In an environment of economic uncertainty, financial market volatility, and higher interest rates, the strength of a firm’s balance sheet often takes center stage. On average, REITs have maintained well-structured balance sheets with low leverage ratios, predominantly utilizing fixed interest rates and unsecured debt. Balance sheet discipline has afforded REITs greater operational flexibility and allowed them to face less stress than their counterparts with higher debt loads and costs. REITs are well-equipped to weather future market turbulence.

While U.S. public equity REITs have not been immune from the vagaries of the market, recent data from Nareit’s quarterly REIT Industry Tracker show that they have been reasonably well-insulated from them. By focusing on longer-term fixed rate and unsecured debt, public equity REITs have limited their exposure to the challenges of the current marketplace.

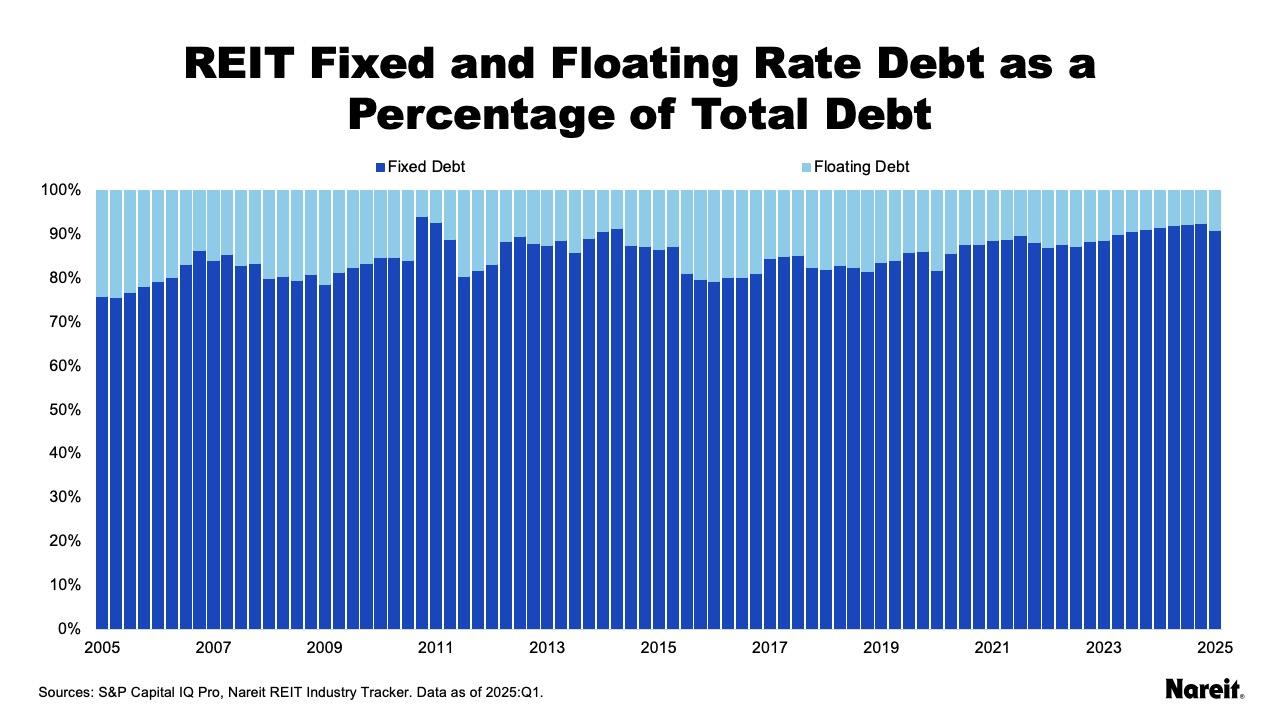

Using data from Nareit’s REIT Industry Tracker, the chart above presents fixed and floating rate debt as percentages of total debt for U.S. public equity REITs from the first quarter of 2005 to the first quarter of 2025. REITs have predominantly focused on utilizing fixed rate debt. In the first quarter of 2025, fixed rate debt accounted for 90.9% of total debt; the weighted average term to maturity on REIT debt was 6.2 years. These elements have limited REIT exposure to higher interest rates and highlight REITs’ typical longer-term investment focus.

