At the start of the year, economists and financial markets anticipated that the Federal Reserve (Fed) would embark on a series of target fed fund rate cuts in 2024. Since that time, there have been indications that the timing of any potential interest rate drops may be delayed. More recently, Fed Chair Jerome Powell downplayed the likelihood of a cut in March. In its job situation report, the U.S. Bureau of Labor Statistics announced that total nonfarm payrolls increased by 353,000 in January 2024, significantly outpacing its 2023 average of 255,000. This better-than-forecast gain reflects material strength in the economy and provides further impetus for a delay in Fed monetary policy loosening.

A lack of Fed rate cuts, however, are not expected to pose a problem for U.S. public equity REITs. Data from the Nareit Total REIT Industry Tracker Series® (T-Tracker) show that, on average, REITs have maintained long-term, well-structured balance sheets with low leverage ratios, predominantly utilizing unsecured debt and fixed interest rates. With their disciplined balance sheets, U.S. public equity REITs may not be immune from higher interest rates, but they are reasonably well-insulated from them.

Since the Great Financial Crisis, many REITs have lowered their leverage ratios and locked in debt at low, fixed rates. As of the third quarter of 2023, the REIT debt-to-market assets ratio was 36.2%. This level can be considered akin to those used by private real estate funds following core/core-plus investment strategies.

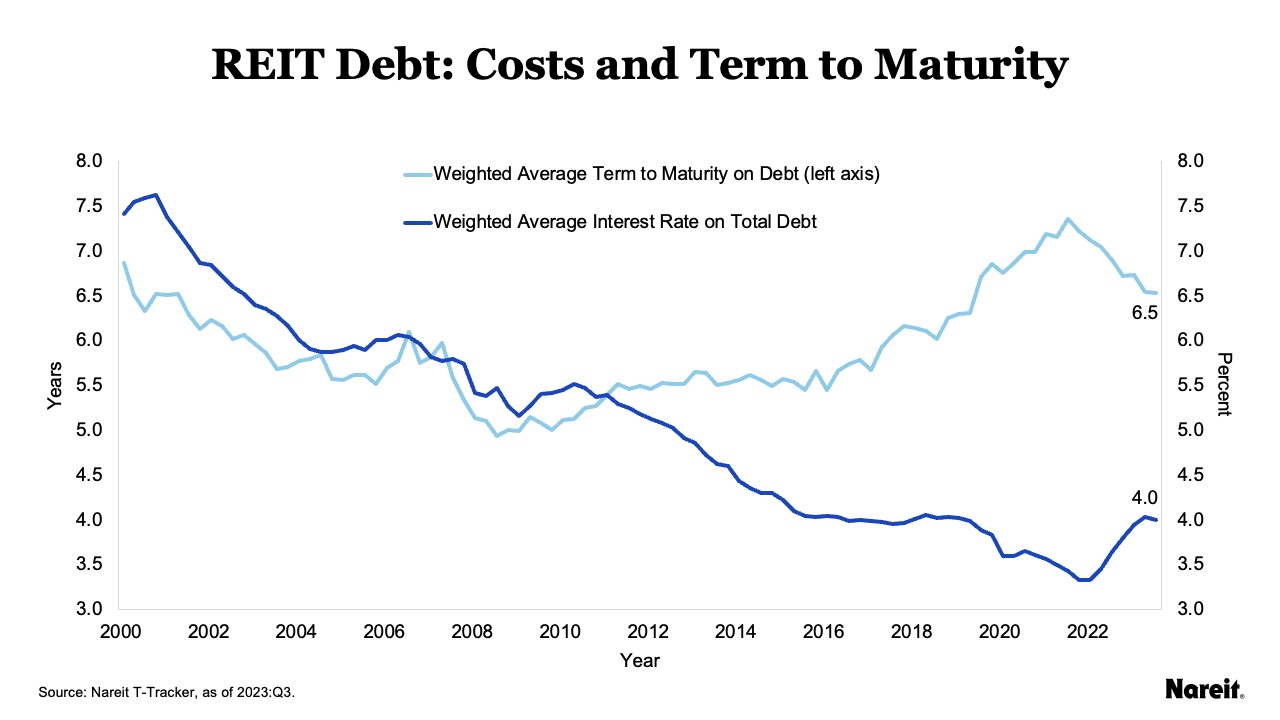

Using data from T-Tracker, the chart above displays the weighted average terms to maturity and weighted average interest rates on total debt for U.S. public equity REITs from the first quarter of 2000 to the third quarter of 2023. With a weighted average term to maturity of 6.5 years, REITs have limited their exposure to higher interest rates. The average in-place cost of REIT debt has also remained very attractive; it was 4.0% as of the third quarter of 2023.

