Today’s property market is generally marked by supply-demand imbalances, yet not all segments of the commercial real estate market have exhibited the same levels of operational performance. Across the four traditional property types, recent data show that, on average, U.S. public equity REITs have enjoyed occupancy rates higher than the broad commercial real estate market. These results suggest that REITs may be a cut above when it comes to asset selection and operational performance.

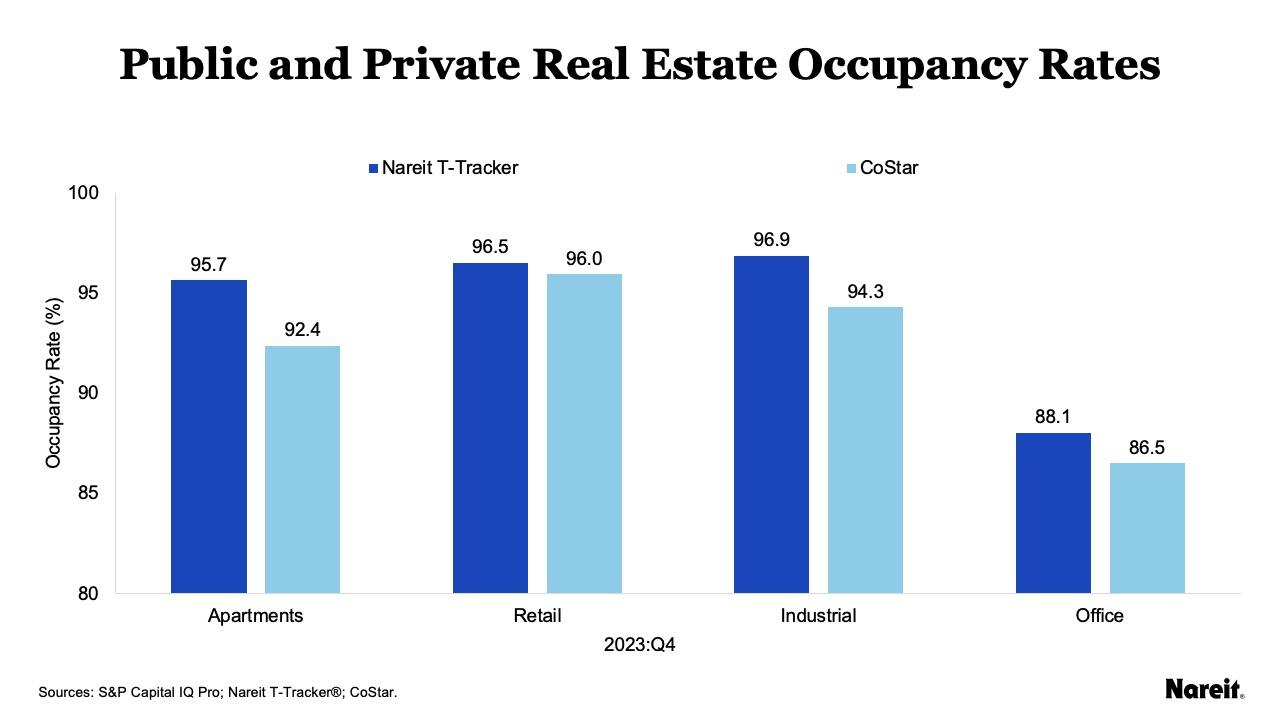

The chart above depicts fourth quarter 2023 occupancy rates for the four traditional property types from the Nareit Total REIT Industry Tracker Series® (T-Tracker) and CoStar. Data from Nareit T-Tracker solely focus on U.S. public equity REITs. CoStar data are typically viewed as broad indicators of the state of the U.S. commercial real estate market.

U.S. public equity REIT data have shown considerable strength and persistence in occupancy rates for each of the four traditional property types, with the exception of office. T-Tracker data indicate that industrial, apartment, and retail occupancy rates have exceeded 95% for 34, 12, and 10 consecutive quarters, respectively. Across all four property types, the T-Tracker occupancy rate was higher than its respective CoStar counterpart, suggesting that occupancy rates for U.S. public equity REITs may be a cut above those of the broader commercial real estate market.

