It is important during periods of market volatility and shifting economic fundamentals for investors to recall the concerns that not long ago dominated discussions about the outlook.

Three years ago, as the Fed was in the early stages of a campaign to raise interest rates, the real estate market was worried that commercial property prices, which had risen steadily in the years since the end of the Great Recession, were poised to fall; that cap rates, which had moved to the lowest level in memory, would reverse direction and rise to match increases in long-term interest rates; and that CRE transactions would tumble as the property market fell from its peak.

None of these things has happened:

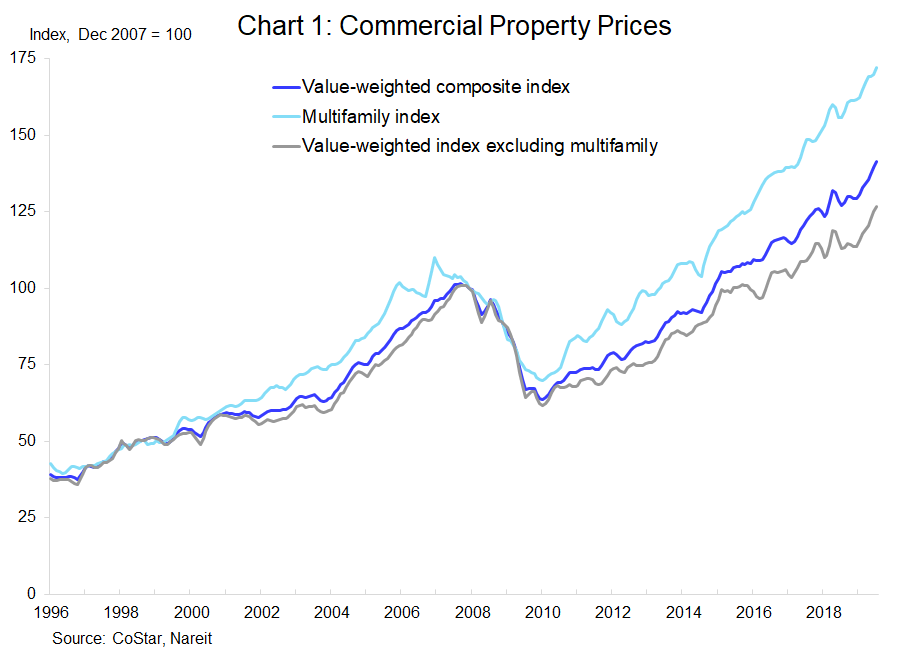

Commercial property prices have continued to climb higher, according to the CoStar Commercial Repeat Sales Indices, reaching new records in 2019. In fact, price gains have gained momentum over the past year, rising 11.5% in the 12 months through July, compared to 3.9% growth one year earlier;

