Does the dismal employment report for March warn that the economy has stumbled again?

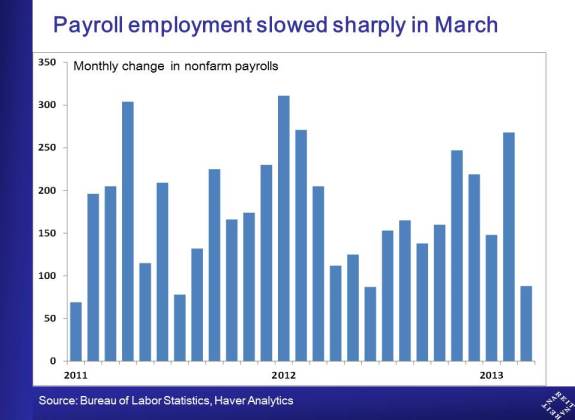

Nonfarm payrolls rose just 88,000 in March, a far cry from the 190,000 that analysts had expected, and the weakest monthly hiring since July 2012 [first chart below] . Is this a harbinger of a sharp slowdown in economic activity due to the sequester and the recent hike in payroll taxes? Let’s examine the details of the report, as well as other data, to look for signs of such a slowing.

Detail of the March job report

- Revisions. The March employment report showed an upward revision of 61,000 to employment growth in January and February, which offsets some of the weakness of the headline figure. Even so, the average monthly payroll growth slowed to 168,000 in the first quarter, from 209,000 in the fourth quarter of 2012. More worrisome is that the upward revision to January and February makes the slowdown in March look even more like the economy fell off a cliff.

-

Industry details. Which industries accounted for the 180,000 deceleration in payroll employment between February and March? And what does other news have to say about those industries? Three industries accounted for more than half of the slowing in the growth of payroll employment:

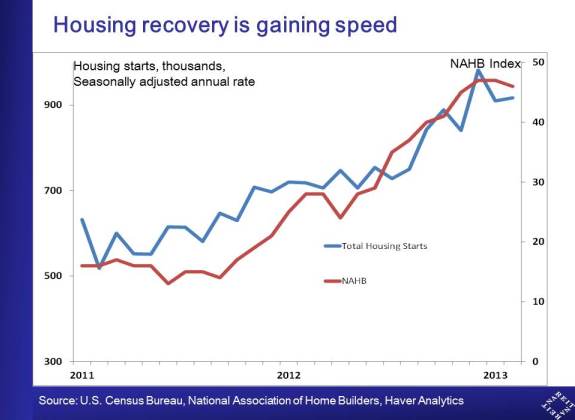

- Construction net employment growth slowed by 29,000 in March. But all other indicators (housing starts, sales of new and existing homes, pending home sales, the index of the National Association of Home Builders (NAHB)) all show that the housing sector is gaining momentum, not slowing [second chart below].

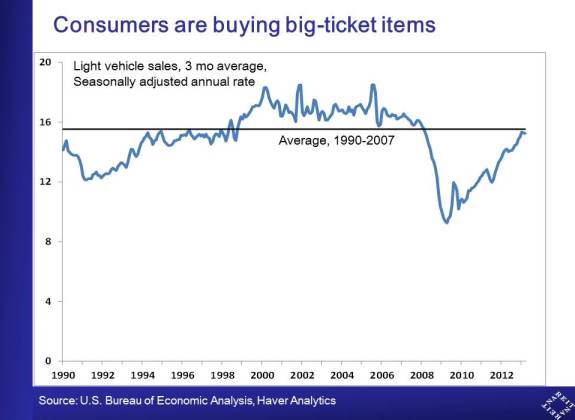

- Manufacturing employment fell slightly after several months of strong gains. But the ISM manufacturing survey is still in positive territory, and strong auto sales are more consistent with rising output than a cutback in manufacturing.

- Retail trade employment fell 24,100. But consumer spending has surprised on the upside lately. For example, auto purchases, a good indicator of consumer discretionary spending, have continued to move up steadily [third chart below].

- Government payrolls fell 7,000, with the U.S. Postal Service cutting 11,700. Furloughs and other cutbacks resulting from the sequester will impact government employment in the months ahead, but this doesn’t explain any of the weakness in March.

-

Other labor market news:

- Average workweek and index of weekly hours both continued to rise in March, which typically indicates stronger demand for labor;

- Average hourly earnings edged up.

- Initial claims for unemployment insurance have declined steadily, which is at odds with the March payroll report. (Claims jumped in the most recent week, but difficulties adjusting for seasonal patterns around the Easter holiday make this number suspect.)

Bottom line: the sharp slowing in payroll growth does have us concerned about the durability of the economic recovery, especially in light of the sequester and recent increases in payroll taxes.

All of the industry details and other labor market and macroeconomic news, however, suggest the economy continues to move forward, albeit in an uneven manner and at a disappointingly slow pace.

For more information on how the recent job market news affects the outlook for the overall economy and for commercial real estate, see the following REIT.com video.