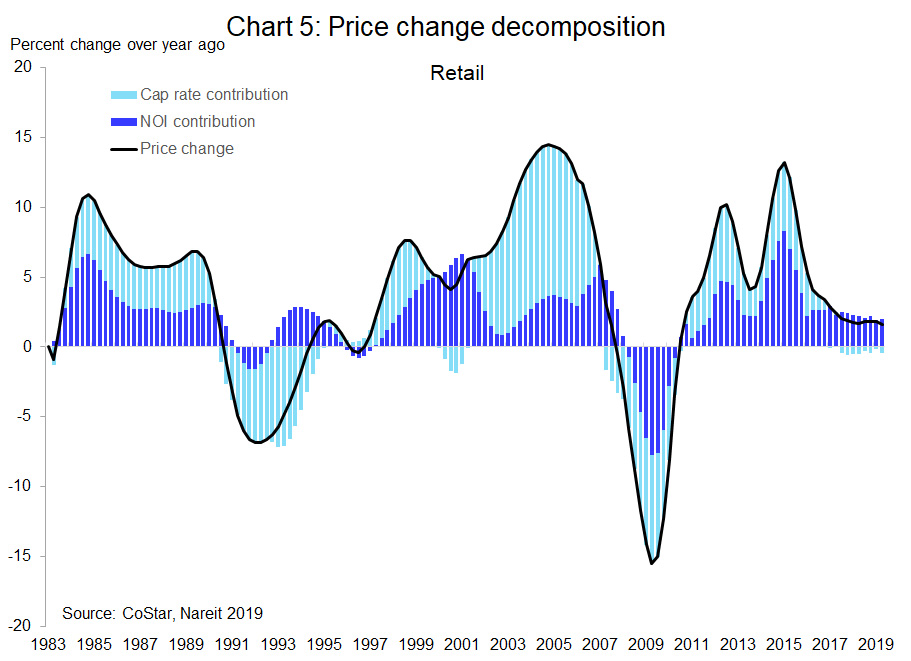

One indication of the risk/reward tradeoff in commercial real estate is whether price gains have been driven by rising net operating income (NOI), or from falling cap rates. While price gains that are supported by income growth are sustainable, increases from cap rate compression may pose risks if NOI does not rise in the future.

It is straightforward to decompose the price gains into these two components. In the following series of charts, the price increase over a year ago (black line) can be separated into a portion from rising NOI (dark blue bars) and another from the change in cap rates (light blue bars) With cap rates for most major property types little changed over the past year, nearly all of the price increase has been fully supported by rising NOI:

Office markets have seen a slight increase in cap rates, as NOI growth has outpaced property prices.

Apartment markets have enjoyed solid NOI growth and stable (and low) cap rates.

Industrial properties have had accelerating NOI growth.

Retail property markets have had modest NOI growth, but slightly faster than price increases.

NOI growth has been supported by low vacancy rates. Moreover, new construction has been in line with the growth of demand, which is likely to help keep rents rising (see my recent Market Commentary for an analysis of supply/demand trends through mid-year).

Recent price gains have been driven by rising NOI, not by cap rate compression, suggesting the risk/reward tradeoff in commercial real estate remains attractive.