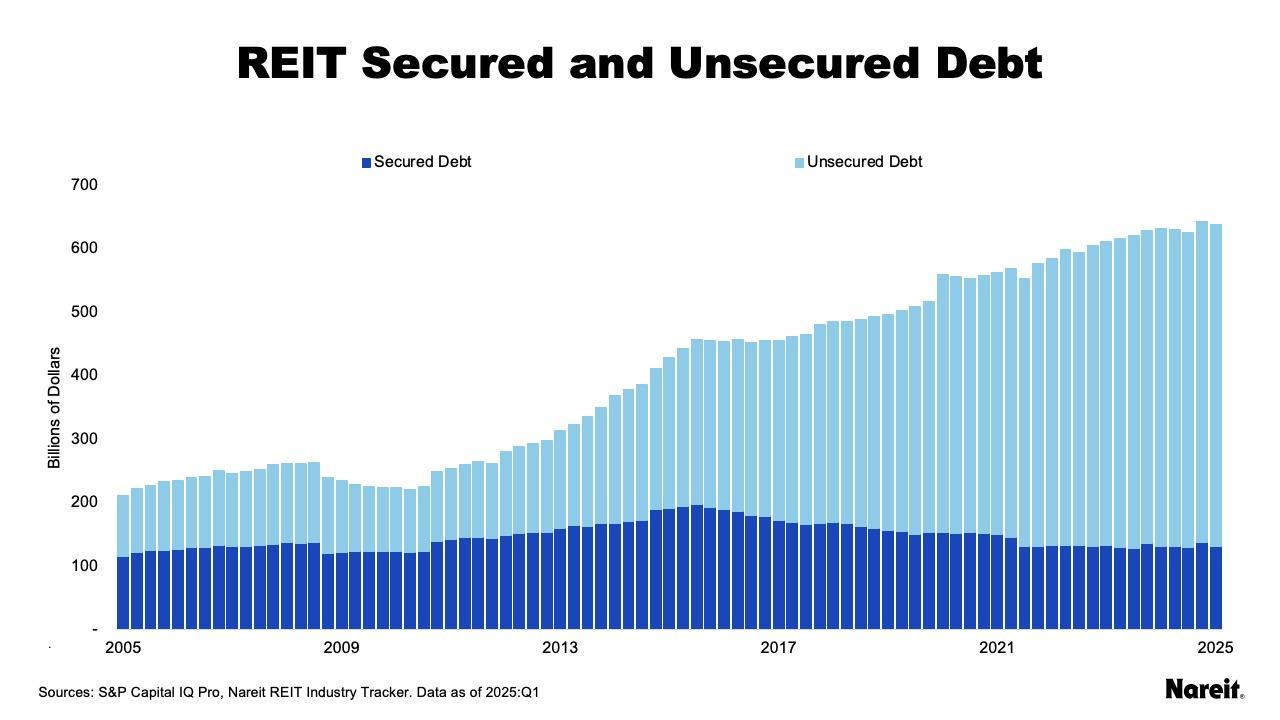

The chart above displays aggregate secured and unsecured debt in billions of dollars for equity REITs from the first quarter of 2005 to the first quarter of 2025 using Nareit’s REIT Industry Tracker data. Twenty years ago, secured and unsecured debt played near equal roles in REIT portfolios. Since that time, unsecured debt use has grown dramatically, increasing by more than a factor of five. In contrast, secured debt has only grown modestly, essentially maintaining its status quo. As of the first quarter of 2025, unsecured debt comprised nearly 80% of total debt; the average in-place cost of REIT total debt was 4.2%. Low debt costs have afforded REITs considerable operational flexibility to address property and firm needs.

Access to unsecured debt provides REITs with a competitive advantage over many of their private real estate counterparts. Through May, REITs issued 37 debt offerings totaling $17.7 billion in 2025. The weighted average yield to maturity of these unsecured debt issuances was 5.6%; the U.S. 10-year Treasury yield averaged 4.4% over the same time period.

Throughout the ups and downs of real estate cycles, REITs have maintained competitive advantages over typical property investors. Best-in-class operator knowledge and efficient access to cost-advantaged capital gives REITs an edge over their competition. Disciplined balance sheets have served REITs well in the current economic and financial market environments. They have also placed REITs in an enviable position when it comes to potential growth opportunities. Today, REIT balance sheets shine in a period of uncertainty.