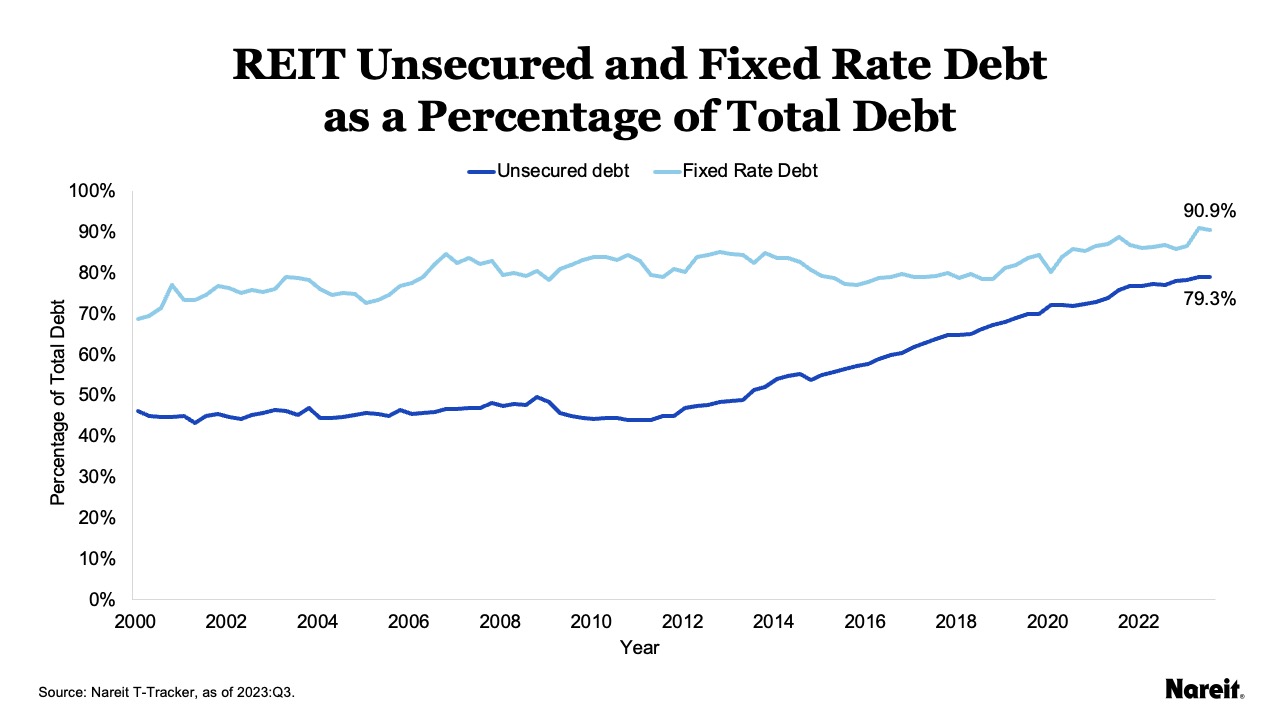

The chart above presents quarterly unsecured and fixed rate debt as percentages of total debt for equity REITs from the first quarter of 2000 to the third quarter of 2023. REIT use of unsecured debt has generally followed an upward trajectory since 2012. By third quarter 2023, it comprised nearly 80% of total debt. Access to unsecured debt provides REITs with a competitive advantage over many of their private real estate market counterparts. REITs have also increasingly utilized fixed rate debt. It accounted for more than 90% of total debt in the third quarter of 2023, highlighting REITs’ typical longer term investment focus.

REITs have exercised discipline in their balance sheet structures. This has served them well in the current interest rate environment. By focusing on low leverage levels, as well as unsecured, fixed rate and longer-term debt, REITs have had less need to refinance and, therefore, their distributable cash flows have been under less stress from higher interest rates. While REITs are not immune from higher interest rates, they are poised to be reasonably well-insulated from them.