Sales of commercial real estate have slowed dramatically during the pandemic. According to data recently released by CoStar, transactions volumes in the three months through July are 69% below the comparable period last year. The dropoff has been more pronounced among investment grade properties, with transactions down 76% from last year. Activity also weakened in the general commercial portion of the market, with sales volumes 51% lower than a year ago.

These low transactions volumes reflect in part uncertainty about the outlook for the economy and commercial real estate, at least until the virus is brought more completely under control. As a result, there are still likely downside risks to valuations. In addition, however, the shutdowns and social distancing measures enacted in the spring have made it more difficult to complete transactions, which has contributed to the sharp decline in transactions volumes.

Indeed, recent economic reports have shown a surprisingly robust recovery in many areas as the economy reopens, with home purchases and retail sales in July being back above pre-pandemic levels. Rent collections have remained high among many REIT property sectors, and have recovered much or most of the decline that occurred last spring among the Free Standing Retail and Shopping Center components, according to the Nareit rent survey.

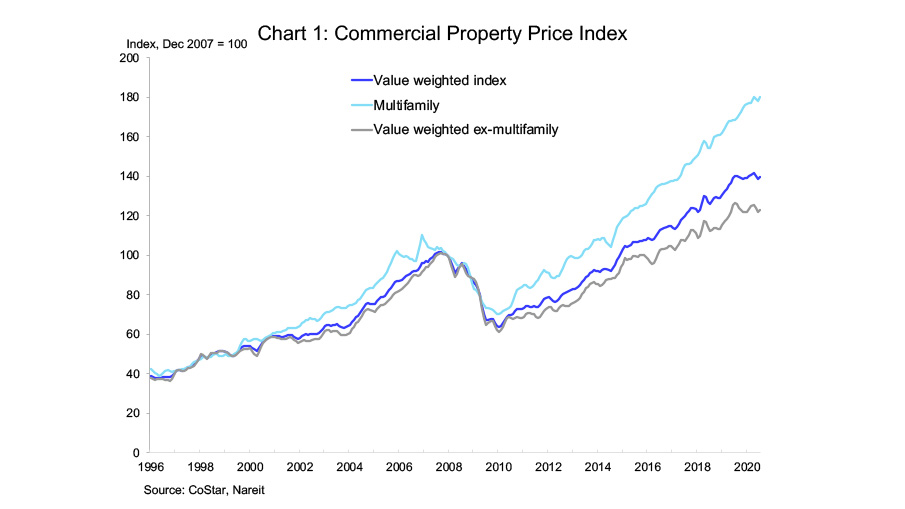

Prices have remained fairly steady to date despite the low sales activity. Valuations in the overall market, as measured by the CoStar Value-weighted Commercial Repeat Sales Index, have edged down 1.4% over the past three months, and are little changed year-to-date. Valuations of multifamily properties, which had been rising 8% to 10% in the few years prior to the pandemic, have continued to rise this year, although the pace of increases has slowed. The Multifamily component of the CoStar index is up 2.4% over the first seven months of this year. The value-weighted index excluding multifamily properties has weakened a bit, declining 1.8% over the past three months.