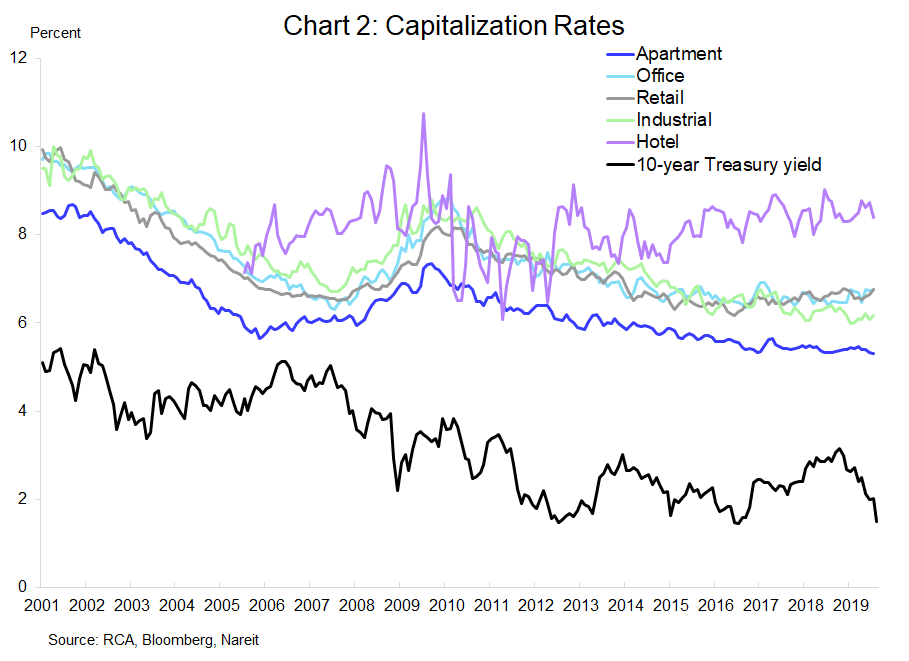

Capitalization rates are close to or even lower than they were three years ago. Cap rates in the apartment market moved to the lowest level since at least 2001 and are 25 bps below where they stood in 2016. Cap rates on industrial properties have declined even further, moving down nearly 50 bps. Cap rates in the office, retail and hotel sectors have moved slightly higher, but not the spike that some had feared.

The low level of cap rates reflects in large part the global low yield market environment. Inflation has remained tame even as the economic expansion has continued to a record length and the unemployment rate has moved to the lowest since 1969. Yields on the 10-year Treasury note have completely reversed the increases that occurred as the Fed began raising short-term rates, and in early September were at their lowest level in more than three years (black line in chart 2).

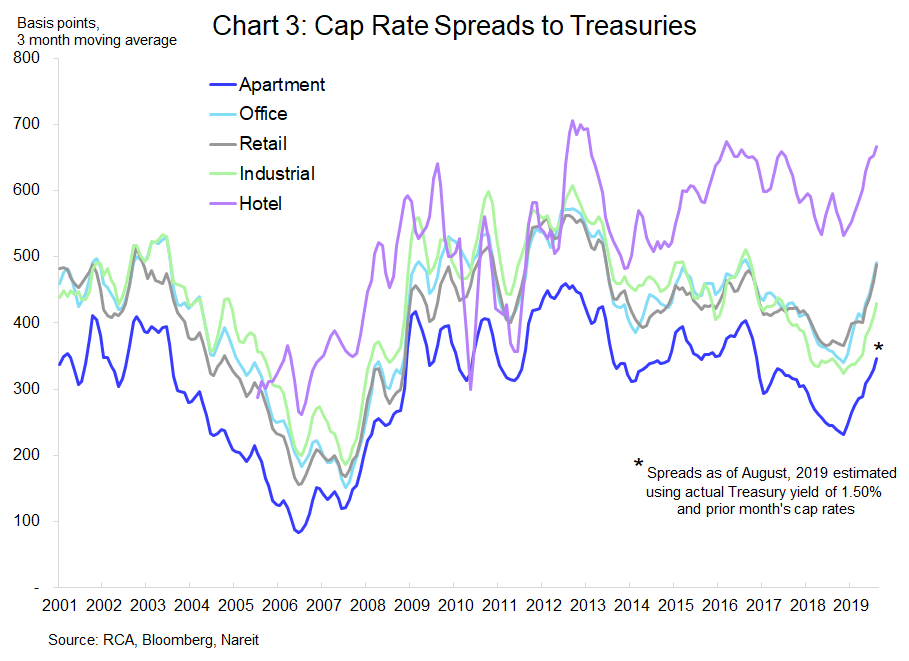

Low cap rates in a low yield market still offer real estate investors a good return relative to risk-free rates. In fact, with the recent decline in long-term rates, cap rate spreads to Treasury yields have widened back to where they were three years ago.