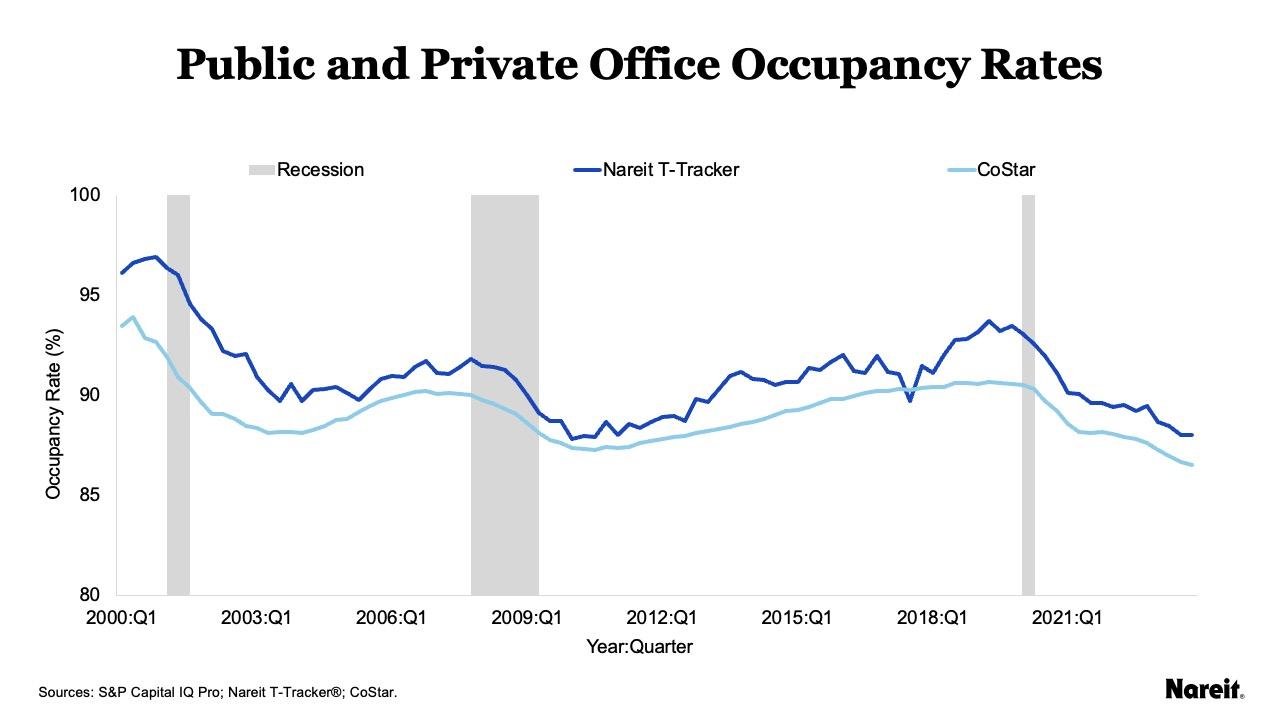

Office demand challenges are well known, but the sector has also suffered from supply issues. Years of negative net absorption have not curtailed office net deliveries. The chart above presents Nareit T-Tracker and CoStar office occupancy rates, as well as U.S. recessionary periods, from the first quarter of 2000 to the fourth quarter of 2023.

Since 2000, in all but one instance, quarterly Nareit T-Tracker office occupancy rates have exceeded those from CoStar; on average, the difference was 1.8%. The office REIT occupancy rate that started its descent in 2019 appears to be firming and leveling off. It ended 2023 at 88.1%, the same level as the previous quarter. The CoStar office occupancy rate declined to 86.5% at year-end 2023. Higher office REIT occupancy rates likely reflect REITs’ strengths related to asset selection and management.