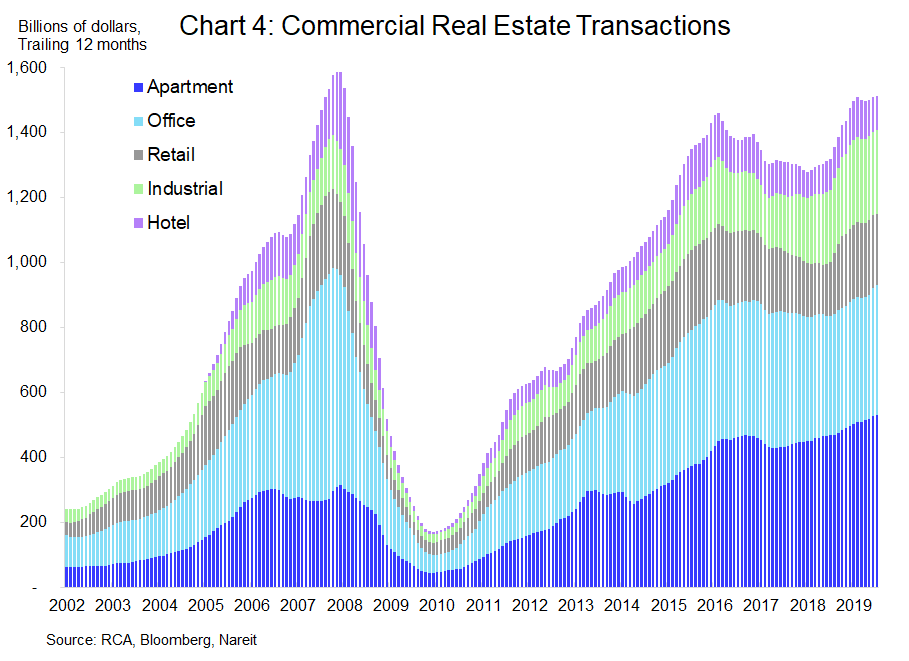

Property transaction volumes have rebounded. Sales of commercial real estate did reach a lull in 2016 and 2017 as many potential investors adopted a wait-and-see attitude until the impact of the Fed’s moves became clearer. Property markets have continued to perform well, however, and transactions volumes over the past 12 months have moved above $1.5 trillion, surpassing the recent peak in 2016.

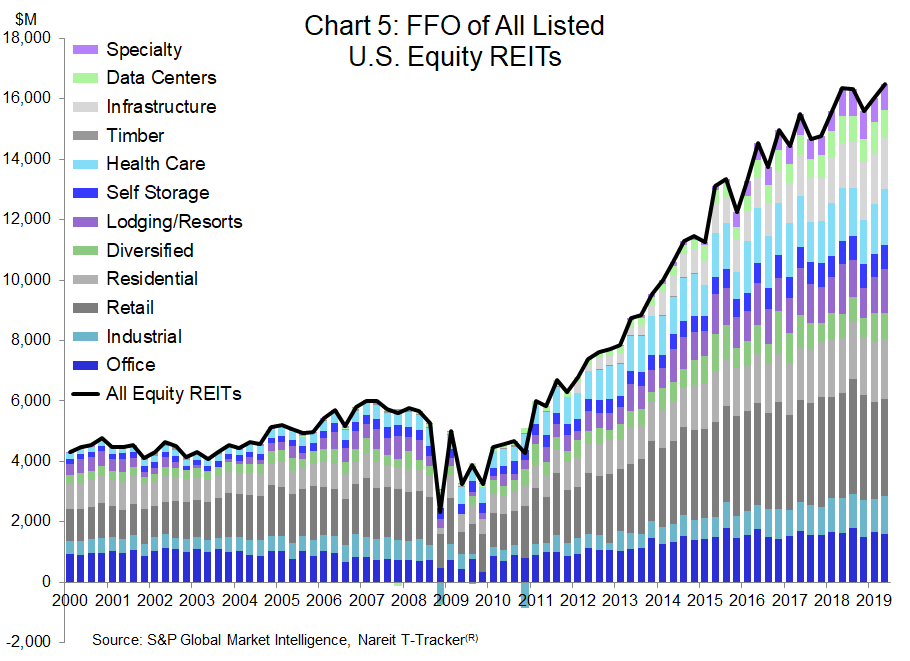

REIT earnings are at a record high. Funds from operations totaled $16.5 billion in Q2, according to the Nareit T-Tracker®, 13.5% higher than three years ago. Data and charts on REIT performance from the T-Tracker® are available for download.

Past performance, of course, is no guarantee of future returns, and the economic risks today—from trade wars and a weakening manufacturing sector to slowing economic growth in China and Europe—may well pose greater challenges in the period ahead. But despite these clouds on the horizon, the sustained modest growth that is likely to result has proven to be a good environment for commercial real estate.